|

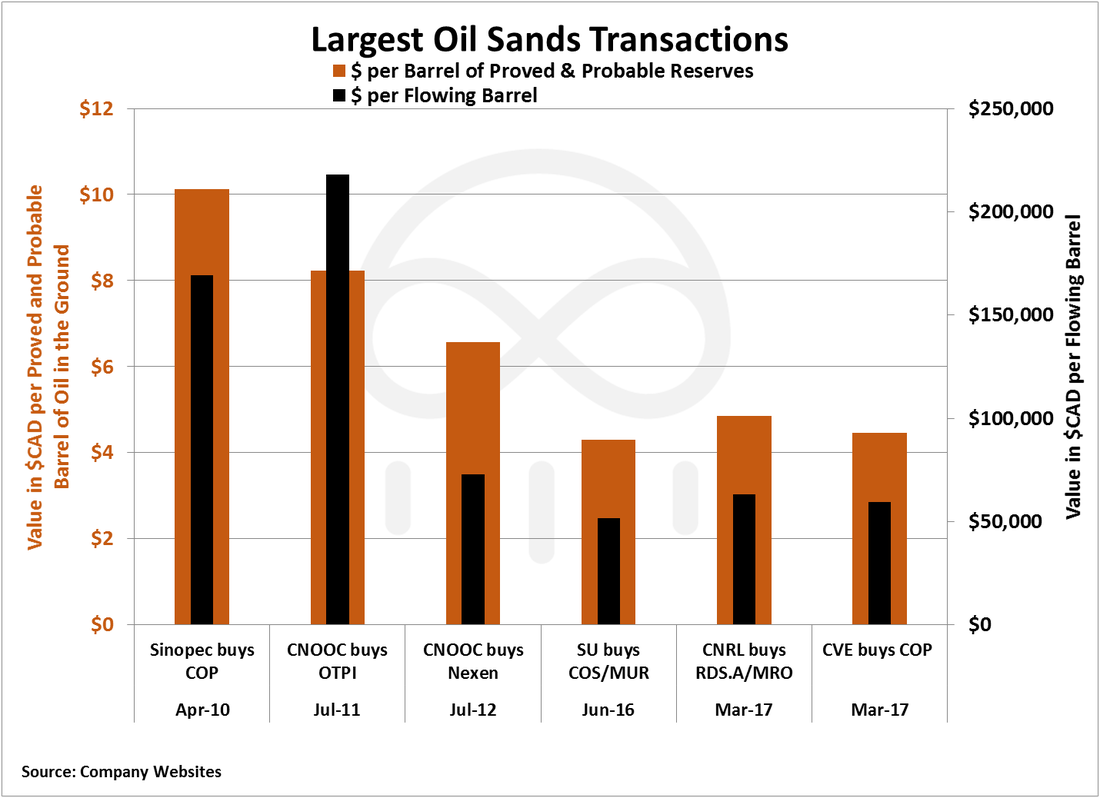

What Does The Future Hold For Canada’s Oil Sands? Buying discounted oil sands producing assets may not seem strategically opportunistic when looking at the economics of oil sands projects. Most oil sands projects have breakeven WTI prices above $80 per barrel and that is far away from current WTI prices hovering around $50 per barrel. Phases in Canada’s Oil Sands We have entered a unique phase in major oil sands acquisitions in Alberta. Canadian companies are using their operational expertise, large market values, and stable balance sheets to build up larger positions in Canada’s oil sands. Over the last decade, oil production from Canada’s oil sands has increased 100 percent and an increasing number of players are participating in that growth. In 2006 there were 6 companies, not including the Syncrude Canada consortium, which controlled all oil sands production in Alberta. Now, there are around 20 oil sands producers. Over the years, key acquisitions took place in Canada’s oil sands that helped grow the resource to what it is now: 1. The first phase was from 2006 to 2010 when oil companies were acquiring undeveloped assets to secure a position in developing Canada’s oil sands. Examples include Statoil’s $2.2 billion acquisition of North American Oil Sands in 2007, PetroChina’s initial acquisition of a 60 percent interest in Athabasca Oil Corporation’s oil sands assets for $1.9 billion in 2009, and Total SA’s $1.5 billion acquisition of a 20 percent stake in Suncor’s Fort Hills oil sands mine from UTS Energy Corporation in 2010. 2. In the latter half of 2010 to 2012, Canada’s oil sands saw the second phase of acquisitions dominated by Asian companies. These Asian companies, often state-owned, were acquiring existing production for a premium to secure producing positions in Canada’s oil sands. As a sharp rebound in oil prices followed the financial collapse of 2008/2009, more oil sands projects were taken from development to production. Asian energy powers were late to the game and began buying up producing oil sands assets to secure future energy resources. The second phase of oil sands acquisitions by state-owned Asian companies started with China’s Sinopec (SHI) and its acquisition of ConocoPhillips’ 9 percent interest in Syncrude Canada for $4.7 billion in 2010. This was followed by Thailand’s PTT Exploration & Production and its acquisition of a 40 percent stake in Statoil’s oil sands projects for $2.3 billion in 2010. Finally, China’s CNOOC (CEO) would make two large adjoining acquisitions to become the sole owner of the Long Lake oil sands project. CNOOC would make a $2.1 billion acquisition of OTPI in 2011, which held a 35 percent interest in Long Lake. Following the OTPI acquisition, CNOOC would buy the remaining share of Long Lake in 2012 with the $15.1 billion acquisition of Nexen. 3. The third and current phase of oil sands acquisitions has one common theme: Canadian opportunism. Suncor (SU), Cenovus (CVE), and Canadian Natural Resources (CNQ) have sought to take advantage of the current market and make large value-oriented acquisitions that are an opportunistic alternative to building a brand-new oil sands project. Canadian Opportunism While it may be a point of pride that Canada is buying back Canadian oil sands assets, this current phase of acquisitions redirects attention away from the fact that oil majors are leaving Canada. Total SA (TOT), Royal Dutch Shell (RDS.A), Marathon Oil (MRO), Statoil (STO), Murphy Oil (MRU) and ConocoPhillips (COP) have all reduced their exposure to oil sands assets in the last couple years. Many of the companies selling Canadian oil sands assets are managing assets on a global scale. This means that they are forced to sell marginal fields to invest in more profitable ventures or re-focus their capital towards core long-term operations. For the Canadian oil companies acquiring oil sands assets, the oil sands are their only core long-term business and they must find a way to manage these assets to remain profitable or cost-effective. This means strategically seizing on opportunities in a low-price oil environment when they are out of favor. Looking at the capital expenditures required for several oil sands project, based on analysis conducted by Citigroup Global Markets Inc. in January 2015, it makes clear business sense for Suncor and Canadian Natural Resources to make acquisitions of oil sands mining projects in the current low-price oil environment. Suncor and Canadian Natural Resources are buying oil sands mining projects at a 25 percent to 50 percent discount to the cost per flowing barrel to build a new project. On the other hand, Cenovus paid almost $60,000 per flowing barrel to consolidate its joint venture (JV) with ConocoPhillips and acquire additional Western Canadian Sedimentary Basin (WCSB) assets. Cenovus’ purchase is higher than the cost to build up phases of its Foster Creek and Christina Lake projects, but the consolidation of its JV with ConocoPhillips is likely to bring immediate cost savings. According to Cenovus’ March 2017 presentation, the company expects to reduce operating costs by 18 percent and reduce general and administrative (G&A) costs by 29 percent upon full integration of ConocoPhillips oil sands and WCSB assets. Oil Sands: The Economics of Time Buying discounted oil sands producing assets may not seem strategically opportunistic when looking at the economics of oil sands projects. Most oil sands projects have breakeven WTI prices above $80 per barrel and that is far away from current WTI prices hovering around $50 per barrel. While capital in North America has been flooding into high margin oil plays like the Permian’s Delaware Basin, investment in Canada’s oil sands requires a long-term approach. Delaware Basin Wolfcamp wells can be drilled in less than 12 days and produce upwards of 2,000 b/d of oil, but those wells face 60 percent to 70 percent production decline rates after one year. Meanwhile, the recent major oil sands mining project operated by Suncor, Fort Hills, started construction in 2013 and is estimated to produce first oil in 2017. The life of the Fort Hills oil sands project is expected to last approximately 50 years. Oil sands players like Suncor, Cenovus, and Canadian Natural Resources look at oil prices over several decades and are less influenced by short term volatility in oil prices. According to Suncor’s Executive Vice President and Chief Financial Officer, Alister Cowan, in the January 22, 2017 Financial Post article, How high break-even costs are challenging new oil sands projects, Cowan noted of the Fort Hills project, “You don’t make decisions on 50-year life [of an oil sands mine] on the basis of spot price, so we would expect to see multiple periods of price volatility during the life [of the Fort Hills mine].” Mr. Cowan goes on to note the current opportunistic environment, “Ironically, building a major capital-intensive project — this is precisely when you want to build it because nobody else is.” Even as oil prices hover around $50 per barrel, Canadian oil sands companies are still building most new mining and in situ projects with a time frame measured by decades. In 2016, 78 percent of all new oil sands projects have been brought online by Canadian companies and 92 percent of all new oil sands projects in 2017 will be brought on by Canadian companies. Construct, Consolidate, and Control With Canada’s largest oil sands companies long-term vision and recent acquisitions, Suncor, Cenovus, and Canadian Natural Resources are coincidentally consolidating positions in Canada’s oil Sands. Based on 2016 oil sands production in Alberta, these three largest Canadian oil sands producers control around 60 percent of oil sands production. anIn 2002, when oil sands production capacity was under a million barrels per day, the market value of Canadian Natural Resources was $3.7 billion and the market value of Suncor was $13 billion. As of 2016, the market value of Canadian Natural Resources has increased 10 times its 2002 value and Suncor’s market value has increased 4 times its 2002 value. The growth of the largest Canadian oil sands producers has provided them with the financial capacity to make recent multi-billion dollar acquisitions. The Future of Canada’s Oil Sands The ever-changing oil price environment and the long-term nature of Canada’s oil sands projects will continue to create opportunities for all oil companies. Companies have come and gone and returned to Canada’s oil sands projects and that trend is bound to continue as oil prices fluctuate over future decades. In this current low price environment, top Canadian oil sands producers are investing in efficiency, innovation, and sustainability for oil sands operations. Canadian Oil sands producers are bringing down operating costs, moving more towards in-situ projects that provide better relative economics to mining projects, and using technology to streamline operations and reduce reliance on non-renewable resources. As oil prices move higher in the future, oil sands operations will emerge leaner and more sustainable with better economics than Citigroup Global Markets’ assessed in January 2015, but that will be yet another phase in Canada’s oil sands future. Source: Oil Price and Suncor

0 Comments

Leave a Reply. |

AuthorDAJK GROUP is the place where investors, business owners and entrepreneurs can research and find useful information, insight, resources, advice, guidance and inspiration for acquiring funds for their project, acquisition for their net lease commercial real estate, increasing their assets and running their profitable business. Archives

July 2023

Categories |

Services |

Company |

|