|

Millennial shoppers transforming retail Those retailers who can’t elevate their game won’t be on the playing field for long While e-commerce presents new, unparalleled possibilities for accelerated growth, most retailers also are going through unprecedented challenges, and their very survival is in query. They must preserve with ever-evolving science and client expectations. Also omnichannel retailers are being pushed via patrons to give a compelling, seamless experience across all channels. The traces of big difference between brick-and-mortar and digital experiences are endlessly blurred. Retailers of all sizes are experiencing tensions within their organization about prioritizing the alterations wanted to remain aggressive. The insights provided listed here are designed to aid them check the exceptional path ahead as they navigate the intricacies of a market that is in no way been tougher. They are clearly divided into four categories:

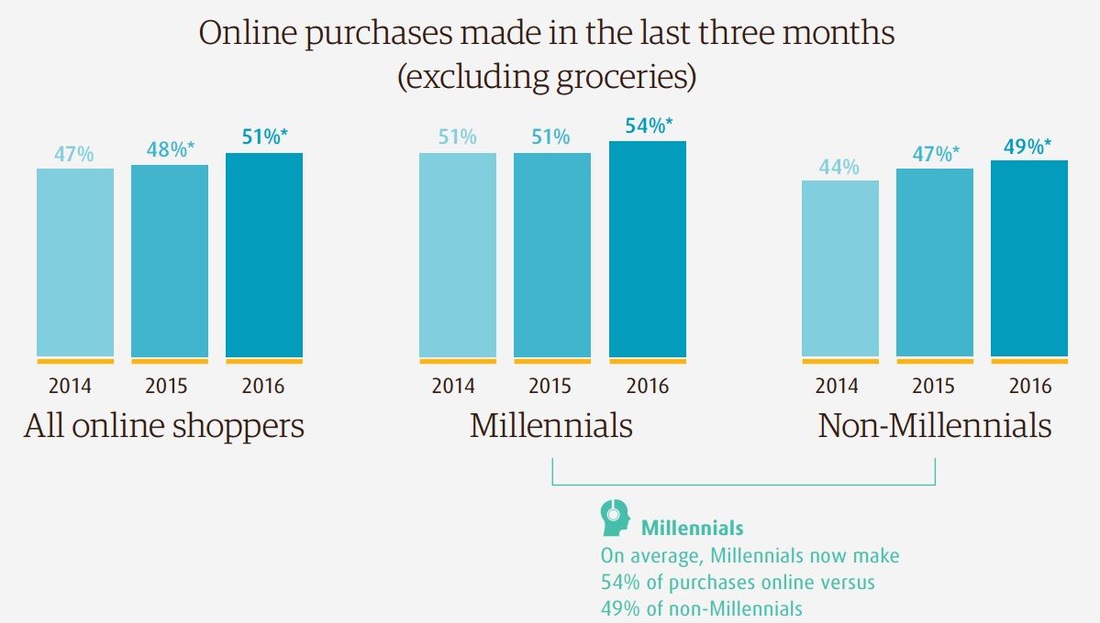

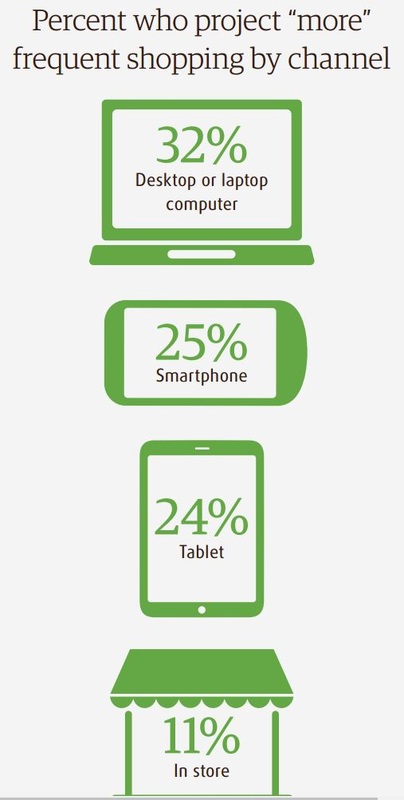

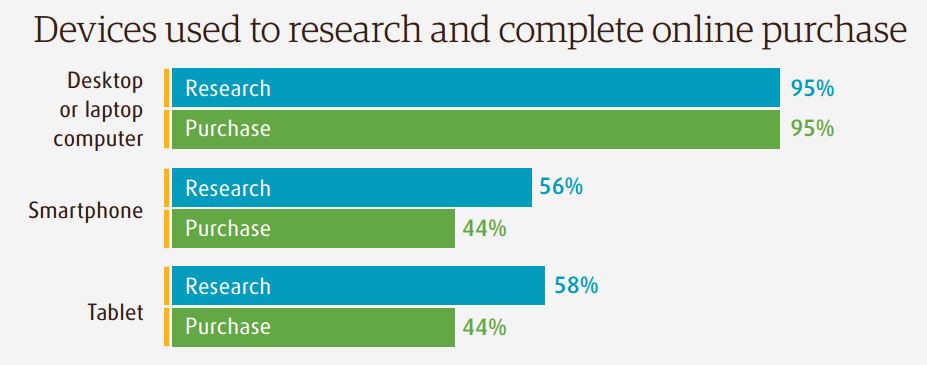

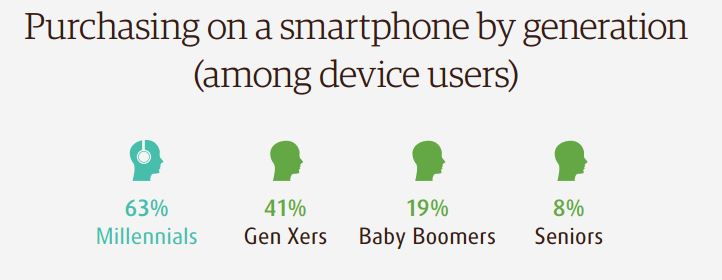

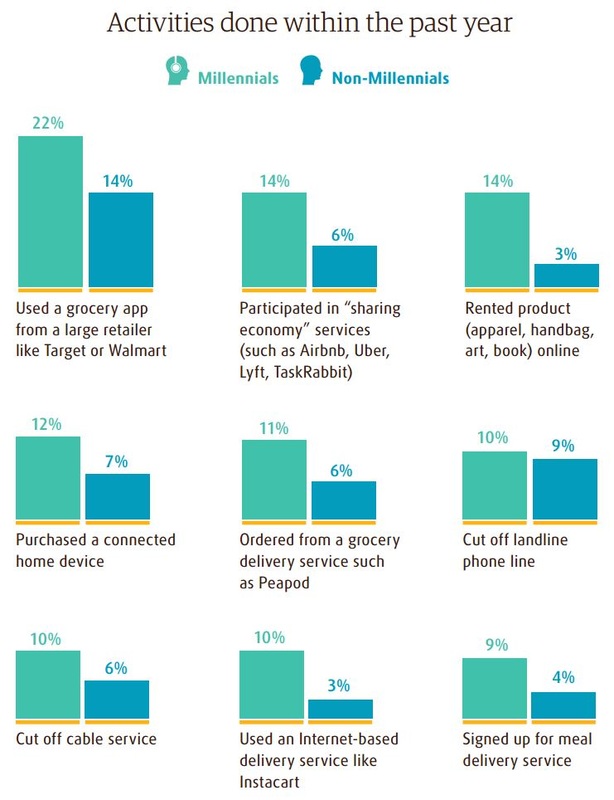

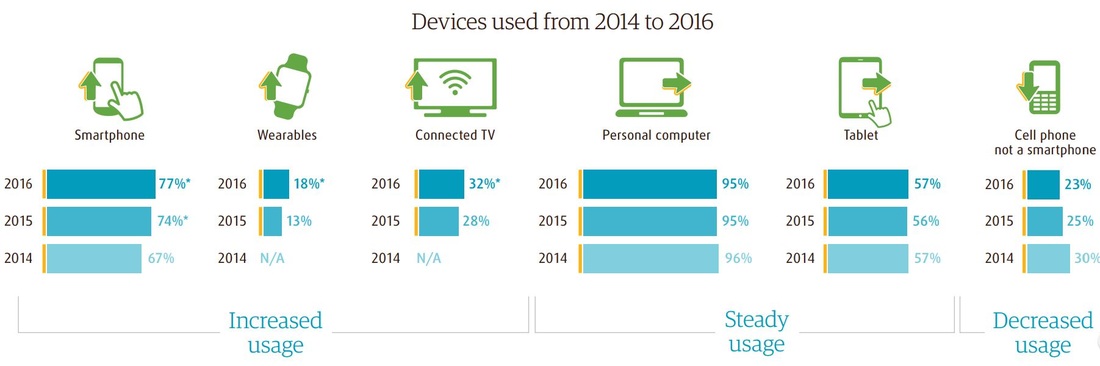

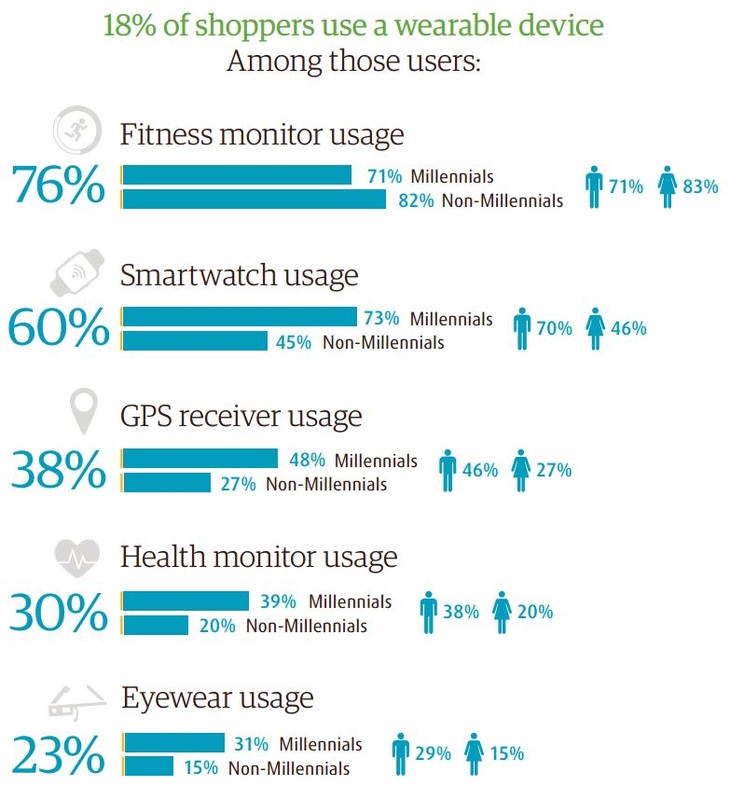

Shoppers are shifting transactions to digital For the first time, online shoppers in this survey now state that on average just over half of their purchases were made online. Increase in use of digital tools projected While the PC remains a stalwart, one in four shoppers are projecting more shopping on smartphones and tablets. Since 2014, user intentions to shop more have increased each year for both PCs and smartphones. Mobile means business Purchasing on mobile is increasing, so retailers must continue to optimize their online experience via these devices. The study shows that customers are often using their smartphone as the glue that connects all shopping interactions — from PC to tablet to store. Millennial technology behavior a disruptor Millennials are adopting devices and participating more in technology services overall, including shopping-related activities, resulting in consumer behavior shifts that have implications for all retailers. These “tech natives” will become even more prevalent in years to come Device adoption rates telling A three-year comparison of adoption rates among online shoppers reveals that many new technologies — including smartphones, connected TVs and wearables — are up. Adoption rates of personal computers and tablets are stable. Wearables interest strongest with males and Millennials Manufacturers are investing heavily in wearables. Global analyst MarketsandMarkets estimates that this sector will grow from $23 billion today to $173 billion in 2020. Wearables use is up 5% from 2015 to 2016 and varies by age and gender. Product searches usually don’t start with search engines Contrary to findings from other sources, the avid online shoppers in this survey started just 15% of their product searches with Google, Bing, etc. Instead, product searches were started 35% of the time at marketplaces (27% Amazon and 8% others), 31% at retailers’ channels (14% website, 13% in store, 4% app), 6% with catalogs and circulars and 4% at a social network Source: UPS Research Please Click on Images Below for More Details...

0 Comments

The Brent crude oil price forecast for 2017 was increased by $1 per barrel from the November STEO, with 2017 prices expected to average $52 per barrel in the December STEO. Brent and WTI crude oil prices for the first half of 2017 are projected to remain near $50 per barrel, with prices ending the year around $55 per barrel. Crude oil Prices: Crude oil prices traded below October levels for most of November before increasing significantly on the last day of the month. West Texas Intermediate (WTI) crude oil prices increased from $46.67 per barrel (b) on November 1 to $51.06/b on December 1, while international benchmark Brent crude oil increased by $5.80/b over the same period to settle at $53.94/b. WTI and Brent average spot prices in November were $4.07/b and $4.79/b lower, respectively, than the October averages. At their November 30 meeting, members of the Organization of the Petroleum Exporting Countries (OPEC) announced a framework for supply reductions among most of its members. Several non-OPEC producers also announced their intention to freeze or reduce production. The extent to which the announced plans will be carried out and actually reduce supply below levels that would have occurred in their absence remains uncertain. If the agreement contributes to prices rising above $50/b in the coming months, it could encourage a return to supply growth in U.S. tight oil more quickly than currently expected. Crude oil prices near $50/b have led to increased investment by some U.S. production companies, particularly in the Permian Basin. A price recovery above $50/b could contribute to supply growth in other U.S. tight oil regions and in other non-OPEC producing countries that do not participate in the OPEC led supply reductions. Continuing global supply growth in 2017 may postpone significant global inventory withdrawals until 2018, with the first half of 2017 showing inventory builds averaging 0.8 million b/d in our current forecast. Global inventory builds are forecast to average 0.4 million b/d for all of 2017. Despite new oil production coming online when oil inventories are at high levels globally, global economic data have been more positive than previous expectations, and increases in oil demand growth could help to support prices in the coming quarters. The Brent crude oil price forecast for 2017 was increased by $1/b from the November STEO, with 2017 prices expected to average $52/b in the December STEO. Brent and WTI crude oil prices for the first half of 2017 are projected to remain near $50/b, with prices ending the year around $55/b. Implied volatility increased in the weeks prior to the OPEC meeting, suggesting significant uncertainty regarding both the prospects for the recent agreement and its potential implications for global oil balances. Oil production, particularly in the United States, has been more resilient in the current oil price environment than had been expected, as reflected in improving financial conditions at oil companies. Improved profits could encourage oil producers to increase capital expenditures and expand production in 2017 and beyond, especially if oil prices increase. In the third quarter of 2016, a group of publicly traded global oil companies reported the first quarterly profit from upstream production business segments since the fourth quarter of 2014, according to recently released earnings statements from 91 companies. Collectively, the group earned almost $2.3 billion in the third quarter when front-month Brent crude oil prices averaged $47/b. In the same period in 2015, when prices averaged $51/b, the group lost $54.1 billion. Since the fourth quarter of 2014, many companies have written down the value of their assets to reflect lower oil prices, which reduces earnings in the quarter in which a company recognizes the write-down. The increase in earnings this year is partially attributable to a reduction in asset write-downs, which declined 80% year-over-year. Additionally, company reductions in operating expenses were greater than the declines in revenue, contributing to higher profitability. One example of an impairment charge is Royal Dutch Shell's announcement to discontinue a Canadian oil sands project, reducing its proved reserves by an estimated 418 million barrels, according to company filings. A different company, Whiting Petroleum, wrote down the value of some assets it acquired from Kodiak Oil and Gas when the two companies merged last year. Large impairment charges represent acknowledgement by a company that some of its projects are no longer profitable and are being discontinued. While this adjustment reduces the investment expenditures that the company would incur, it also reduces the future estimated cash flow from these projects. Options for conserving cash include reductions in dividends to shareholders, elimination of share repurchase programs or increases in cash through share issuance, increasing debt, or sales of assets. Since 2014, these 46 companies reduced dividends by 16% and share repurchases by 92%. Impairments make increasing debt and selling assets more difficult. Lenders may be less willing to lend if a company's assets declined in value, or may only be willing to lend up to a certain percentage of the value of a company's proved reserves, which declined in value from impairments. Selling assets becomes difficult because they are typically sold at a lower valuation than when the company purchased them because of the impairment charge, raising less cash than otherwise would be expected. Full e-report STEO December 2016 will be emailed to you upon receipt of your request with our contact. Source: US EIA Click on these images below for further details |

AuthorDAJK GROUP is the place where investors, business owners and entrepreneurs can research and find useful information, insight, resources, advice, guidance and inspiration for acquiring funds for their project, acquisition for their net lease commercial real estate, increasing their assets and running their profitable business. Archives

July 2023

Categories |

Services |

Company |

|