|

Highlights:

1. Oil and the Global EconomyDuring the past month, there have been several important developments which could have a major impact on the course of oil prices and production in the next few years. First was the OPEC/NOPEC decision to extend the current 1.8 million b/d production cut for another 18 months despite increasing evidence that increasing US shale oil output and rebounding Libyan and Nigerian production are offsetting the production cut. Because of the timid nature of the OPEC decision, increasing stockpiles and higher oil production, the price of crude has fallen some 11-12 percent in the last three weeks leaving US futures below $46 and Brent below $48 a barrel. The continuing price slide took prices back to where they were before the production freeze was first discussed last fall. Oil prices back in the mid-$40s has OPEC and other oil producers very concerned. Most analysts do not see much of a further decline in oil prices; however, bullish enthusiasm and confidence that that OPEC will rebalance the markets have faded for the time being. OPEC and Russia are already talking about the need for deeper production cuts, and another meeting is being discussed for July to weigh further actions should prices not rebound by then. OPEC and Russia now are talking about a permanent alliance between the oil producers that are currently a party to the production cut. OPEC is said to be working on forming a legal relationship between the cartel and the members of the production cut alliance that in effect could expand the cartel to control more than 40 percent of world oil production. The next major development during the last month was the blow up over the freewheeling foreign policy and good relations with Iran that Qatar has maintained in recent years. In a dramatic announcement, Bahrain, Egypt, Saudi Arabia, the UAE, and Yemen said that they were breaking diplomatic relations with Doha and cutting off land, air and sea travel to the country. All but Egypt which has 250,000 of it citizens earning a good living there directed their nationals to return home. The main charge against the Qatari government is that it supports what some consider terrorist groups across the Middle East. Qatar produces only a small amount of oil but is the world’s largest exporter of natural gas. The regional embargo is already making trouble for Qatar’s LNG exports although Exxon announced that its exports of LNG from Qatar had not been affected. This situation already has many facets, ranging from a major US airbase in the middle of the country to Turkish troops coming to support Qatar to Iran’s offer of alternative transportation routes for food and water. As Qatar believes, the Saudis are trying to affect a regime change in the country; they will resist as best they can with the help of Turkey, and Iran. The situation is obviously dangerous as so many of the world’s major oil exporters are involved not to mention Qatar’s large LNG exports. The final noteworthy development in the last month was the announcement that the US is pulling out of the Paris climate change agreement. Opinions are mixed as the impact of this action. Some see this as a major setback to the effort to reverse climate change; others as a boom to the fossil fuel industry that will be free to develop new sources of energy that will start an economic boom; and still others believe that the global movement to slow climate change is so strong and deeply embedded that the pull-out will have little effect on the use of fossil fuels over the long run. During the past month, there has been an unusual amount of discussion in the financial press about the possibility of “peak oil demand.” This development is supposed to be caused by the advent of large numbers of electric vehicles which in the next 25 years will reduce the demand for gasoline way below most projections. Most major manufacturers have announced electric vehicle programs, and some are talking about building networks of recharging stations to speed their adoption. The situation is made more interesting because of the attitude of the Chinese government seems close to making electric powered cars mandatory as part of the effort to clean up their air. Needless to say, the oil industry rejects the notion that the public will buy large numbers of electric-powered cars in the foreseeable future citing their high cost, limited range and time to refuel. Others are not so sure that sales of electric cars will not take off and come to dominate the market much as cell phones did 30 years ago. Proponents of electric cars cite the falling costs, improved technology, the advent of autonomous cars, lower operational costs and reduced emissions as reasons electric cars will come to dominate the markets in the next few decades. 2. The Middle East & North AfricaQatar: On June 5th yet another Mid-Eastern crisis began when five Arab countries severed relations with Qatar alleging that Doha was funding and supporting many “terrorist” groups across the region. The trouble had been brewing since 1995 when the grandfather of the current Emir of Qatar was overthrown, and the country embarked on a foreign policy not dictated by the Saudis. Qatar became a friend of almost everybody, hosting a large US airbase as well as maintaining good ties with Shiite nations such as Iran. The Qatar-sponsored Al-Jazeera TV network has been critical of the Saudis and their allies for years. Qatar is the wealthiest of the oil and gas exporting nations on a per capita basis; Qatar has had the income from large LNG sales to support many Arab groups around the region. Some of these, especially groups supporting Iran and the Muslim Brotherhood which was overthrown by a military coup in Egypt were an anathema to the Saudis and their Sunni friends. Some believe that the recent Trump administration embrace of the Saudis as America’s best friend in the region was the proximate cause of the crisis which is likely aimed at a regime change in Qatar. If this is indeed the Saudi goal, a negotiated settlement will be hard to attain and the crisis may continue for a considerable time. The Saudis seem unlikely to invade a small neighbor with large US military base, and the backing of the Turks, who are planning to move more troops to Qatar, and Iran which says it will substitute for the now closed Qatari-Saudi border. The question here is the implication of this crisis for oil and LNG exports from the region. While it is still too early to assess the full impact of the embargo on Qatar, ports in Saudi Arabia and the UAE have already been closed to shipping traffic to and from Qatar. Oil shipments from Qatar are frequently mixed with oil from other Gulf States and LNG ships taking away Qatari gas are usually serviced in other countries. Beyond the immediate impact of the embargo, there are many ways this crisis could go that will impact the oil markets. If the crisis drags on the OPEC production cut could be affected. Saudi efforts to attract more foreign investment could be harmed. Qatari LNG exports could be curtailed driving up prices. Finally, hostilities could break out leading to all sorts of problems that would drive up oil prices. Iran: The major news of the week was an attack on Iran’s Parliament and the Shrine of the Iranian revolution’s founding father, the Ayatollah Khomeini, by suspected ISIS gunmen. There is some suspicion that ISIS would be able to mount attacks so deeply in a Shiite state. Tehran is blaming the Saudis for the attacks. If nothing else the attacks show that security throughout the region continues to deteriorate among the numerous confrontations currently going on. Tehran said last week that the first post-sanctions petroleum contract that will be made available on commercial terms would be announced next month. The contract will be for the Azadegan oil field near the Iraqi border which is supposed to hold 6 billion or perhaps 37 billion barrels of recoverable reserves. Tehran is notorious for hyping its projects. The contract for developing the field had been held by the China National Petroleum Corp, but the Chinese were kicked out for failure to make any progress in developing the field. Iraq: Last week Wood Mackenzie released a report assessing the status of the Iraqi oil industry. Iraq is a low-cost producer and has some of the world’s most capable energy companies working on expanding its production. The country, however, is burdened with the ISIS insurgency, low oil prices and a stagnant bureaucracy which is keeping it from expanding production to its goal of 12 million b/d. The costs of the war have prevented many oil contractors from being paid and the initiation of new projects. The country has agreed to a 4.35 million b/d production cap that will last for another year. Insurgent attacks are picking up in Diyala province as ISIS is being driven out of Mosel. In the last week, there has been a spate of deadly attacks targeting Iraqi security forces and energy infrastructure. The US has begun importing increased amounts of Iraqi crude to replace cuts from Saudi Arabia, which is concentrated on maintaining its share of the Asian market. During the first week of June, Iraqi oil entered the US at the rate of 1.1 million b/d, the first time in five years that Iraq has surpassed Saudi Arabia as a source of crude. Baghdad plans to increase its refining capacity which currently is only 500,000 b/d in contrast with its daily production of 4.35 million. Iraq currently is spending $2 billion each year importing refined products despite being one of the world’s largest oil producers. Saudi Arabia: Events are moving rapidly in the kingdom which is fighting a war in Yemen; recently opened a serious confrontation with Qatar; just negotiated a $200-$350 billion deal to invest and buy arms from the US; and is running through its foreign currency reserves at the rate of circa $100 billion a year. Some are concerned that the confrontation with Qatar could backfire on the Saudis by scaring away the foreign investors Riyadh needs to revamp its economy away from dependence on oil exports. The deeper the Saudis become involved in Middle Eastern confrontations, the harder it will become to sell off part of Aramco and start partnerships with foreign companies. In the meantime, the Saudi oil minister says there is no need to adjust the oil freeze agreement immediately, but deeper cuts may be discussed at the OPEC meeting coming in November. The Saudis recently announced that they will cut oil shipments to the US to reduce swollen US stockpiles and drive up prices. The OPEC/NOPEC production cut has led to the realization in Moscow and Riyadh that the two countries have a lot in common in their mutual interest to drive up oil prices as a paramount national goal. The two have been discussing new forms of cooperation in what Reuters terms “an axis of love.” Both realize that should oil prices remain at their current levels or lower for the next few years, both of their economies could be in serious trouble. Libya: Oil production seems to be back up to 827,000 b/d in recent weeks as many of the internal squabbles between the National Oil Company and the groups that control many of the oil facilities have been settled – at least for now. Outside observers doubt that Libya can increase its production much beyond 1 million b/d without an improvement in the security situation that would allow large numbers of foreign workers back into the country to repair damaged infrastructure. Even so, a Libya producing 1 million b/d and not subject to the OPEC production cap would go a long way towards offsetting the current production cut of 1.8 million b/d. 3. ChinaDespite efforts to clean up their environment and slowing economic growth, Beijing continues to import increasing quantities of oil and coal. In the case of oil, newly released customs data shows that China is now the world’s largest importer of oil with crude imports up 13.1 percent over the first five months of the year. Part of the increase is to offset declining high-cost domestic oil production and part is going to increased exports of refined products. China’s coal imports in May were up 17 percent over last year. Again, some of this is due to the recent closure of small, inefficient coal mines. Increasing coal imports suggest that economic growth still has a higher priority than cleaning up the air. However, Beijing announced that it will continue to adhere to the climate pact despite the US withdrawal. 4. RussiaMoscow is adamantly maintaining that low oil prices will not harm its future economic growth and continues to say that it can live with $40 oil indefinitely. While oil prices have recovered from the very low levels seen last spring, some 40 percent of federal budget revenues comes from oil and gas revenues. It is difficult to see how Moscow can rework its economy in the short run to reduce this dependency. Despite concerns about EU dependence on Russian natural gas, exports to the EU in the first quarter were higher with German purchases up nearly 20 percent, Polish purchases up 24 percent and French purchases up 14 percent. Gazprom has called for tenders to build a second Nord Stream pipeline under the Baltic to supply western Europe. The new line could be open sometime in 2019. Moscow is also considering building a pipeline to Japan to supply gas directly to Japanese power plants. The issue is still open as Japan decides which, if any, of its nuclear power plants will be reopened. In Washington, the Comey testimony that Moscow was involved in interfering with the US election last fall increases the odds that a bill containing new sanctions on Russia will get though the US Senate. 5. NigeriaOn June 6th, Shell lifted the force majeure that has been on the Forcados Export Terminal for the last 17 months after repairs to a sabotaged pipeline. The reopening of the terminal improves the prospects of the government meeting its goal of a 2.2 million b/d export target. As with the situation in Libya, the resumption of full production capability goes a long way towards offsetting the OPEC production cut as Nigeria is exempt from the agreement. On the downside, the New Delta Avengers vowed last week to resume disruption of oil production in Delta State. The militants announced that from midnight June 30, 2017, there would be no more oil operations in the Delta. The Nigerian story is far from over. 6. VenezuelaMass anti-government demonstrations have entered their third month with no end in sight. So far some 70 people have been killed by security forces and hundreds wounded. The government is desperate for money to pay for imported food and medicine and to keep paying the security forces that are opposing the mass demonstrations and are keeping the government from being overrun. Venezuela teeters on the brink of collapse threatening some 1 to 2 million b/d of oil that is still being produced. The Trump administration is considering sanctions against Venezuela’s oil industry, but fears it would only make the social crisis worse and cut exports to the US. In March, Venezuela was the 3rd largest US source of foreign crude and 8 percent of US imports. Source: Peak

0 Comments

Drilling rigs and roughnecks are hot commodities once again across the Montney shale formation in northern British Columbia and Alberta, and companies like Grimes Well Servicing Ltd. are having a hard time keeping up with demand. That’s because the Montney, unlike many parts of Canada’s oil and gas region, is seeing a surge of investment three years after the worst energy slump in decades. During the first four months of 2017, the number of wells drilled jumped 80 percent from a year earlier to 277, according to Calgary-based Grobes Media Inc.’s BOE Report. It’s the most for the period since 2014, when oil prices were twice what they are now and natural gas was 50 percent higher. Grimes started noticing a pickup in orders back in November and December -- the start of the winter drilling season -- as more customers put in urgent orders for equipment. Demand hasn’t let up. “By January, it was getting pretty crazy,” Derek Mackey, the company’s accountant, said by telephone from Edmonton. “Some people called saying: Can we get a rig in a couple days?” Exploration is roaring back because energy prices stabilized, halting the slide at levels that remain profitable. The slump also left idle equipment, making it cheaper to drill. A new well now costs about C$5 million ($3.7 million), down from C$8 million in 2014, according to Wood Mackenzie Ltd. Seven Generations Energy Ltd. and ARC Resources Ltd. are among those stepping up exploration in the gas-rich Montney, which may signal more energy investment elsewhere. “We call it Canada’s bellwether play,” said Mark Oberstoetter, lead analyst for upstream research at Wood Mackenzie in Calgary. “We have seen reduction in activity in every play, but the Montney has held up better than most.” Like Permian The deposit straddles the northern border of Alberta and British Columbia. It was dubbed the “Permian of the North” by Vancouver-based Blackbird Energy Inc. because the Montney has the same layered, stratified geology as the Texas shale formation that has led a resurgence in U.S. oil production. But unlike the Permian, which yields mostly crude, the Montney is rich in gas and associated liquids such as condensate. Shale deposits have become popular targets for North American producers as technologies like horizontal drilling and hydraulic fracturing made it cheaper to extract oil and gas trapped in narrow seams deep underground. The techniques led to gushers at old fields in Texas, North Dakota and Pennsylvania. That surge in supply helped to make the U.S. the world’s largest oil and gas producer. It also led to a crash in prices. Crude that fetched more than $100 a barrel in 2014 tumbled as low as $26 by early last year. It’s recovered since then, averaging just under $50 for much of the past 12 months, as the Organization of Petroleum Exporting Countries and partners like Russia cut output. West Texas Intermediate rose to $50.41 a barrel as of 11:57 a.m in New York on Friday, topping $50 for the first time this month. Western Canadian gas also has recovered. After dropping as low as 65 Canadian cents (50 U.S. cents) per million British thermal units last May, the lowest in about 20 years, prices have more than quadrupled to almost C$3, data compiled by Bloomberg show. Rising Output The Montney contains about 449 trillion cubic feet of marketable natural gas, Canada’s National Energy Board estimated in 2013. That’s about half the total reserves of Qatar, the Persian Gulf country that is the world’s biggest exporter of liquefied natural gas. The Canadian formation also contains 14.5 billion barrels of natural gas liquids and 1.13 billion barrels of oil, according to the NEB report. With investment and drilling on the rise, daily gas production at the Montney will jump to 7 billion cubic feet by 2019, compared with 4.9 billion cubic feet now, according to Wood Mackenzie. Condensate, oil and other natural gas liquids will grow to 470,000 barrels a day from 250,000 barrels, as development proceeds in liquids-rich areas of northern British Columbia, Heritage/Tower, Elmworth and Kakwa, the industry researcher said. On April 27, the Petroleum Services Association of Canada raised its 2017 well-drilling forecast for the country by 60 percent to 6,680. Encana Corp., the largest Montney producer, plans to drill about the same number of wells this year as in 2014, Jay Averill, a spokesman, said in an April 20 email. By 2019, the company expects to double gas output to 1.2 billion cubic feet, with similar gains in production of liquids to more than 70,000 barrels a day. ‘Costs Lower’ “The Montney has evolved into a world-class condensate play, and with a relentless focus on innovation and efficiency, we have driven costs lower and increased well productivity,” Averill said. Even with those gains, Encana probably will lose the top spot to bigger increases by Seven Generations, according to Wood MacKenzie. ARC Resources will be No. 3, followed by Royal Dutch Shell Plc. While the Montney is a long way from the energy-hungry U.S., it is close to Canada’s biggest consumer of gas and condensate -- Alberta’s oil sands mines and wells. The industry uses gas to loosen the hard bitumen rock, as well as to heat water used in the process. Condensate is blended with viscous, raw bitumen so it can flow freely through pipelines. Oil sands production by 2020 could reach 3.4 million barrels a day, up 34 percent from 2015, according to Canadian Energy Research Institute projections. Montney producer Kelt Exploration Ltd., which planned at least three new wells, is the best-performer this year among 27 companies tracked by the S&P/TSX Composite Oil & Gas Exploration & Production Index. Its shares are up 6.5 percent, while the index is down 14 percent. The drilling revival in the Montney has been a lifesaver for Grimes Well Servicing, which increased its winter workforce to 80 from 50 a year earlier. While demand isn’t strong enough yet to raise service rates that were cut 20 percent during the slump, executives at the company are glad for the business. “Its an improvement over the last couple of years, no doubt about it,” said Mackey, the company’s accountant. Source: Bloomberg

Small Business Computer Security Basics

Don Draper, The Man In The Iron Mask – And 400,000 Consumers It’s the thread that connects Alexandre Dumas’ The Man in the Iron Mask, the title character in The Talented Mr. Ripley, Don Draper’s back story in Mad Men – and an event scheduled for May 24, 2017, at the FTC. It’s identity theft. Ten years ago, the White House issued an Executive Order establishing the Identity Theft Task Force, co-chaired by the FTC. As ID thieves’ tactics morph and modify, public and private partners develop new strategies to prevent the crime and offer assistance to victims. Just one example is IdentityTheft.gov, a site the FTC introduced last year to help people create a recovery plan, complete with personalized paperwork to speed up the process of winning back their good name. Now is the time to take a comprehensive look at how identity theft has evolved over the last decade and consider where we go from here. That’s the topic of a May 24th workshop, Identity Theft: Planning for the Future. The FTC has released the agenda for the day. Panelists will talk about the shadowy dark web where stolen data is fenced, the effect that ID theft has on industries like financial services and healthcare, the impact the crime has on people’s lives, and resources available for victims. Free and open to the public, the conference will take place at the FTC’s Constitution Center building, 400 7th Street, S.W., in Washington, DC. Registration begins at 7:45 AM and Acting Chairman Ohlhausen will open the event at 9:15. Can’t make it to DC? We’ll post a webcast link moments before the event starts. Why should businesses be concerned about the nearly 400,000 reports of identity theft the FTC received last year? Because the fight against ID theft is an all-hands-on-deck endeavor and businesses have three key roles to play:

Small Business Computer Security Basics

If you’re running a small business with only a few employees, you’ve learned about a lot of things – accounting, marketing, HR, you name it. And you probably depend on technology, even if it’s only a computer and a phone. You can’t afford to get thrown off-track by a hacker or scammer.

Here are a few computer security basics to help your company, even if you’re the only employee. If you have employees, train them to follow these tips. If you collect any consumer information, also check out our advice about protecting personal information.

PROTECT YOUR FILES & DEVICES

Keep your software up-to-date. No matter what operating system, browser or other software you use, keep it up to date. Set it to update automatically so you don’t leave holes hackers can exploit. Back up your files. No system is completely secure. Create offline backups of important files. That way, if your computer is compromised, you’ll still have access to your files. Use strong passwords. The longer the better – at least 12 characters. Complexity also helps strengthen a password. Mix numbers, symbols, and capital letters into the middle of the password, not at the beginning or end. Don’t use patterns to lengthen a password. Never use the same password for more than one account, or for personal and business accounts. If you write them down, lock them up. Consider using a password manager, an easy-to-access application that allows you to store all your valuable password information in one place. Be sure to protect your password manager with a strong master password, and only use a password manager from a reputable company. Don’t share passwords on the phone, in texts or by email.

Turn on two-factor authentication. For accounts that support it, two-factor authentication requires both your password and an additional piece of information to log in to your account. The second piece could be a code sent to your phone, or a random number generated by an app or a token. This protects your account even if your password is compromised.

Don’t leave your laptop, phone or other devices unattended in public, even locked in a car. They may contain sensitive information – and they’re costly to replace. If they go missing, the information stored on them may fall into the hands of an identity thief. You also can turn on device encryption to encrypt all data on each device. This reduces the risk to sensitive information in case your device is stolen or misplaced. Password protect all your devices. If you access your business network from an app on your phone or tablet, use a strong password for the app, too.

THINK BEFORE YOU SHARE YOUR INFORMATION

Protect account information. Every time someone asks for business information – whether in an email, text, phone call or web form – think about whether you can really trust the request. Scammers will say or do anything – or pretend to be anyone – to get account numbers, credit card numbers, Social Security numbers or other credentials. Scammers will rush, pressure or threaten you to get you to give up company information. Only give sensitive information over encrypted websites. If your company is banking or buying online, stick to sites that use encryption to protect your information as it travels from your computer to their server. Look for https at the beginning of the web address in the address bar of your browser. Look for https on every page of the site you’re on, not just where you log in.

PROTECT YOUR WIRELESS NETWORK

Set up your router securely. If your small business has a wireless network, your "access point" is probably a cable or DSL modem connected to a wireless router, which sends a signal through the air. Your router directs traffic between your local network and the internet. Any device within range can pull the signal from the air and access the internet. If you don't secure your router, strangers could easily gain access to sensitive personal or financial information on your devices.

Use encryption on your wireless network. Encrypt the information you send over your wireless network, so that nearby attackers can’t understand your communications. Encryption scrambles the information you send into a code so that it’s not accessible to others. Modern routers offer WPA2, the strongest wireless encryption widely available. To protect your data, use it.

Wireless routers often come with the encryption feature turned off. You must turn it on. The directions that come with your router should explain how. If they don't, check the company’s website. Limit access to your network. Allow only specific devices to access your wireless network. Wireless routers usually have a mechanism to allow only devices with particular unique Media Access Control (MAC) address to access to the network. If you want to provide free Wi-Fi for your customers, set up a second, public network – separate from the network for your business devices.

BE CAREFUL WITH WI-FI HOTSPOTS

If you’re on the go, Wi-Fi hotspots in coffee shops, libraries, airports, hotels, and other public places are convenient – but often they’re not secure. In fact, if a network doesn’t require a WPA2 password, it’s probably not secure. To protect your information when using wireless hotspots, send information only to websites that are fully encrypted – look for https on every page. And avoid using mobile apps that require sharing personal or financial information over public Wi-Fi.

KNOW WHAT TO DO IF SOMETHING GOES WRONG

Plan ahead so you know what to do if a hacker gets into your system. There are steps you can take to minimize the damage if you discover malware on your computers, that your email has been hacked, or even if someone takes over your system and demands a ransom to return control of it. And if someone accesses personal or financial information that they shouldn’t, take steps to respond to that data breach. Source: Federal Trade Commission

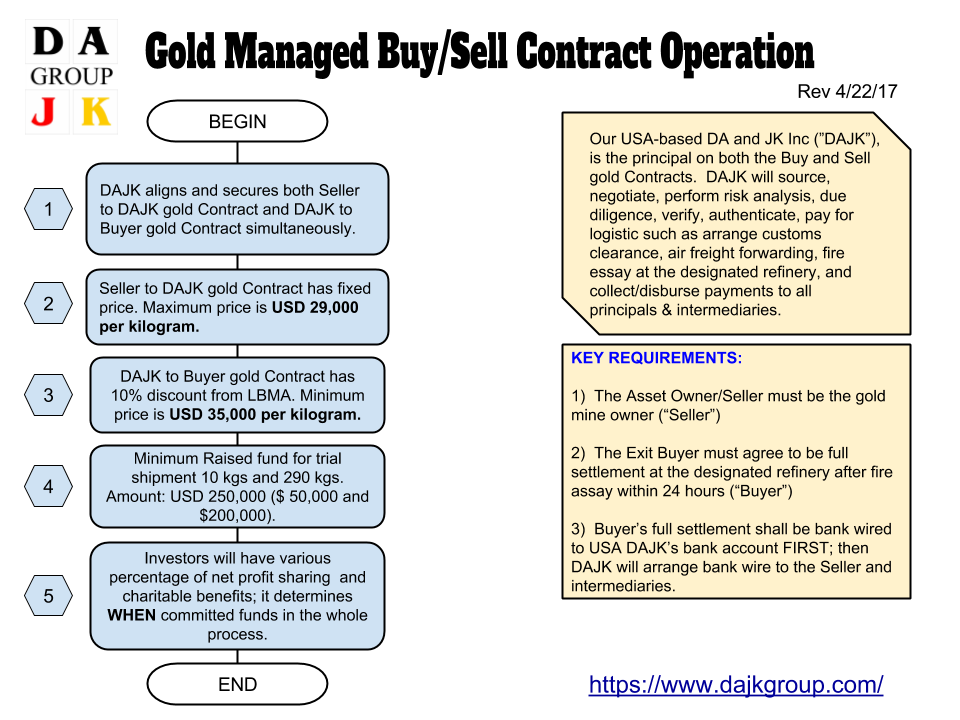

What Does The Future Hold For Canada’s Oil Sands? Buying discounted oil sands producing assets may not seem strategically opportunistic when looking at the economics of oil sands projects. Most oil sands projects have breakeven WTI prices above $80 per barrel and that is far away from current WTI prices hovering around $50 per barrel. Phases in Canada’s Oil Sands We have entered a unique phase in major oil sands acquisitions in Alberta. Canadian companies are using their operational expertise, large market values, and stable balance sheets to build up larger positions in Canada’s oil sands. Over the last decade, oil production from Canada’s oil sands has increased 100 percent and an increasing number of players are participating in that growth. In 2006 there were 6 companies, not including the Syncrude Canada consortium, which controlled all oil sands production in Alberta. Now, there are around 20 oil sands producers. Over the years, key acquisitions took place in Canada’s oil sands that helped grow the resource to what it is now: 1. The first phase was from 2006 to 2010 when oil companies were acquiring undeveloped assets to secure a position in developing Canada’s oil sands. Examples include Statoil’s $2.2 billion acquisition of North American Oil Sands in 2007, PetroChina’s initial acquisition of a 60 percent interest in Athabasca Oil Corporation’s oil sands assets for $1.9 billion in 2009, and Total SA’s $1.5 billion acquisition of a 20 percent stake in Suncor’s Fort Hills oil sands mine from UTS Energy Corporation in 2010. 2. In the latter half of 2010 to 2012, Canada’s oil sands saw the second phase of acquisitions dominated by Asian companies. These Asian companies, often state-owned, were acquiring existing production for a premium to secure producing positions in Canada’s oil sands. As a sharp rebound in oil prices followed the financial collapse of 2008/2009, more oil sands projects were taken from development to production. Asian energy powers were late to the game and began buying up producing oil sands assets to secure future energy resources. The second phase of oil sands acquisitions by state-owned Asian companies started with China’s Sinopec (SHI) and its acquisition of ConocoPhillips’ 9 percent interest in Syncrude Canada for $4.7 billion in 2010. This was followed by Thailand’s PTT Exploration & Production and its acquisition of a 40 percent stake in Statoil’s oil sands projects for $2.3 billion in 2010. Finally, China’s CNOOC (CEO) would make two large adjoining acquisitions to become the sole owner of the Long Lake oil sands project. CNOOC would make a $2.1 billion acquisition of OTPI in 2011, which held a 35 percent interest in Long Lake. Following the OTPI acquisition, CNOOC would buy the remaining share of Long Lake in 2012 with the $15.1 billion acquisition of Nexen. 3. The third and current phase of oil sands acquisitions has one common theme: Canadian opportunism. Suncor (SU), Cenovus (CVE), and Canadian Natural Resources (CNQ) have sought to take advantage of the current market and make large value-oriented acquisitions that are an opportunistic alternative to building a brand-new oil sands project. Canadian Opportunism While it may be a point of pride that Canada is buying back Canadian oil sands assets, this current phase of acquisitions redirects attention away from the fact that oil majors are leaving Canada. Total SA (TOT), Royal Dutch Shell (RDS.A), Marathon Oil (MRO), Statoil (STO), Murphy Oil (MRU) and ConocoPhillips (COP) have all reduced their exposure to oil sands assets in the last couple years. Many of the companies selling Canadian oil sands assets are managing assets on a global scale. This means that they are forced to sell marginal fields to invest in more profitable ventures or re-focus their capital towards core long-term operations. For the Canadian oil companies acquiring oil sands assets, the oil sands are their only core long-term business and they must find a way to manage these assets to remain profitable or cost-effective. This means strategically seizing on opportunities in a low-price oil environment when they are out of favor. Looking at the capital expenditures required for several oil sands project, based on analysis conducted by Citigroup Global Markets Inc. in January 2015, it makes clear business sense for Suncor and Canadian Natural Resources to make acquisitions of oil sands mining projects in the current low-price oil environment. Suncor and Canadian Natural Resources are buying oil sands mining projects at a 25 percent to 50 percent discount to the cost per flowing barrel to build a new project. On the other hand, Cenovus paid almost $60,000 per flowing barrel to consolidate its joint venture (JV) with ConocoPhillips and acquire additional Western Canadian Sedimentary Basin (WCSB) assets. Cenovus’ purchase is higher than the cost to build up phases of its Foster Creek and Christina Lake projects, but the consolidation of its JV with ConocoPhillips is likely to bring immediate cost savings. According to Cenovus’ March 2017 presentation, the company expects to reduce operating costs by 18 percent and reduce general and administrative (G&A) costs by 29 percent upon full integration of ConocoPhillips oil sands and WCSB assets. Oil Sands: The Economics of Time Buying discounted oil sands producing assets may not seem strategically opportunistic when looking at the economics of oil sands projects. Most oil sands projects have breakeven WTI prices above $80 per barrel and that is far away from current WTI prices hovering around $50 per barrel. While capital in North America has been flooding into high margin oil plays like the Permian’s Delaware Basin, investment in Canada’s oil sands requires a long-term approach. Delaware Basin Wolfcamp wells can be drilled in less than 12 days and produce upwards of 2,000 b/d of oil, but those wells face 60 percent to 70 percent production decline rates after one year. Meanwhile, the recent major oil sands mining project operated by Suncor, Fort Hills, started construction in 2013 and is estimated to produce first oil in 2017. The life of the Fort Hills oil sands project is expected to last approximately 50 years. Oil sands players like Suncor, Cenovus, and Canadian Natural Resources look at oil prices over several decades and are less influenced by short term volatility in oil prices. According to Suncor’s Executive Vice President and Chief Financial Officer, Alister Cowan, in the January 22, 2017 Financial Post article, How high break-even costs are challenging new oil sands projects, Cowan noted of the Fort Hills project, “You don’t make decisions on 50-year life [of an oil sands mine] on the basis of spot price, so we would expect to see multiple periods of price volatility during the life [of the Fort Hills mine].” Mr. Cowan goes on to note the current opportunistic environment, “Ironically, building a major capital-intensive project — this is precisely when you want to build it because nobody else is.” Even as oil prices hover around $50 per barrel, Canadian oil sands companies are still building most new mining and in situ projects with a time frame measured by decades. In 2016, 78 percent of all new oil sands projects have been brought online by Canadian companies and 92 percent of all new oil sands projects in 2017 will be brought on by Canadian companies. Construct, Consolidate, and Control With Canada’s largest oil sands companies long-term vision and recent acquisitions, Suncor, Cenovus, and Canadian Natural Resources are coincidentally consolidating positions in Canada’s oil Sands. Based on 2016 oil sands production in Alberta, these three largest Canadian oil sands producers control around 60 percent of oil sands production. anIn 2002, when oil sands production capacity was under a million barrels per day, the market value of Canadian Natural Resources was $3.7 billion and the market value of Suncor was $13 billion. As of 2016, the market value of Canadian Natural Resources has increased 10 times its 2002 value and Suncor’s market value has increased 4 times its 2002 value. The growth of the largest Canadian oil sands producers has provided them with the financial capacity to make recent multi-billion dollar acquisitions. The Future of Canada’s Oil Sands The ever-changing oil price environment and the long-term nature of Canada’s oil sands projects will continue to create opportunities for all oil companies. Companies have come and gone and returned to Canada’s oil sands projects and that trend is bound to continue as oil prices fluctuate over future decades. In this current low price environment, top Canadian oil sands producers are investing in efficiency, innovation, and sustainability for oil sands operations. Canadian Oil sands producers are bringing down operating costs, moving more towards in-situ projects that provide better relative economics to mining projects, and using technology to streamline operations and reduce reliance on non-renewable resources. As oil prices move higher in the future, oil sands operations will emerge leaner and more sustainable with better economics than Citigroup Global Markets’ assessed in January 2015, but that will be yet another phase in Canada’s oil sands future. Source: Oil Price and Suncor

If you see a product or service that is being consumed in one market, that product is not available in your market, you could perhaps import that product or service, and start that business in your home country. A key question that all would-be entrepreneurs face is finding the business opportunity that is right for them. Should the new startup focus on introducing a new product or service based on an unmet need? Should the venture select an existing product or service from one market and offer it in another where it may not be available? Or should the firm bank on a tried and tested formula that has worked elsewhere, such as a franchise operation. There are many sources for new venture opportunities for individuals. Clearly, when you see inefficiency in the market, and you have an idea of how to correct that inefficiency, and you have the resources and capability — or at least the ability to bring together the resources and capability needed to correct that inefficiency — that could be a very interesting business idea. In addition, if you see a product or service that is being consumed in one market, that product is not available in your market, you could perhaps import that product or service, and start that business in your home country. Many sources of ideas come from existing businesses, such as franchises. You could license the right to provide a business idea. You could work on a concept with an employer who, for some reason, has no interest in developing that business. You could have an arrangement with that employer to leave the company and start that business. You can tap numerous sources for new ideas for businesses. Perhaps the most promising source of ideas for new business comes from customers — listening to customers. That is something we ought to do continuously, in order to understand what customers want, where they want it, how they want a product or service supplied, when they want it supplied, and at what price. Obviously, if you work in a large company, employees might come up with ideas. Indeed, you might want to listen to what they have to say. You could pursue these ideas by asking yourself some key questions such as, “Is the market real? Is the product or service real? Can I win? What are the risks? And is it worth it?” Well, obviously in the age of the Internet, there is no shortage of examples of entrepreneurs who started a company based on a perceived need. You could go back to the beginning of E-Bay, where they saw an opportunity to connect people through launching a virtual flea market. It offered a platform that connected buyers and sellers directly. Other companies have found similar models. For instance, take PayPal, a company whose co-founder [Elon Musk] was a Penn and Wharton graduate. The company provided people the opportunity to pay online. Flycast is another company started by a former Wharton MBA student, [Rick Thompson]. It addressed issues of advertising on-line. All of these companies have one thing in common. They addressed an unmet need in the marketplace. There is no substitute for understanding the unmet needs of customers. That will allow you to discover whether you are able to supply those needs, at the price customers want to pay, and if you can still make a profit. The process of evaluating and identifying the risks that should be considered in deciding whether or not to pursue that business opportunity? The first step that everyone should go through is to ask the question, is the market real? In order to do so, the first thing you want to do is conduct what we call a customer analysis. You can do that perhaps in a very technical way, by conducting surveys. Or perhaps, in a less technical way, you can attempt to answer the question, “Who is my customer?” What does the customer want to buy? When does the customer want to buy? What price is the customer willing to pay? So, asking the “W questions” — who, where, what, when — is the first step. At the end of the day, the one thing every entrepreneur is looking for is revenue, and the revenue will come from customers. That is why you need to ask yourself, is there a market here? The second thing you want to ask yourself is, who else is supplying that particular market? That is what we call competitor analysis. Ask yourself who else is in this market, and what are they doing for the customers. Are they supplying a similar substitute product or service as you have in mind? That is the second thing you have to establish, and by doing that, you can understand better what need is not met at the moment. That will also give you the opportunity to zero in on the price points and feature points of where you can differentiate yourself from existing players in the market. You also need to conduct a broader industry analysis to understand the attractiveness of the industry you’re going to enter. Is the industry growing or shrinking? What power do the suppliers have in this industry? How many buyers are there? Are there substitute products? Are there any barriers to entry? If so, what are they? That is very important for you to understand, because it will help you realize whether the industry you’re thinking of entering is attractive. In addition, you may want to look at regulations that affect that industry. Are there any regulations that you would be subject to? This especially applies in the life sciences sector, where there are strict regulations that control the supply of products into the market. In the United States, the FDA, the Food and Drug Administration, is a significant regulator. Every country around the world has a regulator in the life science sector. So, these are the high level questions that you may want to ask yourself. Once you answer these questions, and you identify the need, given the competition and all the regulatory constraints that exist in that market, that will provide you with the opportunity to tailor your service or product — or combination of the service and product — to that marketplace. The logic we are suggesting here is to understand the need, and tailor the product and/or service to that need, as opposed to saying, “Well, I have an idea. And now let me think how I can shove it down the distribution channel.” More often than not, the latter doesn’t work. More often than not, the former approach works. This is the approach where you identify the need, do a rigorous analysis of understanding who else is out there, and what constraints exist, and how you could differentiate yourself in a meaningful way. When you approach a new opportunity this way, when you introduce your product and/or service, you can expect to have substantial sales and growth for your company. Are there any financial risks that entrepreneurs should take into account? What would those be? When starting a business, there are many risks that need to be considered. One way to think about the various risks an entrepreneur is faced with — or, for that matter, an investor in an entrepreneurial venture is faced with — is to break them down into several buckets. Let’s start with the first bucket, the company bucket. Well, here, the biggest sources of risk are the founders. Do they have the wherewithal not just to start the company, but also grow the company? Experience has shown that the prevalence of individuals such as Bill Gates or Michael Dell, Steve Jobs, that can not only start companies, but also manage its growth — the prevalence of such individuals is relatively limited. A second source of risk is technology risk. To the extent that your company employs technology, there are obviously issues of, how long will this technology be the leading edge? Secondly, are there any intellectual property issues that need to be addressed? Lastly, there exists the product risk. If you haven’t developed a product yet, can you manufacture it? Will it work? All these issues are under the bucket of company risk. A second bucket for the sources of risk is the market for the product. You need to be aware of two big uncertainties. First, what is the customer’s willingness to buy? And second, what is the pace, if you’re successful, at which competitors will be able to imitate you? One of the things you have to think about when you enter that market is how you can create barriers to imitation, so that if you’re successful, the competition won’t be able to imitate you very quickly. A third bucket consists of risks associated with the industry. Are there any factors in that industry that relate to availability of supply? In some cases, you need to have certain raw materials that are in limited supply, and that some suppliers might be able to take advantage of that. Barriers to entry might change. Regulations might change, and adversely or positively affect your business. Lastly, there are financial risks. And here, the question is, will you be able to raise the money early on? At what valuation will you be able to do it? Will you be able to raise follow-up money? And then, from the investor’s standpoint, obviously there’s a risk that if the company is very successful — and I can tell you that most early stage companies don’t work out, but for the few that do, when it is time for, say, a public offering, will the public market be open? We have just gone through a substantial period of almost two years where IPOs were few and far between. At the time you make the investment, you don’t know what the state of the capital market will be in five to seven years from the date you make the investment. That’s a big risk the investor is assuming. Obviously, it’s a big risk for the entrepreneur to be able to have some liquidity, and perhaps realize the fruits of her investment, of her time, talent, and in some cases some of the money she puts into that venture. What are the biggest mistakes you have found entrepreneurs make at the initial stage of identifying business opportunities? The most frequent mistake that people tend to make is to think everybody in the market is like them. If they like the product, everybody else will. Sometimes — too often — entrepreneurs, and especially entrepreneurs with an engineering background, are too focused on the engineering features or technology features of the particular product, rather than on the need that they are trying to fulfill. Customers don’t buy technology. Customers buy products that add value. Customers buy products that they need, in order to satisfy some issue that they wish to satisfy. But not the technology, per se; it is the services of the technology that matter. Very often, entrepreneurs — particularly smart entrepreneurs — are overwhelmed by the technological aspect, and they pay too little attention to what the customers want. If you ask me, this is the most frequent issue at the early stage that entrepreneurs are faced with. Source: Wharton

Nigeria is no longer running short on dollars—for now In the past year, it’s been almost impossible to say anything about Nigeria’s economy without talking about the naira. Currency controls imposed by the government of Muhammadu Buhari led to a downward spiral for the naira, which changes hands at vastly weaker rates on the black market than the official one set by the Central Bank of Nigeria (CBN). As the central bank tries to manage the exchange rate rather than let it float freely, as advised by the IMF and World Bank, the parallel markets have delivered a damning verdict on what the naira is really worth. Nigeria’s latest currency woes can be traced back two years ago, when president Buhari first took over. Despite dwindling foreign reserves thanks to the fall in global oil prices, CBN governor Godwin Emefiele at first refused to devalue the naira—in line with Buhari’s wishes. But in June last year the CBN finally gave in, adopting a flexible exchange-rate policy determined by market forces. To nobody’s surprise, the naira immediately fell sharply against the dollar. But soon after the policy was adopted, it became clear that the naira was never fully floated. As part of a “managed float,” the CBN intervened in the market for dollars, which were in high demand. This didn’t last, and so importers and anyone else who needed dollars were forced, once more, turn to the black market. The gap between the official and black-market exchange rates then grew wider. The CBN is back in the market now, stepping up its interventions over the past month, supplying banks with dollars and allowing retail customers who want to buy forex for travel allowances or to pay school fees to do so—although at an approved rate. In recent months, restrictions on sales had pushed many to resort to the black market regardless. With at least some of the pent-up demand for dollars now being met by banks, the rate in the parallel market has started to return closer to the official rate. The improved supply of dollars has eased a shortage which left local businesses unable to import raw materials and Nigerians unable to meet medical expenses as well as pay tuition at foreign schools. The shortage, as well as the CBN’s unpredictable controls and Nigeria’s weak economy, had also scared away investors. The moves by international airlines to either pull out or cut routes to Nigeria has not been the best advertisement for the country’s business climate. By easing the dollar shortage, the CBN is likely hoping to convince Nigerians, and foreign investors, that the naira’s most nervous days are over. Regardless of recent stability, Nonso Obikili, a Nigeria-based economist, says it’s not clear how long the central bank can keep up its interventions. These have only been possible lately thanks to slightly improved foreign reserves: with a fragile peace pact holding in Nigeria’s oil Niger Delta region, production once hobbled by militants has been ramping up, allowing the country to earn more from its main export. The central bank’s ability to keep the supply of dollars flowing is dependent on conditions beyond its control, such as global oil prices and peace in the volatile Niger Delta region. But just as importantly, the CBN’s struggles to keep the naira under control have hurt its credibility. For much of his tenure as central bank governor, Emefiele has been thought to prioritize politics over economics, leading to the botched naira float and calls for his resignation. The recent dollar interventions have helped somewhat, but the CBN’s somewhat arbitrary new set of exchange rates has done little to ease the most serious concerns. “There is still no credibility, and still no functioning transparent official market. There is no price discovery mechanism. The result is that the CBN is still acting as a price fixer which, at the core, is the problem,” Obikili says. The creation of yet more exchange rates “will remain concerning for investors,” says Manji Cheto of consultancy Teneo Intelligence. The short-term goal of closing the gap between official and black-market rates has been achieved, but regaining investor confidence in the long term will take longer. “Investors would like to see a more sustained period of policy certainty before they can begin to feel more confident again,” Cheto says. IMF Executive Board Concludes 2017 Article IV Consultation with Nigeria March 30, 2017 On March 29, 2017, the Executive Board of the International Monetary Fund (IMF) concluded the Article IV consultation with Nigeria. With oil receipts dominating fiscal revenue and exports, the Nigerian economy has been hit hard by low oil prices and falling oil production. The country entered into a recession in 2016, with growth contracting by 1.5 percent. Annual inflation levels doubled to 18.6 percent, reflecting hikes in electricity and fuel tariffs, a weaker naira and accommodating monetary conditions (broad money expanding at 19 percent y-o-y). Even with a significant under-execution in capital spending, the consolidated fiscal deficit increased from 3.5 percent of GDP in 2015 to 4.7 percent of GDP in 2016, because of significant revenue shortfalls. This resulted, over the same period, in a doubling of the Federal Government (FG) interest payments-to-revenue ratio to 66 percent. The external current account turned into a surplus in 2016, as import compression continues to offset falling exports. The foreign exchange regime was liberalized in June 2016, but FX restrictions remain in place and the market continues to be characterized by significant distortions that have contributed to a 50 percent parallel market premium, which was halved following recent increases in central bank interventions and the removal of prioritized allocation of foreign exchange. Under unchanged policies, the outlook remains challenging. Growth would pick up only slightly to 0.8 percent in 2017, mostly reflecting some recovery in oil production and a continuing strong performance in agriculture. Policy uncertainty, crowding out, and FX market distortions would be expected to drag activity. Accommodative monetary policy would keep inflation in double digits. Financing constraints and banks’ risk aversion would crowd out private sector credit and increase the Federal Government’s already high debt service burden. A continued policy of prioritizing exchange rate stability would lead to an increasingly overvalued exchange rate, leading to a deterioration in the non-oil trade balance and gross reserves below adequate levels. Recognizing the unsustainability of current policies, the authorities have adopted an Economic Recovery and Growth Plan (ERGP) to transform the economy into a more diversified and inclusive economy. Key priorities include ensuring food security through agro-related manufacturing, promoting industrialization, and achieving sufficiency in energy—including the recently approved Power Sector Recovery Plan. The ERGP’s inclusive growth focus is to be supported through macroeconomic stability, investing in social infrastructure, building a globally competitive economy, and improving governance. Executive Board Assessment Executive Directors recognized that the Nigerian economy has been negatively impacted by low oil prices and production. Directors commended the efforts already made by the authorities to reduce vulnerabilities and enhance resilience, including by increasing fuel prices, raising the monetary policy rate, and allowing the exchange rate to depreciate. However, in light of the persisting internal and external challenges, they emphasized that stronger macroeconomic policies are urgently needed to rebuild confidence and foster an economic recovery. Directors welcomed the authorities’ Economic Recovery and Growth Plan (ERGP), which focuses on economic diversification driven by the private sector, and government initiatives to strengthen infrastructure—including the recently adopted power sector recovery plan. However, they underlined that without stronger policies these objectives may not be achieved. Directors generally emphasized the need for a front-loaded, revenue-based fiscal consolidation starting in 2017, to reduce the federal government interest payments-to-revenue ratio to sustainable levels. They underscored that priority should be given to increasing non-oil revenue, including through raising VAT and excise rates, strengthening compliance, and closing loopholes and exemptions. Administering an independent fuel price-setting mechanism to eliminate fuel subsidies, strengthening public financial management, and developing a well-targeted social safety net would also support the adjustment. Directors stressed the need to contain the fiscal deficit of state and local governments, including through improved transparency and monitoring. Directors underscored that external adjustment is necessary to protect foreign currency buffers and reduce vulnerabilities. They commended the recent easing of some exchange restrictions and urged the authorities to remove the remaining restrictions and multiple currency practices, thus unifying the foreign exchange market and helping regain investor confidence. Directors emphasized that these policies should be supported by tighter monetary policy and fiscal consolidation to anchor inflation expectations and to limit the risk of exchange rate overshooting, as well as structural reforms to improve competitiveness. Directors welcomed the steps to strengthen banking sector resilience through stronger prudential requirements. With asset quality declining, they recommended further intensifying bank monitoring, enhancing contingency planning, and strengthening resolution frameworks. Directors encouraged quickly increasing the capital of undercapitalized banks and putting a time limit on regulatory forbearance. Directors emphasized that ambitious structural reforms are key to achieving a competitive, investment-driven economy that is less dependent on oil. Priority should be given to improving infrastructure, enhancing the business environment, improving access to financing for small enterprises, and strengthening governance and anti-corruption efforts. Timely and effective implementation of these measures would promote sustainable and inclusive growth. Directors welcomed progress in improving the quality and availability of economic statistics and encouraged further efforts to compile subnational fiscal accounts. Source: IMF

Claim Your Place In History

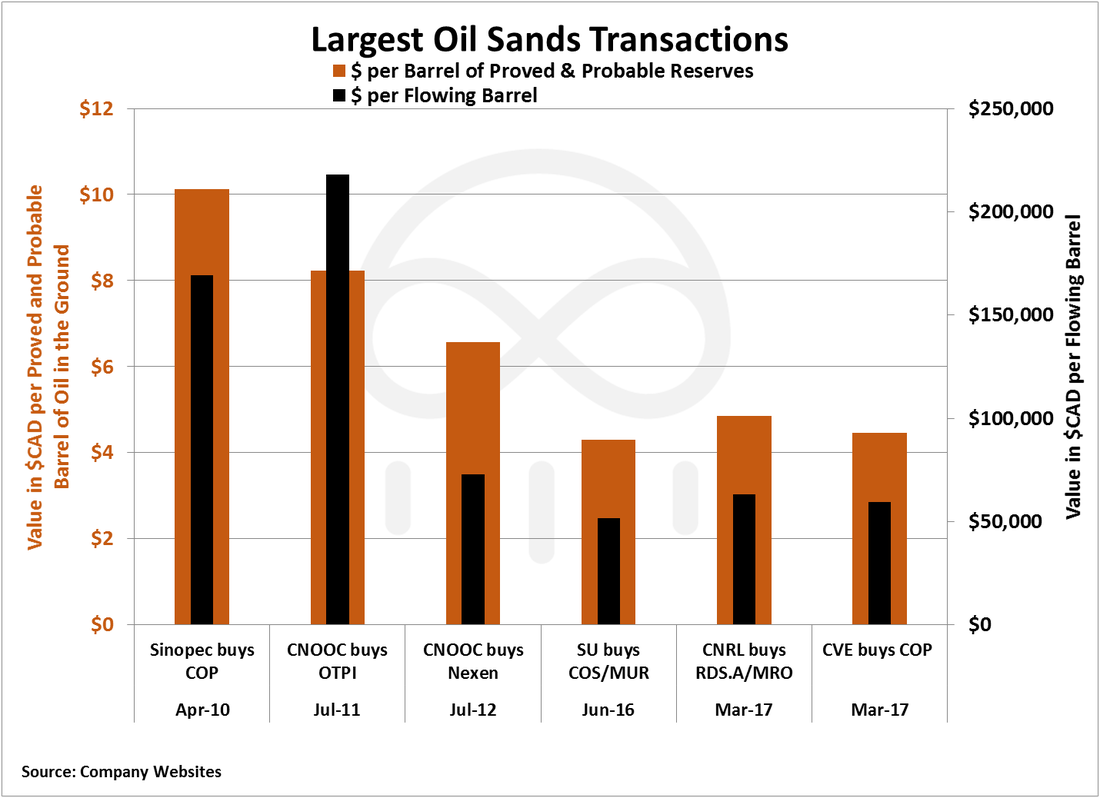

Our Los Angeles-based DA and JK Inc. (“DAJK”) is a partner with the Global Gallery founded by Mr. Donald Brown; DAJK is also an authorized seller (more details at links below). DAJK will pledge Five percent (5%) of total sales through the registered organization’s members and/or affiliates. Once your organization is registered, DAJK will issue to you the unique tracking reference so that we can track and credit to your organization accurately. Please note there is no minimum quantity requirement. Our art prints and open edition sculptures are anticipated:

A Sporting Chance for Peace’s prints and sculptures provides an opportunity for every one can claim his place in history, support a Global Peace Initiative and Ghana Medical Tourism, founded by A) Pre-Launch Promotion of 50,000 prints. Discover more details DONATION: TEN PERCENT (10%) of sales of these prints will support not-for-profit HEAG Foundation and Medical Community in Ghana (“HMCG”)

B) Global Sales Target of 15,000 Sculptures. Discover more details

DONATION: TEN PERCENT (10%) of sales of these sculptures will support not-for-profit HEAG Foundation and Medical Community in Ghana (“HMCG”)

Discover more at our websites: (Benefits and Bonuses)

If our business proposition is acceptable, please provide us your Letter of Interest or Commitment or Purchase Order promptly. Please make sure your LOI or PO is including with our provided unique reference so that we can track and credit to your organization accurately.

Thank you for your time. I look forward doing business with you. P.S If you or your affiliates is interested in the limited sculptures, please advise. Also, the Five percent (5%) of total sales from these limited sculptures will be pledged to your organization as well. The Price list (scroll down to the end of this page). BONUS: Constructing the Wall of Peace

|

Libyan Crude Oil Offer |

Our Concierge Services |

ANNOUNCEMENT |

ANNOUNCEMENT |

Print Sales Agents |

Sculpture Sales Agents |

Venezuela, Shell, Keystone XL, Libyan Oil, and Saudi Arabia

- Venezuela Suffering Through Gasoline Shortage

- Shell Oil Spills Led to 'Astonishingly High' Pollution in Nigeria

- More Hurdles Ahead for Keystone XL, TransCanada Head Tells Trump

- Libyan Oil Output Rises To 700,000 Barrels Per Day After Port Fighting Ends: NOC

- Saudi Arabia May Insist On Iran Oil Output Cuts To Continue OPEC Deal

Venezuela Suffering Through Gasoline Shortage

Venezuela suffering through gasoline shortage. Gasoline lines are growing in Caracas as Venezuela’s state-owned PDVSA is rumored to be struggling to pay for imported fuel. “They’re not importing enough because they are saving up to pay the debt,” Jose Brito, an opposition lawmaker in Venezuela told Bloomberg. “It’s unbelievable that this is happening in an oil producing country.” The economic crisis in Venezuela is worsening and there are growing fears of a default this year.

Venezuela’s state oil company was rushing to replenish gasoline supplies in various neighborhoods of Caracas on Thursday as drivers lined up at filling stations amid a worsening shortage of fuel.

While Petroleos de Venezuela SA says the situation is normalizing and blamed the lines on transport delays, the opposition says the company has had to reduce costly fuel imports as it tries to preserve cash to pay its foreign debt. Tanker trucks were seen in several neighborhoods of the capital city resupplying filling stations after local newspaper El Nacional reported widespread shortages across the country.

“Yesterday, I went to three filling stations and I couldn’t fill my tank,” Freddy Bautista, a 26-year-old student, said in an interview while waiting outside of a gas station in the Las Mercedes area of eastern Caracas on Thursday. “I’ve been waiting 30 minutes here, and it seems like I’ll be able to fill up today.”

As the company’s crumbling refineries fail to meet domestic demand, imports have become a financial burden because the country buys fuel abroad at market prices only to sell it for pennies per gallon at home. PDVSA, as the state-run producer is known, has been reducing the money-losing imports as it prepares for $2 billion in bond payments due next month, said Jose Brito, an opposition lawmaker on the National Assembly’s oil commission.

“They’re not importing enough because they are saving up to pay the debt,” he said in a telephone interview. “It’s unbelievable that this is happening in an oil producing country.”

Call for Calm

Ysmel Serrano, commercial and supply vice president at PDVSA, said on Twitter late Wednesday that the company has sufficient supply from its refineries and is working to increase shipments to stabilize distribution after transportation delays led to lines at gasoline stations in four states.

“We call for calm and to resist false rumors from sectors trying to create chaos in the country!” Serrano said.

The comments came just hours after the company said it had controlled a “minor” fire at the Amuay refinery in Falcon state, the largest refining complex in the country where a 2012 explosion killed dozens of people.

PDVSA’s press department on Thursday declined to make additional comments when contacted by Bloomberg News, but said it may release more information later in the day.

Shortages of Everything

The hunt for gasoline is just the latest headache for consumers after years of severe economic contraction and triple-digit inflation have produced shortages of everything from bread to antibiotics. Long accustomed to the world’s cheapest gasoline in the country with the world’s largest oil reserves, now Venezuelans are worried they’ll lack fuel, too.

Venezuela has been forced to increase imports of finished gasoline and components over the past years as its refinery utilization rates declined because of deteriorating infrastructure and under-investment. The country imported about 75,000 barrels a day of refined products from the U.S. in 2016, according to the U.S. Energy Information Administration.

In Caracas’ eastern Sucre municipality, around 20 cars were lined up outside of a PDVSA gas station trying to fill up. National police in the Las Mercedes part of the city, meanwhile, were trying to prevent lines from forming outside of filling stations there.

Outside of Caracas, El Carabobeno, a newspaper based in the central city of Valencia, reported widespread line there.

Shell Oil Spills Led to 'Astonishingly High' Pollution in Nigeria

Shell admitted liability for two large oil spills from a broken pipeline in 2008 in Bodo, a Niger Delta fishing community that, according to U.K. court claims, was inundated with over 500,000 barrels of oil -- roughly twice the amount when the Exxon Valdez ran aground in Alaska in 1989

Royal Dutch Shell PLC oil spills that haven't been cleaned up for over eight years have contributed to "astonishingly high" levels of pollution in a Nigerian community, according to a consultant who helped produce a confidential damage assessment for Shell and its partners in the cleanup.

Shell admitted liability for two large oil spills from a broken pipeline in 2008 in Bodo, a Niger Delta fishing community that, according to U.K. court claims, was inundated with over 500,000 barrels of oil -- roughly twice the amount when the Exxon Valdez ran aground in Alaska in 1989. Shell disputed the volume of the spills but reached an out-of-court settlement with the community for GBP55 million in 2015 -- or around $80 million at the time -- after facing a lawsuit in London.

An environmental damage study was also conducted that year as part of efforts to clean up the area under the Bodo Mediation Initiative, which included Shell's Nigerian subsidiary, civil society groups, and members of the local community and government.

The study found that "astonishingly high" levels of pollution remained in Bodo's mangroves and creeks years after the spill, endangering the community, wrote Kay Holtzmann, the former director of the cleanup project, in a Jan. 26 letter to the Bodo Mediation Initiative, which was seen by The Wall Street Journal.

"The soil in the mangroves is literally soaked with hydrocarbons," wrote Mr. Holtzmann, who oversaw the study but no longer works for the initiative. "Whoever is walking in the creeks cannot avoid contact with toxic substances."

Mr. Holtzmann wrote that the study dictated a need for health screenings and should be widely publicized. He wrote that Shell has denied him permission to publish the study's results in a scientific journal and exposed Bodo, an expanse of Niger Delta swamp and mangroves, to dangerous levels of toxins.

"SPDC has no right to conceal data important for the public although they might be unpleasant," the letter said, referring to Shell Petroleum Development Co. of Nigeria, the Anglo-Dutch company's Nigerian subsidiary.

Shell said the analysis didn't reveal any information that hadn't been previously established by a United Nations Environment Program report on pollution levels in Ogoniland, the part of the Niger Delta where Bodo is located.

The 2011 report revealed high levels of contamination that could take as long as 30 years to fully clean up. In an interview, UNEP's executive director Erik Solheim described the current situation in Ogoniland as "one of the biggest environmental scandals and catastrophes anywhere in the world."

According to people familiar with the matter, complex disputes between the company and the local community have stalled cleanup efforts in Bodo and attempts to communicate findings from the assessment, though they were shared with local representatives and government agencies. The environmental damage caused by the 2008 spills has also been compounded by illegal refining in the area, the people said.

The oil-rich Niger Delta has been a center for Shell's oil production for decades, but aging infrastructure and widespread sabotage and theft have resulted in regular oil spills that ravaged the local environment. Shell maintains that the bulk of the oil spills in the Niger Delta are caused by sabotage, theft and illegal refining.

Efforts to improve the situation in Bodo have been plagued by mistrust, local power struggles, and disputes over how money for the work would be distributed, according to Inemo Samiama, chairman of the Bodo Mediation Initiative. In late 2015, the camp where cleanup contractors were staying was attacked, effectively halting work until now, the people said.

In response to the concerns raised in Mr. Holtzmann's letter, Mr. Samiama said: "The number one solution to dealing with the health consequences is to start the cleanup."

Leigh Day, the law firm that represented the Bodo community, wrote to Shell in January to request clarification after receiving a copy of Mr. Holtzmann's letter. The law firm said it had yet to receive a response.

"We're extremely concerned," said Daniel Leader, a partner at Leigh Day who worked on the Bodo case. "We have been asking for health testing and to check the water supply for many years and they have simply not done it."

Shell admitted liability for two large oil spills from a broken pipeline in 2008 in Bodo, a Niger Delta fishing community that, according to U.K. court claims, was inundated with over 500,000 barrels of oil -- roughly twice the amount when the Exxon Valdez ran aground in Alaska in 1989. Shell disputed the volume of the spills but reached an out-of-court settlement with the community for GBP55 million in 2015 -- or around $80 million at the time -- after facing a lawsuit in London.

An environmental damage study was also conducted that year as part of efforts to clean up the area under the Bodo Mediation Initiative, which included Shell's Nigerian subsidiary, civil society groups, and members of the local community and government.

The study found that "astonishingly high" levels of pollution remained in Bodo's mangroves and creeks years after the spill, endangering the community, wrote Kay Holtzmann, the former director of the cleanup project, in a Jan. 26 letter to the Bodo Mediation Initiative, which was seen by The Wall Street Journal.

"The soil in the mangroves is literally soaked with hydrocarbons," wrote Mr. Holtzmann, who oversaw the study but no longer works for the initiative. "Whoever is walking in the creeks cannot avoid contact with toxic substances."

Mr. Holtzmann wrote that the study dictated a need for health screenings and should be widely publicized. He wrote that Shell has denied him permission to publish the study's results in a scientific journal and exposed Bodo, an expanse of Niger Delta swamp and mangroves, to dangerous levels of toxins.

"SPDC has no right to conceal data important for the public although they might be unpleasant," the letter said, referring to Shell Petroleum Development Co. of Nigeria, the Anglo-Dutch company's Nigerian subsidiary.

Shell said the analysis didn't reveal any information that hadn't been previously established by a United Nations Environment Program report on pollution levels in Ogoniland, the part of the Niger Delta where Bodo is located.

The 2011 report revealed high levels of contamination that could take as long as 30 years to fully clean up. In an interview, UNEP's executive director Erik Solheim described the current situation in Ogoniland as "one of the biggest environmental scandals and catastrophes anywhere in the world."

According to people familiar with the matter, complex disputes between the company and the local community have stalled cleanup efforts in Bodo and attempts to communicate findings from the assessment, though they were shared with local representatives and government agencies. The environmental damage caused by the 2008 spills has also been compounded by illegal refining in the area, the people said.

The oil-rich Niger Delta has been a center for Shell's oil production for decades, but aging infrastructure and widespread sabotage and theft have resulted in regular oil spills that ravaged the local environment. Shell maintains that the bulk of the oil spills in the Niger Delta are caused by sabotage, theft and illegal refining.

Efforts to improve the situation in Bodo have been plagued by mistrust, local power struggles, and disputes over how money for the work would be distributed, according to Inemo Samiama, chairman of the Bodo Mediation Initiative. In late 2015, the camp where cleanup contractors were staying was attacked, effectively halting work until now, the people said.

In response to the concerns raised in Mr. Holtzmann's letter, Mr. Samiama said: "The number one solution to dealing with the health consequences is to start the cleanup."

Leigh Day, the law firm that represented the Bodo community, wrote to Shell in January to request clarification after receiving a copy of Mr. Holtzmann's letter. The law firm said it had yet to receive a response.

"We're extremely concerned," said Daniel Leader, a partner at Leigh Day who worked on the Bodo case. "We have been asking for health testing and to check the water supply for many years and they have simply not done it."

More Hurdles Ahead for Keystone XL, TransCanada Head Tells Trump

Trump Says Keystone XL Approval Is a 'Great Day for Jobs'

TransCanada Corp. said there’s more "work to do” before it can start construction of the $8 billion Keystone XL pipeline.

The controversial project, which would help bring crude from Canada’s oil-sands to the U.S. Gulf Coast, was approved by the Trump administration Friday. Other permissions, including from states along the way and the U.S. Interior Department, are still required.

Foes including environmentalists and local landowners have vowed to continue fighting the pipeline, first proposed more than 8 years ago. President Donald Trump, in an appearance with TransCanada CEO Russ Girling at the White House, said the decision represented the start of a new era in energy policy.

The policy is designed “to lower costs for American families and very significantly reduce our dependence on foreign oil and create thousands of jobs," Trump said. Pipelines are the safest way to transport oil, the president said, adding that Keystone XL was just one of many energy projects he’s planning to approve.

Once built, Keystone XL will run from Canada through Montana, South Dakota and Nebraska, where it connects to pipes traveling to Gulf Coast refineries. Asked by Trump when construction would begin, TransCanada Chief Executive Officer Russ Girling said there remains "work to do in Nebraska” first.

Energized landowners in that state have already forced changes to the project in regulatory reviews. Trump said he would contact Nebraska officials to help TransCanada get the necessary approvals.

Job Creation

Both Girling and Trump in their comments said the project would create thousands of U.S. jobs, though foes say many will be temporary construction positions and that falling oil prices since the project was planned undercut its usefulness. Under President Barack Obama, the U.S. State Department estimated Keystone XL would create about 42,100 jobs for the two-year construction period, including direct and in-direct spending.

Once operational, though, the pipeline would only require about 50 employees in the U.S., including 35 permanent workers and 15 temporary contractors, according to the estimate.

With a nod to Trump’s buy-American drive, TransCanada also said it will acquire 200 miles of pipe made with U.S. steel. The company previously estimated that about half of the 660,000 tons of steel used in the U.S. portion of the pipeline would come from domestic producers, specifically a pipe mill in Little Rock, Arkansas. The remaining 50 percent was to be supplied by pipe mills in Canada, Italy and India.

The new 200 miles of pipe will increase the use of American steel for the project to more than 50 percent, according to Terry Cunha, a company spokesman. The company also said it will end legal claims taken against U.S. after then-President Barack Obama declined to approve it in 2015.

"It’s a great day for our company, and the workers that are going to be put to work," Girling said at the White House. The company’s shares rose 1 percent in trading in New York.

The federal thumbs-up was expected, but the challenges remaining for the TransCanada project are significant, said Christi Tezak, managing director of research at ClearView Energy Partners LLC in Washington.

"We expect environmental groups and landowners to try to slow down or halt necessary proceedings for TransCanada to begin construction in each state," she said. While lawsuits arguing the project violated the National Environmental Policy Act are unlikely to be successful, "it’s certainly their prerogative to fight it," Tezak said by telephone.

Fossil fuel opponents have said Keystone XL will encourage the development of Canadian oil sands crude, which generally requires more energy to extract and process, and that it endangers drinking water resources in America’s heartland. More recently, they’ve pointed to the changing economic backdrop for the project.

Price Drop

West Texas Intermediate crude oil, the U.S. benchmark, traded near $100 a barrel when the State Department’s final environmental study was issued in January 2014 but has slumped by roughly half, now hovering near $50 a barrel. Meanwhile, the Canadian government has approved other projects carrying crude from its oil sands.