|

Highlights:

|

RANK FRANCHISE | INVESTMENT |

| # 1 McDonald's | $1M - $2.2M |

| # 2 7-Eleven Inc. | $38K - $1.1M |

| # 3 Dunkin' Donuts | $229K - $1.7M |

| # 4 The UPS Store | $178K - $403K |

| # 5 RE/MAX LLC | $38K - $225K |

| # 6 Sonic Drive-In Restaurants | $1.1M - $2.4M |

| # 7 Great Clips | $137K - $258K |

| # 8 Taco Bell | $525K - $2.6M |

| # 9 Hardee's | $1.4M - $1.9M |

| # 10 Sport Clips | $189K - $355K |

| # 11 Jimmy John's Gourmet Sandwiches | $330K - $558K |

| # 12 Servpro | $158K - $212K |

| # 13 Culver Franchising System Inc. | $1.8M - $4.3M |

| # 14 Supercuts | $144K - $297K |

| # 15 Carl's Jr. Restaurants | $1.4M - $2M |

| # 16 Papa John's Int'l. Inc. | $130K - $844K |

| # 17 Anytime Fitness | $89K - $678K |

| # 18 uBreakiFix | $60K - $221K |

| # 19 Ace Hardware Corp. | $273K - $1.6M |

| # 20 Kumon Math & Reading Centers | $70K - $141K |

| # 21 Planet Fitness | $857K - $4.2M |

| # 22 Keller Williams | $184K - $337K |

| # 23 Budget Blinds LLC | $105K - $226K |

| # 24 Jersey Mike's Subs | $193K - $660K |

| # 25 Marco's Pizza | $223K - $664K |

| # 26 CPR-Cell Phone Repair | $58K - $176K |

| # 27 Primrose School Franchising Co. | $717K - $5.8M |

| # 28 Mathnasium Learning Centers | $103K - $144K |

| # 29 Hampton by Hilton | $6.9M - $17.1M |

| # 30 Snap-on Tools | $170K - $350K |

| # 31 Wingstop Restaurants Inc. | $347K - $733K |

| # 32 Pet Supplies Plus | $555K - $1.3M |

| # 33 Hilton Hotels and Resorts | $29.1M - $112M |

| # 34 Valvoline Instant Oil Change | $162K - $2.3M |

| # 35 Smoothie King | $226K - $778K |

| # 36 Matco Tools | $91K - $270K |

| # 37 HomeVestors of America Inc. | $44K - $347K |

| # 38 Merry Maids | $87K - $124K |

| # 39 Firehouse Subs | $95K - $1.1M |

| # 40 Mac Tools | $103K - $256K |

| # 41 Baskin-Robbins | $94K - $402K |

| # 42 Mosquito Joe | $67K - $128K |

| # 43 Jack in the Box | $1.5M - $2.9M |

| # 44 Freddy's Frozen Custard & Steakburgers | $593K - $2M |

| # 45 Massage Envy | $435K - $1M |

| # 46 The Maids | $76K - $164K |

| # 47 Pizza Hut LLC | $302K - $2.2M |

| # 48 Orangetheory Fitness | $488K - $994K |

| # 49 Right at Home LLC | $78K - $138K |

| # 50 Nurse Next Door Home Care Services | $105K - $199K |

Please contact us for a complete list from #51 to #150

5 Things To Do Before You Search For A Franchise

Financing Option:

The TGG’s Patron Incentives: To Be Determined (case by case) such as Initial Investment, Initial Franchise Fee, Net-worth Requirement, Liquid Cash Requirement. More details from The Global Gallery

Confidential Consultation: Contact us

The TGG’s Patron Incentives: To Be Determined (case by case) such as Initial Investment, Initial Franchise Fee, Net-worth Requirement, Liquid Cash Requirement. More details from The Global Gallery

Confidential Consultation: Contact us

Your preparation is the key. In other words, the time to get all your ducks in a row is not only an essential step for your success but it is also a tremendous gain an insight which will help to reduce your risk.

1. Start Reading & Studying.

Reading books on these topics will help you get a better understanding of business, and what it’s going to take to succeed. You want you to read books about:

1. Start Reading & Studying.

Reading books on these topics will help you get a better understanding of business, and what it’s going to take to succeed. You want you to read books about:

- Starting a business

- Entrepreneurship

- Franchising

- Business plans

- And if you really want to get a leg up, read an accounting book.

“The more that you read, the more things you will know. The more that you learn, the more places you’ll go.” – Dr. Seuss

2. Financials

Before you take the time needed to search for a franchise to buy, it’s important to see where you stand, financially. The best way to do it is by putting together a financial statement.

Generally speaking, the most time-consuming part of doing a financial worth statement is gathering all the information you need.

You’ll need your mortgage loan and credit card statements, information on all of your investments, and more. In a nutshell, you’ll need to gather everything that lists all of your assets and all of your liabilities.

Before you take the time needed to search for a franchise to buy, it’s important to see where you stand, financially. The best way to do it is by putting together a financial statement.

Generally speaking, the most time-consuming part of doing a financial worth statement is gathering all the information you need.

You’ll need your mortgage loan and credit card statements, information on all of your investments, and more. In a nutshell, you’ll need to gather everything that lists all of your assets and all of your liabilities.

3. Learn About Small Business Loans

If you’re like most of the people who are considering franchise business ownership, you’ll need a small business loan for the lion’s share of your startup capital needs.

That’s why it’s crucial to learn all you can about the types of loans that are currently available. And the information you need is only one-click away.

If you’re like most of the people who are considering franchise business ownership, you’ll need a small business loan for the lion’s share of your startup capital needs.

That’s why it’s crucial to learn all you can about the types of loans that are currently available. And the information you need is only one-click away.

4. Share Your Plan In Franchising With Your Family's Member

Transitioning from employee to franchise owner is a big deal.

That’s why it’s essential to discuss what you’re thinking of doing with the people who will be affected the most; your family.

And when you have the discussion, don’t hold back. Tell them why you want to be your own boss. Tell them how you’re going to get the money. Tell them how careful you’re going to be-and that you promise to do great research.

In the long run, as long as you’re upfront with them, and communicate with them during the entire process, chances are they’ll support your decision.

Transitioning from employee to franchise owner is a big deal.

That’s why it’s essential to discuss what you’re thinking of doing with the people who will be affected the most; your family.

And when you have the discussion, don’t hold back. Tell them why you want to be your own boss. Tell them how you’re going to get the money. Tell them how careful you’re going to be-and that you promise to do great research.

In the long run, as long as you’re upfront with them, and communicate with them during the entire process, chances are they’ll support your decision.

5. Eliminate Distraction

The last thing to do, before you start your search for a franchise opportunity is to eliminate all unnecessary distraction.

Specifically, take an internet-social media break. Spend a few months with you.

Refrain from answering emails, logging into your social media networks, or reading articles about franchising-or business. Instead, spend some time away from your Smartphone. Maybe you can spend time outdoors, or at least somewhere that will provide a change of scenery. But, it has to be distraction-free.

Doing what I just recommended will force you to take a hard look at what you’re thinking of doing.

The last thing to do, before you start your search for a franchise opportunity is to eliminate all unnecessary distraction.

Specifically, take an internet-social media break. Spend a few months with you.

Refrain from answering emails, logging into your social media networks, or reading articles about franchising-or business. Instead, spend some time away from your Smartphone. Maybe you can spend time outdoors, or at least somewhere that will provide a change of scenery. But, it has to be distraction-free.

Doing what I just recommended will force you to take a hard look at what you’re thinking of doing.

Summary

To sum things up, deciding to become the owner of a franchise business is a big decision. The preparation you do before you begin your franchise search really matters. That includes talking about your idea with your family, and spending a period of distraction-free time alone. Combined, all these action items will go a long way in preparing yourself up for success as the owner of a franchise.

When you are ready, please contact us

To sum things up, deciding to become the owner of a franchise business is a big decision. The preparation you do before you begin your franchise search really matters. That includes talking about your idea with your family, and spending a period of distraction-free time alone. Combined, all these action items will go a long way in preparing yourself up for success as the owner of a franchise.

When you are ready, please contact us

0 Comments

Managing smaller projects with increased rigor and a through-cycle mentality can help companies to capture significant untapped value.

Growth in the metals and mining sector typically requires large capital investments, which naturally garner considerable top-management attention. Yet these big projects account for only 50 to 60 percent of the sector’s $350 billion in annual capital spending. Many companies struggle to manage another category of capital expenditure with sufficient rigor: small investments to maintain existing assets, as well as small and midsize growth projects. And therein lies an opportunity.

Projects with a value of $50 million or less (frequently less than $10 million) make up a significant portion of capital spending for mining and metals companies: these projects typically account for 80 percent of all capital projects by number, and up to 50 percent of capital spending value. Yet many of these projects fall below the executive radar. According to the CFO of a diversified mining company, “We have a very solid central process to align capital allocation with corporate strategy, but [we are] primarily focused on major projects while the individual mines have a lot of autonomy in planning small capital projects.” As a result, these small projects can contribute to low investor returns. For example, the return on invested capital in metals and mining companies averages just 4 percent—typically below the cost of capital and much lower than the typical small-to-medium project, which have pay-back periods of less than 3 years.

But that’s just part of the equation. As demand for basic materials decreases, metals and mining companies dramatically reduce their capital investment; the industry reduced its capital expenditure (capex) by more than 25 percent between 2012 and 2016. The CFO of an international mining company recently confirmed that “in downtimes, we strictly limit capital allocation to safety and production, and reduce in-house project execution capabilities to reduce costs.”

However, we have found that decreases in capital spending rarely come with additional on spending (i.e., more robust processes to plan and manage small and medium capex). As a result, companies miss out on capturing additional value when demand returns—an opportunity they could seize by developing a through-cycle mentality to capex and increasing spend discipline.

However, we have found that decreases in capital spending rarely come with additional on spending (i.e., more robust processes to plan and manage small and medium capex). As a result, companies miss out on capturing additional value when demand returns—an opportunity they could seize by developing a through-cycle mentality to capex and increasing spend discipline.

Small and medium capex challenge

In dealing with small and medium capex projects, mining and metals companies face the following specific challenges:

- Time-force approvals. Management teams are asked for hundreds of approvals every year during the budgeting cycle.

- Weak business cases and risk assessment. Many business cases are poor or nonexistent, with no clear benefits or revenue impacts, underestimated costs, and optimistic schedules. Risks are not fully assessed and mitigation plans are insufficiently robust, leading to delays and cost overruns.

- Bundling of small projects into large packages. Many projects are bundled together under one large topic, and decisions are made for the entire package. Limited granularity means that low-return projects end up being approved.

- Poor tracking. Executives frequently lack transparency into real-time project progress, preventing timely management intervention.

- No feedback loop. Most companies do not have a structured review process, which inhibits future opportunities to learn from mistakes.

- Low productivity. Construction productivity often falls short; there is not enough true lean construction/execution.

Project sponsors are often overburdened and may lack time or technical capabilities to effectively stress-test proposed small and medium projects.

We observe mixed approaches among mining and metals executives when it comes to planning and managing small and medium capex. Some confirm that the prioritization process is “nonexistent” and that capex budgets are defined from the top down. “We do not have a specific process for prioritizing small and medium capex,” affirmed an international mining company CFO. Others describe a structured process in which projects are selected based on business logic, designed with optimal scope, and executed under stringent timelines with sufficient internal and supplier engagement. In many cases, these companies have robust stage-gate governance frameworks with clear requirements in place that would, if followed, lead to well-designed and executed capital projects.

The reality of the industry, however, is often different. Many companies overestimate returns, basing decisions on inconsistent assumptions or relying on unclear criteria for prioritizing small and medium projects. Project sponsors are often overburdened and may lack time or technical capabilities to effectively stress-test proposed small and medium projects. As a result, many of these projects do not generate the expected value or end up being relegated during the final approval process.

Implementing best practice

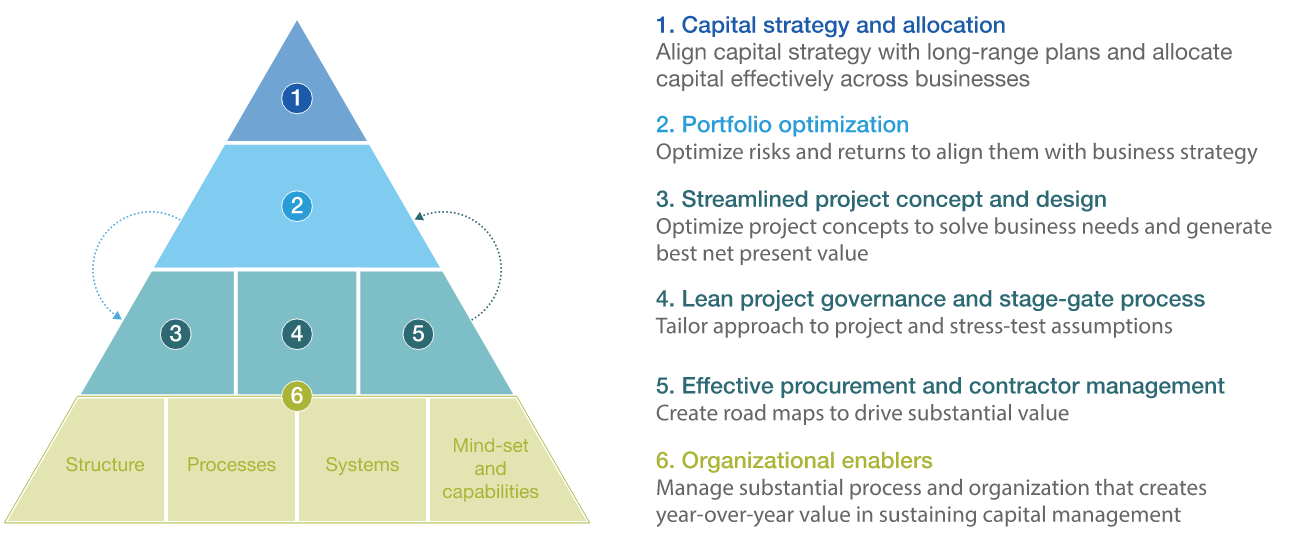

Best-in-class companies and executives overcome these problems by developing small-to-midsize capital-management dedicated programs and teams around six core building blocks: aligning capital strategy and allocation with corporate strategy; optimizing portfolios; streamlining project concept and design; implementing lean project governance; implementing effective procurement and contractor-management processes; and instituting sustainable organizational enablers (exhibit). In doing so, we have observed that they can deliver 15 percent to 30 percent additional value by improving the way they select and manage small-to-midsize projects.

Align capital strategy and allocation with corporate strategy

To achieve desired outcomes, mining and metals companies must translate overall corporate strategy into individual business-unit, regional and then mine/asset strategy, taking into consideration the risk-return profile of each entity. Best-practice companies ensure that projects are properly aligned with their overall strategy and are appropriately prioritized. Most recently, those companies are also incorporating lessons from the last few years and using a through-cycle mentality to determine optimal annual expenditure levels. Because many projects are small, the allocation is often made at the business-unit or even mine/asset level, which requires companies to adopt disciplined processes to ensure that expenditures align in the aggregate.

Leading companies in the industry also examine projects in terms of the value they create for the company overall, not only for the mine/asset. Often, this approach leads to the conclusion that a project should not be approved and that the value-creation goal can be achieved in other ways. This process also constitutes an important release mechanism, enabling companies to escape from the “engineer’s mind-set”—a focus on implementing the best engineered solution regardless of value. In addition, best practices also call for establishing systems to regularly monitor capital spending.

Optimize portfolios

Management teams often lack the data or processes to evaluate the merits of one project portfolio over another. Instead, they may pursue a default basket of projects year after year or make blunt, across-the-board spending cuts without actively shaping the portfolio for optimized growth and operations maintenance. In contrast, the most successful companies identify an optimal portfolio of projects, basing their assessment on two main factors:

Management teams often lack the data or processes to evaluate the merits of one project portfolio over another. Instead, they may pursue a default basket of projects year after year or make blunt, across-the-board spending cuts without actively shaping the portfolio for optimized growth and operations maintenance. In contrast, the most successful companies identify an optimal portfolio of projects, basing their assessment on two main factors:

A. Prioritization. Best-practice mining and metals companies require a business-case evaluation for each project. This brings transparency to the business problem the project aims to solve, and also helps to determine which projects can be delayed or canceled. This in turn frees up funds for projects with the most attractive returns. Companies should also classify projects to ensure that the mix aligns with their strategic goals. Typical classifications include “must do” investments to comply with safety or environmental regulations; “sustaining” projects to improve an asset production process and reduce the likelihood of outages; “strategic” projects to open up future growth directions; and “growth” projects to increase margins or revenues. Once again, developing a clear business case that demonstrates a suitable return on investment helps prevent executives from advancing projects simply based on a classification. Across all these categories, committed and work-in-progress capital expenditures are generally prioritized to minimize cost escalations.

Experience in the mining and metals industry shows that quality, safety, and environmental projects—typically mandated by regulators—are often inefficiently executed. Yet when viewed through the prioritization prism, they can yield cost savings ranging from 10 percent to 30 percent. A large precious metal miner recently realized 37 percent cost reduction through the capital scrubbing of its quality, safety, and environmental projects—savings that could then be reallocated to higher-value projects.

Experience in the mining and metals industry shows that quality, safety, and environmental projects—typically mandated by regulators—are often inefficiently executed. Yet when viewed through the prioritization prism, they can yield cost savings ranging from 10 percent to 30 percent. A large precious metal miner recently realized 37 percent cost reduction through the capital scrubbing of its quality, safety, and environmental projects—savings that could then be reallocated to higher-value projects.

B. Financial- and nonfinancial-indicator trade-offs. Trade-offs are based on financial measures such as net present value (NPV), internal rate of return, and profitability index, as well as nonfinancial indicators such as emissions levels or environmental impact. Best-in-class companies apply NPV calculations not only to greenfield mines or new plants but to all projects, including those with no revenue component as well as those that suffer from production-outage induced reductions in profitability. Applying a range of measures enables mining and metals companies to make refined trade-offs in terms of project choice.

Streamline project concept and design

In streamlining project concept and design, managers must scrub the business cases for each project to ensure they are realistic and robust. Companies must ensure projects meet key objectives, such as:

In streamlining project concept and design, managers must scrub the business cases for each project to ensure they are realistic and robust. Companies must ensure projects meet key objectives, such as:

- Does the proposed project fix a real problem (safety, environment, operations, maintenance) or can noncapital solutions address the root issue?

- Is the project based on complete, error-free data?

- Are the underlying assumptions reasonable?

- Have all dependencies been identified?

In addition, managers should keep an eye out for common pitfalls. Examples we commonly observe in the mining and metals industry include teams tacking on “nice-to-have” but costly features or capabilities, exaggerating the impact of not doing the project by considering a worst case scenario, proposing major modifications when easy work-arounds are possible, and proposing expansions when additional capacity is still available.

Projects should also be optimized for cost and value over their life span. In doing so, managers should analyze key cost drivers by asking questions including:

- Can the project be done with less capital by optimizing the project scope, simplifying technical specifications, or buying from lower-cost sources?

- Can the project be made to generate revenue faster—for example, by reducing construction or ramp-up time or by introducing a phased implementation process?

- Can operational cash flows be enhanced by improving yields or reducing running costs?

Careful evaluation with technical or commercial experts can often reveal lower-cost solutions that yield the same benefits. Companies should conduct design-optimization reviews as a project progresses, starting with design and continuing through equipment selection once basic engineering is completed. By optimizing its portfolio of projects and project scopes through a minimum-technical-solution approach, a large chrome producer reduced its “stay in business” (SIB) capital expenditure by 19 percent. In addition, a PGM mine operator achieved savings on a series of mid-size capital investments by systematically applying value improvement principles during the feasibility stage; their savings included a 17 percent reduction on an infrastructure project, and a 50 percent reduction on a tailing dam extension cost.

Implement lean project governance and stage-gate processes

Many mining and metals companies have effective stage-gate processes for managing large projects such as new mines or process facilities expansions; yet many smaller projects are managed with a one-size-fits-all approach, which leads to frustration and process or bureaucratic overload. Companies with effective portfolio management tailor their approach to each project based on its size and complexity. For example, for smaller, simpler projects, they streamline the number of stage gates and stakeholders involved. By redeploying engineering and project-management staff to the most complex or costly projects, they maximize value.

Many mining and metals companies have effective stage-gate processes for managing large projects such as new mines or process facilities expansions; yet many smaller projects are managed with a one-size-fits-all approach, which leads to frustration and process or bureaucratic overload. Companies with effective portfolio management tailor their approach to each project based on its size and complexity. For example, for smaller, simpler projects, they streamline the number of stage gates and stakeholders involved. By redeploying engineering and project-management staff to the most complex or costly projects, they maximize value.

We observe mining and metals companies often missing a crucial step in governance when it comes to smaller projects: stress-testing or challenging project-proposal objectives and their underlying assumptions. Examples include using internal or external benchmarks for cost estimates instead of precise project-specific calculations, or failing to consider multiple design solutions. Stress-testing provides another opportunity to verify that the project will truly meet strategic objectives. This work is best done by subject matter experts independent from the mine/asset and its traditional engineering partners. Formally introducing external challenges at each stage gate is fundamental to delivering required outcomes.

But there is also another issue affecting optimization. Due to labor cuts during commodity downturn, SIB projects—projects that are required to maintain profits, operations, and safety at existing levels—suffer from a significant project management skills shortage. This results in an increase in SIB spending, as the operations teams rarely possess the skills to effectively execute the project. This puts significant production pressure on the business and further reduces capex efficiency. Typically, the recruiting process in the industry is also significantly slower than the ramp-up required to maintain or improve current mine/asset effectiveness. In addition, mining and metals engineering and construction contractors experience a similar skilled-resources shortage, exacerbating the problem, as contractors can no longer serve as a source of skilled labor to effectively execute projects.

Use effective procurement and contractor-management processes

Many mining and metals companies tout excellent capabilities in managing their capital procurement. In reality, many fail to integrate procurement professionals into the front end of the project life cycle. As a result, they miss opportunities to incorporate the latest supply-market insights or technological advancements. Companies also fail to capture synergies by procuring projects individually as “spot” purchase. In the procurement of equipment, materials, or services, the industry’s best-performing companies:

Many mining and metals companies tout excellent capabilities in managing their capital procurement. In reality, many fail to integrate procurement professionals into the front end of the project life cycle. As a result, they miss opportunities to incorporate the latest supply-market insights or technological advancements. Companies also fail to capture synergies by procuring projects individually as “spot” purchase. In the procurement of equipment, materials, or services, the industry’s best-performing companies:

- Create clear product road maps, allowing them to bundle like commodities across different projects and mines/assets.

- Employ advanced analytic tools to facilitate supplier discussions.

- Expand their supply markets to include global suppliers and take advantage of the best technology or labor markets.

- Deploy the most appropriate contracting model for each project (for example, switching between cost-plus and lump-sum methodologies) rather than always sticking to the same contracting approach.

- Base decisions on the clarity of the project scope and an understanding of the execution risk, as well as the natural ownership of that risk.

- Carefully assess contractor capabilities and select contractors that can deploy the most efficient and effective crews to sites that are often remote.

Regardless of the contracting model, effective owner oversight is critical to not only mitigate the frequent information asymmetry between owners and contractors, but also to create room for additional contractor margins.

A fertilizer mining company reduced its spending on small and medium capital projects by 15 percent by challenging its insourcing and outsourcing labor strategy; by developing new procurement processes (for example, rules for using time and materials rather than fixed-cost contract structures); and through new contractor management approaches (for example, level of contractor supervision).

A fertilizer mining company reduced its spending on small and medium capital projects by 15 percent by challenging its insourcing and outsourcing labor strategy; by developing new procurement processes (for example, rules for using time and materials rather than fixed-cost contract structures); and through new contractor management approaches (for example, level of contractor supervision).

Institute sustainable organizational enablers

Small to medium capex management in a highly cyclical industry like mining and metals is often most successful when senior management treats it as a priority. Leading companies actively manage their process with regular performance dialogues between project teams and senior management. In addition, these companies do not treat smaller project optimization as a one-off event. Rather, they invest in team capabilities that promote project optimization and higher standards of execution throughout the company. They invest in training a cadre of project and portfolio-management experts. They also create centers of excellence, which they use to train small-project teams from different mines/assets to be more effective and efficient in leveraging resources. Over time, such training programs can be rolled out across the entire company. This “Capex Academy” model spreads expertise across all sites, which is essential for small-scale projects that are typically driven at the mine/asset level, in contrast to major projects that receive abundant attention from headquarters. Using this approach, one company put all of its project teams through thorough training on the prefeasibility and feasibility phases, resulting in substantial increases in project quality.

Small to medium capex management in a highly cyclical industry like mining and metals is often most successful when senior management treats it as a priority. Leading companies actively manage their process with regular performance dialogues between project teams and senior management. In addition, these companies do not treat smaller project optimization as a one-off event. Rather, they invest in team capabilities that promote project optimization and higher standards of execution throughout the company. They invest in training a cadre of project and portfolio-management experts. They also create centers of excellence, which they use to train small-project teams from different mines/assets to be more effective and efficient in leveraging resources. Over time, such training programs can be rolled out across the entire company. This “Capex Academy” model spreads expertise across all sites, which is essential for small-scale projects that are typically driven at the mine/asset level, in contrast to major projects that receive abundant attention from headquarters. Using this approach, one company put all of its project teams through thorough training on the prefeasibility and feasibility phases, resulting in substantial increases in project quality.

Many companies manage large-scale projects effectively, but few apply the same discipline to small-to-midsize projects. By implementing appropriate rigor in their evaluation, prioritization, and optimization of their small-to-midsize portfolio, companies can unearth significant savings and develop a strong organization rooted in capability building.

Source: Mc & Company

Source: Mc & Company

Author

DAJK GROUP is the place where investors, business owners and entrepreneurs can research and find useful information, insight, resources, advice, guidance and inspiration for acquiring funds for their project, acquisition for their net lease commercial real estate, increasing their assets and running their profitable business.

Archives

July 2023

June 2023

May 2023

August 2019

March 2019

December 2018

October 2018

September 2018

August 2018

July 2018

June 2018

May 2018

April 2018

March 2018

January 2018

December 2017

November 2017

October 2017

September 2017

July 2017

June 2017

May 2017

April 2017

March 2017

January 2017

December 2016

November 2016

October 2016

September 2016

August 2016

July 2016

June 2016

May 2016

April 2016

February 2016

January 2016

December 2015

October 2015

September 2015

August 2015

July 2015

June 2015