|

Our Risk Analysis:

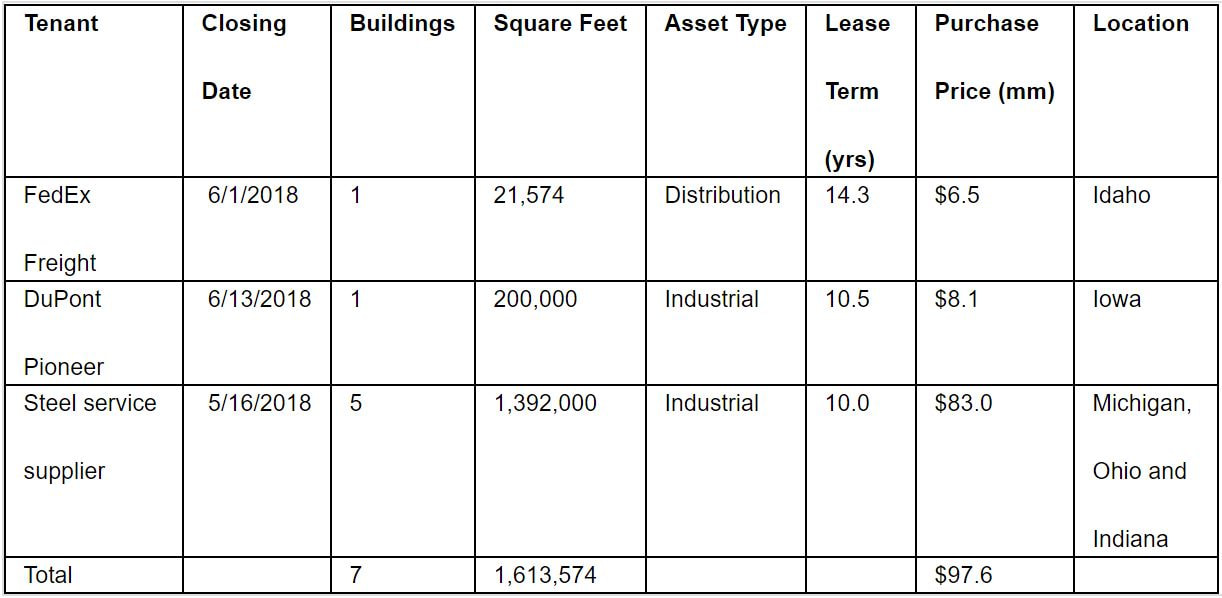

Global Net Lease, Inc., a real estate investment trust focused on the acquisition of net lease properties, has closed on its previously announced acquisitions of a total of seven properties in the second quarter, which represents 1.6 million square feet for $97.6 million. The properties are leased to FedEx Freight, DuPont Pioneer and the additional five properties acquired during the quarter are industrial facilities leased to a leading steel service supplier which were closed in May 2018. The seven properties were purchased at a weighted-average going-in capitalization rate of 7.59%, equating to a weighted-average GAAP capitalization rate of 8.05%, with a weighted-average remaining lease term of 10.1 years. These accretive transactions strengthen GNL's already strong robust Midwest presence and extend its weighted-average remaining lease term. These properties are part of the $307.3 million of acquisitions announced earlier in 2018, and to date $161.1 million has closed. GNL funded the transactions with borrowings under its revolving credit facility. Subsequent to the close of the second quarter, as part of its ongoing growth initiatives, GNL closed an upsizing of its unsecured credit facility of $132.0 million for the multi-currency revolving credit facility portion and €51.8 million for the senior unsecured term loan facility portion. Property Summary Table Property and Tenant Summary The first property is a cross-dock facility industrial distribution facility leased to FedEx Freight, a leading provider of less-than-truckload freight services. Located in Blackfoot, Idaho the property at closing had 14 years remaining on the lease. The parent company and guarantor is FedEx Corporation, a multinational courier and delivery company. FedEx Corporation has an investment grade credit rating of "Baa2" and "BBB" from Moody's and S&P. The building was purchased at a price equating to a weighted-average GAAP capitalization rate of 6.76% with a weighted-average remaining lease term of 14.3 years. The second property is an industrial distribution facility leased to Pioneer Hi-Bred International, Inc. (d/b/a DuPont Pioneer). The tenant signed a 10.5-year lease extension effective April 1, 2018. The facility is located in proximity to the tenant's production plants and key customers. DuPont Pioneer is a leading developer and supplier of advanced plant genetics, agronomic support, and other services to farmers. The building was purchased at a price equating to a weighted-average GAAP capitalization rate of 7.27% with a weighted-average remaining lease term of 10.5 years. As previously announced on May 17, 2018, the group of five properties leased to a leading steel service supplier with products and services provided to clients throughout the Midwestern U.S. and Canada that has an implied investment grade credit rating on Moody's Analytics of "Baa3" as of March 2, 2018. The properties were purchased at a price equating to a weighted-average GAAP capitalization rate of 8.19% with a weighted-average remaining lease term of 10.0 years. Source: GNL

0 Comments

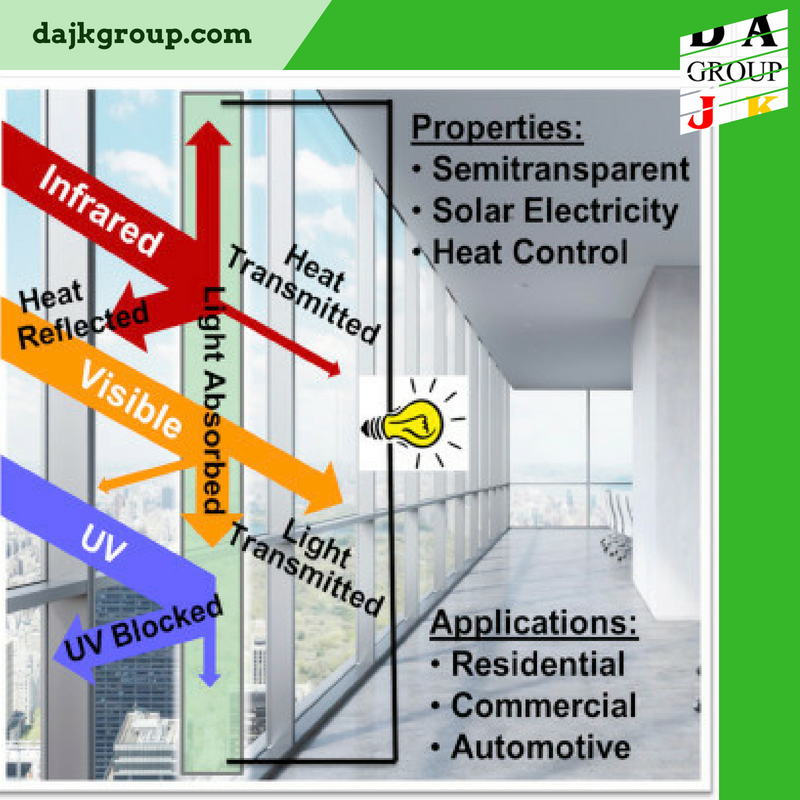

New Application Of OPVs For Both Energy Harvesting And Saving - the ST-OPVs generate over 6% power conversion efficiency with a high visible light transmission of over 25% and outstanding infrared radiation rejection rate of over 80% HIGHLIGHTS

SUMMARY Semitransparent organic photovoltaics (ST-OPVs) have attracted extensive attention due to their potential for integration into the windows of buildings. Herein, we propose a dual-functional ST-OPV device that is not only highly efficient but it is also very effective for heat insulation. By introducing non-fullerene acceptor with enhanced near-infrared absorption and distributed Bragg reflectors for selectively enhancing the transmittance in visible wavelengths while keeping high reflectance for near-infrared light, the ST-OPVs generate over 6% power conversion efficiency with high visible light transmission of over 25% and outstanding infrared radiation rejection rate of over 80%. Our results show that with proper design of ST-OPVs, they can be used not only for generating power from sunlight but it is also for solar shading and heat insulation, which opens up a new application of OPVs for both energy harvesting and saving. A new dual threat window could double the energy efficiency of average households. Researchers from the South China University of Technology have developed a window that blocks unneeded parts of sunlight to keep heating and cooling costs low, while also serving as a miniature electricity generator. “Building-integrated photovoltaics are a great example of a market where silicon photovoltaics, despite their cheapness and performance, are not the most appropriate due to their dull appearance and heaviness,” Hin-Lap Yip, senior author and professor of materials science and engineering at the South China University of Technology, said. “Instead, we can make organic photovoltaics into semi-transparent, lightweight and colorful films that are perfect for turning windows into electricity generators and heat insulators.” The researchers performed a three-way balancing act between harvesting light for electricity generation, blocking it for heat insulation and transmitting it as a window normally would to construct a prototype capable of simultaneously outputting electricity and preventing excessive heating. By mixing and matching different materials and chemical compounds previously used for the different window functions, the researchers were able to create a device that let familiar visible portions of sunlight through, while turning back the infrared light and converting the near-infrared region in-between into an electric current. Back-of-the-envelope calculations suggest that, in theory, installing windows outfitted with dual electricity-generating and heat- insulating properties could cut an average household's reliance on external electric sources by over 50 percent. While it is estimated that every square inch of every window would be paneled with multifunctional solar cells, the new windows only require a slight uptick in power-conversion performance from the 6.5 percent figure realized by the researchers. “For this demonstration, we are not even using the best organic photovoltaics that are out there in this field,” Yip said. “Their efficiency is improving rapidly, and we expect to be able to continuously improve the performance of this unified solar-cell window film.” Along with new energy efficient window, the researchers believe the dual-functioning materials could be used various emerging technologies. “Making heat-insulating multifunctional semitransparent polymer solar cells is just the beginning of exploring new applications of organic photovoltaics,” Yip said. “A version tailored for self-powered greenhouses is only one of many impactful products that we want to develop for the future.” Source: RD and Joule |

AuthorDAJK GROUP is the place where investors, business owners and entrepreneurs can research and find useful information, insight, resources, advice, guidance and inspiration for acquiring funds for their project, acquisition for their net lease commercial real estate, increasing their assets and running their profitable business. Archives

July 2023

Categories |

Services |

Company |

|