If the middle-class investor "saves" money by investing in mutual funds or 401K, then the wealthy and strategic investor "save" money by invest in net lease or triple net lease. Highlights:

Please review our previous blogs: What Are The Key Data From Net Lease Listing?

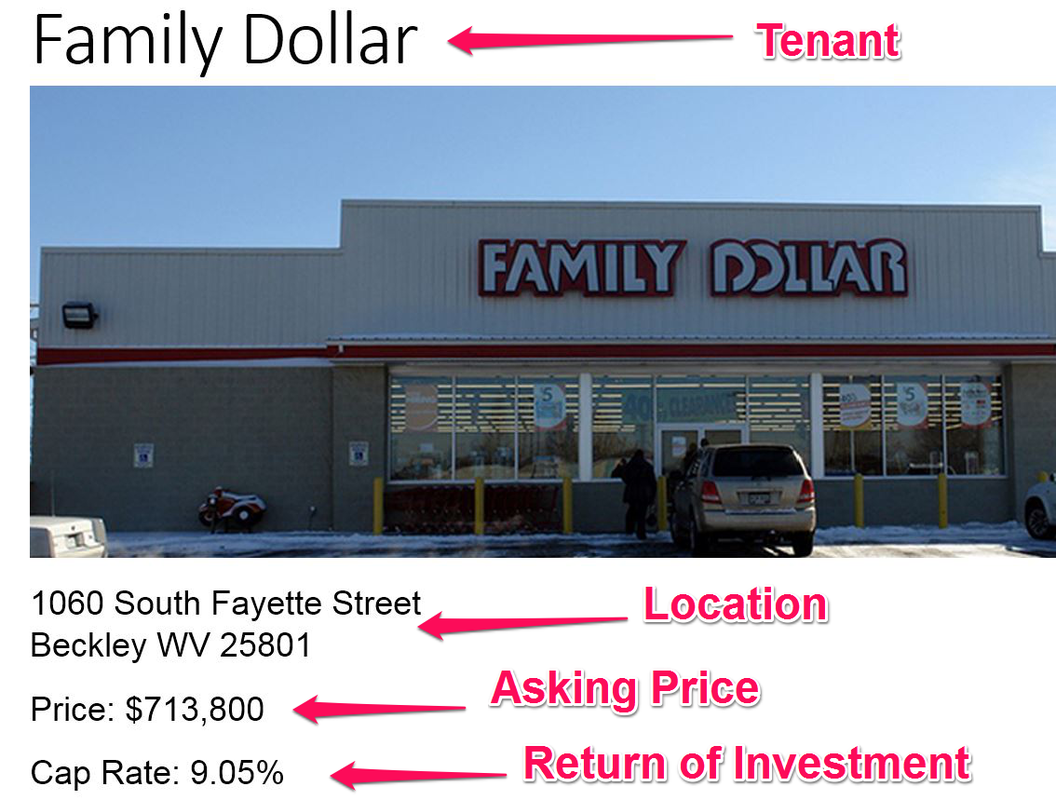

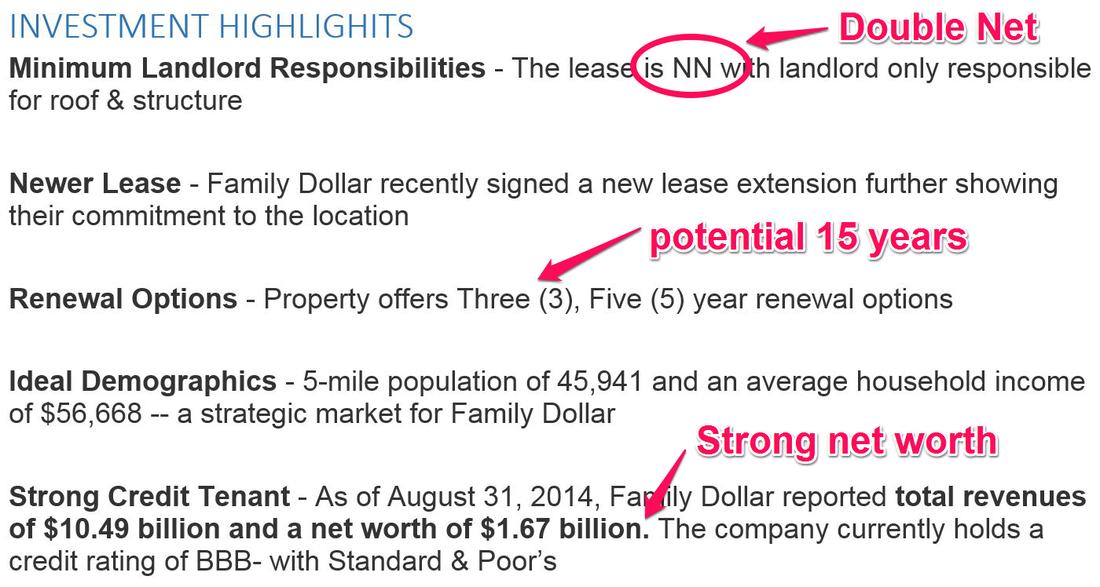

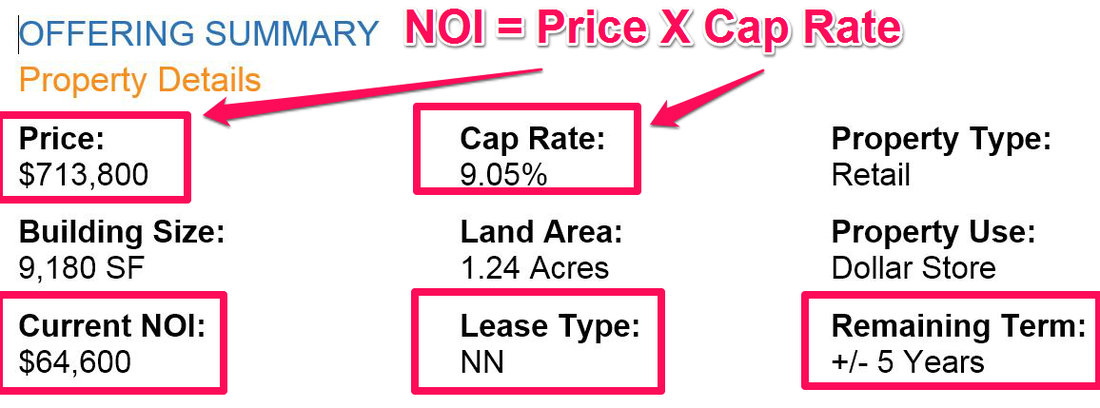

You want to reduce your risk by select strong credit tenant with strong net worth $US 100+ million. Also, you make sure the Family Dollars will be a guarantee for your lease payment. How much monthly fixed income will investor receive if he invests $US 713,800?The annual return of investment, before mortgage and tax, is $US 64,600. If you invest all cash in this Family Dollar, you will receive $US 5,383 a month. Please note your payment is directly from Family Dollar. Please note this is a passive income (NOT earning income) which is taxed at lower tax rate. The exact tax rate depends on individual entire financial structure. Please consult with your Certified Public Accountant. Your potential passive income is $64,600 X 15 years = $US 968,984 What Other Benefits When USA-investor Invests in Net Lease?Depreciation & Appreciation: For USA-based investor, you may receive additional benefits such as depreciation and appreciation. Scalability: Also, you are NOT involved in daily operations of the Family Dollar neither repair & maintenance. This means you can invest simultaneously in multiple net lease properties and different locations. Therefore, your scalability is limitless. It’s only limit by how much capital you can access. Re-financeable & Transferable: You can borrow against it if you need additional cash. You can structure this net lease be transferred to your foundation or business entity at your death event. How Much Risk When USA-investor Invest in This Net Lease, Family Dollars?

If the middle-class investor "saves" money by investing in mutual funds or 401K, then the wealthy and strategic investor "save" money by investing in net lease or triple net lease. For further discussion, please contact us for our free 30-min confidential consultation. Related resources at Amazon Corner:

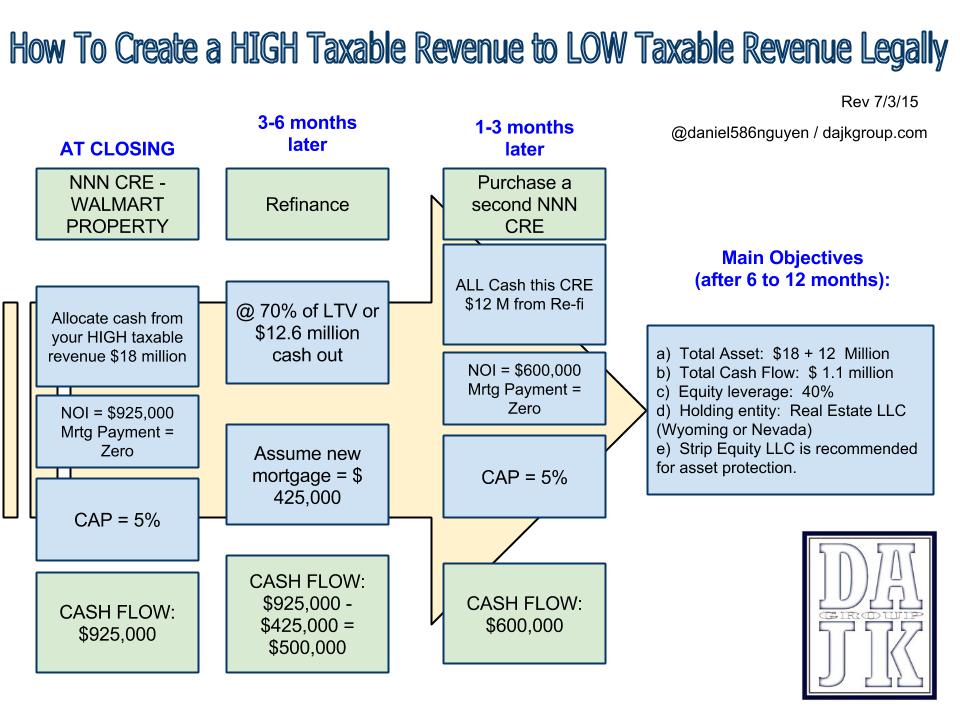

Referenced Net Lease Listing: Case Study_Family Dollar NN Diagram for illustrating of How using a Triple Net Lease To Create a High Taxable Revenue to a Low Taxable Revenue LegallyTypical Scenario: The Digital Online Business (“DOB”) generates average $US 40 million in last 3 years. Since this DOB has very little on overhead and management’s expenses, it is most likely DOB’s revenue will be taxed at the highest tax rate. Its total taxes’ bill most likely is Fifty Percent (50%) or $US 20,000,000. How can this DOB minimize his taxes’ bill legally and simultaneously increase his asset?First, the owner of DOB just allocates $US 18 million for investment in the Net Lease or Triple Net Lease commercial real estate (“NNN CRE”). Step #1: DOB purchases all cash of the 1st NNN CRE for $US 18 million. Step #2: Refinance after 3 to 6 months of closing of the 1st NNN CRE. The loan amount is approximately 70% Loan-to-value or $US 12,600,000. Please note this is a debt finance, the DOB would not pay tax on this $US 12.6 million. Step #3: DOB purchases all cash of the 2nd NNN CRE for $US 12 million from his debt finance. Please note DOB can repeat step #2 and #3 again if he wants to. After approximately 12 months, DOB creates at least 3 favorable and strategic objectives?

For further discussion, please sign-up for our free 30-min confidential consultation. DAJK GROUP is the place where investors, business owners and entrepreneurs can research and find useful information, insight, resources, advice, guidance and inspiration for acquiring funds for their project, acquisition for their net lease commercial real estate, increasing their assets and running their profitable business.

Our group of expert Oil Trader, Commercial Real Estate Specialist, Asset Management, and Business & Financial Analyst, can help to answer all your questions and to provide you with investment alternative and options catered to your investment strategy. Sign-up for a free 30-minute consultation with us now! Growing, Evolving and Pushing Forward!

0 Comments

Leave a Reply. |

AuthorDAJK GROUP is the place where investors, business owners and entrepreneurs can research and find useful information, insight, resources, advice, guidance and inspiration for acquiring funds for their project, acquisition for their net lease commercial real estate, increasing their assets and running their profitable business. Archives

July 2023

Categories |

Services |

Company |

|