|

We would like to invite you to participate in our Referral Earnings specifically of Project Funding Program (“PFP”) nationally and internationally. We value all your talents and resources. We would like to leverage our PFP through your networks. There is absolutely No Cost to you to register, but your business could potentially generate a significant revenue for your business. More details of PFP Step #1: Once your company is registered with us, we will issue the PFP Unique Identification (“PFP UI”). Again, there is NO COST for registration. However, if there is no activity from your registered account continuously 90 days, we will transfer its status to INACTIVE status. After 90 continuously days INACTIVE status, we will disable your PFP UI. Please note there is NO limit on a number of submissions per PFP UI. Register at Step #2: You can start sent an email to your clients immediately. Please advise your clients using YOUR UI when they submit their Project Funding Inquiry to us. We will advise you of its status accordingly. Benefits To Your Company: When and if the PFP successfully complete with your referred clients, we will compensate you TEN PERCENT (10%) of our collected 1% performance-based fee. For example, our collected on 1% of the USD 740 million is USD 7.4 million. Your 10% referral fee is USD 740,000. Important notes:

(a) Based on our experience, it is approximately 20% of submitted inquiries are qualified for the PFP. Therefore, the number of submissions is directly proportioned to your referral fee. (b) The Processing time is average from 90 to 120 days from start to completion. (c) This invitation is for B2B only. Should you have any questions or concerns, please contact us directly. Thank you for your time and an opportunity doing business with you.

1 Comment

Background: My India-based client, called Tom, requested and cancelled our Paymaster Service. We had sent the email to his personal Gmail account as Tom requested; however, for some unknown reason, he could not receive it after 12+ hours. Tom accused us wrongly for not keeping our obligation for sending the confirmation email regarding his Cancellation Request. Action: We had provided swiftly and immediately the timeline when our email sent from our system, and we also forwarded the sent email to Tom’s business email account. Result: Tom had agreed and satisfied with our provided hard documents. There are various ways handling this unexpected issue. We have decided providing the hard facts and evidences expeditiously and composedly even though this incident was REALLY beyond our control. Within 24 hours, I have sent the follow notes to Tom. I would like to share with you as well. Dear Tom (NOT his real name): Just a few thoughts, I would like to share with you regarding the Paymaster Service Incidence. 1) We do always keep our promise. Regrettable, the Gmail account has failed us this time. This is beyond our control. In fact, we did sent our cancel confirm email clearly and convincingly within the 30 minutes window as promised. 2) Our procedures help us to focus on the client's anxiety. We have proceed swiftly, calmly and provided with proven evidences to satisfy our client's demand. We believe that we have earned undoubtedly of your satisfaction. 3) Our business principal, https://www.dajkgroup.com/business-principles.html, has maintain us as a leader. 4) We look forward working with you for any other profitable and legal business and/or investment opportunity which can be mutually and strategically to benefit beyond our communities and countries. Our Risk Analysis:

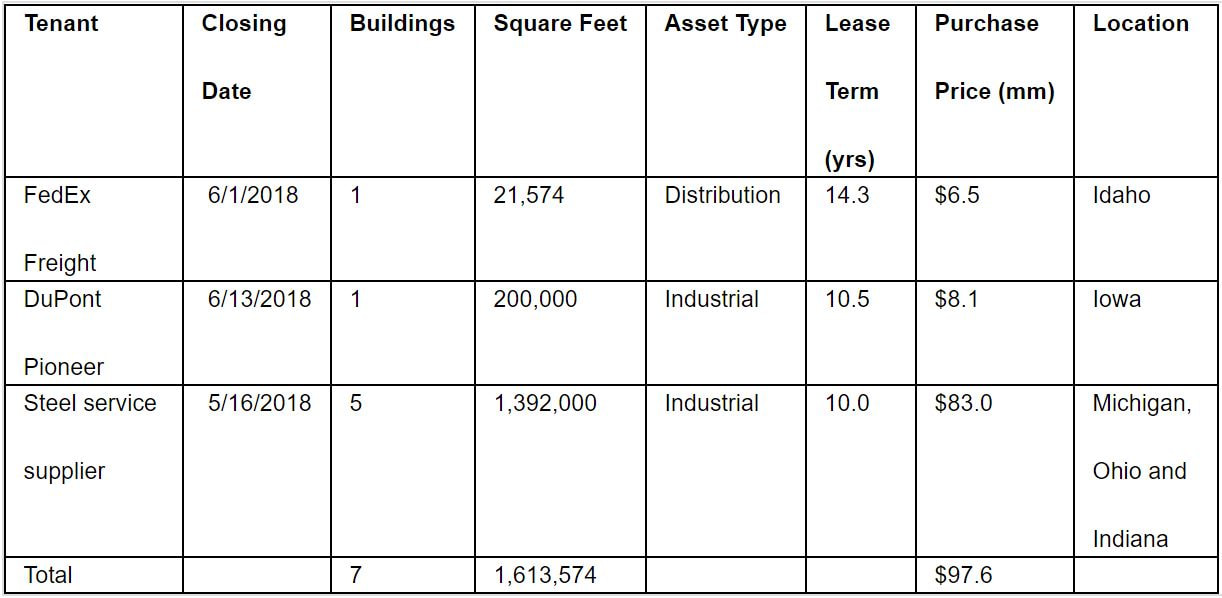

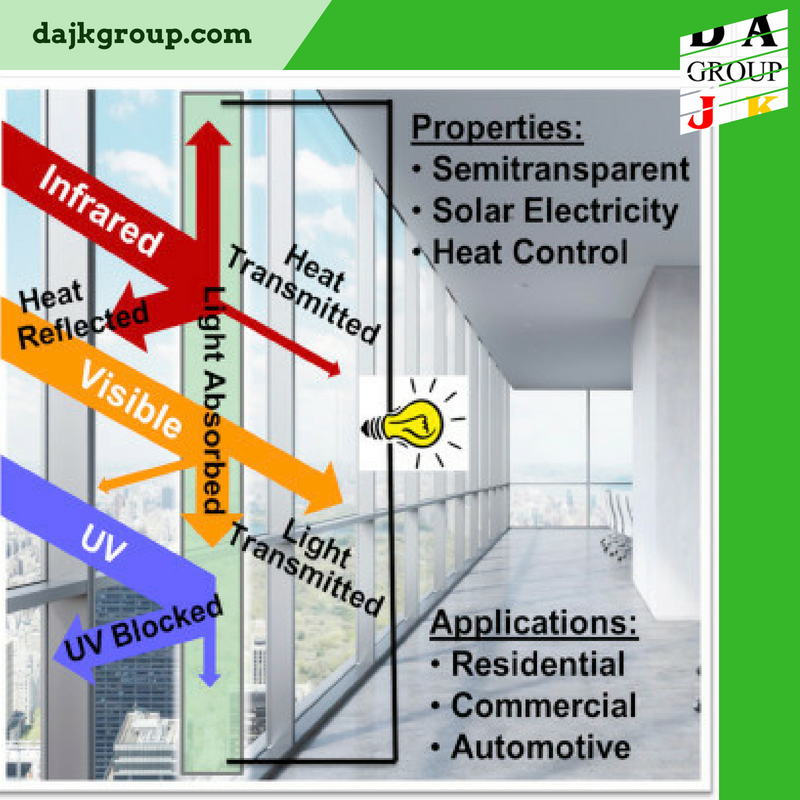

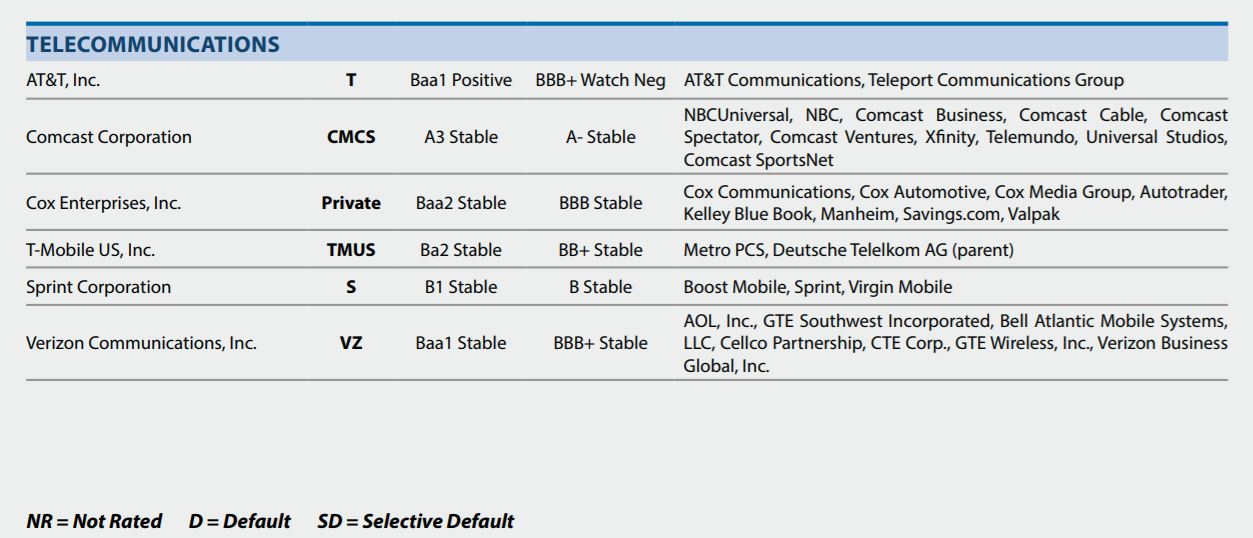

Global Net Lease, Inc., a real estate investment trust focused on the acquisition of net lease properties, has closed on its previously announced acquisitions of a total of seven properties in the second quarter, which represents 1.6 million square feet for $97.6 million. The properties are leased to FedEx Freight, DuPont Pioneer and the additional five properties acquired during the quarter are industrial facilities leased to a leading steel service supplier which were closed in May 2018. The seven properties were purchased at a weighted-average going-in capitalization rate of 7.59%, equating to a weighted-average GAAP capitalization rate of 8.05%, with a weighted-average remaining lease term of 10.1 years. These accretive transactions strengthen GNL's already strong robust Midwest presence and extend its weighted-average remaining lease term. These properties are part of the $307.3 million of acquisitions announced earlier in 2018, and to date $161.1 million has closed. GNL funded the transactions with borrowings under its revolving credit facility. Subsequent to the close of the second quarter, as part of its ongoing growth initiatives, GNL closed an upsizing of its unsecured credit facility of $132.0 million for the multi-currency revolving credit facility portion and €51.8 million for the senior unsecured term loan facility portion. Property Summary Table Property and Tenant Summary The first property is a cross-dock facility industrial distribution facility leased to FedEx Freight, a leading provider of less-than-truckload freight services. Located in Blackfoot, Idaho the property at closing had 14 years remaining on the lease. The parent company and guarantor is FedEx Corporation, a multinational courier and delivery company. FedEx Corporation has an investment grade credit rating of "Baa2" and "BBB" from Moody's and S&P. The building was purchased at a price equating to a weighted-average GAAP capitalization rate of 6.76% with a weighted-average remaining lease term of 14.3 years. The second property is an industrial distribution facility leased to Pioneer Hi-Bred International, Inc. (d/b/a DuPont Pioneer). The tenant signed a 10.5-year lease extension effective April 1, 2018. The facility is located in proximity to the tenant's production plants and key customers. DuPont Pioneer is a leading developer and supplier of advanced plant genetics, agronomic support, and other services to farmers. The building was purchased at a price equating to a weighted-average GAAP capitalization rate of 7.27% with a weighted-average remaining lease term of 10.5 years. As previously announced on May 17, 2018, the group of five properties leased to a leading steel service supplier with products and services provided to clients throughout the Midwestern U.S. and Canada that has an implied investment grade credit rating on Moody's Analytics of "Baa3" as of March 2, 2018. The properties were purchased at a price equating to a weighted-average GAAP capitalization rate of 8.19% with a weighted-average remaining lease term of 10.0 years. Source: GNL New Application Of OPVs For Both Energy Harvesting And Saving - the ST-OPVs generate over 6% power conversion efficiency with a high visible light transmission of over 25% and outstanding infrared radiation rejection rate of over 80% HIGHLIGHTS

SUMMARY Semitransparent organic photovoltaics (ST-OPVs) have attracted extensive attention due to their potential for integration into the windows of buildings. Herein, we propose a dual-functional ST-OPV device that is not only highly efficient but it is also very effective for heat insulation. By introducing non-fullerene acceptor with enhanced near-infrared absorption and distributed Bragg reflectors for selectively enhancing the transmittance in visible wavelengths while keeping high reflectance for near-infrared light, the ST-OPVs generate over 6% power conversion efficiency with high visible light transmission of over 25% and outstanding infrared radiation rejection rate of over 80%. Our results show that with proper design of ST-OPVs, they can be used not only for generating power from sunlight but it is also for solar shading and heat insulation, which opens up a new application of OPVs for both energy harvesting and saving. A new dual threat window could double the energy efficiency of average households. Researchers from the South China University of Technology have developed a window that blocks unneeded parts of sunlight to keep heating and cooling costs low, while also serving as a miniature electricity generator. “Building-integrated photovoltaics are a great example of a market where silicon photovoltaics, despite their cheapness and performance, are not the most appropriate due to their dull appearance and heaviness,” Hin-Lap Yip, senior author and professor of materials science and engineering at the South China University of Technology, said. “Instead, we can make organic photovoltaics into semi-transparent, lightweight and colorful films that are perfect for turning windows into electricity generators and heat insulators.” The researchers performed a three-way balancing act between harvesting light for electricity generation, blocking it for heat insulation and transmitting it as a window normally would to construct a prototype capable of simultaneously outputting electricity and preventing excessive heating. By mixing and matching different materials and chemical compounds previously used for the different window functions, the researchers were able to create a device that let familiar visible portions of sunlight through, while turning back the infrared light and converting the near-infrared region in-between into an electric current. Back-of-the-envelope calculations suggest that, in theory, installing windows outfitted with dual electricity-generating and heat- insulating properties could cut an average household's reliance on external electric sources by over 50 percent. While it is estimated that every square inch of every window would be paneled with multifunctional solar cells, the new windows only require a slight uptick in power-conversion performance from the 6.5 percent figure realized by the researchers. “For this demonstration, we are not even using the best organic photovoltaics that are out there in this field,” Yip said. “Their efficiency is improving rapidly, and we expect to be able to continuously improve the performance of this unified solar-cell window film.” Along with new energy efficient window, the researchers believe the dual-functioning materials could be used various emerging technologies. “Making heat-insulating multifunctional semitransparent polymer solar cells is just the beginning of exploring new applications of organic photovoltaics,” Yip said. “A version tailored for self-powered greenhouses is only one of many impactful products that we want to develop for the future.” Source: RD and Joule If you love building and leading teams, start your own business with an Amazon, delivering smiles to customers across your community. Amazon is looking for hands-on leaders who are passionate about hiring and coaching great teams. With low startup costs, built-in demand, and access to Amazon's technology and logistics experience, this is an opportunity to build and grow a successful package delivery business. The Amazon is unveiling a program meant to fuel the creation of hundreds of new package-delivery businesses that can help Amazon handle the fast growth that its U.S. retail business continues to enjoy. Amazon says the program will offer new partnering delivery companies access to discounted rates on everything from fuel to vehicle insurance to delivery vans, as well as coaching from Amazon and an app to guide delivery people on which order should be dropped off. As part of the launch, Amazon is also introducing its own Amazon-branded delivery vans that partner companies can lease, as well as uniforms that delivery partners can outfit their drivers. Amazon claims that new partners can start up their business for as little as $10,000 — an amount that the company will reimburse to businesses founded by U.S. military veterans. Successful Owners Can Expect

The Business With Amazon AdvantageLow startup costs Start your business with as little as $10,000. Logistics experience not required Use our technology, processes, and more than 20 years of logistics experience to set up and run your delivery business. Focus on people, not sales Amazon’s packages keep your business growing, so you can focus on building a great team and delivering without worrying about driving sales. Support when you need it Amazon’s experience is behind you every step of the way, from hands-on training to on-demand support to ensure your operation runs smoothly. Deliver smiles Delight thousands of customers every day as an essential part of Amazon, the most customer-centric company on Earth. Is This The Right Business Opportunity For You?If you’re a customer-obsessed people person who loves coaching teams in a high speed, ever-changing environment, becoming an Amazon Delivery Service Partner is an ideal opportunity for you. As an owner, you will operate with 20-40 vans and have 40-100 employees. You’ll be fully responsible for hiring and developing a team of high-performing, hardworking drivers, while we take care of getting you set up and ready to operate out of an Amazon delivery station in your city. You’ll be expected to provide consistent coaching and support for your team to ensure the successful delivery of packages in a 7 days/week, 365 days/year operation. What You DoSet up your business Use our suite of exclusive deals to acquire the assets you need to start your business, and work with our network of top-in-class service providers to keep your business rolling. Build your team You’re a coach. This is your team. As you set up your business, the most important step you’ll take is recruiting and retaining solid drivers that will enable the ongoing success of your operation. Deliver packages Your team of drivers will deliver between 20-40 routes per day. Serving thousands of customers daily isn’t easy, but the smiles are incredibly rewarding. Create your team culture Your can-do attitude ensures your business reflects Amazon’s high standards and customer-obsessed culture. Motivate your team to exceed expectations on every delivery through coaching and development. Grow your business Deliver a great customer experience to gain more opportunities to hire more people, and deliver additional packages to further grow your business. What Amazon DoesGet you started Our exclusive deals on Amazon-branded vans, comprehensive insurance, industrial-grade handheld devices, and other services help you get your delivery business up and running. Provide training We provide three weeks of hands-on training to ensure you’re set up for success, starting with a one-week introduction to Amazon in Seattle, followed by two weeks in the field working alongside the community of existing owners and drivers to learn the tips and tricks of operating a successful delivery business from those who know it best. Give you a comprehensive toolkit We give you all the tools and technology you’ll need to run your business, including daily processes designed to keep your operation running smoothly. Offer on-demand support Owners receive ongoing support from Amazon, which includes a comprehensive operations manual, driver assistance for on-road issues, and a dedicated account manager. Share our experience Amazon shares more than 20 years of technological and logistics experience to guide you in one of the fastest-growing industries in the world. Source: Amazon The Russian energy and finance ministries agreed with oil companies to start cutting the export duty on crude gradually, to bring it from the current 30 percent to zero over the next six years. The Russian energy and finance ministries agreed with oil companies to start cutting the export duty on crude gradually, to bring it from the current 30 percent to zero over the next six years, government sources told Reuters. The duty will be cut by 5 percent annually over the period, as part of a wider tax reform that seeks to replace the export duties and mineral resources extraction taxes with a single tax based on the profits that oil companies in Russia make. Currently, the oil export duty is tied to oil prices, and calculations for May saw it 6 percent higher than in April, at US$118.5 per ton of oil, based on a price of US$65.80 per barrel. The idea of phasing out the export duties is not new. Last year, Finance Minister Anton Siluanov said the end of the duty will come no earlier than 2022-2025. Now, the six-year phase-out plan will see it gone by 2023. This compares to earlier and much more ambitious plans to have it scrapped by 2020. The oil industry in Russia is backing the tax reform, which will make it easier for the government to collect taxes from the companies directly instead of calculating export duties. For the oil companies, it would be simpler, too, and a direct profit-based tax would encourage higher production as it would be more directly linked to exploration costs and risks, Reuters reported back in March 2017. The tax overhaul is also connected to plans announced by central bank governor Elvira Nabiullina in 2016 to reduce the federal budget’s reliance on the exports of mineral resources. The plan was announced at the height of the oil price crisis. At the time, Nabiullina admitted this will not be an easy or smooth process, but it could contribute to the country’s economic growth. Source: Reuter Everyone needs to educate themselves before they invest. Four things you must know first then you will continue to learn as you go. But you must educate yourself four basics to get started on the right foot. A little education will help you to handle risk more effectively. How about a real estate investment?

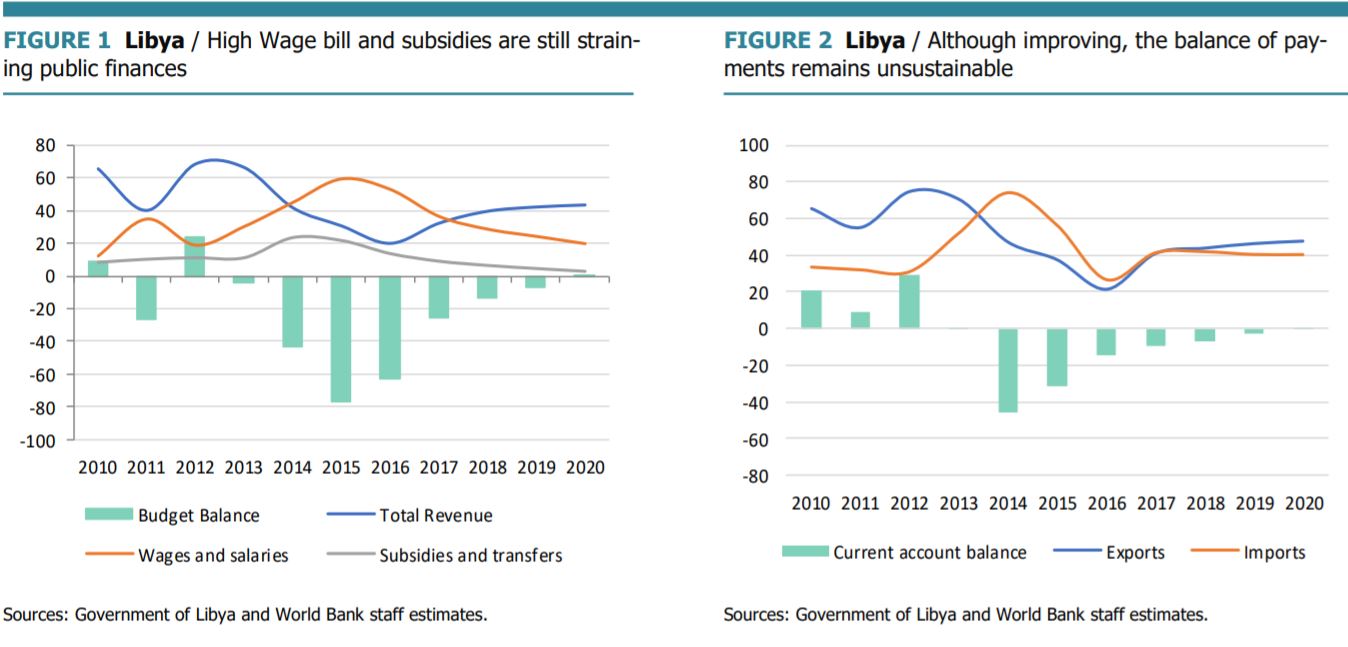

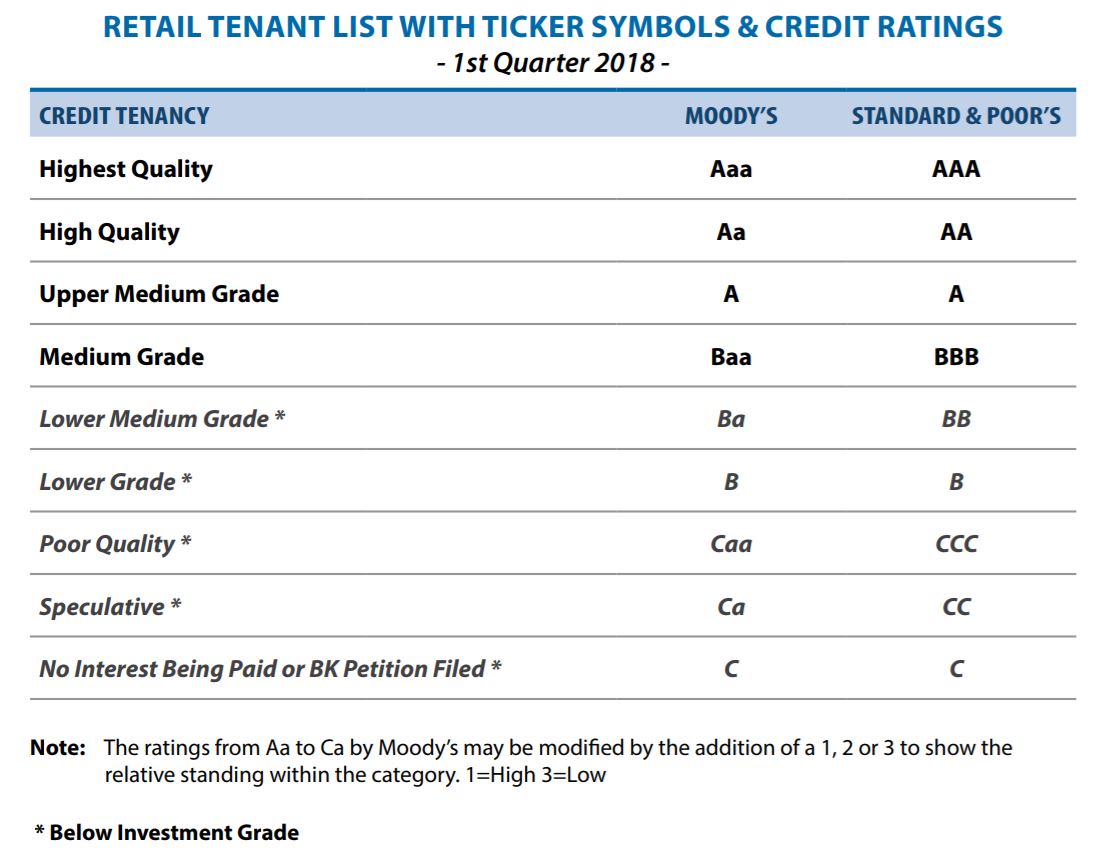

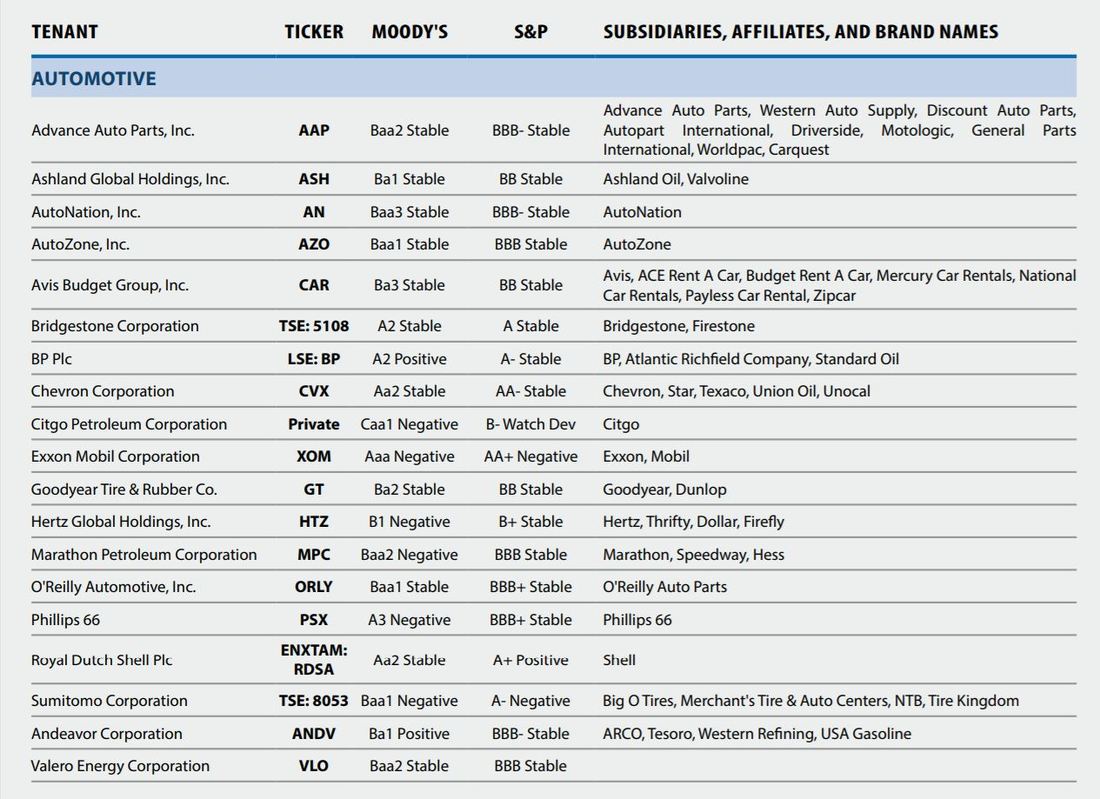

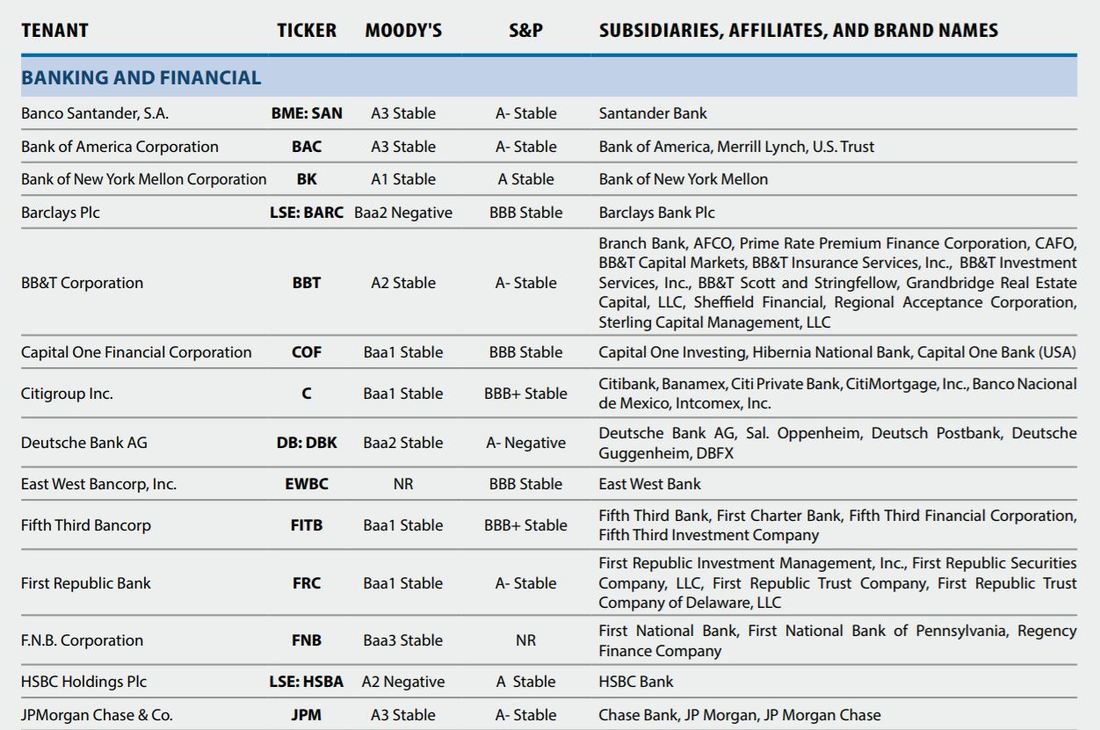

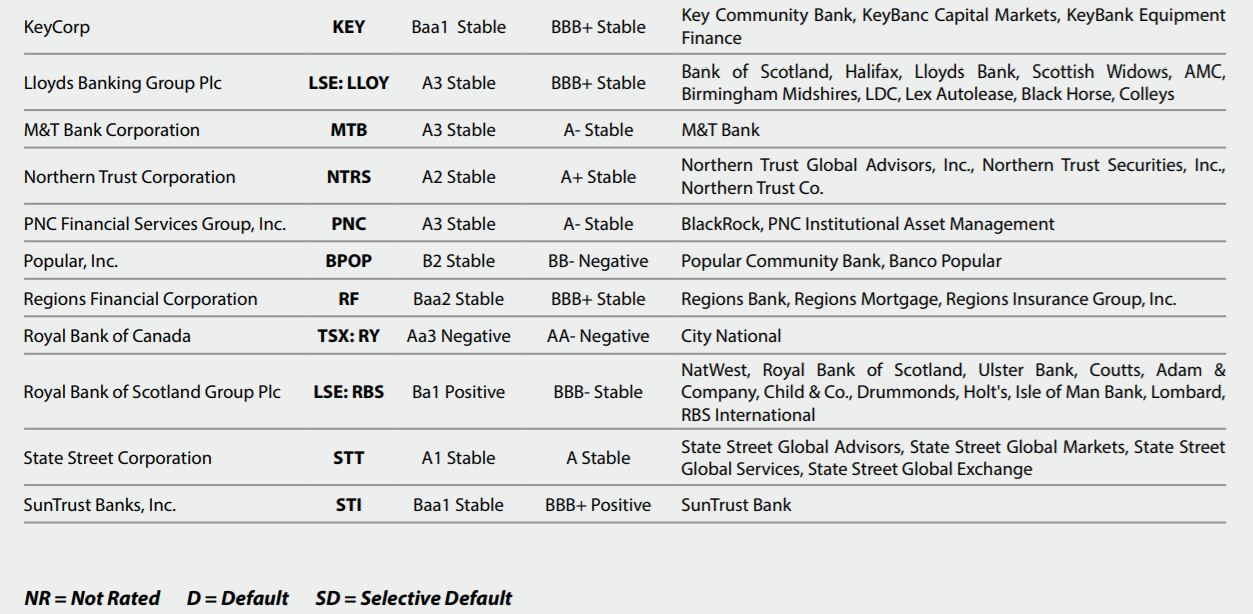

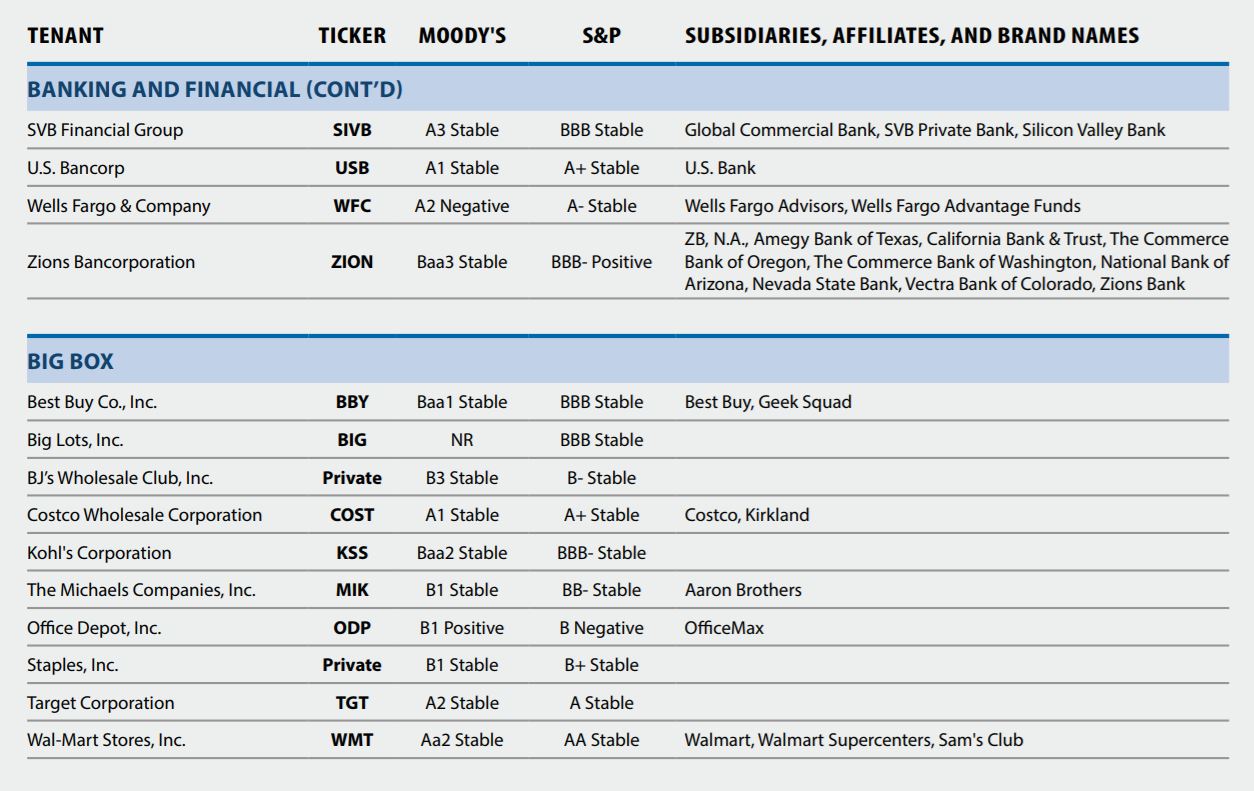

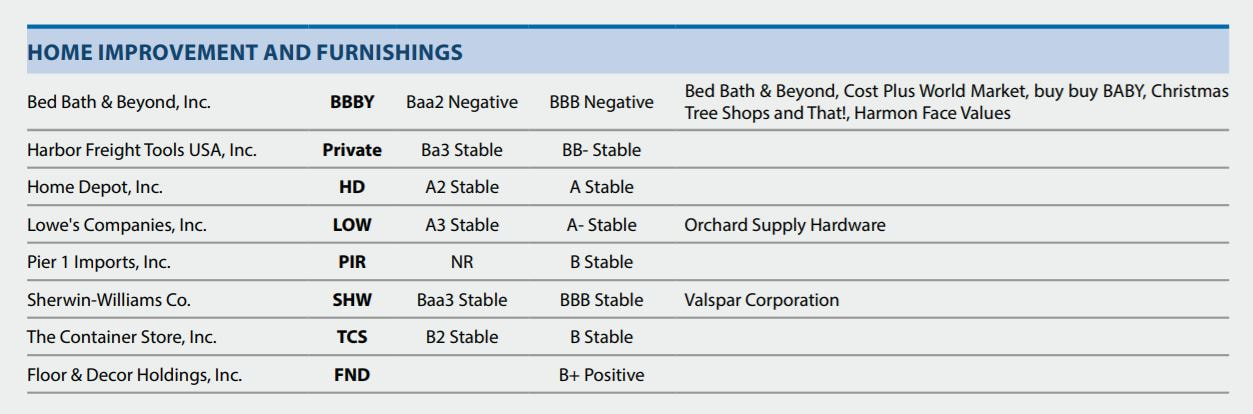

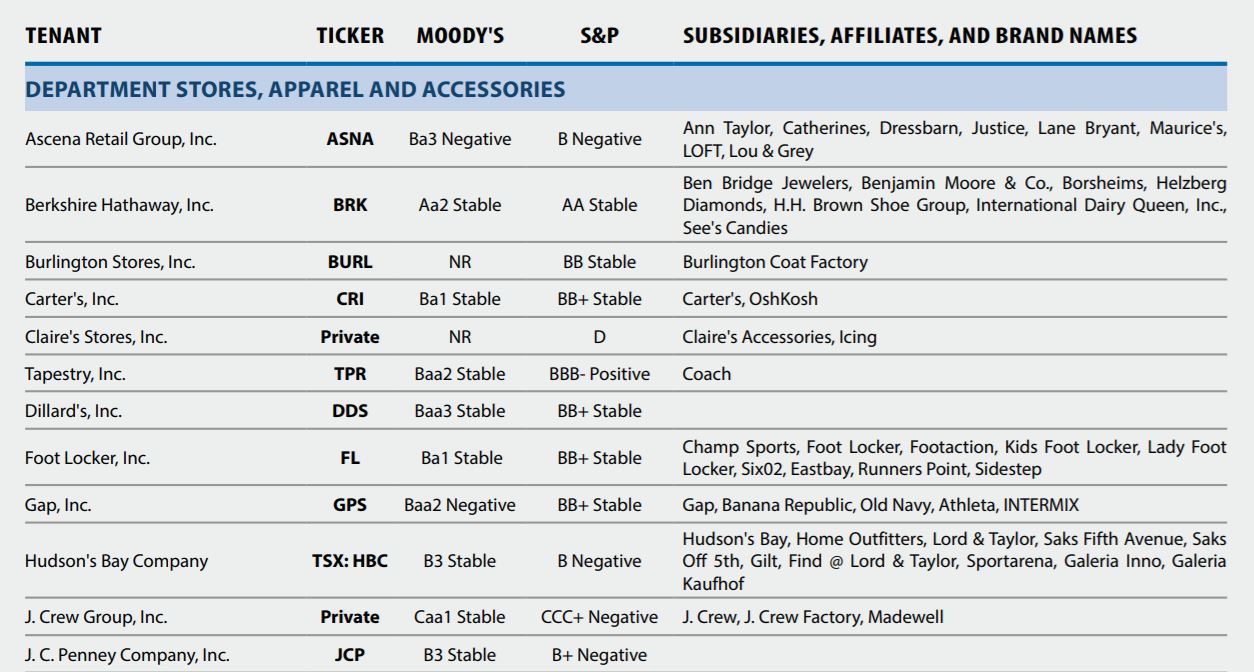

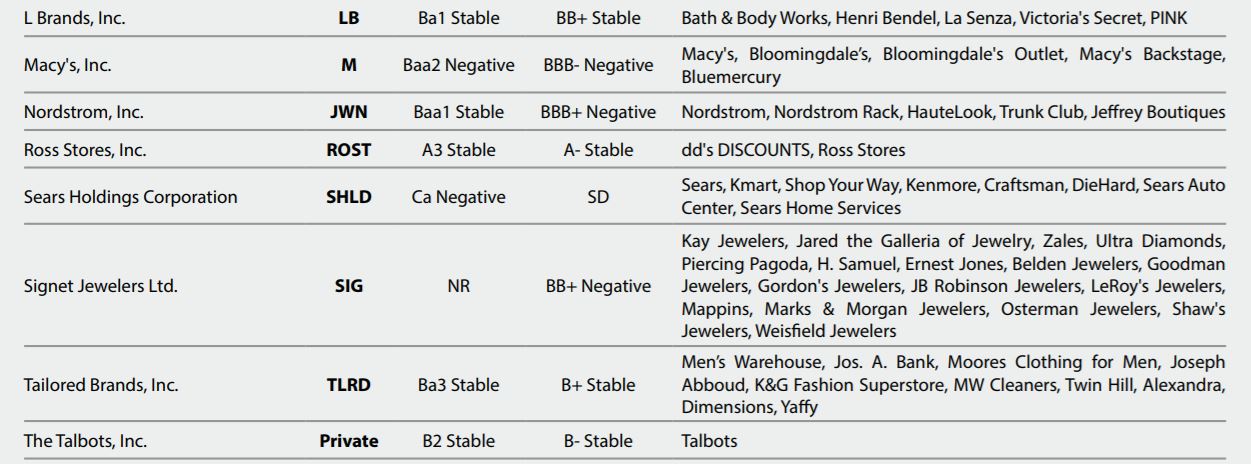

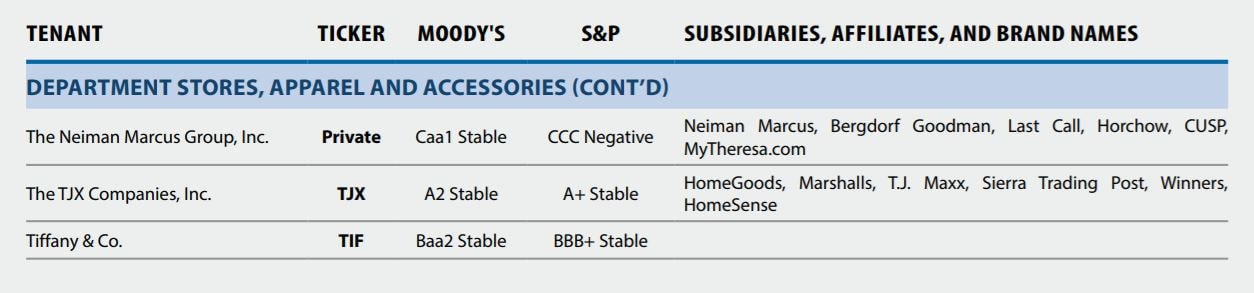

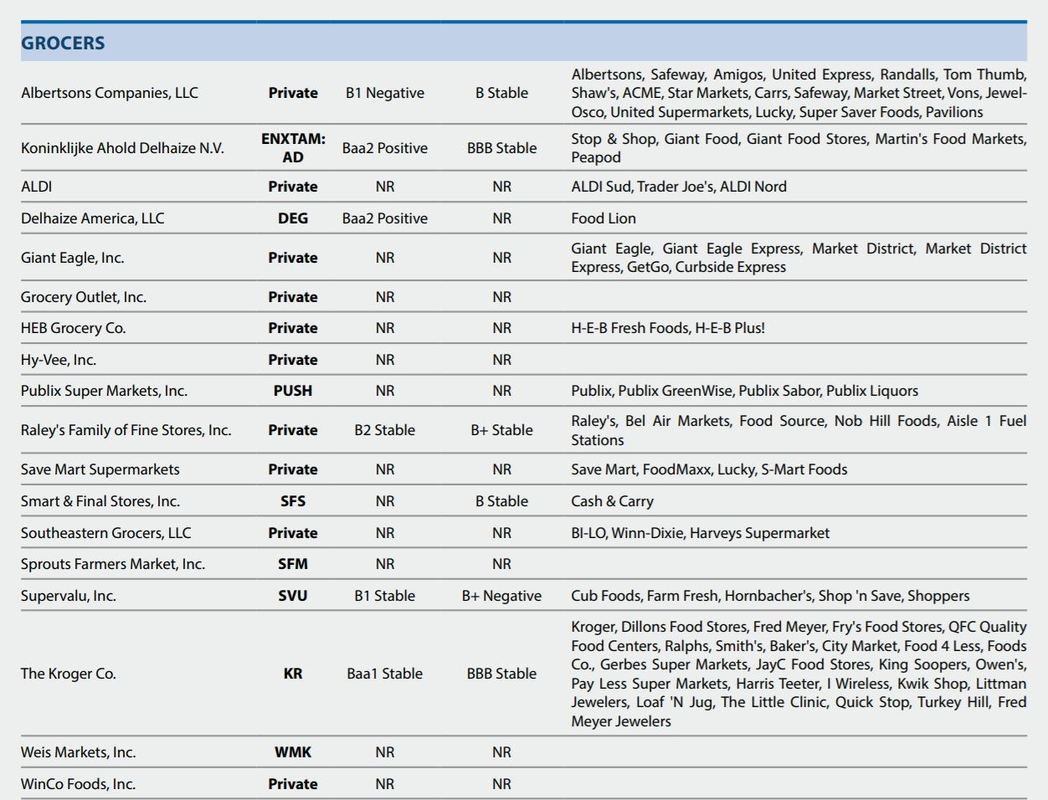

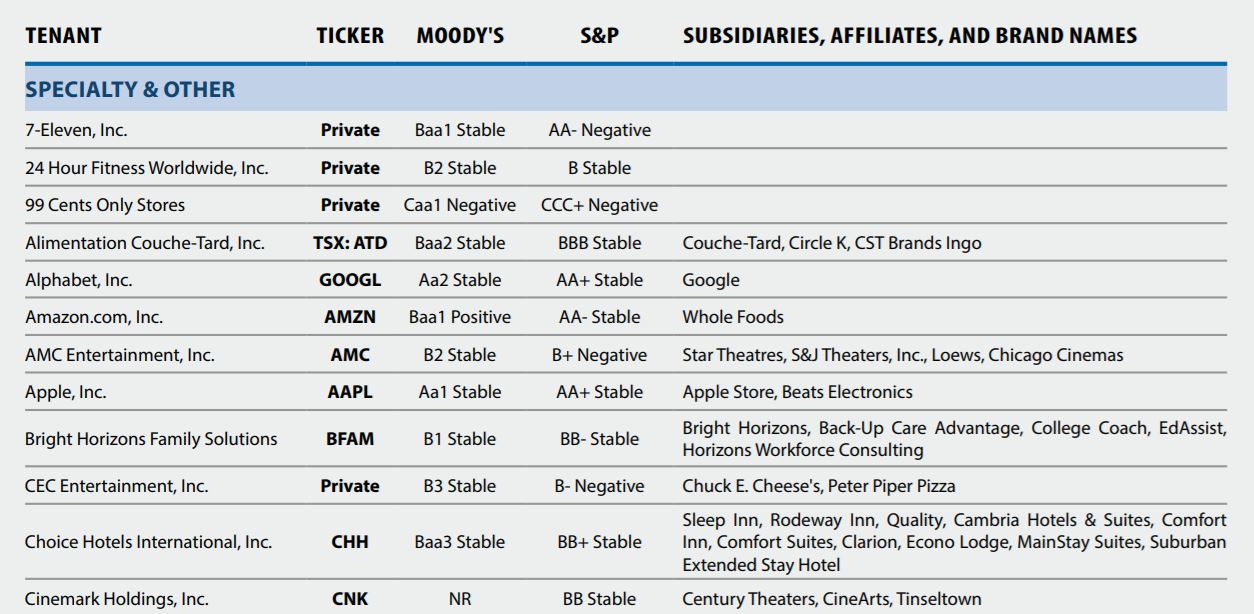

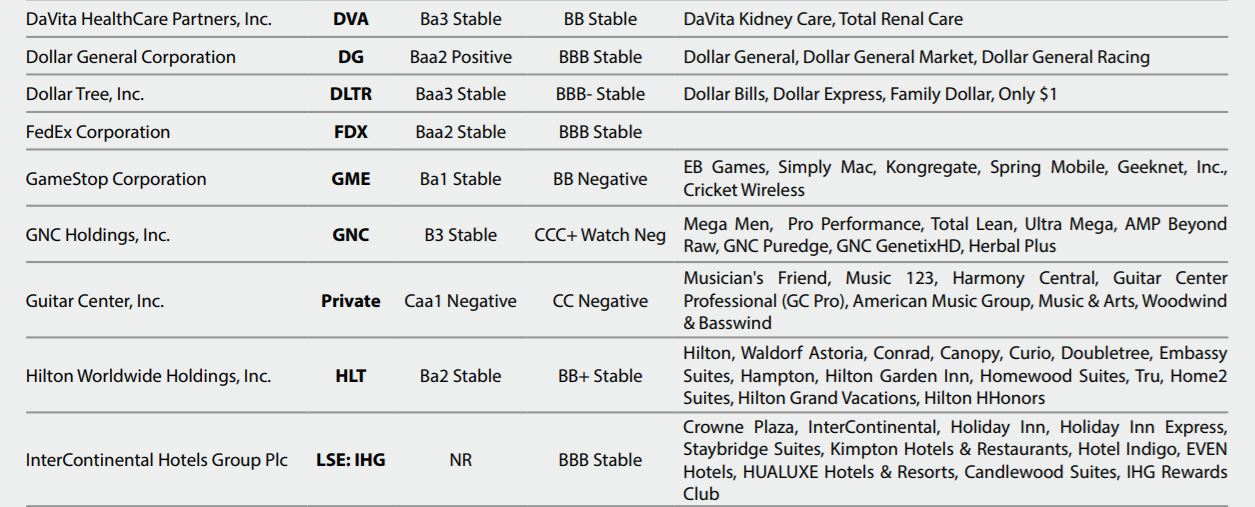

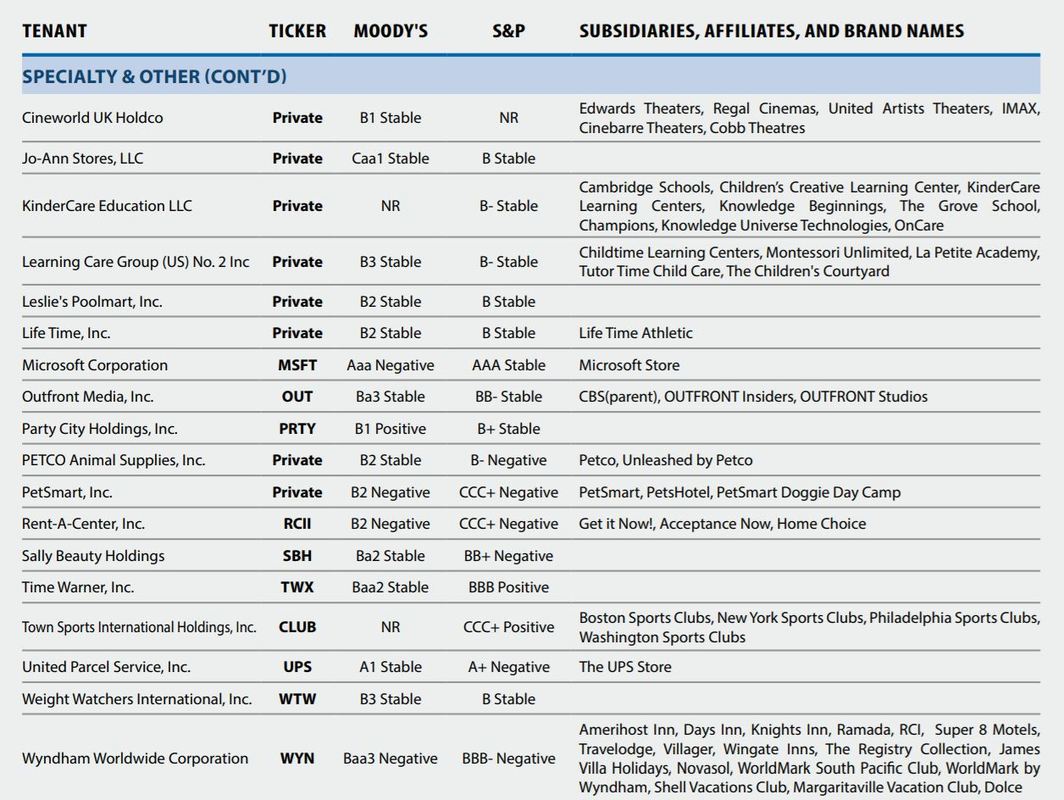

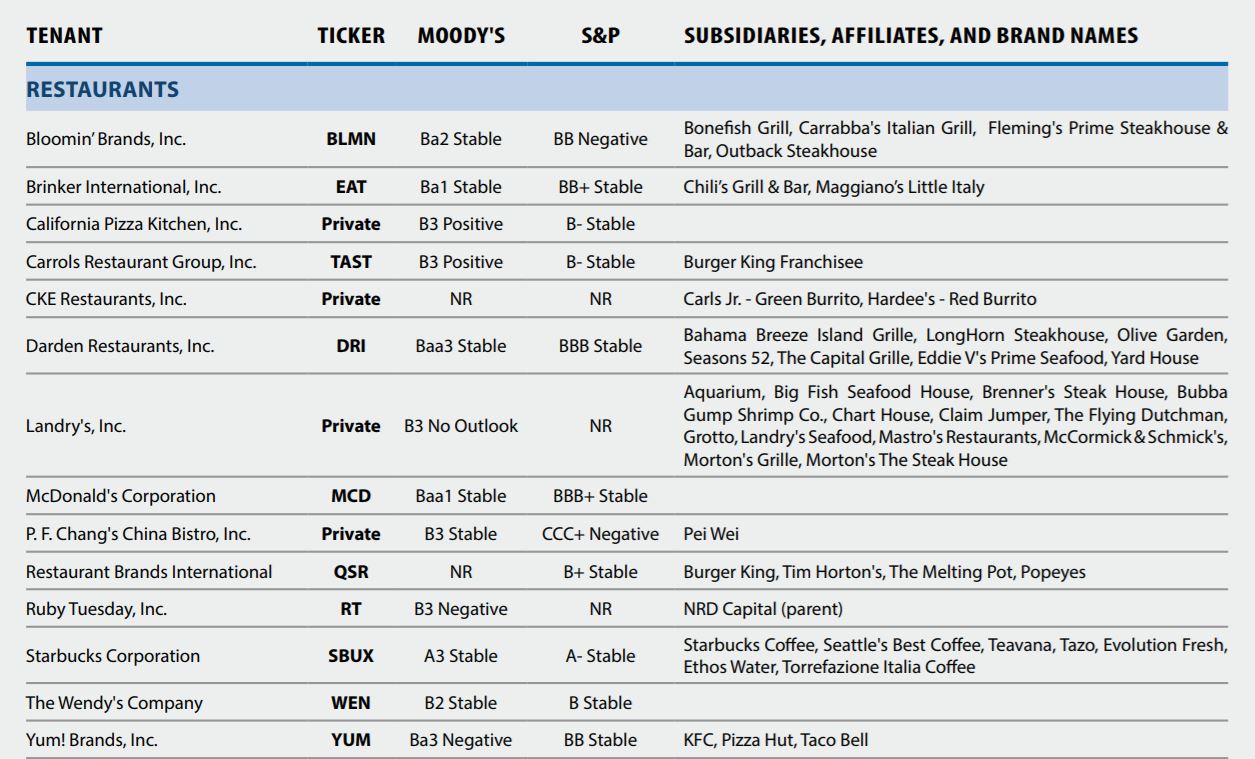

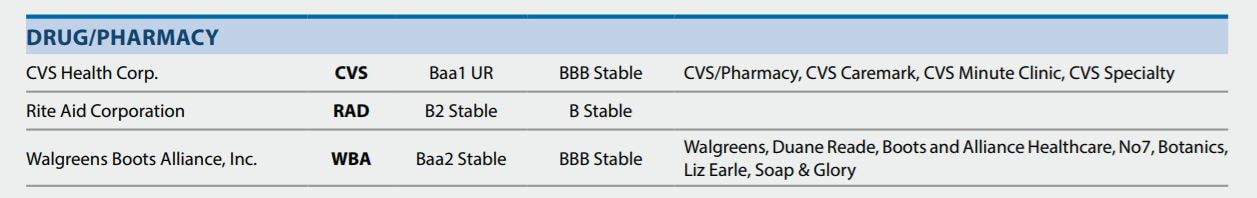

1. Overcome Your Fear With Knowledge Learning about real estate will help to manage your fear of the unknown, uncertainty and unexpected events. Arming with right education, you’re more likely to take the leaps necessary to progress to the next level. More importantly, it will help to reach your investment objectives or goals. Where do you learn about real estate? A good place to start is to read books, newspapers, magazines and online articles on related topics. One resource will lead to another, and then another. You find yourself asking questions or wanting more information on a specific topic, it will guide you to the next article, book, blog or webinar. 2. Ordinary People Can Be Successful You don’t need to have any innate real estate talent or know-how from beginning. You will truly see that most people can learn to invest. You don’t need a degree in law, finance, business, investment or real estate. In fact, you don’t need huge sums of cash. Ordinary people just like you, with ordinary reserves of cash, have achieved great results in real estate investment. 3. Select a Category of Real Estate It will help you to narrow down which area of real estate you’d like to concentrate. There are two main categories: Residential and Commercial. When you understand some of the unique qualities of each category of real estate, you’re more likely to discover the type and location that best align with your investment strategy. 4. Work with Experts to Assist with Your Investment Strategy It will also help you to identify which experts might be best for your particular kind of investment strategy. When you assemble your team of advisers, one of them will be your real estate agent. He or she will be an expert in one particular sector—the one you’re investing in—but most likely will not be an expert in other sectors. For example, he or she might specialize in duplexes (residential), but not strip malls (commercial). So by focusing with one category, you can retain the same team of advisers. If you want exploring further, please contact us. Growth is projected to rebound at around 15% in 2018 and an average 7.6% in 2019-20. Both the fiscal and current account balances will significantly improve, with the budget and the current account running surpluses expected from 2020 onwards Summary: At the current pace of spending in a context of conflict and insecurity, Libya will either exhaust foreign exchange reserves or be forced into ad hoc adjustments necessary to stave off crisis, but far from sufficient to reestablish growth foundations. The economic and social outlook assumes that political strife is resolved and a unified government can ensure macro-stability and launch a comprehensive program to rebuild the economic and social infrastructures. In this context, it is expected that oil production will progressively increase to reach its potential (around 1.5 million barrels per day (bpd)) by 2020, which is the time necessary to restore the heavily damaged oil infrastructure. Growth is projected to rebound at around 15% in 2018 and an average 7.6% in 2019-20. Both the fiscal and current account balances will significantly improve, with the budget and the current account running surpluses expected from 2020 onwards. Foreign reserves will also start building up by 2020. They will average US$72.5 billion during 2018-2020, representing the equivalent of 27.5 months of imports. However, high inflation coupled with weak basic service delivery are likely to have increased poverty and exacerbated socio-economic exclusion. In 2017, inflation accelerated, exacerbating further the hardship of the population. Prices of all commodities continued to increase, mainly driven by acute shortages in the supply chains of basic commodities, speculation in the expanding black markets, and the strong devaluation of the Libyan dinar (LYD) in the parallel markets. Consequently, inflation hit a record level of 28.4% in 2017 following the 25.9% in 2016. Full Report The relative economic improvement in 2017 remains fragile, as sustaining this dynamic depends crucially on a political resolution that in the current context seems hard to reach. The macroeconomic framework is unstable. It is characterized by record inflation and unsustainable twin deficits, mostly driven by rising budget expenditures. Dwindling savings are keeping pressure on foreign reserves and the LYD continued to lose its value in the parallel markets. To stabilize the macroeconomic framework, Libya needs to launch budget reforms and diversify the economy for growth and job creation. Recent developments Following four years of recession, the Libyan economy grew strongly in 2017, driven by a welcome recovery in oil production. However, sustaining this dynamic to reach economic potential depends on the resolve of the political strife. Exceptional but fragile implicit arrangements between the parties in conflict allowed the oil sector to more than double its production to an average 0.820 million barrels per day (bpd) in 2017, compared to only 0.380 million in 2016. The non-hydrocarbon sectors remained sluggish inhibited by lack of liquidity and security. GDP is estimated to have increased by almost 27 percent in 2017 allowing income per capita to substantially improve to 63 percent of its 2010 level after losing more than half of its value. Inflation accelerated, exacerbating further the hardship of the population. Prices of all commodities continued to increase, mainly driven by acute shortages in the supply chains of basic commodities, speculation in the expanding black markets, and the strong devaluation of the LYD in the parallel markets. Consequently, inflation hit a record level of 28.4 percent in 2017 following the 25.9 percent in 2016. High inflation coupled with weak basic service delivery are likely to have increased poverty and exacerbated socioeconomic exclusion. Despite higher hydrocarbon revenues, public finances remained under stress, given the high and rigid current expenditures driven by political motives. Budget revenues almost tripled in 2017 (31.8 percent of GDP) compared to 2016, but remained at half of potential. However, revenues were not even enough to cover public wages (36.4 percent of GDP), which increased due to political hires and higher salaries. Inefficient subsidies (9.2 percent of GDP) continued to absorb a significant amount of budget resources while capital expenditures remained weak (4.8 percent of GDP). Consequently, a high budget deficit persisted at 26 percent of GDP in 2017 (63.1 percent of GDP in 2016). The deficit is being financed mainly through cash advances from the Central Bank of Libya. The domestic debt has quickly increased to reach LYD 59 billion end September 2017, up from LYD 1 billion in 2010. Although improving, the balance of payments continues to suffer from politically constrained production and export of oil and high consumption-induced imports. Libya managed to substantially increase oil export in 2017 (0.7 million bpd), but remained at half of potential. This relative performance is not enough for a sustainable current account considering the high dependence of Libya on imports to meet consumption and intermediate goods requirements. As a result, the current account deficit remained high at an estimated 9.4 percent of GDP. This deficit was fully financed by net foreign financial inflow, allowing foreign reserves to remain unchanged in 2017 at around US$ 72.6 billion. While the pegged official exchange rate was kept stable, the Libyan Dinar lost around 85 percent of its value in the parallel market due to the weak macroeconomic fundamentals and an illiquid banking system. Outlook At the current pace of spending in a context of conflict and insecurity, Libya will either exhaust foreign exchange reserves or be forced into ad hoc adjustments necessary to stave off crisis, but far from sufficient to reestablish growth foundations. The economic and social outlook assumes that political strife is resolved and a unified government can ensure macro stability and launch a comprehensive program to rebuild the economic and social infrastructures. In this context, it is expected that oil production will progressively increase to reach its potential (around 1.5 million bpd) by 2020, which is the time necessary to restore the heavily damaged oil infrastructure. Growth is projected to rebound at around 15 percent in 2018 and an average 7.6 percent in 2019 -20. Both the fiscal and current account balances will significantly improve, with the budget and the current account running surpluses expected from 2020 onwards. Foreign reserves will start building up by 2020. They will average US$72.5 billion during 2018-2020, representing the equivalent of 27.5 months of imports. Risks and challenges The baseline macroeconomic scenario presented above is very fragile because it requires upholding the implicit agreement between the parties in conflict to ensure minimum security around oil infrastructure. Moreover, an improved macroeconomic outlook is unlikely to be sustained and is not sufficient to bring about significant change, unless immediate and targeted actions are taken to address the humanitarian crisis. The country needs humanitarian aid and specific programs to address the destruction and lack of basic services that a large part of the population faces. Immediate challenges are to restore peace that would lead to macroeconomic stability and to improve basic public services. This calls for immediate actions to bring current expenditures under control, especially the wage bill and subsidies, and improve governance of the financial sector, which will also contribute to price stability. Over the medium term, the country needs broader and deeper structural reforms to stabilize the macroeconomic framework and promote private sector-led job generation. Other medium term priorities should focus on promoting the development and diversification of the private sector for job creation through policies to reorient the economy away from hydrocarbon dependence, reforming the financial sector, and improving the business environment. Libya’s economic fragility has important consequences for the people’s well-being. Although there is no systematic study on poverty and very little evidence on the current well-being of Libyan households, it is not unrealistic to think that for most of Libyans living conditions are dire. Since hydrocarbons account for a large share of GDP and government revenues (40 and 86 percent respectively), the sharp decline in oil exports started in 2011 has severely impacted public services. The erratic power supply and the recurrent food shortages also contribute to worsening conditions for people. In the current situation, large share of the population is either vulnerable to poverty or has fallen into poverty. Source: World Bank Know your tenant’s company profile and its ratings before you decide to invest (Tenant is who pays and guarantees the lease for you) One of our criteria selections for net lease commercial real estate investment (NNN CRE) is to select the right tenant very carefully according to their rating. In fact, it is also one of our required selections to mitigate our capital risk. Our typical selected tenant is Dollar General, you can find out this company profile as follow: Dollar General Corporation is a United States chain of variety stores headquartered in Goodlettsville, Tennessee. Dollar General Corporation is an American chain of variety stores headquartered in Goodlettsville, Tennessee. As of August 2017, Dollar General operated over 13,000 stores in all U.S. states except: Alaska, Hawaii, Idaho, Montana, Washington, and Wyoming. The company first began in 1939 as a family-owned business called J.L. Turner and Son in Scottsville, Kentucky by James Luther Turner and Cal Turner. In 1968 the name changed to Dollar General Corporation and the company went public on the New York Stock Exchange. Fortune 500 recognized Dollar General in 1999 and in 2017 reached #128. Dollar General has grown to become one of the most profitable stores in the rural United States with revenue reaching around $21 billion in 2017. Formerly called: J.L. Turner and Son Wholesale Type: Public Traded as: NYSE: DG S&P 500 Component Industry: Discount retailer Founded: 1939 in Scottsville, KY Founders

Number of locations: 14,000 stores (October 2017) Areas served: Contiguous United States except for the Northwest Key people:

Revenue: Increase $20.369 billion (2015) Operating income: Increase$1.940 billion (2015) Net income: Increase$1.165 billion (2015) Total assets: Increase$11.258 billion (2015) Divisions: Dollar General Market Subsidiaries:

Website: www.dollargeneral.com This data is for general information purposes only. DAJK cannot be held responsible for the accuracy of this information. All parties should verify details and ratings independently. If you would like to invest in net lease commercial real estate (NNN CRE), please contact us. If you do not see what you like, please send me your ‘wish list’ with specific investment criteria, we will locate and match your investment wish list. If you would like to learn more how to invest in net lease commercial real estate in USA, you can discover more at NNN CRE USA. PROCEDURE: When you select what NNN CRE(s) you are interested, please send me your Letter of Intent (“LOI”) and Proof of fund (“POF”) to engage the acquisition/investment. The closing time frame is from 30 to 90 days at this point if the Seller accepts our offer. The escrow instructions will be provided for wiring of your investment funds once the Sale and Purchase Agreement is executed. Please note your POF can be a Bank Comfort Letter (“BCL”) from Tier 1 bank or a copy of your deposit with First American Title. Please note our escrow service is with First American Title, Website: http://www.firstam.com/title/commercial/about/index.html The London Bullion Market Exchange’s latest Precious Metals Forecast Survey has split analysts on the likely direction of precious metals in 2018. The annual forecast brings together a group of experts to predict the high, low and average price of gold, silver, platinum and palladium during each 12-month period. This year 34 participants were asked for their views. Notable factors that divided the group’s projections included the level of U.S. real interest rates, the likely impact of geopolitical factors and the pace of global economic growth. For gold, the different opinions prompted forecasts in a trading range of US$390 – from a low of US$1,120 per ounce to a high of US$1,510 per ounce. With similar divergences in the other estimates, including a silver low of US$14 rising to a high of US$23, the LBMA said we could be in for “a dramatic year in precious metals”. The extremes at either end of the forecast, however, effectively cancelled each other out with average price predictions for each metal in 2018 little different from those actually seen in the first half of January. If the combined wisdom plays out, the average price of gold across 2018 would be US$1,318, with silver averaging at US$17.81. In the 2017 forecast survey analysts predicted that the average gold price for the year would be US$1,244. As it transpired, they were just 1% out with actual average price of US$1,257. The full survey and what the individual analysts had to say about precious metals prices in 2018 will be available upon your request. Please contact us for the full survey. |

AuthorDAJK GROUP is the place where investors, business owners and entrepreneurs can research and find useful information, insight, resources, advice, guidance and inspiration for acquiring funds for their project, acquisition for their net lease commercial real estate, increasing their assets and running their profitable business. Archives

July 2023

Categories |

Services |

Company |

|