|

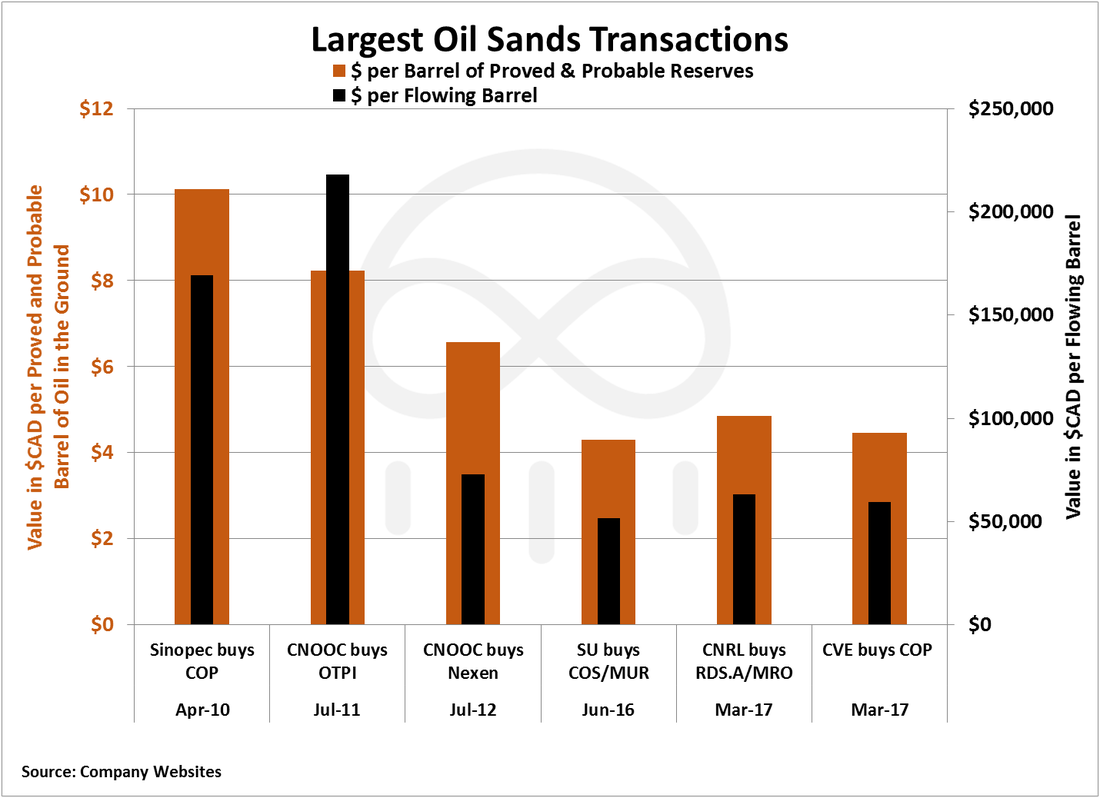

What Does The Future Hold For Canada’s Oil Sands? Buying discounted oil sands producing assets may not seem strategically opportunistic when looking at the economics of oil sands projects. Most oil sands projects have breakeven WTI prices above $80 per barrel and that is far away from current WTI prices hovering around $50 per barrel. Phases in Canada’s Oil Sands We have entered a unique phase in major oil sands acquisitions in Alberta. Canadian companies are using their operational expertise, large market values, and stable balance sheets to build up larger positions in Canada’s oil sands. Over the last decade, oil production from Canada’s oil sands has increased 100 percent and an increasing number of players are participating in that growth. In 2006 there were 6 companies, not including the Syncrude Canada consortium, which controlled all oil sands production in Alberta. Now, there are around 20 oil sands producers. Over the years, key acquisitions took place in Canada’s oil sands that helped grow the resource to what it is now: 1. The first phase was from 2006 to 2010 when oil companies were acquiring undeveloped assets to secure a position in developing Canada’s oil sands. Examples include Statoil’s $2.2 billion acquisition of North American Oil Sands in 2007, PetroChina’s initial acquisition of a 60 percent interest in Athabasca Oil Corporation’s oil sands assets for $1.9 billion in 2009, and Total SA’s $1.5 billion acquisition of a 20 percent stake in Suncor’s Fort Hills oil sands mine from UTS Energy Corporation in 2010. 2. In the latter half of 2010 to 2012, Canada’s oil sands saw the second phase of acquisitions dominated by Asian companies. These Asian companies, often state-owned, were acquiring existing production for a premium to secure producing positions in Canada’s oil sands. As a sharp rebound in oil prices followed the financial collapse of 2008/2009, more oil sands projects were taken from development to production. Asian energy powers were late to the game and began buying up producing oil sands assets to secure future energy resources. The second phase of oil sands acquisitions by state-owned Asian companies started with China’s Sinopec (SHI) and its acquisition of ConocoPhillips’ 9 percent interest in Syncrude Canada for $4.7 billion in 2010. This was followed by Thailand’s PTT Exploration & Production and its acquisition of a 40 percent stake in Statoil’s oil sands projects for $2.3 billion in 2010. Finally, China’s CNOOC (CEO) would make two large adjoining acquisitions to become the sole owner of the Long Lake oil sands project. CNOOC would make a $2.1 billion acquisition of OTPI in 2011, which held a 35 percent interest in Long Lake. Following the OTPI acquisition, CNOOC would buy the remaining share of Long Lake in 2012 with the $15.1 billion acquisition of Nexen. 3. The third and current phase of oil sands acquisitions has one common theme: Canadian opportunism. Suncor (SU), Cenovus (CVE), and Canadian Natural Resources (CNQ) have sought to take advantage of the current market and make large value-oriented acquisitions that are an opportunistic alternative to building a brand-new oil sands project. Canadian Opportunism While it may be a point of pride that Canada is buying back Canadian oil sands assets, this current phase of acquisitions redirects attention away from the fact that oil majors are leaving Canada. Total SA (TOT), Royal Dutch Shell (RDS.A), Marathon Oil (MRO), Statoil (STO), Murphy Oil (MRU) and ConocoPhillips (COP) have all reduced their exposure to oil sands assets in the last couple years. Many of the companies selling Canadian oil sands assets are managing assets on a global scale. This means that they are forced to sell marginal fields to invest in more profitable ventures or re-focus their capital towards core long-term operations. For the Canadian oil companies acquiring oil sands assets, the oil sands are their only core long-term business and they must find a way to manage these assets to remain profitable or cost-effective. This means strategically seizing on opportunities in a low-price oil environment when they are out of favor. Looking at the capital expenditures required for several oil sands project, based on analysis conducted by Citigroup Global Markets Inc. in January 2015, it makes clear business sense for Suncor and Canadian Natural Resources to make acquisitions of oil sands mining projects in the current low-price oil environment. Suncor and Canadian Natural Resources are buying oil sands mining projects at a 25 percent to 50 percent discount to the cost per flowing barrel to build a new project. On the other hand, Cenovus paid almost $60,000 per flowing barrel to consolidate its joint venture (JV) with ConocoPhillips and acquire additional Western Canadian Sedimentary Basin (WCSB) assets. Cenovus’ purchase is higher than the cost to build up phases of its Foster Creek and Christina Lake projects, but the consolidation of its JV with ConocoPhillips is likely to bring immediate cost savings. According to Cenovus’ March 2017 presentation, the company expects to reduce operating costs by 18 percent and reduce general and administrative (G&A) costs by 29 percent upon full integration of ConocoPhillips oil sands and WCSB assets. Oil Sands: The Economics of Time Buying discounted oil sands producing assets may not seem strategically opportunistic when looking at the economics of oil sands projects. Most oil sands projects have breakeven WTI prices above $80 per barrel and that is far away from current WTI prices hovering around $50 per barrel. While capital in North America has been flooding into high margin oil plays like the Permian’s Delaware Basin, investment in Canada’s oil sands requires a long-term approach. Delaware Basin Wolfcamp wells can be drilled in less than 12 days and produce upwards of 2,000 b/d of oil, but those wells face 60 percent to 70 percent production decline rates after one year. Meanwhile, the recent major oil sands mining project operated by Suncor, Fort Hills, started construction in 2013 and is estimated to produce first oil in 2017. The life of the Fort Hills oil sands project is expected to last approximately 50 years. Oil sands players like Suncor, Cenovus, and Canadian Natural Resources look at oil prices over several decades and are less influenced by short term volatility in oil prices. According to Suncor’s Executive Vice President and Chief Financial Officer, Alister Cowan, in the January 22, 2017 Financial Post article, How high break-even costs are challenging new oil sands projects, Cowan noted of the Fort Hills project, “You don’t make decisions on 50-year life [of an oil sands mine] on the basis of spot price, so we would expect to see multiple periods of price volatility during the life [of the Fort Hills mine].” Mr. Cowan goes on to note the current opportunistic environment, “Ironically, building a major capital-intensive project — this is precisely when you want to build it because nobody else is.” Even as oil prices hover around $50 per barrel, Canadian oil sands companies are still building most new mining and in situ projects with a time frame measured by decades. In 2016, 78 percent of all new oil sands projects have been brought online by Canadian companies and 92 percent of all new oil sands projects in 2017 will be brought on by Canadian companies. Construct, Consolidate, and Control With Canada’s largest oil sands companies long-term vision and recent acquisitions, Suncor, Cenovus, and Canadian Natural Resources are coincidentally consolidating positions in Canada’s oil Sands. Based on 2016 oil sands production in Alberta, these three largest Canadian oil sands producers control around 60 percent of oil sands production. anIn 2002, when oil sands production capacity was under a million barrels per day, the market value of Canadian Natural Resources was $3.7 billion and the market value of Suncor was $13 billion. As of 2016, the market value of Canadian Natural Resources has increased 10 times its 2002 value and Suncor’s market value has increased 4 times its 2002 value. The growth of the largest Canadian oil sands producers has provided them with the financial capacity to make recent multi-billion dollar acquisitions. The Future of Canada’s Oil Sands The ever-changing oil price environment and the long-term nature of Canada’s oil sands projects will continue to create opportunities for all oil companies. Companies have come and gone and returned to Canada’s oil sands projects and that trend is bound to continue as oil prices fluctuate over future decades. In this current low price environment, top Canadian oil sands producers are investing in efficiency, innovation, and sustainability for oil sands operations. Canadian Oil sands producers are bringing down operating costs, moving more towards in-situ projects that provide better relative economics to mining projects, and using technology to streamline operations and reduce reliance on non-renewable resources. As oil prices move higher in the future, oil sands operations will emerge leaner and more sustainable with better economics than Citigroup Global Markets’ assessed in January 2015, but that will be yet another phase in Canada’s oil sands future. Source: Oil Price and Suncor

0 Comments

If you see a product or service that is being consumed in one market, that product is not available in your market, you could perhaps import that product or service, and start that business in your home country. A key question that all would-be entrepreneurs face is finding the business opportunity that is right for them. Should the new startup focus on introducing a new product or service based on an unmet need? Should the venture select an existing product or service from one market and offer it in another where it may not be available? Or should the firm bank on a tried and tested formula that has worked elsewhere, such as a franchise operation. There are many sources for new venture opportunities for individuals. Clearly, when you see inefficiency in the market, and you have an idea of how to correct that inefficiency, and you have the resources and capability — or at least the ability to bring together the resources and capability needed to correct that inefficiency — that could be a very interesting business idea. In addition, if you see a product or service that is being consumed in one market, that product is not available in your market, you could perhaps import that product or service, and start that business in your home country. Many sources of ideas come from existing businesses, such as franchises. You could license the right to provide a business idea. You could work on a concept with an employer who, for some reason, has no interest in developing that business. You could have an arrangement with that employer to leave the company and start that business. You can tap numerous sources for new ideas for businesses. Perhaps the most promising source of ideas for new business comes from customers — listening to customers. That is something we ought to do continuously, in order to understand what customers want, where they want it, how they want a product or service supplied, when they want it supplied, and at what price. Obviously, if you work in a large company, employees might come up with ideas. Indeed, you might want to listen to what they have to say. You could pursue these ideas by asking yourself some key questions such as, “Is the market real? Is the product or service real? Can I win? What are the risks? And is it worth it?” Well, obviously in the age of the Internet, there is no shortage of examples of entrepreneurs who started a company based on a perceived need. You could go back to the beginning of E-Bay, where they saw an opportunity to connect people through launching a virtual flea market. It offered a platform that connected buyers and sellers directly. Other companies have found similar models. For instance, take PayPal, a company whose co-founder [Elon Musk] was a Penn and Wharton graduate. The company provided people the opportunity to pay online. Flycast is another company started by a former Wharton MBA student, [Rick Thompson]. It addressed issues of advertising on-line. All of these companies have one thing in common. They addressed an unmet need in the marketplace. There is no substitute for understanding the unmet needs of customers. That will allow you to discover whether you are able to supply those needs, at the price customers want to pay, and if you can still make a profit. The process of evaluating and identifying the risks that should be considered in deciding whether or not to pursue that business opportunity? The first step that everyone should go through is to ask the question, is the market real? In order to do so, the first thing you want to do is conduct what we call a customer analysis. You can do that perhaps in a very technical way, by conducting surveys. Or perhaps, in a less technical way, you can attempt to answer the question, “Who is my customer?” What does the customer want to buy? When does the customer want to buy? What price is the customer willing to pay? So, asking the “W questions” — who, where, what, when — is the first step. At the end of the day, the one thing every entrepreneur is looking for is revenue, and the revenue will come from customers. That is why you need to ask yourself, is there a market here? The second thing you want to ask yourself is, who else is supplying that particular market? That is what we call competitor analysis. Ask yourself who else is in this market, and what are they doing for the customers. Are they supplying a similar substitute product or service as you have in mind? That is the second thing you have to establish, and by doing that, you can understand better what need is not met at the moment. That will also give you the opportunity to zero in on the price points and feature points of where you can differentiate yourself from existing players in the market. You also need to conduct a broader industry analysis to understand the attractiveness of the industry you’re going to enter. Is the industry growing or shrinking? What power do the suppliers have in this industry? How many buyers are there? Are there substitute products? Are there any barriers to entry? If so, what are they? That is very important for you to understand, because it will help you realize whether the industry you’re thinking of entering is attractive. In addition, you may want to look at regulations that affect that industry. Are there any regulations that you would be subject to? This especially applies in the life sciences sector, where there are strict regulations that control the supply of products into the market. In the United States, the FDA, the Food and Drug Administration, is a significant regulator. Every country around the world has a regulator in the life science sector. So, these are the high level questions that you may want to ask yourself. Once you answer these questions, and you identify the need, given the competition and all the regulatory constraints that exist in that market, that will provide you with the opportunity to tailor your service or product — or combination of the service and product — to that marketplace. The logic we are suggesting here is to understand the need, and tailor the product and/or service to that need, as opposed to saying, “Well, I have an idea. And now let me think how I can shove it down the distribution channel.” More often than not, the latter doesn’t work. More often than not, the former approach works. This is the approach where you identify the need, do a rigorous analysis of understanding who else is out there, and what constraints exist, and how you could differentiate yourself in a meaningful way. When you approach a new opportunity this way, when you introduce your product and/or service, you can expect to have substantial sales and growth for your company. Are there any financial risks that entrepreneurs should take into account? What would those be? When starting a business, there are many risks that need to be considered. One way to think about the various risks an entrepreneur is faced with — or, for that matter, an investor in an entrepreneurial venture is faced with — is to break them down into several buckets. Let’s start with the first bucket, the company bucket. Well, here, the biggest sources of risk are the founders. Do they have the wherewithal not just to start the company, but also grow the company? Experience has shown that the prevalence of individuals such as Bill Gates or Michael Dell, Steve Jobs, that can not only start companies, but also manage its growth — the prevalence of such individuals is relatively limited. A second source of risk is technology risk. To the extent that your company employs technology, there are obviously issues of, how long will this technology be the leading edge? Secondly, are there any intellectual property issues that need to be addressed? Lastly, there exists the product risk. If you haven’t developed a product yet, can you manufacture it? Will it work? All these issues are under the bucket of company risk. A second bucket for the sources of risk is the market for the product. You need to be aware of two big uncertainties. First, what is the customer’s willingness to buy? And second, what is the pace, if you’re successful, at which competitors will be able to imitate you? One of the things you have to think about when you enter that market is how you can create barriers to imitation, so that if you’re successful, the competition won’t be able to imitate you very quickly. A third bucket consists of risks associated with the industry. Are there any factors in that industry that relate to availability of supply? In some cases, you need to have certain raw materials that are in limited supply, and that some suppliers might be able to take advantage of that. Barriers to entry might change. Regulations might change, and adversely or positively affect your business. Lastly, there are financial risks. And here, the question is, will you be able to raise the money early on? At what valuation will you be able to do it? Will you be able to raise follow-up money? And then, from the investor’s standpoint, obviously there’s a risk that if the company is very successful — and I can tell you that most early stage companies don’t work out, but for the few that do, when it is time for, say, a public offering, will the public market be open? We have just gone through a substantial period of almost two years where IPOs were few and far between. At the time you make the investment, you don’t know what the state of the capital market will be in five to seven years from the date you make the investment. That’s a big risk the investor is assuming. Obviously, it’s a big risk for the entrepreneur to be able to have some liquidity, and perhaps realize the fruits of her investment, of her time, talent, and in some cases some of the money she puts into that venture. What are the biggest mistakes you have found entrepreneurs make at the initial stage of identifying business opportunities? The most frequent mistake that people tend to make is to think everybody in the market is like them. If they like the product, everybody else will. Sometimes — too often — entrepreneurs, and especially entrepreneurs with an engineering background, are too focused on the engineering features or technology features of the particular product, rather than on the need that they are trying to fulfill. Customers don’t buy technology. Customers buy products that add value. Customers buy products that they need, in order to satisfy some issue that they wish to satisfy. But not the technology, per se; it is the services of the technology that matter. Very often, entrepreneurs — particularly smart entrepreneurs — are overwhelmed by the technological aspect, and they pay too little attention to what the customers want. If you ask me, this is the most frequent issue at the early stage that entrepreneurs are faced with. Source: Wharton

Nigeria is no longer running short on dollars—for now In the past year, it’s been almost impossible to say anything about Nigeria’s economy without talking about the naira. Currency controls imposed by the government of Muhammadu Buhari led to a downward spiral for the naira, which changes hands at vastly weaker rates on the black market than the official one set by the Central Bank of Nigeria (CBN). As the central bank tries to manage the exchange rate rather than let it float freely, as advised by the IMF and World Bank, the parallel markets have delivered a damning verdict on what the naira is really worth. Nigeria’s latest currency woes can be traced back two years ago, when president Buhari first took over. Despite dwindling foreign reserves thanks to the fall in global oil prices, CBN governor Godwin Emefiele at first refused to devalue the naira—in line with Buhari’s wishes. But in June last year the CBN finally gave in, adopting a flexible exchange-rate policy determined by market forces. To nobody’s surprise, the naira immediately fell sharply against the dollar. But soon after the policy was adopted, it became clear that the naira was never fully floated. As part of a “managed float,” the CBN intervened in the market for dollars, which were in high demand. This didn’t last, and so importers and anyone else who needed dollars were forced, once more, turn to the black market. The gap between the official and black-market exchange rates then grew wider. The CBN is back in the market now, stepping up its interventions over the past month, supplying banks with dollars and allowing retail customers who want to buy forex for travel allowances or to pay school fees to do so—although at an approved rate. In recent months, restrictions on sales had pushed many to resort to the black market regardless. With at least some of the pent-up demand for dollars now being met by banks, the rate in the parallel market has started to return closer to the official rate. The improved supply of dollars has eased a shortage which left local businesses unable to import raw materials and Nigerians unable to meet medical expenses as well as pay tuition at foreign schools. The shortage, as well as the CBN’s unpredictable controls and Nigeria’s weak economy, had also scared away investors. The moves by international airlines to either pull out or cut routes to Nigeria has not been the best advertisement for the country’s business climate. By easing the dollar shortage, the CBN is likely hoping to convince Nigerians, and foreign investors, that the naira’s most nervous days are over. Regardless of recent stability, Nonso Obikili, a Nigeria-based economist, says it’s not clear how long the central bank can keep up its interventions. These have only been possible lately thanks to slightly improved foreign reserves: with a fragile peace pact holding in Nigeria’s oil Niger Delta region, production once hobbled by militants has been ramping up, allowing the country to earn more from its main export. The central bank’s ability to keep the supply of dollars flowing is dependent on conditions beyond its control, such as global oil prices and peace in the volatile Niger Delta region. But just as importantly, the CBN’s struggles to keep the naira under control have hurt its credibility. For much of his tenure as central bank governor, Emefiele has been thought to prioritize politics over economics, leading to the botched naira float and calls for his resignation. The recent dollar interventions have helped somewhat, but the CBN’s somewhat arbitrary new set of exchange rates has done little to ease the most serious concerns. “There is still no credibility, and still no functioning transparent official market. There is no price discovery mechanism. The result is that the CBN is still acting as a price fixer which, at the core, is the problem,” Obikili says. The creation of yet more exchange rates “will remain concerning for investors,” says Manji Cheto of consultancy Teneo Intelligence. The short-term goal of closing the gap between official and black-market rates has been achieved, but regaining investor confidence in the long term will take longer. “Investors would like to see a more sustained period of policy certainty before they can begin to feel more confident again,” Cheto says. IMF Executive Board Concludes 2017 Article IV Consultation with Nigeria March 30, 2017 On March 29, 2017, the Executive Board of the International Monetary Fund (IMF) concluded the Article IV consultation with Nigeria. With oil receipts dominating fiscal revenue and exports, the Nigerian economy has been hit hard by low oil prices and falling oil production. The country entered into a recession in 2016, with growth contracting by 1.5 percent. Annual inflation levels doubled to 18.6 percent, reflecting hikes in electricity and fuel tariffs, a weaker naira and accommodating monetary conditions (broad money expanding at 19 percent y-o-y). Even with a significant under-execution in capital spending, the consolidated fiscal deficit increased from 3.5 percent of GDP in 2015 to 4.7 percent of GDP in 2016, because of significant revenue shortfalls. This resulted, over the same period, in a doubling of the Federal Government (FG) interest payments-to-revenue ratio to 66 percent. The external current account turned into a surplus in 2016, as import compression continues to offset falling exports. The foreign exchange regime was liberalized in June 2016, but FX restrictions remain in place and the market continues to be characterized by significant distortions that have contributed to a 50 percent parallel market premium, which was halved following recent increases in central bank interventions and the removal of prioritized allocation of foreign exchange. Under unchanged policies, the outlook remains challenging. Growth would pick up only slightly to 0.8 percent in 2017, mostly reflecting some recovery in oil production and a continuing strong performance in agriculture. Policy uncertainty, crowding out, and FX market distortions would be expected to drag activity. Accommodative monetary policy would keep inflation in double digits. Financing constraints and banks’ risk aversion would crowd out private sector credit and increase the Federal Government’s already high debt service burden. A continued policy of prioritizing exchange rate stability would lead to an increasingly overvalued exchange rate, leading to a deterioration in the non-oil trade balance and gross reserves below adequate levels. Recognizing the unsustainability of current policies, the authorities have adopted an Economic Recovery and Growth Plan (ERGP) to transform the economy into a more diversified and inclusive economy. Key priorities include ensuring food security through agro-related manufacturing, promoting industrialization, and achieving sufficiency in energy—including the recently approved Power Sector Recovery Plan. The ERGP’s inclusive growth focus is to be supported through macroeconomic stability, investing in social infrastructure, building a globally competitive economy, and improving governance. Executive Board Assessment Executive Directors recognized that the Nigerian economy has been negatively impacted by low oil prices and production. Directors commended the efforts already made by the authorities to reduce vulnerabilities and enhance resilience, including by increasing fuel prices, raising the monetary policy rate, and allowing the exchange rate to depreciate. However, in light of the persisting internal and external challenges, they emphasized that stronger macroeconomic policies are urgently needed to rebuild confidence and foster an economic recovery. Directors welcomed the authorities’ Economic Recovery and Growth Plan (ERGP), which focuses on economic diversification driven by the private sector, and government initiatives to strengthen infrastructure—including the recently adopted power sector recovery plan. However, they underlined that without stronger policies these objectives may not be achieved. Directors generally emphasized the need for a front-loaded, revenue-based fiscal consolidation starting in 2017, to reduce the federal government interest payments-to-revenue ratio to sustainable levels. They underscored that priority should be given to increasing non-oil revenue, including through raising VAT and excise rates, strengthening compliance, and closing loopholes and exemptions. Administering an independent fuel price-setting mechanism to eliminate fuel subsidies, strengthening public financial management, and developing a well-targeted social safety net would also support the adjustment. Directors stressed the need to contain the fiscal deficit of state and local governments, including through improved transparency and monitoring. Directors underscored that external adjustment is necessary to protect foreign currency buffers and reduce vulnerabilities. They commended the recent easing of some exchange restrictions and urged the authorities to remove the remaining restrictions and multiple currency practices, thus unifying the foreign exchange market and helping regain investor confidence. Directors emphasized that these policies should be supported by tighter monetary policy and fiscal consolidation to anchor inflation expectations and to limit the risk of exchange rate overshooting, as well as structural reforms to improve competitiveness. Directors welcomed the steps to strengthen banking sector resilience through stronger prudential requirements. With asset quality declining, they recommended further intensifying bank monitoring, enhancing contingency planning, and strengthening resolution frameworks. Directors encouraged quickly increasing the capital of undercapitalized banks and putting a time limit on regulatory forbearance. Directors emphasized that ambitious structural reforms are key to achieving a competitive, investment-driven economy that is less dependent on oil. Priority should be given to improving infrastructure, enhancing the business environment, improving access to financing for small enterprises, and strengthening governance and anti-corruption efforts. Timely and effective implementation of these measures would promote sustainable and inclusive growth. Directors welcomed progress in improving the quality and availability of economic statistics and encouraged further efforts to compile subnational fiscal accounts. Source: IMF

Claim Your Place In History

Our Los Angeles-based DA and JK Inc. (“DAJK”) is a partner with the Global Gallery founded by Mr. Donald Brown; DAJK is also an authorized seller (more details at links below). DAJK will pledge Five percent (5%) of total sales through the registered organization’s members and/or affiliates. Once your organization is registered, DAJK will issue to you the unique tracking reference so that we can track and credit to your organization accurately. Please note there is no minimum quantity requirement. Our art prints and open edition sculptures are anticipated:

A Sporting Chance for Peace’s prints and sculptures provides an opportunity for every one can claim his place in history, support a Global Peace Initiative and Ghana Medical Tourism, founded by A) Pre-Launch Promotion of 50,000 prints. Discover more details DONATION: TEN PERCENT (10%) of sales of these prints will support not-for-profit HEAG Foundation and Medical Community in Ghana (“HMCG”)

B) Global Sales Target of 15,000 Sculptures. Discover more details

DONATION: TEN PERCENT (10%) of sales of these sculptures will support not-for-profit HEAG Foundation and Medical Community in Ghana (“HMCG”)

Discover more at our websites: (Benefits and Bonuses)

If our business proposition is acceptable, please provide us your Letter of Interest or Commitment or Purchase Order promptly. Please make sure your LOI or PO is including with our provided unique reference so that we can track and credit to your organization accurately.

Thank you for your time. I look forward doing business with you. P.S If you or your affiliates is interested in the limited sculptures, please advise. Also, the Five percent (5%) of total sales from these limited sculptures will be pledged to your organization as well. The Price list (scroll down to the end of this page). BONUS: Constructing the Wall of Peace

|

Libyan Crude Oil Offer |

Our Concierge Services |

ANNOUNCEMENT |

ANNOUNCEMENT |

Print Sales Agents |

Sculpture Sales Agents |

Author

DAJK GROUP is the place where investors, business owners and entrepreneurs can research and find useful information, insight, resources, advice, guidance and inspiration for acquiring funds for their project, acquisition for their net lease commercial real estate, increasing their assets and running their profitable business.

Archives

July 2023

June 2023

May 2023

August 2019

March 2019

December 2018

October 2018

September 2018

August 2018

July 2018

June 2018

May 2018

April 2018

March 2018

January 2018

December 2017

November 2017

October 2017

September 2017

July 2017

June 2017

May 2017

April 2017

March 2017

January 2017

December 2016

November 2016

October 2016

September 2016

August 2016

July 2016

June 2016

May 2016

April 2016

February 2016

January 2016

December 2015

October 2015

September 2015

August 2015

July 2015

June 2015