|

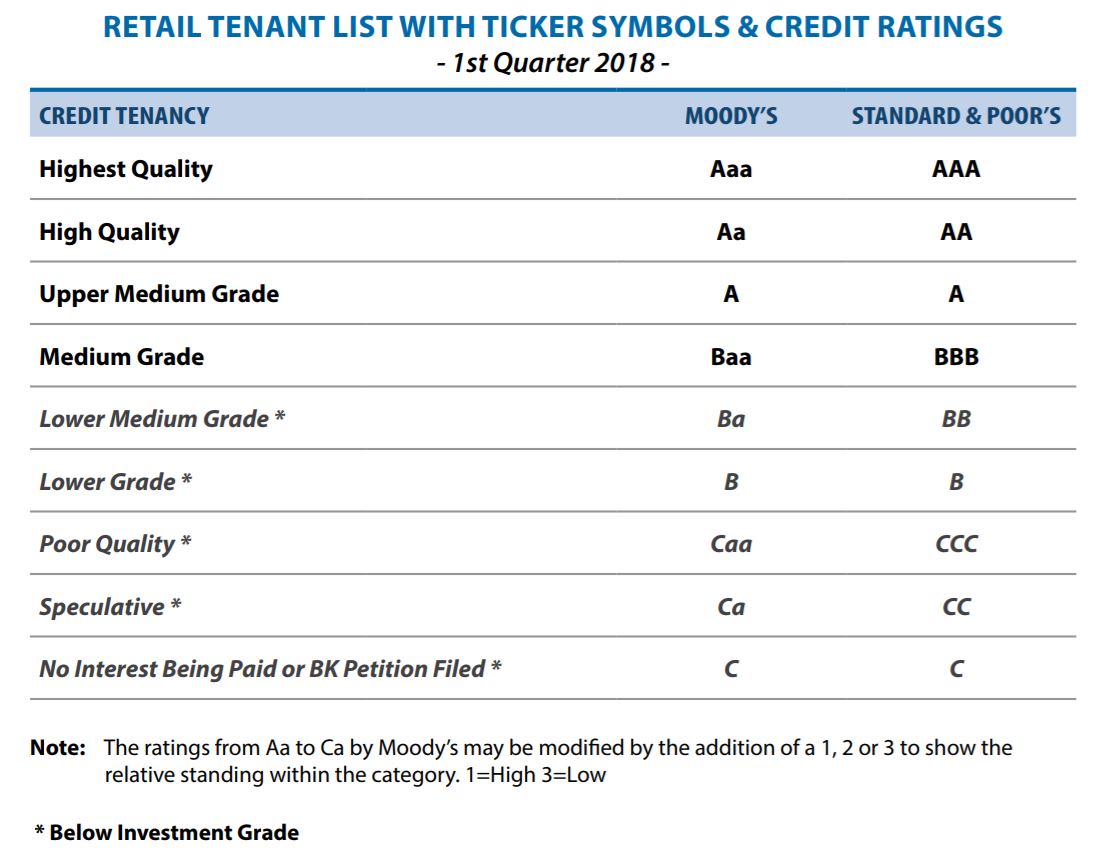

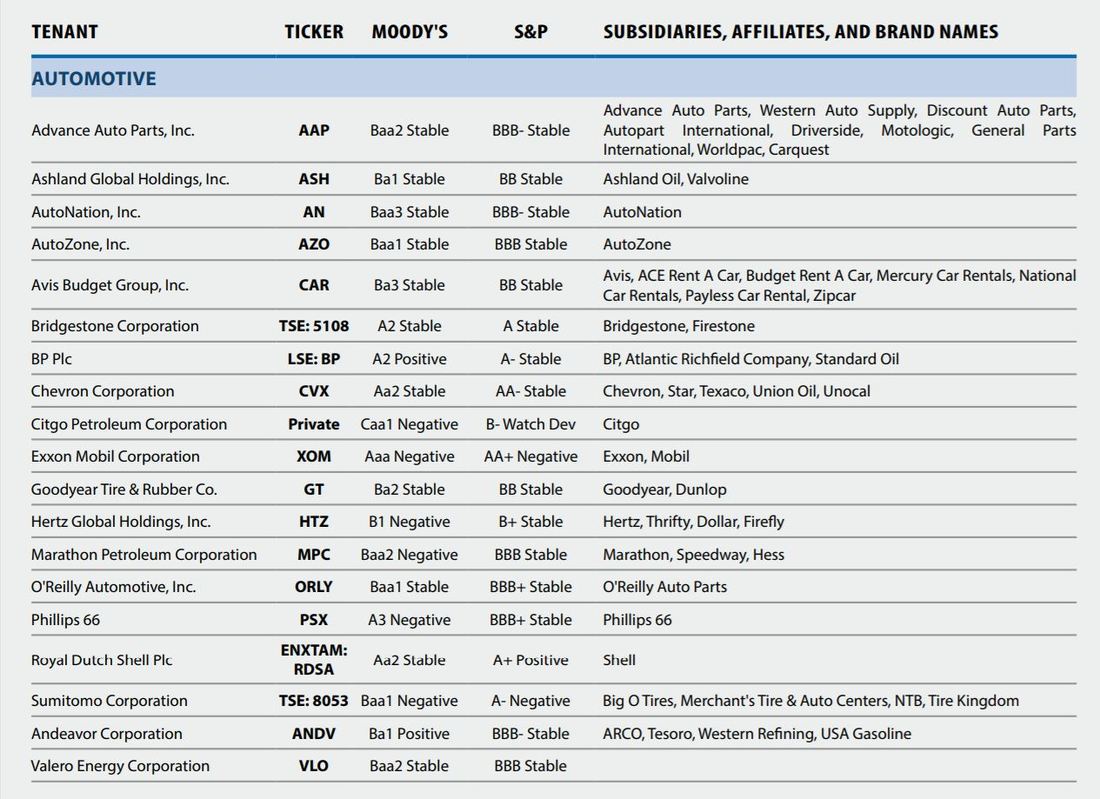

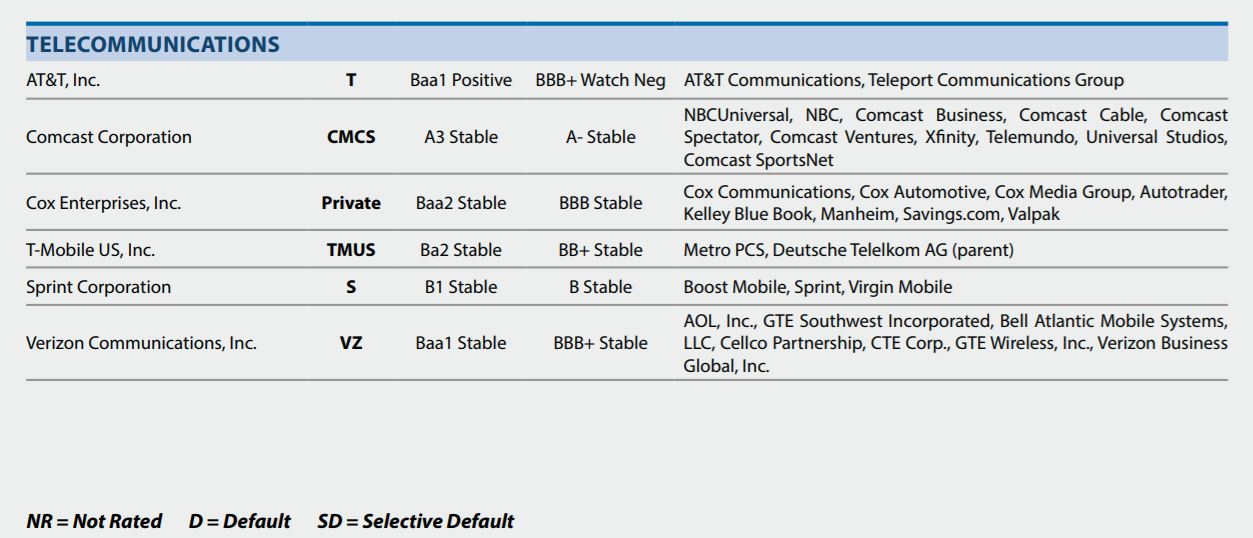

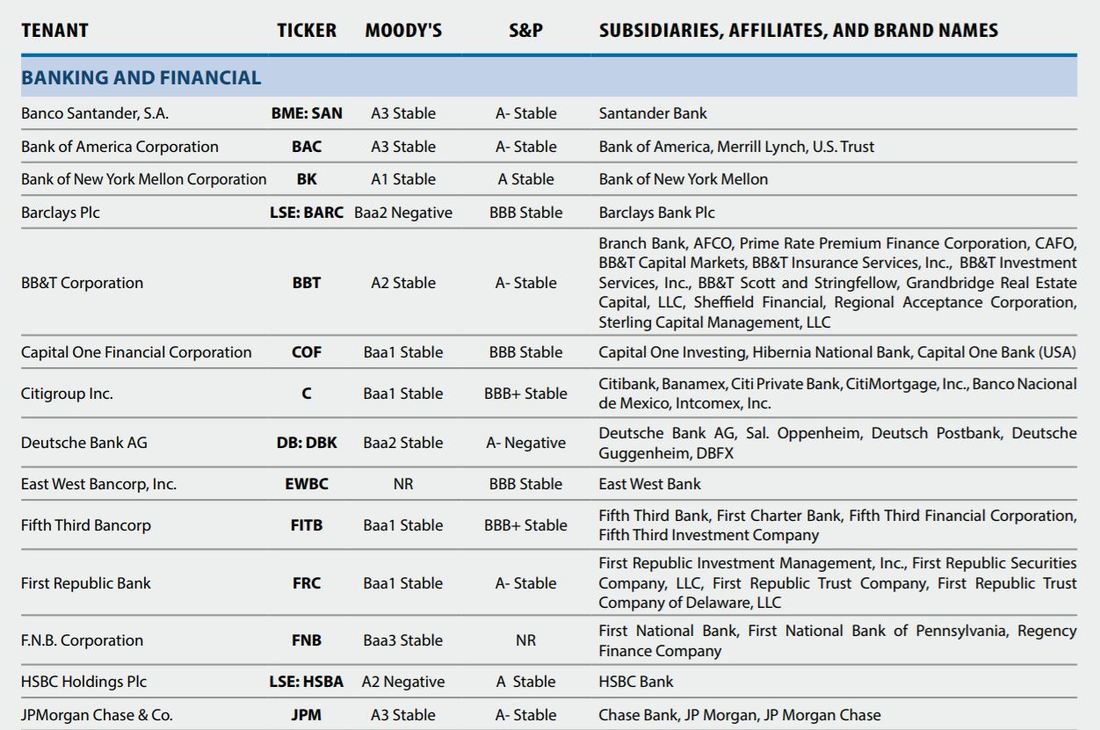

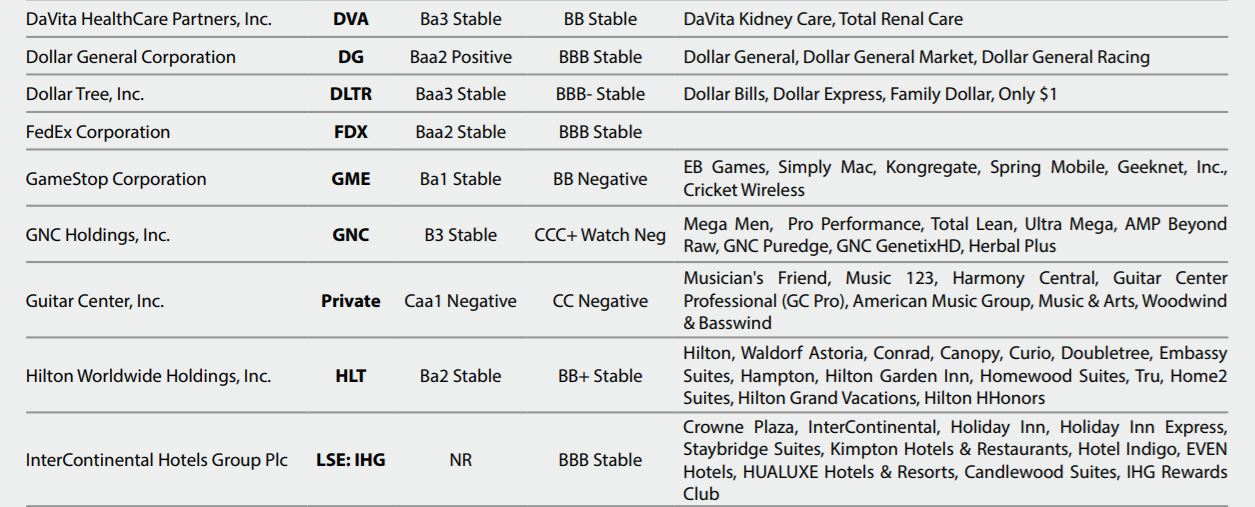

Know your tenant’s company profile and its ratings before you decide to invest (Tenant is who pays and guarantees the lease for you) One of our criteria selections for net lease commercial real estate investment (NNN CRE) is to select the right tenant very carefully according to their rating. In fact, it is also one of our required selections to mitigate our capital risk. Our typical selected tenant is Dollar General, you can find out this company profile as follow: Dollar General Corporation is a United States chain of variety stores headquartered in Goodlettsville, Tennessee. Dollar General Corporation is an American chain of variety stores headquartered in Goodlettsville, Tennessee. As of August 2017, Dollar General operated over 13,000 stores in all U.S. states except: Alaska, Hawaii, Idaho, Montana, Washington, and Wyoming. The company first began in 1939 as a family-owned business called J.L. Turner and Son in Scottsville, Kentucky by James Luther Turner and Cal Turner. In 1968 the name changed to Dollar General Corporation and the company went public on the New York Stock Exchange. Fortune 500 recognized Dollar General in 1999 and in 2017 reached #128. Dollar General has grown to become one of the most profitable stores in the rural United States with revenue reaching around $21 billion in 2017. Formerly called: J.L. Turner and Son Wholesale Type: Public Traded as: NYSE: DG S&P 500 Component Industry: Discount retailer Founded: 1939 in Scottsville, KY Founders

Number of locations: 14,000 stores (October 2017) Areas served: Contiguous United States except for the Northwest Key people:

Revenue: Increase $20.369 billion (2015) Operating income: Increase$1.940 billion (2015) Net income: Increase$1.165 billion (2015) Total assets: Increase$11.258 billion (2015) Divisions: Dollar General Market Subsidiaries:

Website: www.dollargeneral.com This data is for general information purposes only. DAJK cannot be held responsible for the accuracy of this information. All parties should verify details and ratings independently. If you would like to invest in net lease commercial real estate (NNN CRE), please contact us. If you do not see what you like, please send me your ‘wish list’ with specific investment criteria, we will locate and match your investment wish list. If you would like to learn more how to invest in net lease commercial real estate in USA, you can discover more at NNN CRE USA. PROCEDURE: When you select what NNN CRE(s) you are interested, please send me your Letter of Intent (“LOI”) and Proof of fund (“POF”) to engage the acquisition/investment. The closing time frame is from 30 to 90 days at this point if the Seller accepts our offer. The escrow instructions will be provided for wiring of your investment funds once the Sale and Purchase Agreement is executed. Please note your POF can be a Bank Comfort Letter (“BCL”) from Tier 1 bank or a copy of your deposit with First American Title. Please note our escrow service is with First American Title, Website: http://www.firstam.com/title/commercial/about/index.html

1 Comment

|

AuthorDAJK GROUP is the place where investors, business owners and entrepreneurs can research and find useful information, insight, resources, advice, guidance and inspiration for acquiring funds for their project, acquisition for their net lease commercial real estate, increasing their assets and running their profitable business. Archives

July 2023

Categories |

Services |

Company |

|