ERA will begin accepting submissions Oct. 28, 2016 and submissions close Dec. 15, 2016. Emissions Reduction Alberta (ERA) is making up to $40 million CDN available to advance technologies that address methane detection, methane quantification or reduce methane emissions in Alberta. There is a maximum of $5 million per project and up to 50% of eligible costs. ERA is the new tradename of the Climate Change and Emissions Management (CCEMC) Corporation. We were established as a key partner of the Government of Alberta to address climate leadership priorities. ERA will begin accepting submissions Oct. 28, 2016 and submissions close Dec. 15, 2016. Projects can include prototype development and testing, field pilot projects and demonstration projects. Ideas can come from anywhere, but all projects must demonstrate a clear and justified value proposition for addressing methane emissions in Alberta. Field pilots and demonstration projects must occur in Alberta. Multiple-site pilot and demonstration projects are eligible. We are seeking projects that reduce methane emissions from across Alberta’s sectors, including: • Agriculture • Mining • Oil and gas • Waste management The size of opportunity and potential for widespread methane reductions will be taken into consideration during ERA’s evaluation and project selection. WHY METHANE? The climate change impact of methane is significant — 25 times greater than carbon dioxide over a 100-year period. The Alberta Climate Leadership Plan aims to reduce methane emissions by 45% by 2025. ERA is well positioned to play a role in supporting medium- and longer-term methane emissions reduction. The oil and gas industry is responsible for 70% of Alberta’s methane emissions. 31.4 megatonnes in 2014

12.5 megatonnes in 2014 Please contact us for further information if you are interested.

0 Comments

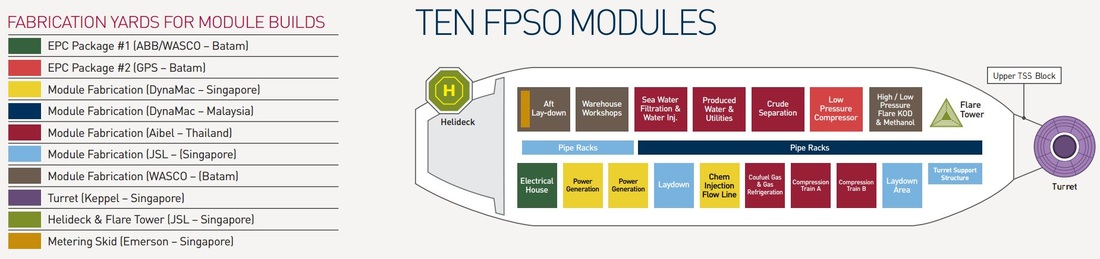

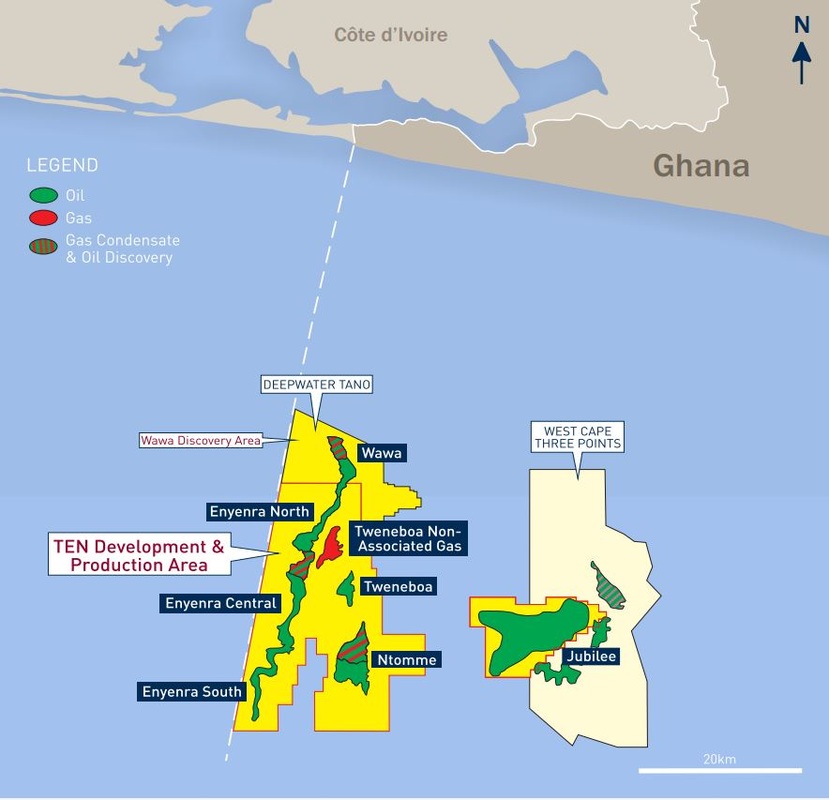

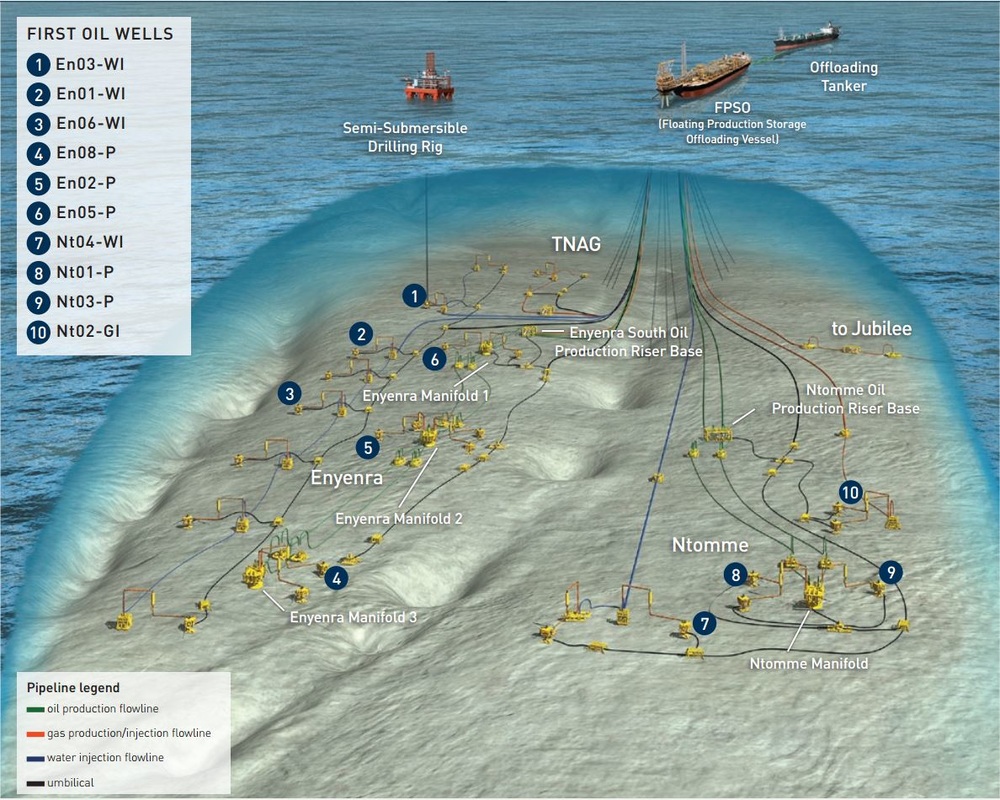

TWENNEBOA, ENYENRA & NTOMME (“TEN”)The TEN Fields lie in the Deepwater Tano block, around 60 kilometres offshore Western Ghana. The fields are spread across an area of more than 500 square kilometres, around 20 kilometres to the west of the Tullow operated Jubilee Field. The reservoirs lie in water depths ranging from 1,000 to 2,000 metres. Following the discovery and appraisal of the fields, the TEN Plan of Development (PoD) was approved by the Government of Ghana in May 2013. The full field development will consist of 24 wells in total – a mixture of water injection, gas injection and production wells which will all be connected to the FPSO through subsea infrastructure. Ten wells were required for First Oil and have all been drilled. The project tendered its major contracts shortly after PoD approval and all key awards were made by September 2013. The conversion of the FPSO began in October 2013, with the arrival of the Centennial Jewel tanker in Singapore. The installation of the subsea umbilicals, risers and flowlines began in July 2015 and lasted almost exactly one year. After nearly 28 million man hours of work the project delivered First Oil on schedule in August 2016. Ghana’s second deepwater development has come onstream within budget, just over three years after the government sanctioned the project. The TEN project in the Deepwater Tano license covers three fields in water depths of 1,000-2,000 m (3,281-6,562 ft), 20 km (12.4 mi) west of the Jubilee field. Operator Tullow Oil, in partnership with Anadarko, Kosmos Energy, Ghanaian National Petroleum Corp. (GNPC), and PetroSA, commissioned MODEC to convert the double-hulled VLCC Centennial J into the 340-m (1,115-ft) long, 56-m (184-ft) wide FPSO Prof. John Evans Atta Mills. The FPSO, moored in 1,500 m (4,921 ft) of water, is designed to process up to 80,000 b/d of oil and 180 MMcf/d of gas. It is connected via subsea manifolds, flexible flowlines and static/dynamic umbilicals to oil and gas production wells and water and gas injectors - depending on performance and future plans, up to 24 development wells may eventually be drilled. Tullow anticipates a productive lifespan of 20 years. Project manager Terry Hughes spoke to Offshore about the various issues the partners dealt with along the way, including reservoir depletion mechanisms, managing engineering, lessons learned from Jubilee, and local content. Offshore: This is Tullow’s first experience of overseeing development of a major deepwater project. How has the company approached this task? Hughes: I joined Tullow in 2011 specifically for TEN, having previously worked with several upstream operating companies doing major projects offshore and onshore around the world. I joined towards the end of the concept selection phase which had concluded TEN was best developed using an FPSO and subsea infrastructure. We then formed a team to complete the technical and engineering requirements from all areas - subsurface, wells, subsea, facilities etc - needed to make a well defined proposal to the field partners to proceed with the development. That was done by early 2013 and TEN completed its sanction and received government approvals in May that year. The next step was to execute the sanctioned project and the team was put in place to do this. With Jubilee, Tullow concentrated on preparing for the operating phase after the major project phase was completed. The project phase itself was executed by an integrated project team drawing expertise from all the partners, led by Kosmos Energy. Several Tullow employees were part of this team, but Tullow’s focus was preparing for operations, which meant assembling a significant group of people, mainly based in Ghana, to oversee field operations. Tullow took all that experience and knowledge into the TEN Project which was a significant step up in size and scale. Location of the TEN fields offshore Ghana. (All images courtesy Tullow Oil) In the project’s early phase, our main partners, Anadarko, Kosmos and GNPC, had a lot of engagement with Tullow as they wanted to understand and provide input into our execution plan and the building up of our team. As the project progressed on schedule and on budget, I believe they became increasingly confident in our capabilities, allowing them to step back a little. Offshore: The exploration campaign that led to the three TEN discoveries on the Deepwater Tano block took place during 2009-12. What is your resultant understanding of these structures and their characteristics? Hughes: The acreage was covered by spec 3D seismic that had been acquired in 2000. We call TEN ‘the field,’ although it actually comprises various reservoirs in different formations - Tweneboa, Enyenra, and Ntomme are various rock types. We have also procured seismic outside the areas where oil and gas has been found in order to correlate the data better, and to look at opportunities for future tie-ins. Certainly, 3D seismic provides a lot more definition and helps to fine-tune the bottomhole locations. And combining the 3D data with the well results allowed us to optimize our development plan, including the reservoir depletion mechanisms. We now know, for instance, that one field features a gas cap and water drive rather than just being a gas-drive field and we have modified our depletion plans in response. As for our predictions on reservoir behavior, you might say we are currently in the middle of the uncertainty range. But once we obtain production history and see how the wells behave, we are hopeful the volume of recoverable reserves will increase. So far all the wells have come in on target, most with slightly better quality reservoirs than we predicted. For several years we have installed pressure gauges in our wells, enabling us to monitor the pressure pulses in the reservoirs which gives our engineers valuable insight into how the reservoirs will behave. It all looks good but we really need some production history to correlate our models and then we can update our predictions. The main reserves, and consequently our focus for the early part of the development, are in the Enyenra and Ntomme reservoirs. Most of TEN’s producing and injecting wells have been drilled on these structures which make up the bulk of the 300 MMboe we believe are recoverable. We are only developing one pocket of the reservoirs at Tweneboa, which is a gas field, and this is not due to start production until mid-2018. The depletion plan for the three fields differs: Tweneboa is via gas condensate blow down; Enyenra - pattern waterflood; and Ntomme - crestal gas injection and flank waterflood driven by reservoir geometry and fluids. Production rates per oil producer across the fields are variable, in the 10-15,000 b/d range. This was confirmed during short flowback tests when we were installing production tubing strings into the wells. Offshore: The 2009-12 campaign also led to discovery of the Okure, Oyo, Sapele and Wawa fields - why were these excluded from the current development? Hughes: Our approved plan is to execute TEN as I have described which includes some pre-investment in the facilities to enable future developments and tie-ins to proceed efficiently. We are well placed now to evaluate options to extend the TEN plateau period or overall field life. We already have a team doing the early planning work and, when it’s complete, we will bring the options forward for our partners and the government of Ghana to consider. Offshore: Various technical issues have cropped up at Jubilee since production started there, notably in the wells and more recently, the bearings in the FPSO’s turret mooring system. Were the partners looking to either replicate or avoid certain experiences from that project with TEN? Hughes: We had an extensive lessons learned initiative in TEN which sought to replicate all the things that went well on Jubilee and avoid some of the issues seen after a few years of its production history. The timeframe between the discovery of the Jubilee field and first oil was incredibly short. The integrated project team did an excellent job bringing that field into production quickly, which benefited all parties, but inevitably they had less time to refine and optimize designs and execution plans. Taking this lesson on board, for TEN we expended extra effort on front-end work in order to ensure we had the right design and that the execution plan was sound. I believe we found the right balance between engineering, design and execution - and with firm project management and rigorous management of change culture, we were able to deliver on time and on budget. There are lots of stories of projects going wrong in the execution phase following repeated alterations to their scope. Offshore: Government approval for the development came in 2013, shortly after the conclusion of exploratory drilling. This seems ultra fasttrack compared with other West African deepwater projects - was this due to the government’s keenness to develop the country’s oil and gas sector as quickly as possible. Hughes: TEN was not actually planned and executed as a fasttrack development. Tullow does not think or act like a major oil company - we are a smaller organization with a more manageable portfolio. With less internal competition for resources, we are able to bring focus and get things done in a shorter period. Clearly, we had to conduct significant exploration and appraisal on a field of this complexity and we spent nearly $1 billion on E&A. With such a significant investment to confirm the size of the resource, we were highly motivated to bring the project forward for sanction as quickly as possible and happily the government of Ghana was like-minded. Offshore: Was one of the government’s conditions for sanctioning the project stepping up involvement of Ghanaian nationals, or would the partners have done this anyway? Hughes: In both cases, yes. The partners would have done it for two reasons: firstly, in Tullow’s case, and probably the same applies to our partners, we have always pushed for local people and local industry to share the prosperity of major finds such as TEN. At the same time, the Ghanaian government and regulator have displayed equal drive to see increased local participation. For these reasons we asked each of our major contractors to include local content plans in their tenders and made them part of our contracts. For example, FMC Technologies, which was awarded the contract for the subsea production systems, has assembled and tested the subsea trees for TEN at their facility in Ghana which has a predominantly local workforce. Other examples are the new Sekondi fabrication yard we used with MODEC and Technip to build piles and structural components for TEN’s subsea architecture; and the Takoradi yard where Subsea 7 has manufactured a complex gas export manifold which will soon be installed on the seabed - a full year ahead of schedule. This will allow TEN’s gas to mix with Jubilee gas being exported to the Ghanaian shore. MODEC also used local companies to build components that were sent to Singapore and installed on the FPSO. Seadrill’s semisubmersible West Leo has drilled and completed the first-phase TEN wells. Doing this work in-country builds capacity and enables knowledge transfer to Ghana. We supplemented these efforts with a secondment program which saw employees from the GNPC and Petroleum Commission of Ghana join our project teams in London, Singapore, Paris, and Houston to gain news skills and experience. Offshore: Did MODEC win the contract to supply the weather-vaning, turret-moored FPSO based partly on the partners’ experience working with the company on the Jubilee floater? Hughes: Clearly this formed part of our thinking, but they still had to go through the process of bidding. All bidders had to consider our requirements and enter a year-long design competition which required extensive engineering and planning work to support their bids. MODEC emerged successful from this process. After winning the contract, MODEC bought and converted a VLCC tanker in Singapore and the resultant FPSO Prof. John Evans Atta Mills, named after the late Ghanaian president who facilitated first oil from Jubilee, reached Ghana this March. It was then moored via nine chains connected to suction piles, all built in Ghana, at the TEN location. Intense planning was necessary to anchor the FPSO in the optimum position to connect to the extensive network of subsea equipment needed for the 24 wells that will ultimately be drilled in the field. On completion of the mooring and hook up of flowlines and controls, the vessel underwent an extensive commissioning and testing process. First oil was produced on Aug. 17. We will soon begin injecting associated gas into the Ntomme reservoir, and then next year gas export to the shore will begin. Offshore: Is development drilling on track? Hughes: All is on track with our plans for first oil. Our development plan is for a total of 24 wells, 10 of which were required, and will be delivered, by first oil. The well stock is a combination of re-used E&A wells and new wells. There is a maritime border dispute between the governments of Ghana and Côte d’Ivoire and until the resolution of this process, we cannot initiate any new drilling. However, we had already completed the drilling of our first oil wells when the drilling hiatus was imposed. The border dispute will be resolved by ITLOS [International Tribunal of the Law of the Sea] in 2017, after which we hope to resume our development plan. Though not ideal, this drilling hiatus does mean that when we resume drilling it will be at the lower rig rates we now see due to the change in market conditions experienced over the last year. Offshore: Will all the subsea equipment be in place before start-up? Hughes: Everything apart from the gas export manifold is in place, and we expect to install the manifold in September, nearly a year ahead of plan. FMC should deliver the last of the subsea trees next March, making them available for when we resume drilling. Our wells feature smart completions which allow us to monitor and control individual reservoir zones. Offshore: Can you provide details of the production capacity and offtake arrangements? Hughes: The facilities can handle up to a nominal 80,000 b/d of oil, with storage capacity of 1.7 MMbbl. Every two weeks during the plateau period, one cargo of 1 MMbbl will leave the facility which is of similar oil quality to Jubilee. We are also hopeful that we will be ready to export gas in 2017 - much earlier than planned. Offshore: Following the oil price ‘shock,’ did the partners and the Petroleum Commission get together to find ways of bringing the project costs down? Hughes: Yes. When we sanctioned the project, our contracting strategy was to secure capacity and minimize risk and exposure. Some of that required ‘lump sum’ contracts where the price is fixed up front so we were limited in what we could do here. But where costs were not fixed, we have achieved some savings. We will not finalize our numbers for a little while yet, but our capital costs to first oil will come in under the $4-billion figure we approved at sanction. And of course, the TEN fields will be operating for many years to come so we are looking hard at our operating costs and the synergies we can achieve from a two-field operation. Offshore: Will Tullow have to relinquish any parts of the Deepwater Tano license at some point, including any of the discoveries? Hughes: The Deepwater Tano Petroleum Agreement was signed in March 2006. Expiry of the TEN development and production area is in 2Q 2036, although we will have to relinquish some of the area around the Tweneboa gas find two years after production. At the moment, we do not have the opportunity to drill appraisal wells on this area, but we will need to look at this with the government. We will also look again at the surrounding area and satellites and will take into account ITLOS’ decision. Source: Offshore and Tullow

October 2016 USDA report released last week shows that in 2014, the biobased products industry contributed $393 billion and 4.2 million jobs to America's recovering economy. The report also indicates that the sector grew from 2013 to 2014, creating or supporting an additional 220,000 jobs and $24 billion over that period. As one of the four pillars USDA has identified to boost our country's rural economy, USDA has invested heavily in growing the biobased economy.

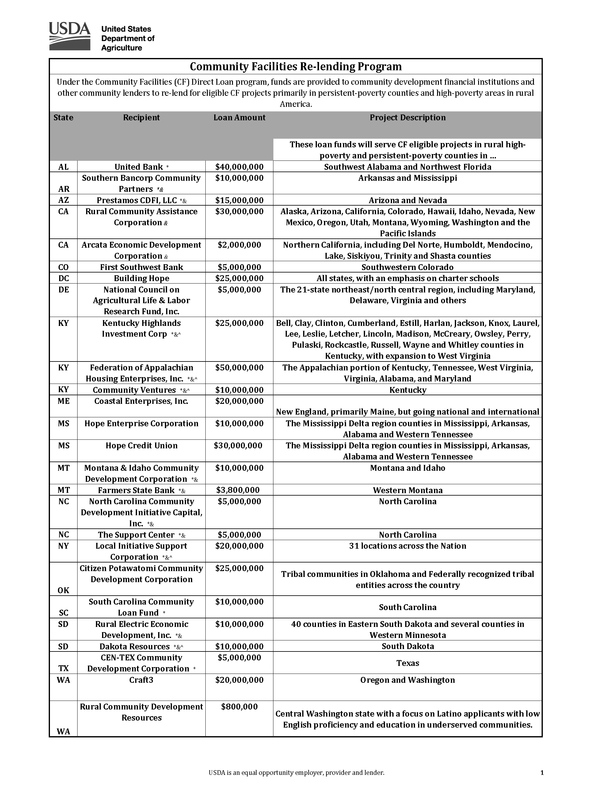

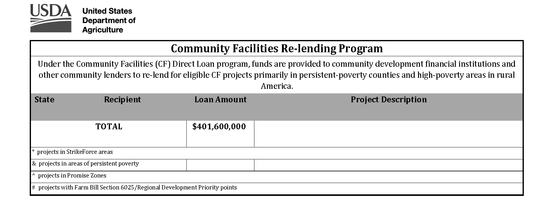

At the same time, we’re working on regional solutions to alleviate long-term poverty, which disproportionately affects rural areas. In an effort to address this, last week USDA unveiled an innovative partnership with community development organizations from across the country, providing $401 million in funds to recipients with a track record of successful programs that help reduce poverty in some of the nation’s most isolated rural communities. Twenty-six community development organizations have been approved to draw upon the funding to help local entities build, acquire, maintain or renovate essential community facilities. The funds also can be used for capacity building and to finance essential community services, such as education, health care and infrastructure. Many of the projects will be in some of the nation's poorest rural areas, such as communities in Appalachia, the colonias along the U.S./Mexico border and in the Mississippi Delta region. Below is a list of the projects.

Source: USDA

Full report in pdf format (142 pages) can be provided upon receive of your request. Our Concierge ServicesIndependent Global Sales Agents Hiring Announcement

|

| Chick-fil-A is dominating fast food. The company generates more revenue per restaurant than any other fast-food chain in the US, according to QSR magazine. Chick-fil-A's average sales per restaurant in 2015 were $3.9 million. Its fried-chicken competitor KFC sold about $1 million per restaurant that year. |

The sub chain Jason's Deli ranked a distant second with $2.7 million in per-restaurant sales, followed by Whataburger and McDonald's, each with $2.5 million in per-restaurant sales.

So what is the secret to Chick-fil-A's success?

According to a new study from QSR and research firm SeeLevelHX, Chick-fil-A has the best drive-thru service of any of its competitors.

The chain scored the highest marks on employee politeness at the drive thru, according to the study, which compiled data from 2,000 visits to 15 fast-food chains.

Employees said "thank you," smiled, and had a pleasant demeanor during nine out of 10 visits.

The chain also had the second-highest rate of accuracy at the drive thru. Chick-fil-A got orders right 95% of the time, which made it second only to Carl's Jr.'s accuracy rate of 97%.

The only place where Chick-fil-A didn't rank highly was in speed of service.

The average wait time at Chick-fil-A's drive thru is 4 minutes and 16 seconds, which is about 31 seconds longer than the average drive-thru wait time.

The drive thru is an essential element to the fast-food business. It's estimated that 60% to 70% of fast-food chains' business comes through the outside car lanes.

One reason for Chick-fil-A's high scores on service is its face-to-face ordering process, in which employees stand outside and take drive-thru customers' orders using tablet computers.

That leaves less room for error and provides a more personable experience at the drive thru. It's also meant to speed up the ordering process.

The strategy was started by local Chick-fil-A operators in Houston and it's now being rolled out nationwide, according to QSR.

Bass Pro Shops Is Buying Cabela's In a $5.5 Billion Deal

| Bass Pro Shops is buying Cabela's in a $5.5 billion deal that brings together two prominent outfitters for the great outdoors. Bass Pro Shops sells fishing supplies, and Cabela's is a hunting store known for its taxidermy displays. There's plenty of crossover -- especially because both companies sell guns and ammunition. |

Cabela said its stockholders would be paid $65.50 in cash per share. Cabela's (CAB) stock jumped 15% at the start of trading.

Johnny Morris, founder of Bass Pro Shops, assured customers in an open letter that "there will be no immediate impact to our stores."

The companies did not immediately respond to CNNMoney messages about whether any of Cabela's 19,000 employees would eventually be laid off or any of its 85 U.S. and Canadian stores closed.

Bass Pro Shops, which is privately held, said it would honor Cabela's rewards cards and credit cards.

Cabela's stores have a distinctive rustic decor featuring displays of stuffed bears, deer, elk and moose. Some of the larger stores resemble theme parks or natural history museums, with extravagant displays of Arctic landscapes with stuffed Musk oxen, or African landscapes with stuffed elephants.

Much of Cabela's merchandise is camouflage and camping gear, including tents and bear-proof food kegs. The company is also known for its so-called gun libraries, green-walled rooms with antique guns for sale, including firearms from both World Wars.

The deal is being financed by Goldman Sachs (GS) and Pamplona.

Sources: Forbes, CNBC, Business Insider and CNN

Johnny Morris, founder of Bass Pro Shops, assured customers in an open letter that "there will be no immediate impact to our stores."

The companies did not immediately respond to CNNMoney messages about whether any of Cabela's 19,000 employees would eventually be laid off or any of its 85 U.S. and Canadian stores closed.

Bass Pro Shops, which is privately held, said it would honor Cabela's rewards cards and credit cards.

Cabela's stores have a distinctive rustic decor featuring displays of stuffed bears, deer, elk and moose. Some of the larger stores resemble theme parks or natural history museums, with extravagant displays of Arctic landscapes with stuffed Musk oxen, or African landscapes with stuffed elephants.

Much of Cabela's merchandise is camouflage and camping gear, including tents and bear-proof food kegs. The company is also known for its so-called gun libraries, green-walled rooms with antique guns for sale, including firearms from both World Wars.

The deal is being financed by Goldman Sachs (GS) and Pamplona.

Sources: Forbes, CNBC, Business Insider and CNN

[Discover more of net lease investment...]

Should you have further questions, please sign-in with our 30-minutes confidential consultation.

Author

DAJK GROUP is the place where investors, business owners and entrepreneurs can research and find useful information, insight, resources, advice, guidance and inspiration for acquiring funds for their project, acquisition for their net lease commercial real estate, increasing their assets and running their profitable business.

Archives

July 2023

June 2023

May 2023

August 2019

March 2019

December 2018

October 2018

September 2018

August 2018

July 2018

June 2018

May 2018

April 2018

March 2018

January 2018

December 2017

November 2017

October 2017

September 2017

July 2017

June 2017

May 2017

April 2017

March 2017

January 2017

December 2016

November 2016

October 2016

September 2016

August 2016

July 2016

June 2016

May 2016

April 2016

February 2016

January 2016

December 2015

October 2015

September 2015

August 2015

July 2015

June 2015