|

Our Risk Analysis:

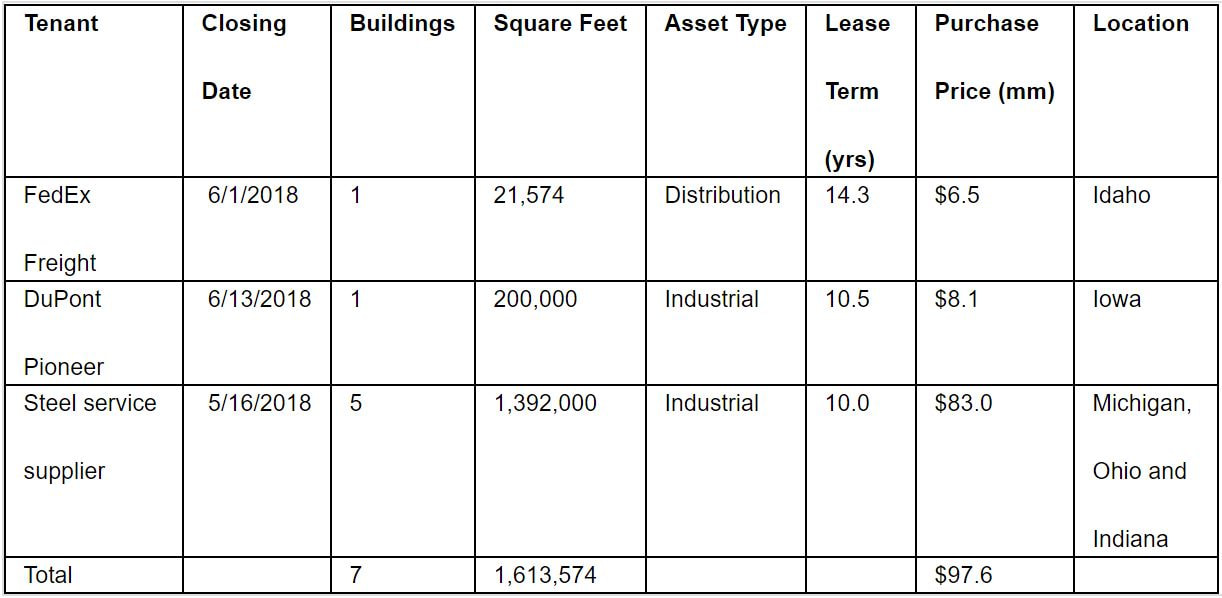

Global Net Lease, Inc., a real estate investment trust focused on the acquisition of net lease properties, has closed on its previously announced acquisitions of a total of seven properties in the second quarter, which represents 1.6 million square feet for $97.6 million. The properties are leased to FedEx Freight, DuPont Pioneer and the additional five properties acquired during the quarter are industrial facilities leased to a leading steel service supplier which were closed in May 2018. The seven properties were purchased at a weighted-average going-in capitalization rate of 7.59%, equating to a weighted-average GAAP capitalization rate of 8.05%, with a weighted-average remaining lease term of 10.1 years. These accretive transactions strengthen GNL's already strong robust Midwest presence and extend its weighted-average remaining lease term. These properties are part of the $307.3 million of acquisitions announced earlier in 2018, and to date $161.1 million has closed. GNL funded the transactions with borrowings under its revolving credit facility. Subsequent to the close of the second quarter, as part of its ongoing growth initiatives, GNL closed an upsizing of its unsecured credit facility of $132.0 million for the multi-currency revolving credit facility portion and €51.8 million for the senior unsecured term loan facility portion. Property Summary Table Property and Tenant Summary The first property is a cross-dock facility industrial distribution facility leased to FedEx Freight, a leading provider of less-than-truckload freight services. Located in Blackfoot, Idaho the property at closing had 14 years remaining on the lease. The parent company and guarantor is FedEx Corporation, a multinational courier and delivery company. FedEx Corporation has an investment grade credit rating of "Baa2" and "BBB" from Moody's and S&P. The building was purchased at a price equating to a weighted-average GAAP capitalization rate of 6.76% with a weighted-average remaining lease term of 14.3 years. The second property is an industrial distribution facility leased to Pioneer Hi-Bred International, Inc. (d/b/a DuPont Pioneer). The tenant signed a 10.5-year lease extension effective April 1, 2018. The facility is located in proximity to the tenant's production plants and key customers. DuPont Pioneer is a leading developer and supplier of advanced plant genetics, agronomic support, and other services to farmers. The building was purchased at a price equating to a weighted-average GAAP capitalization rate of 7.27% with a weighted-average remaining lease term of 10.5 years. As previously announced on May 17, 2018, the group of five properties leased to a leading steel service supplier with products and services provided to clients throughout the Midwestern U.S. and Canada that has an implied investment grade credit rating on Moody's Analytics of "Baa3" as of March 2, 2018. The properties were purchased at a price equating to a weighted-average GAAP capitalization rate of 8.19% with a weighted-average remaining lease term of 10.0 years. Source: GNL

0 Comments

Leave a Reply. |

AuthorDAJK GROUP is the place where investors, business owners and entrepreneurs can research and find useful information, insight, resources, advice, guidance and inspiration for acquiring funds for their project, acquisition for their net lease commercial real estate, increasing their assets and running their profitable business. Archives

July 2023

Categories |

Services |

Company |

|