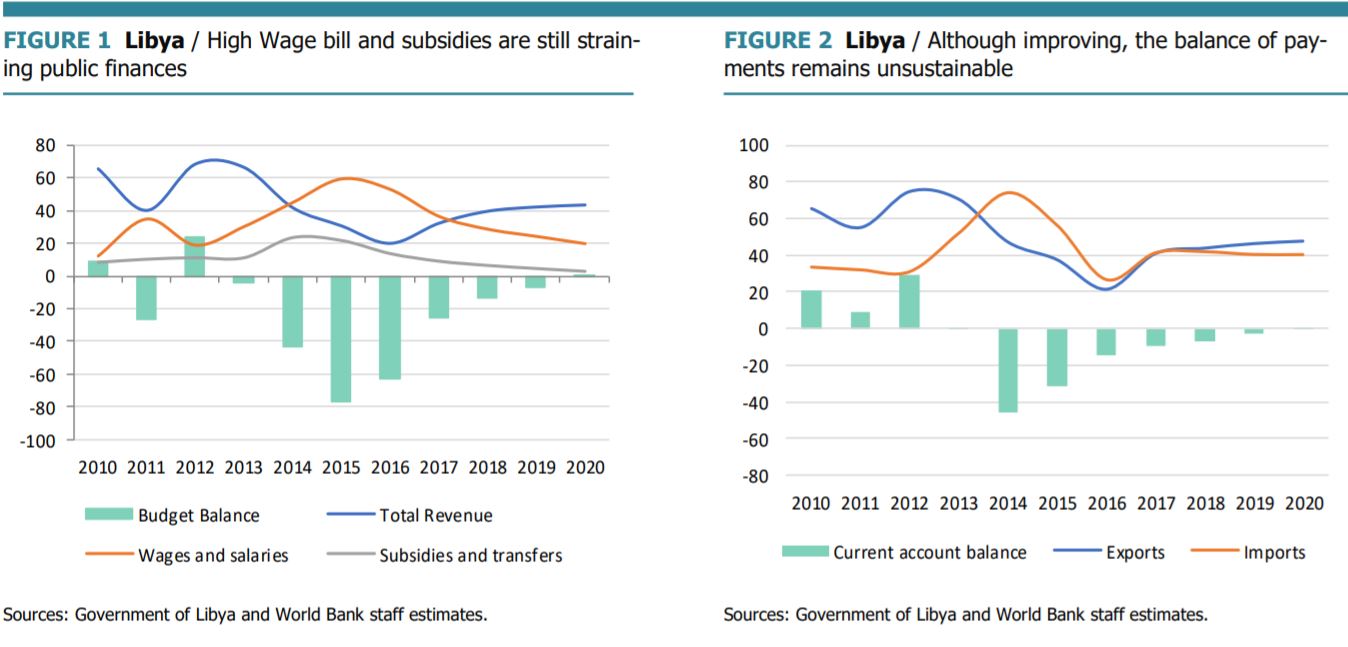

Growth is projected to rebound at around 15% in 2018 and an average 7.6% in 2019-20. Both the fiscal and current account balances will significantly improve, with the budget and the current account running surpluses expected from 2020 onwards Summary: At the current pace of spending in a context of conflict and insecurity, Libya will either exhaust foreign exchange reserves or be forced into ad hoc adjustments necessary to stave off crisis, but far from sufficient to reestablish growth foundations. The economic and social outlook assumes that political strife is resolved and a unified government can ensure macro-stability and launch a comprehensive program to rebuild the economic and social infrastructures. In this context, it is expected that oil production will progressively increase to reach its potential (around 1.5 million barrels per day (bpd)) by 2020, which is the time necessary to restore the heavily damaged oil infrastructure. Growth is projected to rebound at around 15% in 2018 and an average 7.6% in 2019-20. Both the fiscal and current account balances will significantly improve, with the budget and the current account running surpluses expected from 2020 onwards. Foreign reserves will also start building up by 2020. They will average US$72.5 billion during 2018-2020, representing the equivalent of 27.5 months of imports. However, high inflation coupled with weak basic service delivery are likely to have increased poverty and exacerbated socio-economic exclusion. In 2017, inflation accelerated, exacerbating further the hardship of the population. Prices of all commodities continued to increase, mainly driven by acute shortages in the supply chains of basic commodities, speculation in the expanding black markets, and the strong devaluation of the Libyan dinar (LYD) in the parallel markets. Consequently, inflation hit a record level of 28.4% in 2017 following the 25.9% in 2016. Full Report The relative economic improvement in 2017 remains fragile, as sustaining this dynamic depends crucially on a political resolution that in the current context seems hard to reach. The macroeconomic framework is unstable. It is characterized by record inflation and unsustainable twin deficits, mostly driven by rising budget expenditures. Dwindling savings are keeping pressure on foreign reserves and the LYD continued to lose its value in the parallel markets. To stabilize the macroeconomic framework, Libya needs to launch budget reforms and diversify the economy for growth and job creation. Recent developments Following four years of recession, the Libyan economy grew strongly in 2017, driven by a welcome recovery in oil production. However, sustaining this dynamic to reach economic potential depends on the resolve of the political strife. Exceptional but fragile implicit arrangements between the parties in conflict allowed the oil sector to more than double its production to an average 0.820 million barrels per day (bpd) in 2017, compared to only 0.380 million in 2016. The non-hydrocarbon sectors remained sluggish inhibited by lack of liquidity and security. GDP is estimated to have increased by almost 27 percent in 2017 allowing income per capita to substantially improve to 63 percent of its 2010 level after losing more than half of its value. Inflation accelerated, exacerbating further the hardship of the population. Prices of all commodities continued to increase, mainly driven by acute shortages in the supply chains of basic commodities, speculation in the expanding black markets, and the strong devaluation of the LYD in the parallel markets. Consequently, inflation hit a record level of 28.4 percent in 2017 following the 25.9 percent in 2016. High inflation coupled with weak basic service delivery are likely to have increased poverty and exacerbated socioeconomic exclusion. Despite higher hydrocarbon revenues, public finances remained under stress, given the high and rigid current expenditures driven by political motives. Budget revenues almost tripled in 2017 (31.8 percent of GDP) compared to 2016, but remained at half of potential. However, revenues were not even enough to cover public wages (36.4 percent of GDP), which increased due to political hires and higher salaries. Inefficient subsidies (9.2 percent of GDP) continued to absorb a significant amount of budget resources while capital expenditures remained weak (4.8 percent of GDP). Consequently, a high budget deficit persisted at 26 percent of GDP in 2017 (63.1 percent of GDP in 2016). The deficit is being financed mainly through cash advances from the Central Bank of Libya. The domestic debt has quickly increased to reach LYD 59 billion end September 2017, up from LYD 1 billion in 2010. Although improving, the balance of payments continues to suffer from politically constrained production and export of oil and high consumption-induced imports. Libya managed to substantially increase oil export in 2017 (0.7 million bpd), but remained at half of potential. This relative performance is not enough for a sustainable current account considering the high dependence of Libya on imports to meet consumption and intermediate goods requirements. As a result, the current account deficit remained high at an estimated 9.4 percent of GDP. This deficit was fully financed by net foreign financial inflow, allowing foreign reserves to remain unchanged in 2017 at around US$ 72.6 billion. While the pegged official exchange rate was kept stable, the Libyan Dinar lost around 85 percent of its value in the parallel market due to the weak macroeconomic fundamentals and an illiquid banking system. Outlook At the current pace of spending in a context of conflict and insecurity, Libya will either exhaust foreign exchange reserves or be forced into ad hoc adjustments necessary to stave off crisis, but far from sufficient to reestablish growth foundations. The economic and social outlook assumes that political strife is resolved and a unified government can ensure macro stability and launch a comprehensive program to rebuild the economic and social infrastructures. In this context, it is expected that oil production will progressively increase to reach its potential (around 1.5 million bpd) by 2020, which is the time necessary to restore the heavily damaged oil infrastructure. Growth is projected to rebound at around 15 percent in 2018 and an average 7.6 percent in 2019 -20. Both the fiscal and current account balances will significantly improve, with the budget and the current account running surpluses expected from 2020 onwards. Foreign reserves will start building up by 2020. They will average US$72.5 billion during 2018-2020, representing the equivalent of 27.5 months of imports. Risks and challenges The baseline macroeconomic scenario presented above is very fragile because it requires upholding the implicit agreement between the parties in conflict to ensure minimum security around oil infrastructure. Moreover, an improved macroeconomic outlook is unlikely to be sustained and is not sufficient to bring about significant change, unless immediate and targeted actions are taken to address the humanitarian crisis. The country needs humanitarian aid and specific programs to address the destruction and lack of basic services that a large part of the population faces. Immediate challenges are to restore peace that would lead to macroeconomic stability and to improve basic public services. This calls for immediate actions to bring current expenditures under control, especially the wage bill and subsidies, and improve governance of the financial sector, which will also contribute to price stability. Over the medium term, the country needs broader and deeper structural reforms to stabilize the macroeconomic framework and promote private sector-led job generation. Other medium term priorities should focus on promoting the development and diversification of the private sector for job creation through policies to reorient the economy away from hydrocarbon dependence, reforming the financial sector, and improving the business environment. Libya’s economic fragility has important consequences for the people’s well-being. Although there is no systematic study on poverty and very little evidence on the current well-being of Libyan households, it is not unrealistic to think that for most of Libyans living conditions are dire. Since hydrocarbons account for a large share of GDP and government revenues (40 and 86 percent respectively), the sharp decline in oil exports started in 2011 has severely impacted public services. The erratic power supply and the recurrent food shortages also contribute to worsening conditions for people. In the current situation, large share of the population is either vulnerable to poverty or has fallen into poverty. Source: World Bank

0 Comments

Leave a Reply. |

AuthorDAJK GROUP is the place where investors, business owners and entrepreneurs can research and find useful information, insight, resources, advice, guidance and inspiration for acquiring funds for their project, acquisition for their net lease commercial real estate, increasing their assets and running their profitable business. Archives

July 2023

Categories |

Services |

Company |

|