Exchange Traded Fund DefinitionAn ETF, or exchange traded fund, is a marketable security that tracks an index, a commodity, bonds, or a basket of assets like an index fund. Unlike mutual funds, an ETF trades like a common stock on a stock exchange. ETFs experience price changes throughout the day as they are bought and sold. ETFs typically have higher daily liquidity and lower fees than mutual fund shares, making them an attractive alternative for individual investors. Because it trades like a stock, an ETF does not have its net asset value (NAV) calculated once at the end of every day like a mutual fund does. Read more: http://www.investopedia.com/terms/e/etf.asp Kevin O'Leary' OSharesAfter she died I became the executor of her estate and for the first time saw the results of 50 years of investing in only dividend paying stocks. Her returns were stunning. She was not a financial advisor but she believed in the principle that you should get paid while you wait. To her a stock that did not pay a dividend was simply a speculation not an investment because you could only make money if the stock went up. Dividends assured her of income and she would only spend that. Full article at https://www.linkedin.com/pulse/my-love-dividend-paying-stocks-made-me-create-own-etf-kevin-o-leary Our Net Lease Strategy has 4 similar characteristics and 4 distinct and unique advantages over dividend paying stocksOur comments on 7/14/15 14:15 PST Mr. O’Leary, Thank you for sharing of your story regarding your mother’s investment philosophy.

Similarity with your mother’s investment philosophy, our Net Lease Strategy has 4 similar characteristics and 4 distinct and unique advantages over dividend paying stocks.

Your Shark Tank’s episodes are always enjoyable, entertaining and packed of valuable investment strategy and creative structured finance. Thank you for your time, Kind regards Related Blogs

DAJK GROUP is the place where investors, business owners and entrepreneurs can research and find useful information, insight, resources, advice, guidance and inspiration for acquiring funds for their project, acquisition for their net lease commercial real estate, increasing their assets and running their profitable business.

Our group of expert Oil Trader, Commercial Real Estate Specialist, Asset Management, and Business & Financial Analyst, can help to answer all your questions and to provide you with investment alternative and options catered to your investment strategy. Sign-up for a free 30-minute consultation with us now! Growing, Evolving and Pushing Forward!

0 Comments

News to help parents, guardians and caregivers show a child — from a preschooler to a college kid — why and how to become responsible with money. It’s never too early or too late to introduce everyday financial concepts to a young person. And, you don’t have to be a financial expert. Here are tips. Engage in regular conversations about money-related topics: That includes discussing with your child what you are doing, and why, when you manage money at home, around town or with the bank. For example, consider talking about similar products that have noticeably different prices at a store, and how you decide what is a good deal. And, you can explain that having a savings account at a bank has advantages such as income from interest, peace of mind of knowing the money will be there when you need it, and FDIC deposit insurance coverage for each customer up to at least $250,000 if the bank fails. “If you are using plastic to pay for purchases, consider explaining the difference between a debit card, which is like writing an electronic check, and a credit card, which requires the consumer to make a payment in the future,” said Luke W. Reynolds, Chief of the FDIC’s Outreach and Program Development Section. Even with automatic transfers, such as direct deposit of your pay, consider using your bank statements to show how money can move in or out of your account. And, special times of the year — like during tax time or your workplace’s “open season” for selecting health insurance — present opportunities to explain financial decisions. Consider giving an allowance as a teaching tool. It can be a positive way to teach kids, even those who are preschool age, about money management. But before you give the first allowance, help your child decide how much he or she will spend now and how much to save for future goals. Then, help your youngster see whether that target is being reached by looking at a bank statement online or a paper copy. Also talk through the tradeoffs involved with spending decisions, such as how buying one toy may mean forgoing going for the opportunity to purchase another item the child also wants. “There are many approaches to how best to structure an allowance, particularly whether to tie it to work such as household chores, so each family will need to decide what is best for them,” Reynolds added. Think twice before giving a child more money if he or she runs out of funds before the next allowance payment. That’s because part of the benefits of waiting to enjoy a bigger reward. And, for younger kids, consider paying an allowance in smaller denominations to make it easier to learn counting and saving skills. Help your kids develop a healthy skepticism of advertising and unsolicited inquiries: In general, teach children how to analyze advertisements; they need to know that “special offers” often are not the great deal they appear to be. Even young consumers are targets for identity thieves and among the victims of scams and rip-offs. Information for parents on protecting children’s personal information from identity theft is available at https://www.consumer.ftc.gov/articles/0040-child-identity-theft Highlight Series - For All Ages: Teaching Young People About Money

Entire e-book series can be requested with our Concierge Services Form. It will be emailed to you within 24 hours.

Children in this age group are naturally curious about the world around them, including money. By introducing several basic concepts — and being a good role model — you can help them gain financial skills that can last a lifetime. Learn about how money is made and used: Children can be introduced to money as soon as they learn to count. Even if you usually pay by credit or debit card, once in a while use bills and coins so your child can learn about the different values. Imaginary games, such as pretending to be at a store or restaurant, can help teach money concepts, too. Role playing with real coins can be especially advantageous because it can teach children the values of different coins, but remember that coins are a choking hazard for younger kids. The U.S. Mint has resources for parents to use at www.usmint.gov/. Learn about how money is earned: Getting paid for little chores will allow your child to learn the value of working and earning. Consider making a chart for jobs your child can perform and include the payment amount for each completed task. Start to save: Consider separating spending money from savings. Begin with clearly labeled jars or piggy banks for your child to divide up his or her cash. This will show your child that spending and saving should go hand in hand. Understand the difference between needs and wants: For your child to make good spending decisions, he or she will need to be able to identify and distinguish needs (things you cannot live without, like food and shelter) from wants (toys and candy). One game you can play involves singling out items in your house and asking your child if it’s a need or a want…and why. You can try the same thing while shopping. Borrow responsibly: Children at this age generally don’t understand the difference between buying and borrowing — they have to be taught how to be responsible for borrowed items and to return them on time. Help your child create and maintain a list of items he or she has borrowed from friends or relatives, along with the date due. Doing so will support the concepts of responsible borrowing and personal accountability.

Kids in this age group are ready for meaningful lessons about saving and spending money wisely. Many also are ready to open their first savings account, if they haven’t already. Here are key concepts to teach.

Think before you buy: Continue discussing with children how to separate their needs from their wishes. Also help them think how to prioritize how they use their money. Consider, for example, making a household shopping list and asking your child to number the items in the order of importance. Also use visits to the store to point out how advertisements can lead to unnecessary purchases or steer consumers toward products that are more expensive than alternatives. Try to stick to a budget: Creating a simple spending plan at this age will teach him or her to set limits on expenditures, prioritize spending choices, and avoid running out of money. Younger kids may verbally agree to a spending plan, while older kids can write it down. You will likely need to help the child keep written track of spending so both of you can monitor the progress. Consider opening a savings account with your child: Shop together for the account, and pay particular attention to the account balance needed to open the account and to maintain it without incurring fees. Also point out the interest rate, which will be expressed in advertisements as the “Annual Percentage Yield” (APY). Many banks offer special savings accounts for young people that can be opened and maintained for less money than a regular savings account. Consider reviewing with your child one of the savings account statements that shows transactions. “If you also encourage your child to keep a log of the money in the account, that could be an opportunity for you to work together on a simple math exercise and learn the value of keeping track of money,” said Luke W. Reynolds, Chief of the FDIC’s Outreach and Program Development Section. And when you’re at the bank to open or access an account, ask a customer service representative to talk about what the bank does (it takes deposits, makes loans, and so on) and that money kept in a bank is safe. Know that there are different ways to pay for things: Children can benefit from understanding where the money is coming from when people pay for purchases by writing a check or swiping a credit or debit card. Use your bank and credit card statements and ATM withdrawal receipts to explain that actual cash is either deducted from an account or it must be paid back by a certain date. When to be definitive, and when to make a stride back and take a gander at the more extensive picture before making the important decisions. A standout amongst the most imperative aptitudes any great entrepreneur can learn is when to be definitive, and when to make a stride back and take a gander at the more extensive picture before making the important decisions. In times of turmoil, fervor, fast development, or emergency, there will be a larger number of decisions to make than regular and less time to make them. There will likewise be a practically powerful allurement to settle on these decisions as fast as could be expected under the circumstances. A great entrepreneur must be smooth, confident about his decisions, noticeable to his group and their clients, and in control of the circumstance. Be that as it may, this doesn't mean surging in and hopping to rash conclusions before knowing every one of the certainties. I recall of my late read a tale of Stephen Covey's valuable lesson: look for first to see, then to be caught on. He tells the sweet story of a young lady holding two pieces of fruit. Her mom comes in and approaches her for one of the pieces of fruit. The young lady looks at her mom and takes a nibble of one apple, then the other. The mother looks frustrated at her little girl's self-centeredness. At that point the young lady gives one of her nibbled fruits to her mom, and says: "Mommy, here you are. This is the sweeter one." Notwithstanding when we think we know the greater part of the statistical data points, and have seen each edge of a given situation, reality around a circumstance can be a major astonishment. This is one of the things that makes life so energizing — exactly when we think we comprehend something, we discover some new information. This is the reason postponing judgment can be so valuable in business. There have been numerous events when I have been enticed to settle on an on the spot decision and chose to hold up until I can see the entire picture all the more plainly. These deferrals can mean missing the odd open door. There is a developing overreliance on utilizing insights as a distinct option for utilizing judgment. While raw numbers are to a great degree valuable, information investigation shouldn't singularly drive each decision. One imperative part of decision making that is frequently disregarded is peaceful consideration. In the wake of taking a gander at all the details, identifying with every one of the specialists and breaking down the greater part of the points, then take eventually to yourself to think things through unmistakably. Go out for a stroll, locate a shady spot, or basically sit and think for some time. Try not to defer superfluously — yet don't surge either. Get that adjust right, and you are significantly more prone to make the wise and intelligent decision. Growing, Evolving and Pushing Forward! Related Topics: Business, Entrepreneur and Investment

Related Books on Amazon Corner: Entrepreneur & Business

DAJK GROUP is the place where investors, business owners and entrepreneurs can research and find useful information, insight, resources, advice, guidance and inspiration for acquiring funds for their project, acquisition for their net lease commercial real estate, increasing their assets and running their profitable business.

Our group of expert Oil Trader, Commercial Real Estate Specialist, Asset Management, and Business & Financial Analyst, can help to answer all your questions and to provide you with investment alternative and options catered to your investment strategy. Sign-up for a free 30-minute consultation with us now! Growing, Evolving and Pushing Forward! If the middle-class investor "saves" money by investing in mutual funds or 401K, then the wealthy and strategic investor "save" money by invest in net lease or triple net lease. Highlights:

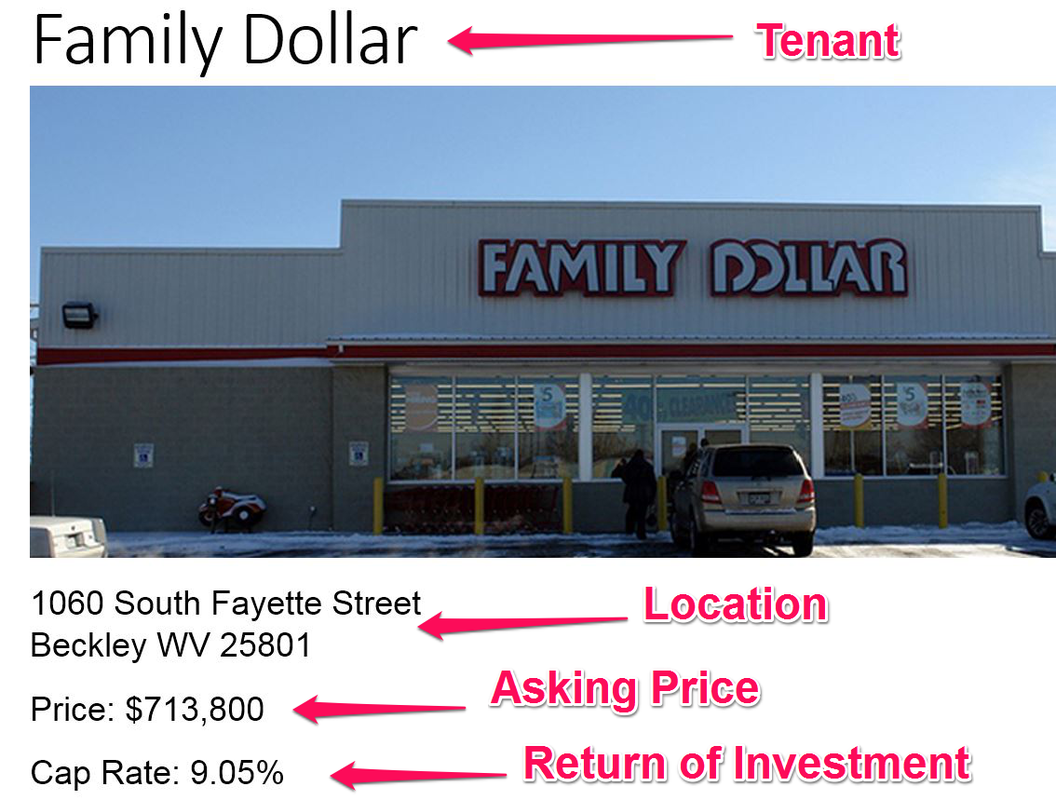

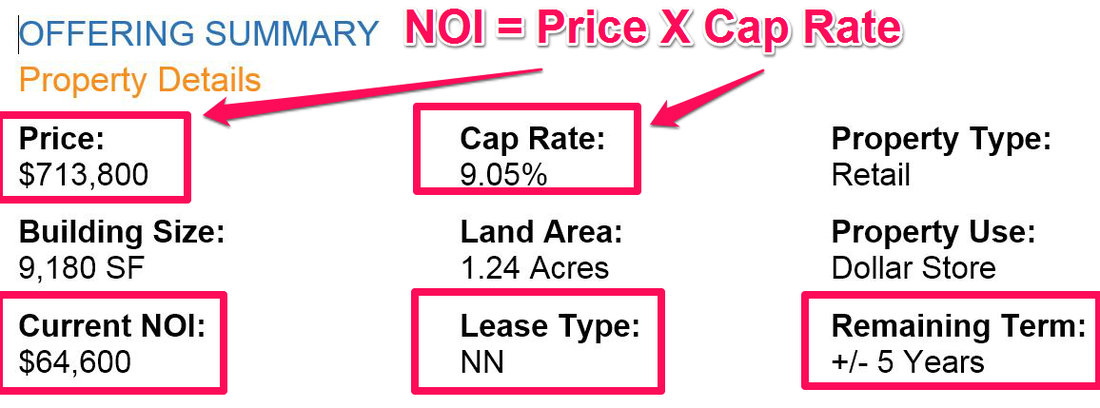

Please review our previous blogs: What Are The Key Data From Net Lease Listing?

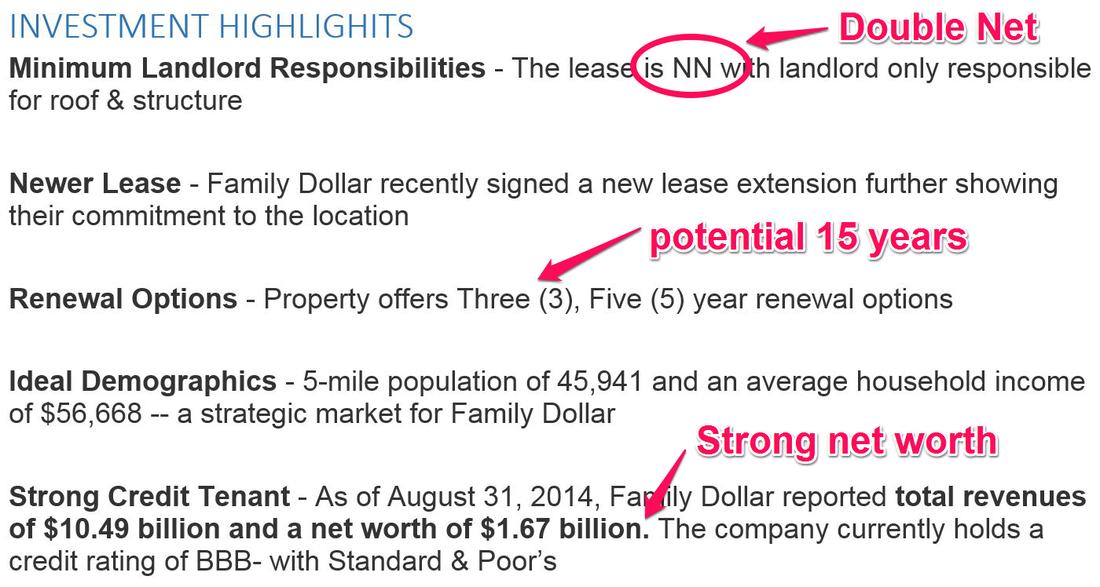

You want to reduce your risk by select strong credit tenant with strong net worth $US 100+ million. Also, you make sure the Family Dollars will be a guarantee for your lease payment. How much monthly fixed income will investor receive if he invests $US 713,800?The annual return of investment, before mortgage and tax, is $US 64,600. If you invest all cash in this Family Dollar, you will receive $US 5,383 a month. Please note your payment is directly from Family Dollar. Please note this is a passive income (NOT earning income) which is taxed at lower tax rate. The exact tax rate depends on individual entire financial structure. Please consult with your Certified Public Accountant. Your potential passive income is $64,600 X 15 years = $US 968,984 What Other Benefits When USA-investor Invests in Net Lease?Depreciation & Appreciation: For USA-based investor, you may receive additional benefits such as depreciation and appreciation. Scalability: Also, you are NOT involved in daily operations of the Family Dollar neither repair & maintenance. This means you can invest simultaneously in multiple net lease properties and different locations. Therefore, your scalability is limitless. It’s only limit by how much capital you can access. Re-financeable & Transferable: You can borrow against it if you need additional cash. You can structure this net lease be transferred to your foundation or business entity at your death event. How Much Risk When USA-investor Invest in This Net Lease, Family Dollars?

If the middle-class investor "saves" money by investing in mutual funds or 401K, then the wealthy and strategic investor "save" money by investing in net lease or triple net lease. For further discussion, please contact us for our free 30-min confidential consultation. Related resources at Amazon Corner:

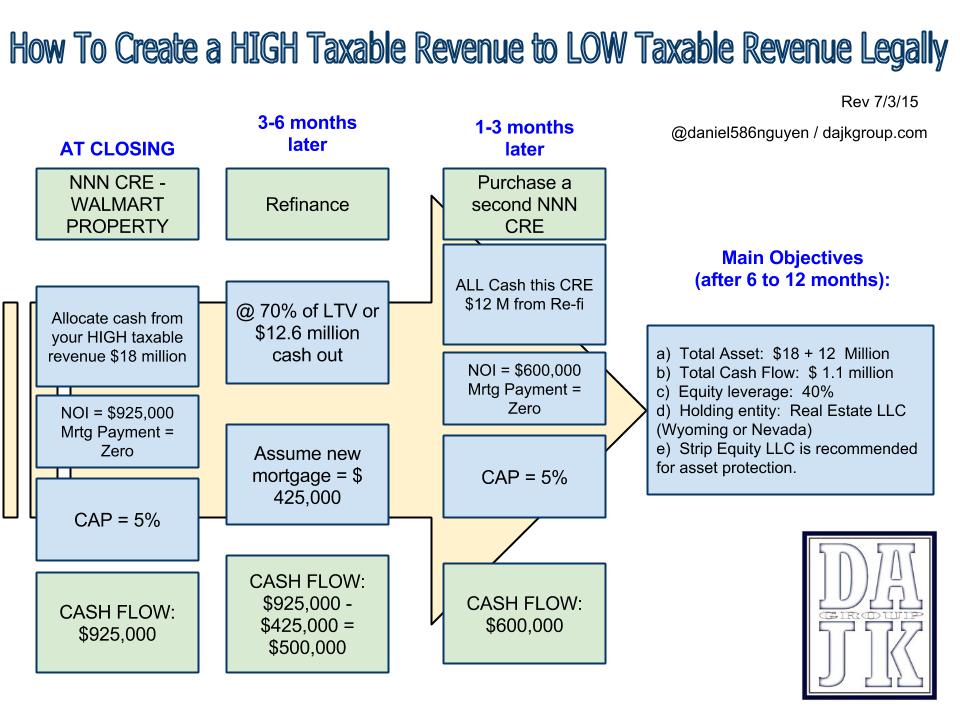

Referenced Net Lease Listing: Case Study_Family Dollar NN Diagram for illustrating of How using a Triple Net Lease To Create a High Taxable Revenue to a Low Taxable Revenue LegallyTypical Scenario: The Digital Online Business (“DOB”) generates average $US 40 million in last 3 years. Since this DOB has very little on overhead and management’s expenses, it is most likely DOB’s revenue will be taxed at the highest tax rate. Its total taxes’ bill most likely is Fifty Percent (50%) or $US 20,000,000. How can this DOB minimize his taxes’ bill legally and simultaneously increase his asset?First, the owner of DOB just allocates $US 18 million for investment in the Net Lease or Triple Net Lease commercial real estate (“NNN CRE”). Step #1: DOB purchases all cash of the 1st NNN CRE for $US 18 million. Step #2: Refinance after 3 to 6 months of closing of the 1st NNN CRE. The loan amount is approximately 70% Loan-to-value or $US 12,600,000. Please note this is a debt finance, the DOB would not pay tax on this $US 12.6 million. Step #3: DOB purchases all cash of the 2nd NNN CRE for $US 12 million from his debt finance. Please note DOB can repeat step #2 and #3 again if he wants to. After approximately 12 months, DOB creates at least 3 favorable and strategic objectives?

For further discussion, please sign-up for our free 30-min confidential consultation. DAJK GROUP is the place where investors, business owners and entrepreneurs can research and find useful information, insight, resources, advice, guidance and inspiration for acquiring funds for their project, acquisition for their net lease commercial real estate, increasing their assets and running their profitable business.

Our group of expert Oil Trader, Commercial Real Estate Specialist, Asset Management, and Business & Financial Analyst, can help to answer all your questions and to provide you with investment alternative and options catered to your investment strategy. Sign-up for a free 30-minute consultation with us now! Growing, Evolving and Pushing Forward! |

AuthorDAJK GROUP is the place where investors, business owners and entrepreneurs can research and find useful information, insight, resources, advice, guidance and inspiration for acquiring funds for their project, acquisition for their net lease commercial real estate, increasing their assets and running their profitable business. Archives

July 2023

Categories |

Services |

Company |

|