|

Investing in various assets can be an effective way to grow your wealth and achieve financial goals. However, it's crucial to choose investment assets wisely based on their potential returns and your individual risk tolerance. In this article, we will explore the top five investment assets known for generating high rates of return in the last five years. Here are the top 5 investment assets that can generate the highest rate of return:

3. Private Equity. Private equity is a type of investment that involves investing in privately held companies. Private equity investments can be very profitable, but they also come with a high degree of risk. The average annualized ROI in the last five years is 15%. 4. Venture Capital. Venture capital entails investing in early-stage companies that show potential for rapid growth. While venture capital investments come with substantial risks, they can yield exceptionally high returns. Over the past five years, the average annualized ROI for venture capital investments has been 20%. 5. Cryptocurrencies. Cryptocurrencies are digital or virtual currencies secured through cryptography. Although highly volatile, they offer the potential for significant returns. It's important to approach cryptocurrency investments with caution due to their unpredictability. On average, cryptocurrencies have demonstrated an annualized ROI of 30% over the last five years. Factors to Consider When Choosing Investment AssetsWhen selecting investment assets, consider the following factors. The best investment asset for you will depend on your individual risk tolerance and investment goals. Here are some additional factors to consider when choosing investment assets:

Here are some additional questions that you can ask yourself to help you determine your investment risk tolerance:

2. Your investment goals: What are you hoping to achieve with your investments?

Here are some examples of different investment goals:

3. Your time horizon: How long do you have until you need to access your money? If you are saving for retirement, you may want to allocate a higher percentage of your portfolio to bonds and real estate.

Once you've answered these questions, you'll have a better idea of your time horizon. This will help you choose the right investments for your financial goals. 4. Your financial situation: How much money do you have to invest? Or if you have a high income, you may be able to afford to allocate a higher percentage of your portfolio to riskier assets.

Here are some additional questions that you can ask yourself to help you determine your financial situation:

Here are some additional factors that can affect your financial situation:

It is important to do your research and talk to a financial advisor before making any investment decisions. It is important to note that these are just averages, and the actual ROI of each asset class will vary depending on the specific investment. For example, the ROI of stocks will vary depending on the specific stocks you invest in, and the ROI of real estate will vary depending on the specific properties you invest in. It is also important to note that the ROI of each asset class can change over time. For example, the ROI of stocks has been higher in recent years than it was in the past. This is because the stock market has been on a bull run in recent years. However, the ROI of stocks could decline in the future. The best way to determine the ROI of an investment asset is to consult with us. We can help you assess your individual risk tolerance and investment goals, and they can recommend specific investment assets that are right for you. In summary, we discuss the top 5 investment assets with the highest return on investment (ROI) in the last five years. The assets include stocks, commercial real estate net lease (CRE-NNN), private equity, venture capital, and cryptocurrencies.

IMPORTANT NOTICE: This is unsolicited information and/or a private, proprietary, and confidential communication and is for information purposes only. This is not intended to be and must not be construed to be in any form or manner a solicitation of investment funds or a security offering.

DISCLAIMER: DAJK is NOT a Securities Dealer or Broker or Investment Adviser. DAJK is a consultant and makes no warranties or representations as to the validity of the Program and is compensated for introducing clients only. All due diligence is the responsibility of the Buyer and Seller. This blog and related documents are never to be considered a solicitation for any purpose in any form or content. Upon receipt of these documents, the Recipient hereby acknowledges this Disclaimer. If acknowledgment is not accepted, the Recipient must return all documents in their original receipted condition to Sender.

0 Comments

How To Grow Your Wealth From 100 Million To 1 Billion Highlights: Part 1:Part 2:

Cash Flow ManagementCash flow management is the process of tracking and managing your income and expenses. This is important for both individuals and businesses. By understanding your cash flow, you can make sure that you have enough money to cover your expenses and reach your financial goals. Here are several specific steps involved in cash flow management, including forex and crypto currencies:

By following these steps, you can improve your cash flow management and achieve your financial goals. When it comes to forex and crypto currencies, it is important to be aware of the risks involved. These assets are volatile and can fluctuate in value rapidly. It is important to do your research and understand the risks before investing in them. If you are considering investing in forex or crypto currencies, it is important to use a reputable broker or exchange. You should also consider using a stop-loss order, which will automatically sell your investment if it reaches a certain price. This can help you to limit your losses if the market turns against you. It is also important to remember that forex and crypto currencies are not regulated by the government. This means that there is no guarantee that you will get your money back if you lose money investing in them. If you are not comfortable with the risks involved, you may want to consider other investment options. Tax ManagementTax management is the process of minimizing tax liabilities while complying with tax laws and regulations. Effective tax management can help individuals and businesses optimize their financial resources and maximize their wealth growth. Here are some key considerations for tax management:

Based on Tax Foundation, the corporate tax rates 2022 around the world are:

Trust & Estate PlanningTrust and estate planning involves creating a comprehensive plan to manage and distribute assets during and after a person's lifetime. It encompasses various legal and financial strategies to protect and transfer wealth according to the individual's wishes while minimizing tax implications and potential conflicts. Here are some key elements of trust and estate planning:

When it comes to offshore tax neutral jurisdictions, there are several factors to consider, such as:

Here are some additional tips for effective trust & estate planning:

Asset ProtectionAsset protection is the process of protecting your assets from creditors, lawsuits, and other legal threats. There are several different asset protection strategies available, such as setting up trusts, forming corporations, and buying insurance. Here are several specific steps involved in asset protection, including whole life insurance policies:

Whole life insurance policies can be used as an asset protection strategy. Whole life insurance policies have a cash value component, which can be used to pay for legal fees and other expenses in the event of a lawsuit. It is important to note that asset protection is a complex legal matter and should only be done with the assistance of an experienced attorney. Here are some additional tips for effective asset protection:

Charitable Planning & PhilanthropyCharitable planning and philanthropy involve making strategic decisions about giving back to society and supporting causes that align with your values. It allows you to make a positive impact while potentially enjoying tax benefits and leaving a lasting legacy. Here are some considerations for charitable planning and philanthropy:

Whole Life InsuranceWhole life insurance policies can be used as a charitable planning tool. Whole life insurance policies have a cash value component, which can be donated to charity. The death benefit of a whole life insurance policy can also be used to fund a charitable trust or foundation. It is important to note that charitable planning is a complex legal matter and should only be done with the assistance of an experienced attorney. Here are some additional tips for effective charitable planning:

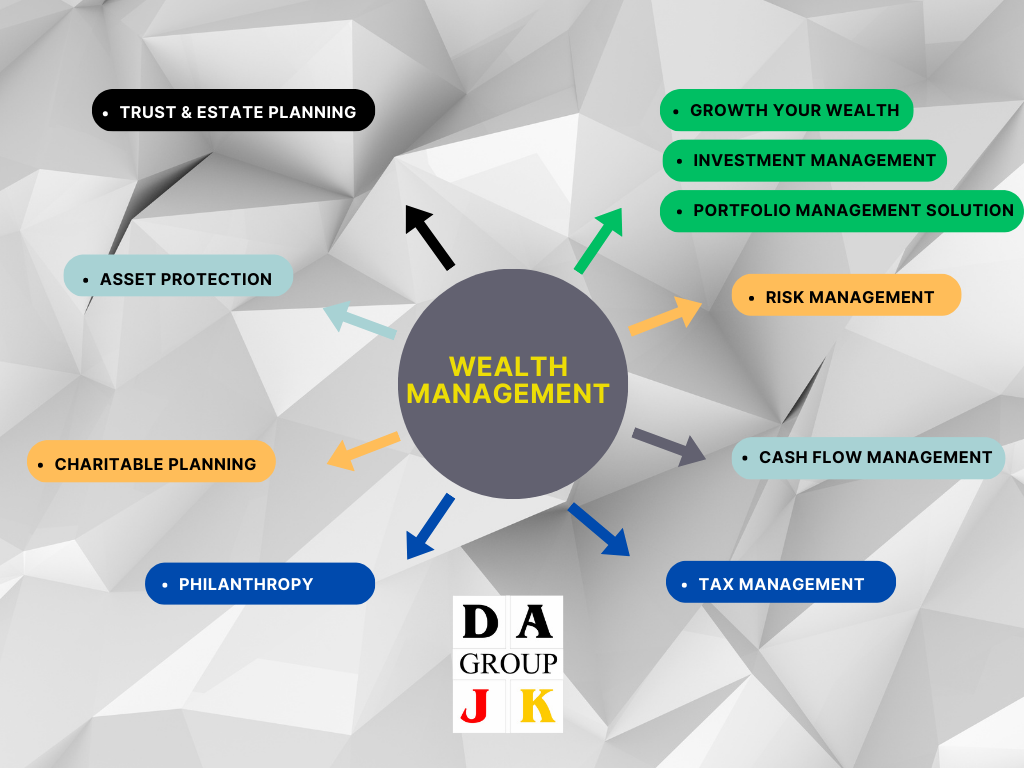

In summary We cover various topics related to wealth management, including cash flow management, risk management, tax management, investment and portfolio management, trust and estate planning, asset protection, and charitable planning.

In the section on cash flow management, the process of tracking and managing income and expenses is outlined, including developing a cash flow plan and monitoring it regularly. Various investment options with the potential for significant growth, such as stocks, commercial real estate, and businesses, are discussed. The section on risk management emphasizes the importance of identifying, assessing, and mitigating risks on an ongoing basis. The potential risks include financial, operational, and compliance risks. The section also covers the need to develop risk mitigation strategies and implement them, as well as regularly reviewing the risk management plan. On the topic of tax management, strategies for planning and executing tax-efficient strategies are discussed. There are many different tax management strategies available, and it is important to work with professionals to find the ones that are right for individual needs. Trust and estate planning involve selecting trustees who are competent, trustworthy, and financially responsible. Various types of trusts, such as revocable and irrevocable trusts, are discussed. It is important to regularly review and update the trust and estate plan to ensure it still meets individual needs. To grow wealth, it is essential to research and understand the risks involved with investment options, such as forex and crypto currencies. Strategies for growing wealth include living below one's means, investing in assets with growth potential, and automating finances. Finally, the importance of balancing risk with investment objectives and risk tolerance is emphasized. We hope this information is helpful. Please contact us with further questions. IMPORTANT NOTICE: This is unofficial information and for information purposes only. This is not intended to be and must not be construed to be in any form or manner a solicitation of investment funds or a security offering. Before undertaking any action, be sure to discuss your options with a qualified advisor. How To Grow Your Wealth From 100 Million To 1 Billion Highlights: Part 1:

Growth Your WealthThere are many ways to grow your wealth. Some common methods include investing in stocks, bonds, mutual funds, and commercial real estate. You can also grow your wealth by saving money and paying down debt. By taking steps to grow your wealth, you can improve your financial security and achieve your financial goals. Here are some tips on how to grow your wealth from 100 million to 1 billion:

Here are some additional factors to consider when choosing global businesses for investment:

It's important to note that there is no guarantee that any investment will be appreciated. However, if you're willing to take on some risk and be patient, you have a good chance of growing your wealth from 100 million to 1 billion. Here are some additional tips that may help you grow your wealth:

Investment ManagementInvestment management is the process of overseeing and managing an investment portfolio. This includes tasks such as selecting investments, rebalancing the portfolio, and monitoring performance. Investment managers can help you achieve your financial goals by investing your money in a way that is aligned with your risk tolerance and investment objectives. Portfolio Management SolutionA portfolio management solution is a software program that helps you track, manage, and analyze your investment portfolio. These solutions can help you to:

Risk ManagementRisk management is the process of identifying, assessing, and mitigating risks. This is an important part of any investment strategy. By understanding the risks involved in your investments, you can make informed decisions about how to allocate your assets. Here are several specific steps involved in risk management:

Risk management is an ongoing process. It is important to regularly review your risk management plan and make changes as needed.

Here are some additional tips for effective risk management:

Part 2 of 2 IMPORTANT NOTICE: This is unofficial information and for information purposes only. This is not intended to be and must not be construed to be in any form or manner a solicitation of investment funds or a security offering. Before undertaking any action, be sure to discuss your options with a qualified advisor. U.S Commercial Real Estate Outlook 2023: Navigating Challenges and Embracing Transformation6/4/2023 Discover the key trends shaping the commercial real estate landscape in 2023, including the impact of high interest rates, a moderate recession, evolving work dynamics, ESG considerations, and decarbonization efforts. Stay informed to make strategic real estate decisions. Highlights:

A Challenging Year Ahead OverviewAs we step into 2023, the commercial real estate industry faces a unique set of challenges and opportunities. In this overview, we delve into the major trends that will shape the landscape and offer insights to help you navigate the evolving market. From the impact of high interest rates and a moderate recession to the transformative effects of ESG considerations and the digital economy, we explore how these factors will influence real estate demand and investment decisions.

Conclusion: As you plan your real estate strategy in 2023, it is crucial to consider the prevailing trends that will define the year. High interest rates, a moderate recession, evolving work dynamics, ESG considerations, and decarbonization efforts are just some of the factors demanding attention. Stay informed, monitor market developments, and seek professional advice to make informed and strategic decisions aligned with the changing real estate landscape. Contact us for personalized insights into how these trends may impact your specific real estate strategy. Investment Activity and Asset Values Expected to Drop The commercial real estate investment activity that started slowing down in the second half of 2022 is predicted to continue in the first half of 2023. With increasing capital costs and a drop in lender appetite, obtaining financing may prove to be challenging. However, CBRE predicts that capital will still be available for high-quality deals, such as multifamily, industrial, and grocery-anchored retail, particularly with established and creditworthy borrowers. Additionally, the market is expected to benefit from the record amounts of equity capital that continue to target real estate investment, despite the likelihood of a moderate recession in the coming year. As interest rates rise, real estate asset values tend to fall, tightening financial conditions and hindering both economic activity and real estate demand. CBRE forecasts that cap rates may expand by another 25 to 50 bps next year, translating to roughly another 5% to 7% decline in values. However, multifamily and industrial properties will remain the most favored by investors due to their relatively strong fundamentals and positive long-term demand outlooks. Meanwhile, grocery-anchored retail centers, which have experienced a decade of restrained development, are expected to weather any downturn. While higher capital costs may deter some buyers, large equity players who can quickly deploy their capital will still find opportunities. However, CBRE warns that these investors will likely have only a short window of opportunity. Following the Great Recession, the bottoming out of pricing only lasted around six to nine months before cap rates began to compress. Given expectations for a relatively moderate recession, the window of opportunity may be even shorter this time. CBRE predicts a 15% year-over-year drop in U.S. commercial real estate investment volume in 2023. However, it is still expected to exceed the pre-pandemic record annual total in 2019. Investment activity is anticipated to bottom out in the first quarter and then gradually improve, assuming a moderate recession, lower inflation, a drop in long-term U.S. Treasury yields, and the end of rapid-fire interest rate hikes. In summary, CBRE highlights multifamily, industrial, and grocery-anchored retail properties as the most attractive to investors due to demands. Meanwhile costs may prove to be a deterrent for some buyers, but large equity players who can efficiently deploy their capital will still find opportunities. The window of opportunity, however, may be relatively short, lasting only around six to nine months based on past trends. Investment activity is predicted to drop in 2023, but a clearer economic outlook should emerge by Q2, reducing uncertainty and bolstering investor sentiment. Industrial & Logistics: Supply Chain Diversification and Location Optimization are KeyIn 2023, companies will strive to diversify their product sourcing to mitigate potential disruptions to their global supply chains. The ongoing war in Ukraine, inclement weather, labor issues at U.S. ports, and China's port shutdowns all pose potential risks. As a result, companies will adopt a "China Plus One" approach, adding other countries to their supply chains or shifting manufacturing to other Asian countries. There is also a trend towards onshoring and nearshoring to Mexico. The shift in imports away from congested West Coast ports will benefit markets in Savannah, Charleston, Houston, and Baltimore, while onshoring of manufacturing will benefit Phoenix, major Texas markets, Atlanta, Cincinnati, Greenville-Spartanburg, and Northern Florida. Occupiers' location decisions will be driven by factors such as supply chain costs, high-quality infrastructure, and strong labor dynamics. Louisville, Memphis, Indianapolis, and Kansas City stand to benefit from the shift. In 2022, there was a record 661 million sq. ft. of industrial space under construction, nearly double the amount since 2020. However, falling groundbreakings and construction financing challenges will lead to a decrease in completions by 2024 and a shortage of first-generation space. Despite this, industrial leasing activity is still expected to be solid in 2023, led by 3PLs who are outsourcing to deal with inventory, labor shortages, and rising transportation costs. However, in markets with an excess of construction deliveries, concessions such as free rent and higher tenant improvement allowances may be required. In summary, U.S. Real Estate Market Outlook for Industrial & Logistics in 2023 will require supply chain diversification and location optimization to mitigate potential disruptions. Risk-management firms need to look at opportunities that'll come up following the supply chain diversification, such as expansion close to the new sources and shifts in imports among the ports. Data Centers: Power and Land Availability Constraints Expected to Slow Future SupplyThe expanding need for data centers is being driven by the transformation of digital infrastructure resulting from the shift towards hybrid cloud environments as a way of adapting to a post-pandemic world. Despite the growth witnessed in the industry, the future supply is likely to slow due to land and power constraints. The problem is particularly evident in major markets like Northern Virginia and Silicon Valley, where the demand for wholesale colocation inventory has more than tripled to 3.71 gigawatts (GW) since 2015. Although there were 1,600 megawatts (MW) under construction in major markets in H1 2022, a lack of space and power is likely to constrain further development in primary markets in the coming year. The hypervisors are the dominant users, but enterprise demand has also increased in the data center market. Rent is, therefore, expected to increase with space availability and power having the most significant influence on asking rates in 2023. Hyperscale demand will continue to grow, with developers expanding their offerings in secondary markets with more affordable land, better power supply, and tax incentives, such as Omaha and Salt Lake City. Data center operators face pressure from various stakeholders, including the government, financial markets, and corporate clients, to make their facilities more sustainable. The growing scrutiny over the large amounts of water needed to cool data centers is raising questions surrounding water resources. Consequently, large technology corporations in water-stressed areas are expected to adopt new technology to minimize water usage in 2023. Site selection is expected to be influenced significantly by environmental considerations, with markets like Montreal and Hillsboro, Oregon, benefiting from an abundance of clean energy. Conversely, markets like Phoenix and Las Vegas will face challenges because of tighter resource restrictions. Consequently, data center providers and users will seek to find ways to minimize their carbon emissions in 2023. In summary, U.S. Real Estate Market Outlook for Data Centers in 2023 will likely experience a slowdown in future supply, with power and land availability being the primary constraints in primary markets like Northern Virginia and Silicon Valley. The activity will, therefore, shift to secondary markets, where there is more power capacity and affordable land. Data center operators and users will also focus on finding ways to reduce carbon emissions and promote sustainability. Life Sciences: Normalization Expected with New Construction in Key Markets The life sciences sector in the U.S. has experienced rapid growth in recent years. However, in 2023, the market is expected to moderate due to the economic slowdown. Nevertheless, the life sciences real estate market should remain relatively resilient, with new construction set to increase supply in the most sought-after lab/R&D markets of Boston-Cambridge, the San Francisco Bay Area, and San Diego. Other markets will experience more stable supply and demand trends as the long-term expansion of the life sciences sector continues.

Despite the economic challenges, the life sciences industry has a history of resilience during economic downturns and is expected to exhibit milder declines than most other sectors in 2023. Several megatrends, including the rising demand from an aging population, higher healthcare costs, and the need for more effective and cost-efficient therapies, all support the relative stability of life sciences employment. Moreover, rapid advances in high technology and artificial intelligence are driving transformative medical advancements. The industry's response to each phase of the business cycle also creates stability in the market. During favorable cycles, smaller companies with innovative research remain independent, but during less favorable cycles, they become more open to partnerships and mergers and acquisitions with larger-cap firms. As the industry entered the current cycle, the largest pharmaceutical and biotechnology companies accumulated historic cash balances and have now started using this capital through partnerships, acquisitions, and other activities to stabilize smaller companies showing promise. The ongoing reduction in venture capital funding and dearth of equity financing is causing many life sciences companies to slow their expansion. The annual venture capital investment in the life sciences arena has decreased by 27% since its peak in Q4 2021. However, the government has expressed commitment to bioscience investment, with proposed funding from the National Institutes of Health expected to increase significantly in fiscal year 2023. Additionally, the Biden administration is investing $2 billion to expand the U.S. biotech and biomanufacturing sectors. Such government policies are expected to alleviate the impact of a lack of private capital funding. The life sciences real estate market slowdown and pullback in private capital that has lessened current demand for commercial real estate are expected to continue in 2023. Many occupiers and investors wait on the sidelines until there is greater clarity on the trajectory of interest rates and the economy. However, with a historic amount of new life sciences laboratory/R&D construction underway, mostly in the premier clusters of Boston-Cambridge, the San Francisco Bay Area, and San Diego, smaller, emerging markets are also expected to experience favorable demand for multi-tenanted lab/R&D space. In conclusion, the U.S. Real Estate Market Outlook 2023 for Life Sciences presents challenges and opportunities. Although the market is expected to moderate due to the economic slowdown, the life sciences industry has a history of resilience during economic downturns. Emerging markets and government policies, such as bioscience investment, continue to offer opportunities for growth. The industry's response to each phase of the business cycle, in addition to new construction, will also provide stability to the market. Highlights:

Investing in the financial markets can be a rewarding endeavor, but it also comes with inherent risks. Whether you are a seasoned investor or just starting out, it is essential to have a solid risk management strategy in place. By following key principles such as consistency, long-term focus, diversification, hedging, and implementing self-imposed rules like stop loss and take profit, you can effectively manage investment risks and increase your chances of success. In this article, we will delve into each of these strategies and explore how they can help protect and grow your investment portfolio. Consistency is key when it comes to managing investment risks. It involves having a disciplined approach to investing and sticking to your predetermined investment plan. This means avoiding impulsive decisions based on short-term market fluctuations or emotional reactions to market volatility. Consistency helps to eliminate the temptation of trying to time the market, which is notoriously difficult to do consistently. Instead, focus on a long-term investment horizon and resist the urge to make frequent changes to your portfolio. By staying consistent with your investment strategy, you can ride out short-term market fluctuations and potentially benefit from long-term growth.Investing in the financial markets can be a rewarding endeavor, but it also comes with inherent risks. Whether you are a seasoned investor or just starting out, it is essential to have a solid risk management strategy in place. By following key principles such as consistency, long-term focus, diversification, hedging, and implementing self-imposed rules like stop loss and take profit, you can effectively manage investment risks and increase your chances of success. In this article, we will delve into each of these strategies and explore how they can help protect and grow your investment portfolio. A long-term focus is another crucial aspect of managing investment risks. It involves looking beyond day-to-day market movements and focusing on the overall performance of your investments over an extended period. Short-term volatility is a common occurrence in the financial markets, but it often evens out over the long run. By adopting a long-term perspective, you can avoid making knee-jerk reactions to temporary market downturns and remain committed to your investment strategy. This approach allows you to benefit from the power of compounding and the potential for higher returns that come with long-term investment horizons. Diversification is often referred to as the only free lunch in investing. It involves spreading your investments across different asset classes, sectors, and geographic regions. By diversifying your portfolio, you can reduce the impact of any single investment or market segment on your overall returns. For example, if you have a portfolio consisting solely of technology stocks, a downturn in the technology sector could significantly impact your investments. However, by diversifying your portfolio to include other sectors such as healthcare, consumer goods, or real estate, you can mitigate the risk associated with any single sector. Diversification provides a level of protection and can potentially enhance your risk-adjusted returns. Hedging is a risk management strategy that involves taking offsetting positions to protect against adverse price movements. While hedging can be complex and may not be suitable for all investors, it can be an effective tool in managing specific risks. One common hedging technique is to use derivatives such as options or futures contracts. For example, if you own a portfolio of stocks and are concerned about a potential market downturn, you can purchase put options to offset any potential losses. If the market does indeed decline, the value of the put options would increase, offsetting the losses in your stock portfolio. Hedging strategies should be carefully considered and implemented with the guidance of a knowledgeable financial professional. Stop loss and take profit orders are self-imposed rules that can help you manage risk and protect your investments. A stop loss order is a pre-determined price at which you are willing to sell an investment to limit potential losses. By setting a stop loss order, you can establish a maximum acceptable loss on a particular investment. If the price reaches or falls below the stop loss level, the order is triggered, and the investment is sold automatically. Take profit orders work in a similar way but are used to lock in profits. By setting a take profit order, you can specify a target price at which you are willing to sell an investment to secure gains and capitalize on positive market movements. Once the target price is reached or surpassed, the take profit order is triggered, and the investment is sold automatically. Implementing stop loss and take profit orders can help you avoid emotional decision-making and ensure that you adhere to your predetermined risk tolerance levels. These orders provide a level of discipline and protection by limiting potential losses and securing profits. However, it is important to set these levels carefully, taking into account the volatility of the investment and your individual risk appetite. It is also essential to regularly review and adjust these orders as market conditions change. In addition to specific strategies like diversification, hedging, and using stop loss and take profit orders, it is crucial to establish self-imposed rules for your investment activities. These rules serve as a set of guidelines or principles that govern your decision-making process. They can help you maintain discipline, avoid impulsive actions, and stay focused on your long-term investment objectives. Self-imposed rules can vary depending on your personal investment style and goals, but here are a few examples:

Remember that risk management is an ongoing process. As the financial markets evolve, your risk management strategies should also adapt. Regularly assess your investment portfolio, review your risk management techniques, and make adjustments as needed. Additionally, consider seeking advice from financial professionals who can provide valuable insights and guidance tailored to your specific investment goals and risk tolerance. In conclusion, effectively managing investment risks requires a combination of strategies and self-imposed rules. Consistency and a long-term focus help you avoid impulsive decisions and benefit from the power of compounding. Diversification and hedging reduce exposure to specific risks, while stop loss and take profit orders protect against adverse market movements. Self-imposed rules provide discipline and guidance in your investment activities. By incorporating these principles into your investment strategy, you can navigate the challenges of the financial markets and increase your chances of long-term success. Disclaimer: The information provided in this blog post is for educational purposes only and should not be considered as financial advice. Investing in financial markets involves risk, and past performance is not indicative of future results. Always do your own research and consult with a qualified financial professional before making investment decisions.

Highlights:

Introduction: Net Lease Commercial Real Estate — A Lucrative Investment OptionNet Lease Commercial Real Estate (NLCRE) is considered a highly lucrative option for investors looking for steady cash flow and relatively low risks. As a passive investment strategy, NLCRE allows investors to enjoy the financial rewards of properties that are occupied by tenants with long-term lease contracts. In this ultimate guide, we will cover the ins-and-outs of investing in net lease commercial real estate, including relevant data, financial figures, and useful sources for potential investors. Understanding the Basics of Net Lease Commercial Real EstateBefore diving into the intricacies of NLCRE, it's crucial to understand the basics. Net Lease refers to the agreement where the tenant is responsible for a portion or all the property expenses, including maintenance, taxes, and insurance, aside from the rent. The primary types of net lease contracts include:

Reasons to Invest in Net Lease Commercial Real EstateThere are several reasons NLCRE is an attractive investment option:

Investigating Market Research and Relevant DataSuccessful investments in NLCRE require extensive market research and data analysis. Here are some essential factors to consider:

Financial Figures and MetricsUnderstanding key financial metrics is vital for making informed NLCRE investment decisions. These include:

Investment Strategies for Net Lease Commercial Real EstateThere are several investments for NLCRE, each tailored to the investor's financial goals, risk tolerance, and desired level of involvement.

Staying Informed Monitoring and Adapt the Performance of Your Net Lease MarketThe commercial real estate landscape is constantly evolving due to various factors, such as economic fluctuations invested, technological advancements in net, and lease changes in tenant preferences. To optimize your commercial NLCRE real investments, estate it's crucial, to stay informed it and's adapt crucial to market regularly changes monitor: Your investment's Industry performance News: ensure regularly remains read industry profitable publications, such as the Wall align Street Journals, with your National Estate financial Investor, and Globe goals. Here are some key aspects to track:

Sudden Understanding Risk Mitigation Spikes StrategiesWhile investing in areas Net Lease is can generally considered a lower-risk option, it cuts costs to improve your NOI.

Adapting to Changes in the MarketThe commercial real estate market is constantly evolving, which is why it's essential to stay informed and adapt your investment strategies as needed. Here are some tips for adapting to market changes:

Conclusion: Embracing Long-term Growth and Success in Net Lease Commercial Real EstateThrough careful research, strategic planning, and continuous learning, investing in net lease commercial real estate has the potential for long-term growth and success. As you further explore the possibilities of NLCRE, remember to adapt to market changes, work alongside experienced professionals, and remain proactive in mitigating risks to achieve the best possible outcome for your investment. With these strategies in hand, investors can confidently build a sustainable and rewarding investment portfolio in the net lease commercial real estate sector. stay updated on the latest trends and data affecting NLCRE.

Growing Wealth through Net Lease Commercial Real Estate InvestmentsNet Lease Commercial Real Estate aims to be a profitable and rewarding investment vehicle. Properly understanding the basics of NLCRE, conducting in-depth research, identifying potential opportunities, and monitoring your portfolio can pave the way for the long-lasting financial rewards. Embrace the market's evolving nature and adapt as necessary, working alongside experienced professionals and adopting best practices to secure a successful and prosperous journey with net lease commercial real estate investments. Please reach out to us for more information or further discussion. #net lease commercial real estate, #commercial real estate investing, #real estate investments, #financial rewards, #property investment strategies

How To Find My New Client For Project Funding Program (“PFP”)

Key Points:

In addition to the referral for gaining a new client, I also find a new client for my PFP from hours of research on the internet. The question is HOW? First, I have to know and understand EXACTLY and SPECIFICALLY all terms and conditions my project funding program would be applicable. For instant, whether or not PFP be applicable to such as healthcare, energy, waste management, renewable energy, environment, agriculture, transportation, real estate, infrastructure, technology…etc. This step is very crucial; otherwise, I will waste a lot of time. How do I find new client, battery storage, for my PFP regarding 5MW solar energy project? Basically, I have to read, research, and validate carefully its source. Since my PFP would not support start-up business, my raw sources of information are government grants, venture capital investments, equity investments…etc. Search: In this case, my keywords for searching are: battery storage, government grants, venture capital investments, equity investments. Scan: I will scan all results from the first 10 web pages including ads and sponsored results from browser. Validate: I will read, analyze, and validate these raw sources to a few filtered sources. Confirm: Then I will continue to review and analyze these filtered sources or results. Finally, I found the Vionx Energy. My average hours are 5 hours per new prospect client from raw sources since I have experience. I remember from the beginning, it took me a few days. Once I identify the target Vionx Energy. I will continue to scrutinize, analyze, and cross-check Vionx Energy’s technology, company profile, news, and press releases. After I confirm whether this Vionx Energy company is seeking for development cost for building a new plant, expand to different markets or wanting to commercialize their technology, I will reach out to them. This is how I find a new battery storage’s client for my PFP. In summary:

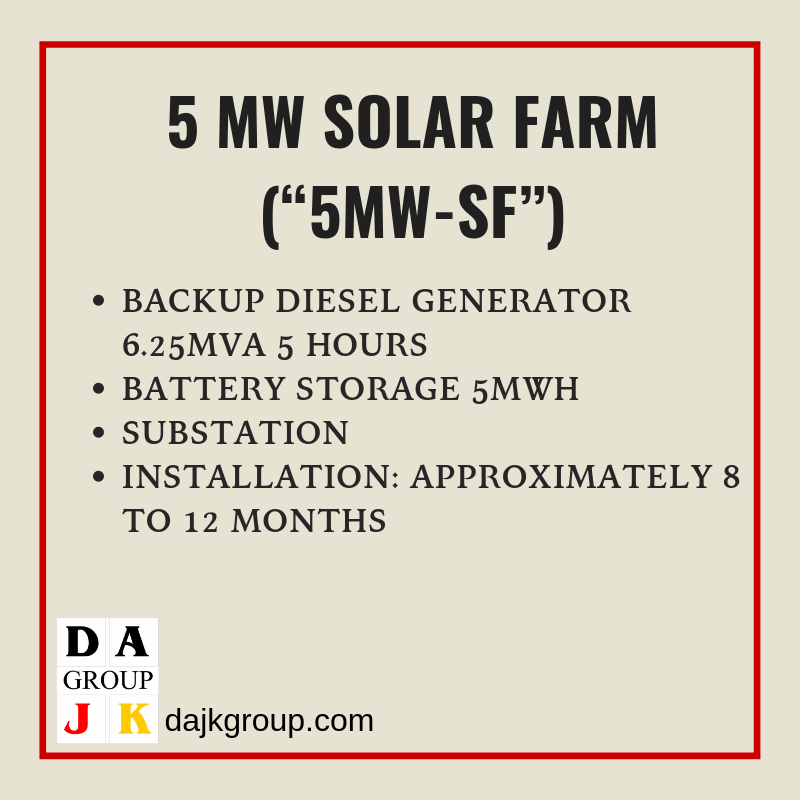

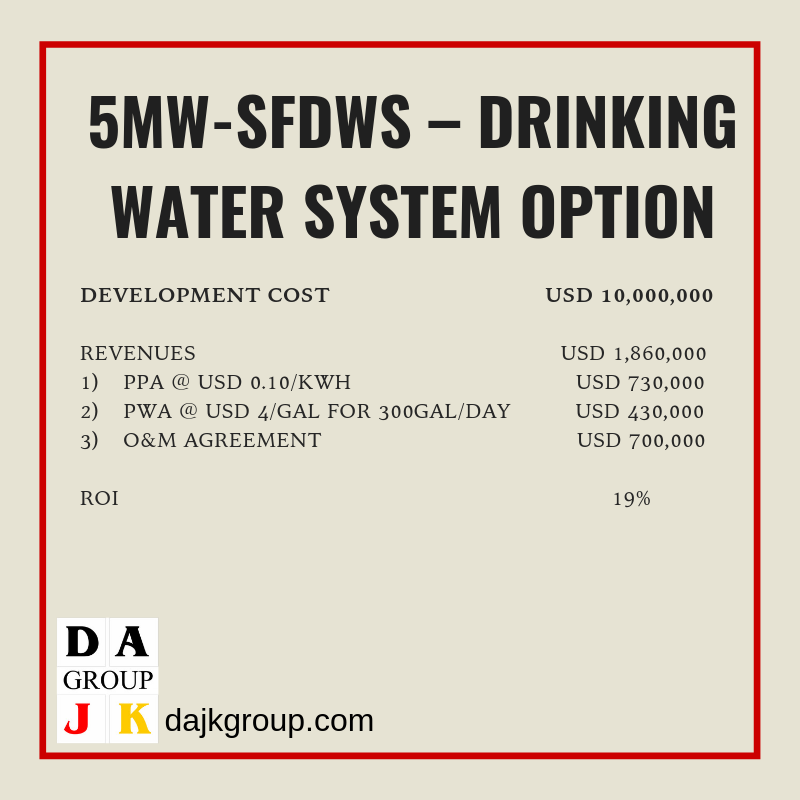

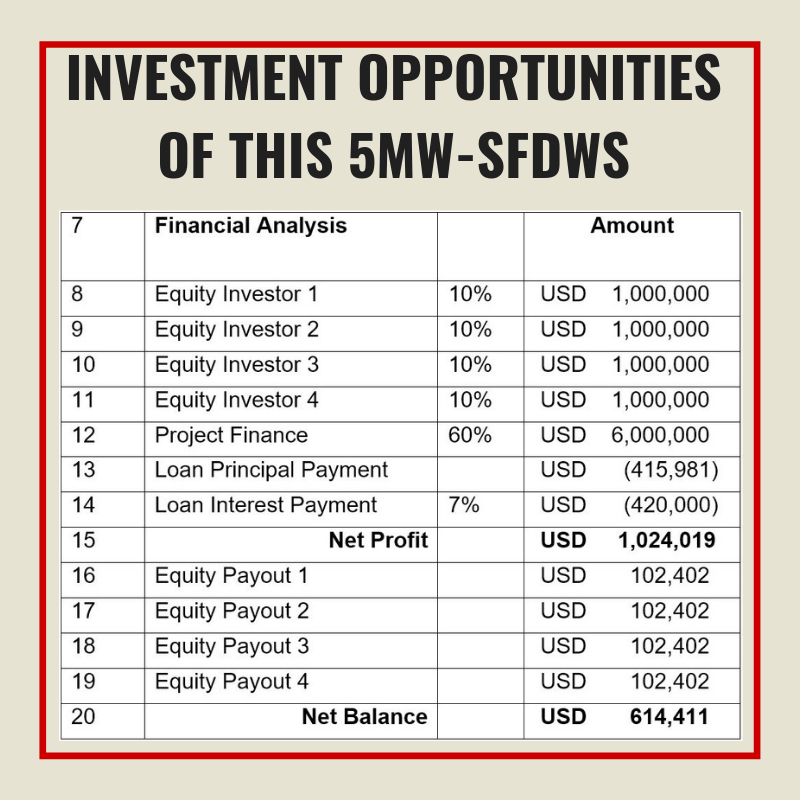

Discover more We, Sponsor, would like to invite your consideration to invest in our Solar Farm Project with five (5) complementary options which are creating more employment and generating additional revenue sources. If you consider all four options for your Solar Farm Project, (“SFP +4”), please contact us immediately to discuss further. Since SFP +4 is not only a profitable but it also creates employment and shelters for needed families.

Potential Clients

Geological Locations:

Employment Creation Potential:

Affordable Community Housing:

Should you have further questions, please contact us 5 MW Solar Farm (“5MW-SF”)Investment Opportunities of this 5MW-SFDWS |

AuthorDAJK GROUP is the place where investors, business owners and entrepreneurs can research and find useful information, insight, resources, advice, guidance and inspiration for acquiring funds for their project, acquisition for their net lease commercial real estate, increasing their assets and running their profitable business. Archives

July 2023

Categories |

Services |

Company |

|