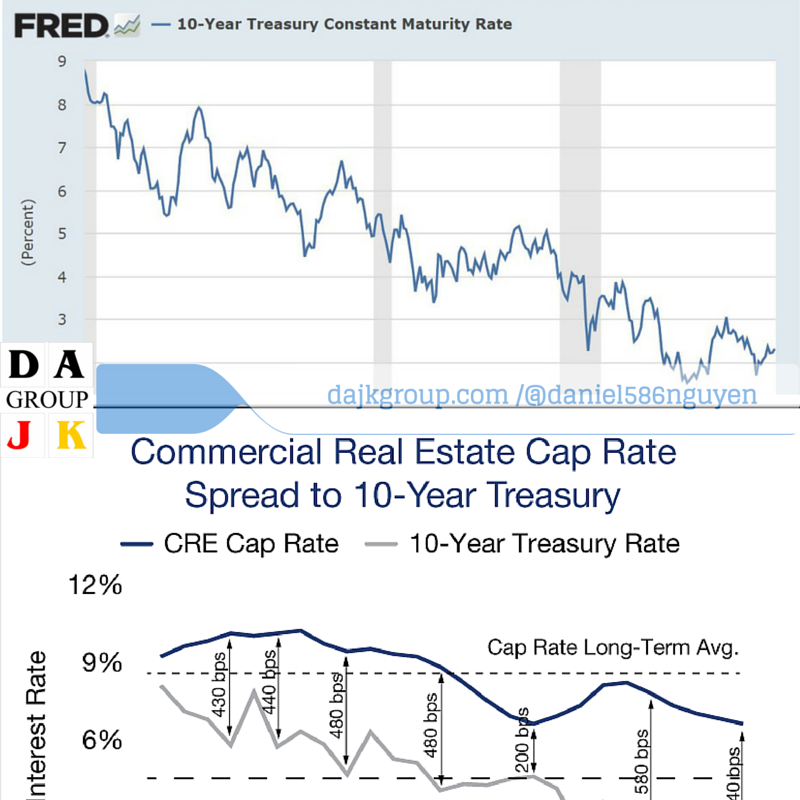

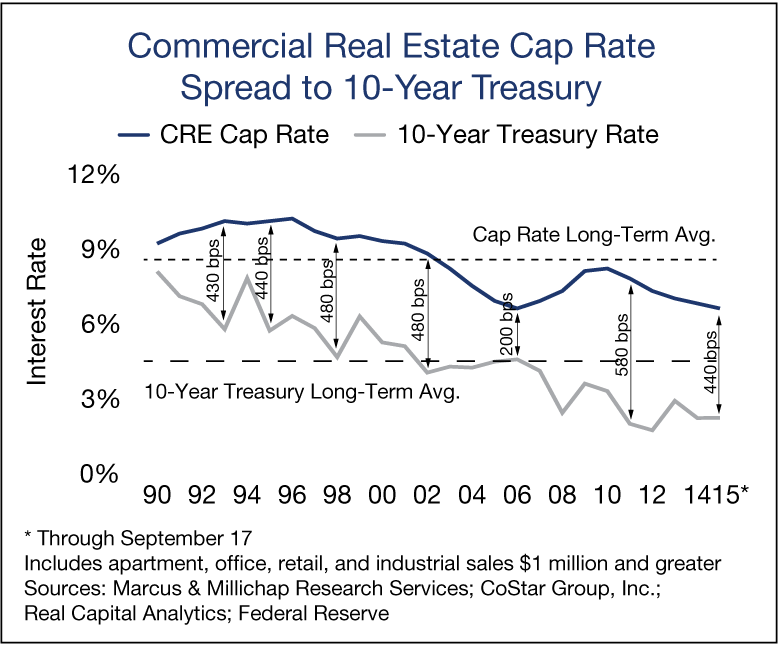

The relationship of Commercial Real Estate’s Cap Rate and Federal Reserve’s 10-Year Treasury Rate9/19/2015

Commercial Real Estate’s Cap Rate is average 436 bps over 20 years reference to Federal Reserve's 10-Year Treasury Rate. In fact, its average from 1990 to 2000 is 450 bps and its average from 2002 to 2015 is 425 bps.

Transactions in 2015 are on course to exceed pre-recession peak levels, and most property sectors continue to see inflows of equity and disciplined underwriting by debt providers. With positive economic trends lifting gauges of property performance, commercial real estate remains a favored asset class on a risk-adjusted basis.

Another words, the sophisticate and savvy CRE’s investor are studying and analyzing carefully its Federal Reserve’s 10-Year Treasury Rate in order to make an informed decision on his next acquisition. It would help reduce his risk significantly.

Commercial property sectors continue to perform well amid this extended period of low interest rates and the Federal Reserve’s decision will not disrupt property performance

Learn more of investment in Net lease CRE Should you have further clarification, please sign-up for our free 30-minutes confidential consultation. Related Blogs

Decade of Peace sculpture: "The Sporting Chances for Peace"

This limited edition #1 is no longer available for sale. However, the remaining of Edition 1799 sculptures is available for pre-order. Please note we are also seeking for:

Once this public announcement is scheduled, our remaining editions' price will be raised at minimum of $US 500,000. Partnership

0 Comments

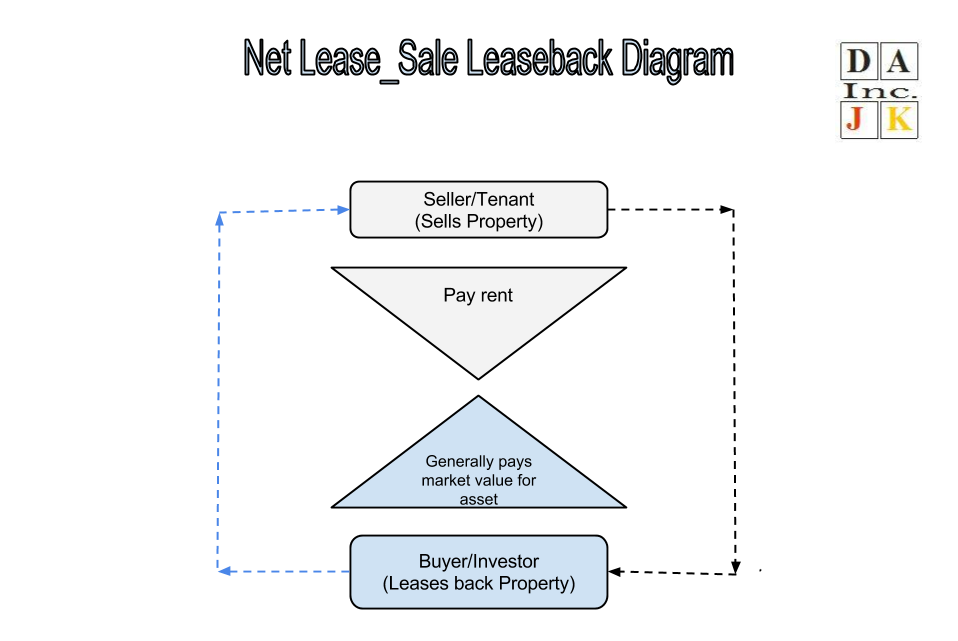

Net Lease’s Sale leaseback and Built-to-Suit StrategyThe growing business who owns real estate can raise an inexpensive working capital and/or debt reduction with Net Lease’s Sale leaseback and Built-to-Suit Strategy. Sale-Leaseback StrategySale-Leaseback Strategy Sale-leaseback strategy is a form of financing in which a company sells its real estate for cash and simultaneously signs a long-term lease with the buyer. Sale-leaseback transactions provide the lessee company with a source of capital that is an alternative to other financing sources such as corporate borrowing, mortgaging real property or selling shares of common stock. A Seller/Tenant is able to convert the value of real estate assets into working capital it can use to:

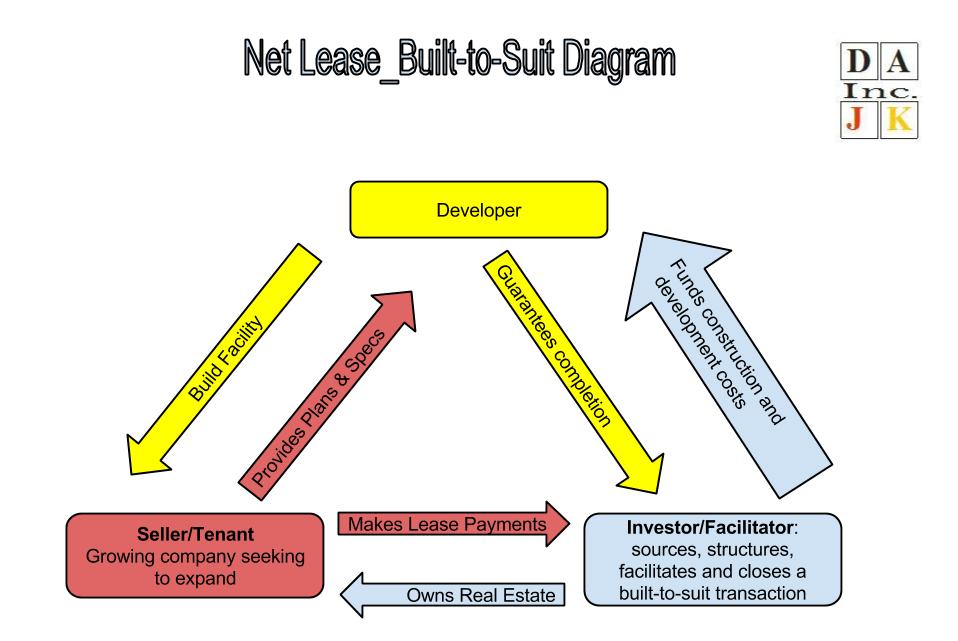

Build-to-Suit StrategyThrough build-to-suit strategy, Investor/Lender (“Investor”) provides a growing company with the funding for the expansion of an existing facility or the construction of a new facility in a different location. Investor can source, facilitate, arrange, structure and close the build-to-suit transaction. The build-to-suit provides innovative financing for:

Case Study: WPC’s Key Facts of Net Lease’s Sale leaseback and Built-to-Suit Strategy

Reference: NEW YORK, Sept. 9, 2015 /PRNewswire/ -- (NYSE: WPC), a real estate investment trust specializing in corporate sale-leaseback and build-to-suit financing, and the acquisition of single-tenant net lease properties, announced today that it has acquired a portfolio of three modern truck and bus servicing facilities for approximately $42.9 million (€38.9 million). The facilities — two in Germany and one in Austria — were purchased from the developer, Wohnungsunternehmen Semmelhaack, and are net leased to wholly-owned subsidiaries of MAN SE (The MAN Group). Related blogs:

DAJK GROUP is the place where investors, business owners and entrepreneurs can research and find useful information, insight, resources, advice, guidance and inspiration for acquiring funds for their project, acquisition for their net lease commercial real estate, increasing their assets and running their profitable business.

Our group of expert Oil Trader, Commercial Real Estate Specialist, Asset Management, and Business & Financial Analyst, can help to answer all your questions and to provide you with investment alternative and options catered to your investment strategy. Sign-up for a free 30-minute consultation with us now! Growing, Evolving and Pushing Forward! |

AuthorDAJK GROUP is the place where investors, business owners and entrepreneurs can research and find useful information, insight, resources, advice, guidance and inspiration for acquiring funds for their project, acquisition for their net lease commercial real estate, increasing their assets and running their profitable business. Archives

July 2023

Categories |

Services |

Company |

|