DAJK Asset Management Paves New Ground On the Project Funding

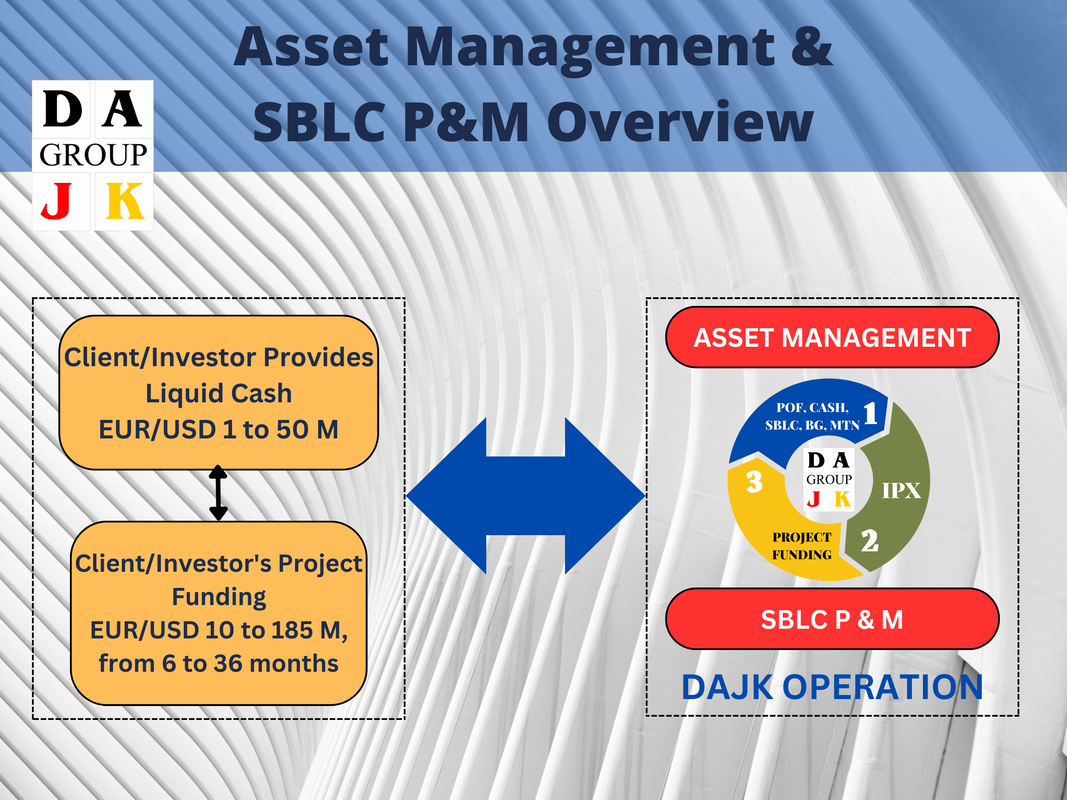

Our SBLC Provider and Monetizer (SBLC P&M) has developed a strategic investment structure that enables clients to participate as co-investors in a joint venture alongside DAJK Asset Management.

This strategic model offers clients the opportunity to share in the returns generated by DAJK's asset management expertise, which can then be strategically deployed to fund their own projects.

Through a meticulously crafted Joint Venture Agreement, SBLC P&M facilitates client partnerships with DAJK Asset Manager, granting them access to project funding tailored to their specific needs. This innovative approach allows clients to accelerate the scaling of their project funding efforts.

This strategic model offers clients the opportunity to share in the returns generated by DAJK's asset management expertise, which can then be strategically deployed to fund their own projects.

Through a meticulously crafted Joint Venture Agreement, SBLC P&M facilitates client partnerships with DAJK Asset Manager, granting them access to project funding tailored to their specific needs. This innovative approach allows clients to accelerate the scaling of their project funding efforts.

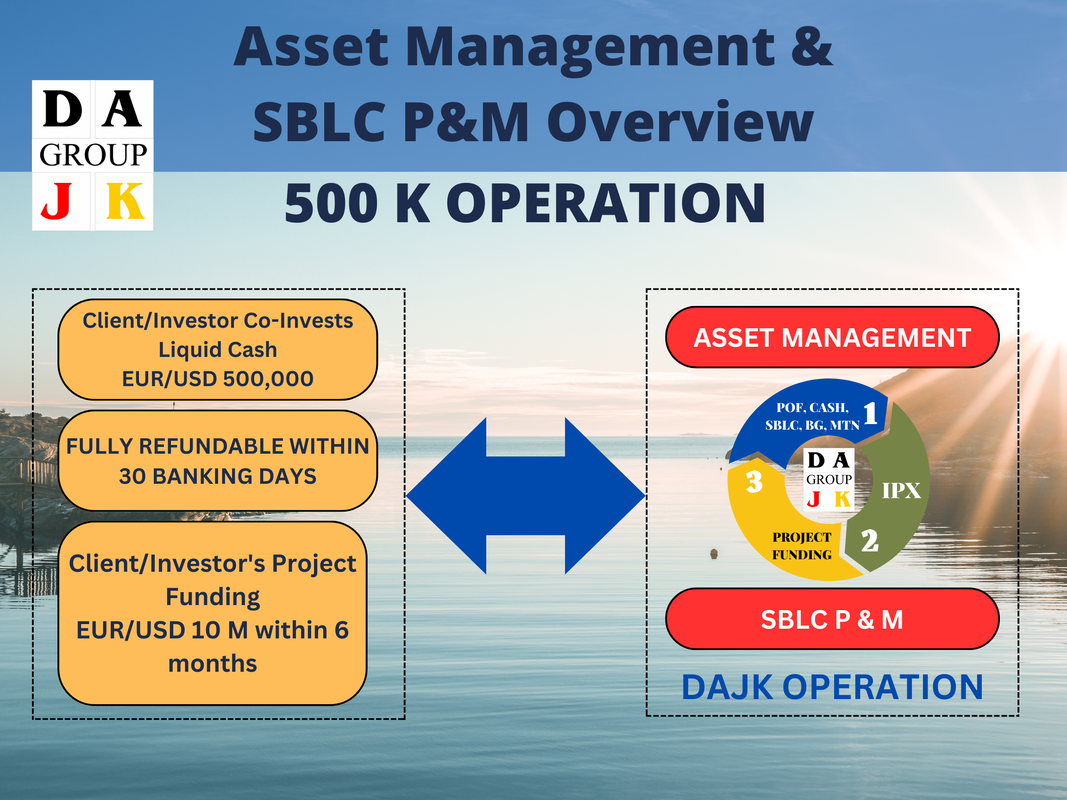

SBLC P & M 500K OPERATION

Leveraging economies of scale, SBLC P&M has established a customizable strategic model capable of serving clients on a global basis. This model offers project funding solutions ranging from EUR 10 million to EUR 185 million over a 36-month timeframe.

For projects requiring a lower development budget, ranging from EUR 10 million to EUR 20 million, SBLC P&M 500K Operation can expedite the process to a completion timeframe of 6 calendar months. This expedited access to funding is contingent upon the client's project meeting the following criteria:

- Sound Investment Potential: The project must demonstrate a strong likelihood of success and profitability.

- Proven Track Record: The client must have a history of successfully completing similar projects.

- Liquid Assets: Availability of 10% of the requested funding amount in readily accessible cash reserves.

It is important to note that this 10% co-investment will be fully refunded within a period of 30 banking days.

SBLC Provider and Monetizer (“SBLC P & M”)

SBLC Provider and Monetizer (SBLC P&M) distinguishes itself through a client-centric approach. Leveraging over a decade of industry experience, DAJK Asset Management, an integral component of SBLC P&M, initiates the collaboration by conducting a comprehensive assessment of each client's project and associated business plan. This upfront consultation allows SBLC P&M to tailor its solutions to meet the specific requirements of each client's unique venture.

Demonstrated Success: By way of illustration, a recent Joint Venture Agreement (JVA) established with a client based in the United States exemplifies the efficacy of the SBLC P&M model. Through this partnership, SBLC P&M facilitated a 6X return on investment for the client within a six-month timeframe. This demonstrably enhanced the overall annual ROI for the client's entire portfolio.

“Their services and SBLC P & M have consistently exceeded our expectations, providing our project funding on time and top-notch customer service. We could not be more satisfied with their joint venture partnership.”

Demonstrated Success: By way of illustration, a recent Joint Venture Agreement (JVA) established with a client based in the United States exemplifies the efficacy of the SBLC P&M model. Through this partnership, SBLC P&M facilitated a 6X return on investment for the client within a six-month timeframe. This demonstrably enhanced the overall annual ROI for the client's entire portfolio.

“Their services and SBLC P & M have consistently exceeded our expectations, providing our project funding on time and top-notch customer service. We could not be more satisfied with their joint venture partnership.”

Proven Track Record: For over two years, SBLC P&M has served as a trusted partner in raising development capital and project funding for a diverse clientele. The following examples showcase the breadth of our expertise:

Client Participation and Benefits: For privately held companies seeking capital for expansion or growth, SBLC P&M offers a unique joint venture opportunity with DAJK Asset Management. By electing to participate, company owners can share in a percentage of the distribution generated by the Asset Manager, directly supporting their own growth and expansion initiatives. It is important to note that the typical 10% initial investment from the client is fully repaid within sixty banking days.

- Portugal-Based Client (Manufacturing): SBLC P&M provided project funding of EUR 10 million within six months, enabling the client to scale up production of water-based products, including ice cubes and bottled water, while concurrently investing in R&D activities. This funding further supported the client's goal of establishing a functional facility for water-from-air generation, targeting both commercial and domestic markets.

Client Participation and Benefits: For privately held companies seeking capital for expansion or growth, SBLC P&M offers a unique joint venture opportunity with DAJK Asset Management. By electing to participate, company owners can share in a percentage of the distribution generated by the Asset Manager, directly supporting their own growth and expansion initiatives. It is important to note that the typical 10% initial investment from the client is fully repaid within sixty banking days.

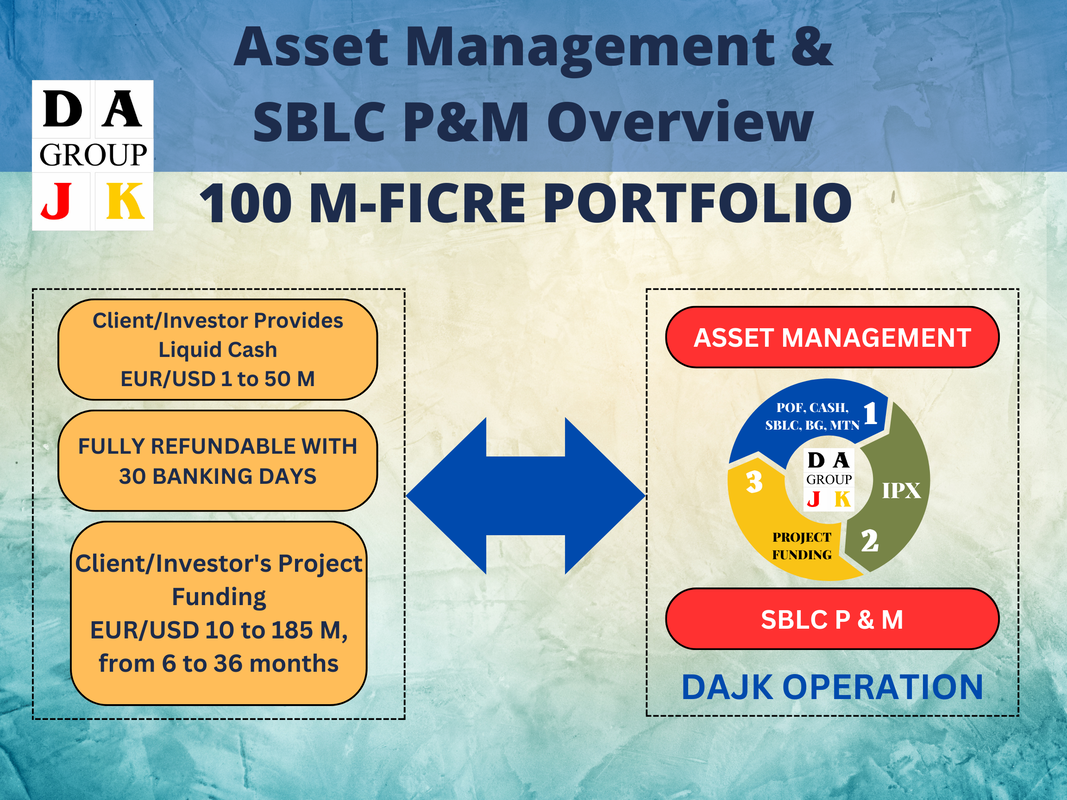

Long-Term Advantages (SBLC P & M 100+M FICRE Portfolio)

Beyond the immediate access to capital for expansion or growth, SBLC P&M offers a strategic investment opportunity that cultivates a foundation for securing larger project funding in the future. This translates into a diversified revenue stream, ultimately unlocking a wider range of business opportunities for our clients.

Sustainable Partnership: The establishment of an SBLC P&M solution fosters a long-term partnership with our clients. This partnership extends beyond the initial capital injection, as it grants clients the potential to benefit from an ongoing return on investment (ROI) through profit sharing. More importantly, this collaboration empowers clients to cultivate profitable and sustainable business practices.

Empowering Client Growth: Small and medium-sized business owners seeking to embark on their journey towards becoming a partner in the SBLC P&M 500K Operation or 100+M FICRE Portfolio are encouraged to contact us.

Sustainable Partnership: The establishment of an SBLC P&M solution fosters a long-term partnership with our clients. This partnership extends beyond the initial capital injection, as it grants clients the potential to benefit from an ongoing return on investment (ROI) through profit sharing. More importantly, this collaboration empowers clients to cultivate profitable and sustainable business practices.

Empowering Client Growth: Small and medium-sized business owners seeking to embark on their journey towards becoming a partner in the SBLC P&M 500K Operation or 100+M FICRE Portfolio are encouraged to contact us.

Social Impact Investment Opportunities

Kenya, Hospital 300 beds

Subject: Seeking for Equity Participation Capital and/or Strategy Debt and/or Equity Investors (“Investor”)

Project: Kenya, Hospital 300 Beds

Development Cost: USD 180 million

Building Time Commitment: 36 months

Status: Active.

We partner with the Project Developer to raising development costs for this Project. Please contact us if you are interested.

The NDA is required for receiving additional details.

Please note we will compensate for your referral fee if you are direct to the Investor.

Project: Kenya, Hospital 300 Beds

Development Cost: USD 180 million

Building Time Commitment: 36 months

Status: Active.

We partner with the Project Developer to raising development costs for this Project. Please contact us if you are interested.

The NDA is required for receiving additional details.

Please note we will compensate for your referral fee if you are direct to the Investor.

Katangowa Market, Lagos, Nigeria

DAJK seeks equity investor(s) up to 25% for our KATANGOWA MARKET LAGOS PROJECT. Its development cost is approximately USD 110 million.

Please contact us if you are interested.

- Create 35,000 direct and indirect jobs

- Impact the lives of 100,000 Nigerians

- Impact the entire West Africa sub-region

Please contact us if you are interested.

Overview of Project

The Project will comprise retail outlets of assorted sizes (i.e. over 3,000 small, medium and big size showroom/office spaces as well as 3,500 k-klamps in an open floor arrangement), a 5,000 sitter Exhibition Hall, Assemblage/Warehouses, Offices, Innovation Technology labs, budget hotel, Banking Facilities, Restaurants, Helipad, public toilets and public showers, car parking space, trailer parking space, security office, security posts, fire service station, incinerator, generator house I electrical rooms, loading and off-loading bays, ICT training center, administrative block, clinic among other facilities.

The Project will serve and transform Lagos to an astute regional commercial hub for ICT in West Africa. It will among other benefits develop ICT proficiency and skills acquisition, enhance revenue generation to all stakeholders (Government, Shop owners, investors, etc), ensure optimization of resources, improve hygienic trading environment, effective utilization of land, increase commerce and market activities, job creation and poverty alleviation. When completed, it will create over 3,000 direct and indirect jobs during the construction phase and another 35,000 direct and indirect jobs from the operations of this Project. This has a potential multiplier effect to impact the lives of 100,000 Nigerians and possibly more and further impact the entire West African sub region.

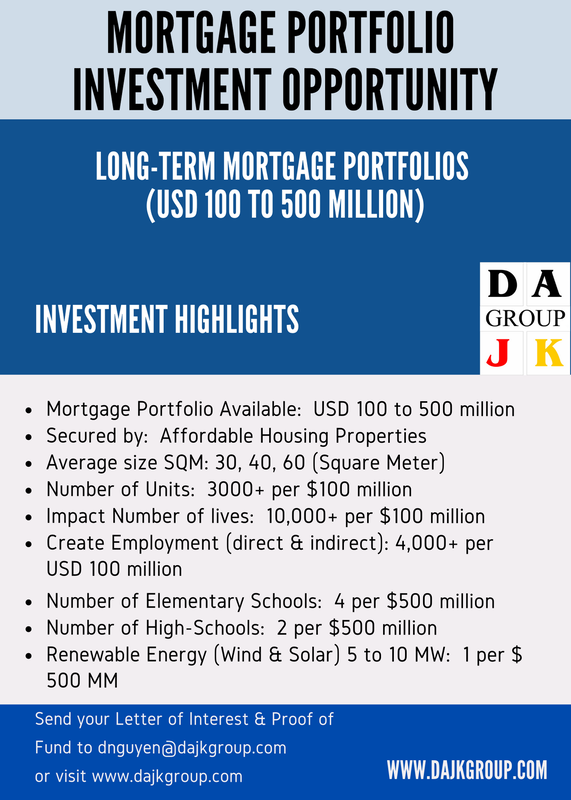

Long-Term Mortgage Portfolios Investment Opportunities

Three Long-Term Mortgage Portfolios are ranging from US$100 Million to 5 Billion. These Portfolios are secured by the Affordable Housing Properties at 80% its market value. Terms are varied from 3 to 15 years.

- Long-Term Mortgage Portfolios (USD 100 to 500 Million)

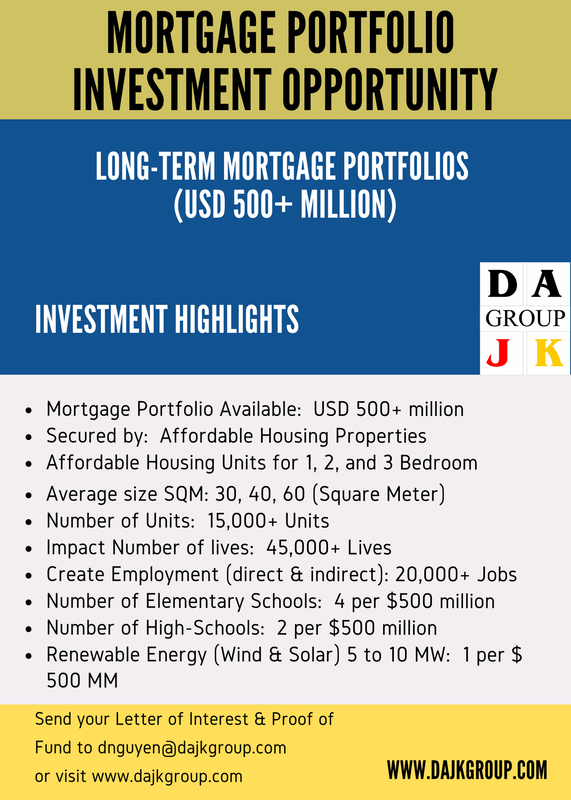

- Long-Term Mortgage Portfolios (USD 500 Million)

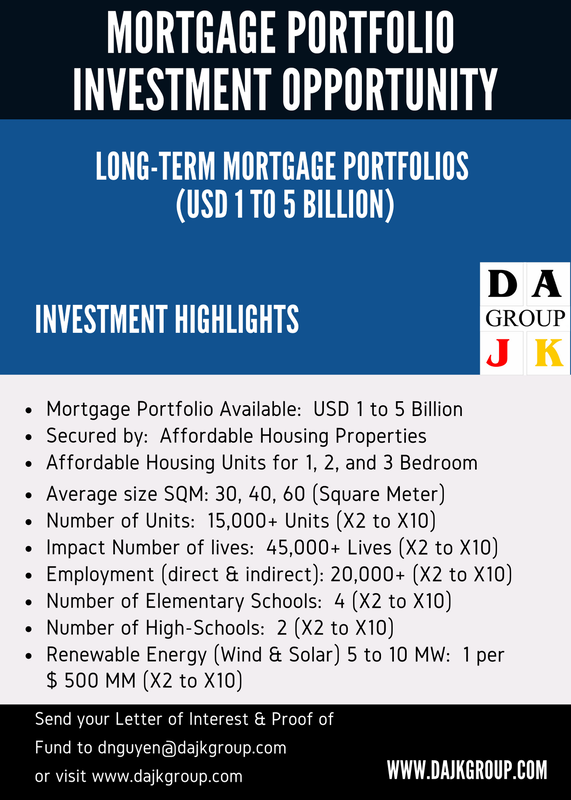

- Long-Term Mortgage Portfolios (USD 1 to 5 Billion)

Please contact us for further questions.

Long-Term Mortgage Portfolios ($100 to 500 Million)

Long-Term Mortgage Portfolios (USD 500 Million)

Long-Term Mortgage Portfolios (USD 1 to 5 Billion)

Vietnam Solar Energy Portfolio - 1000 MW

PORTFOLIO - Vietnam 180 MW Wind Energy

Investment Highlights

Learn more please contact us.

- In Operation: (1) HL 1 30MW + (2) HL 2 30MW

- In Operation: 1Q21 (1) TH 1 30MW + 1Q21 (2) TH 2 30MW + 1Q22 (3) TH 3 30MW + 1Q22 (4) TH 4 30MW

- Investment: US$ 2.5 million per MW

- Operating & Maintenance Cost: US$ 8,000 per MW

- Secured by: 20-Year PPA @ USD 0.0908 per kWh (excluding VAT)

- Projected Annual Net Operating Income (EBITDA): US$ 16 million Per 30MW

- CAP Rate: 21%

- Provide Electricity to Family: Circa 30,000 families per 30MW

- Reduce CO2: 62 tons per year per 30 MW

Learn more please contact us.

How To Start

|

For quicker process of your Project Funding Application, please fill out fill out this form: Project Funding Questionnaires Form |

Project Funding – If you are seeking Project Funding for your projects, please email three required documents for further analysis and review.

The minimum cost of your project is USD/EUR 100+ million. It is applicable to international projects except sanctioned countries by the USA. Your project can be energy, renewable energy, real estate, mining, infrastructure, environmental…etc. Please contact us Thank you for your consideration in advance and an opportunity doing business with you. |