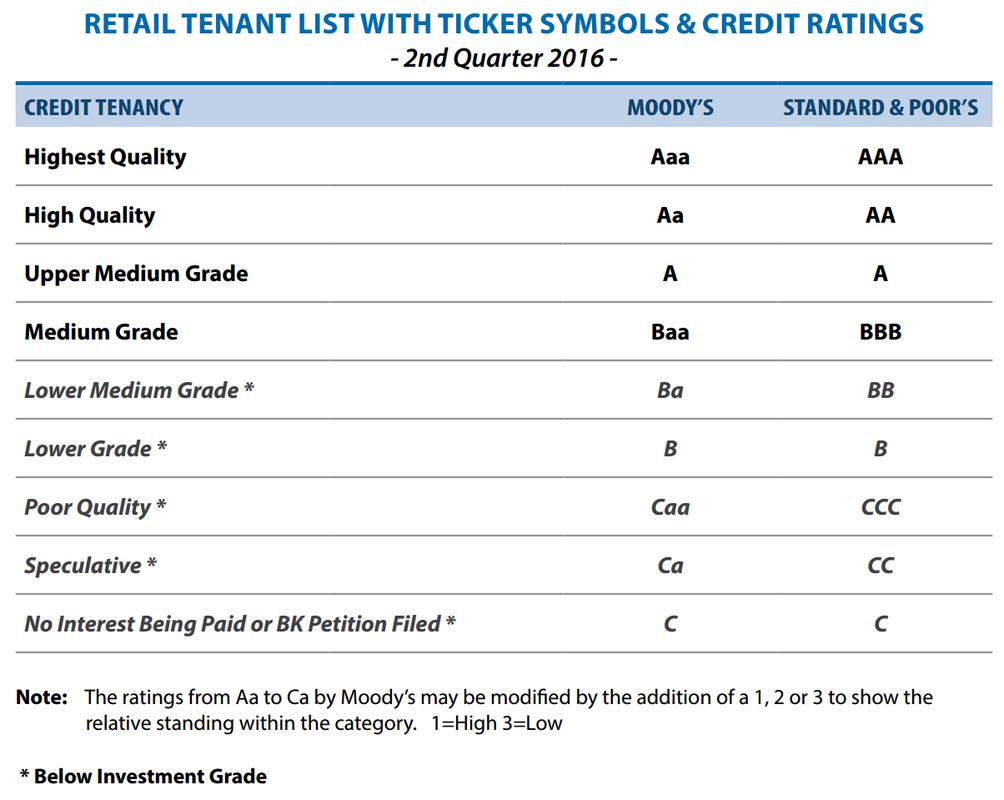

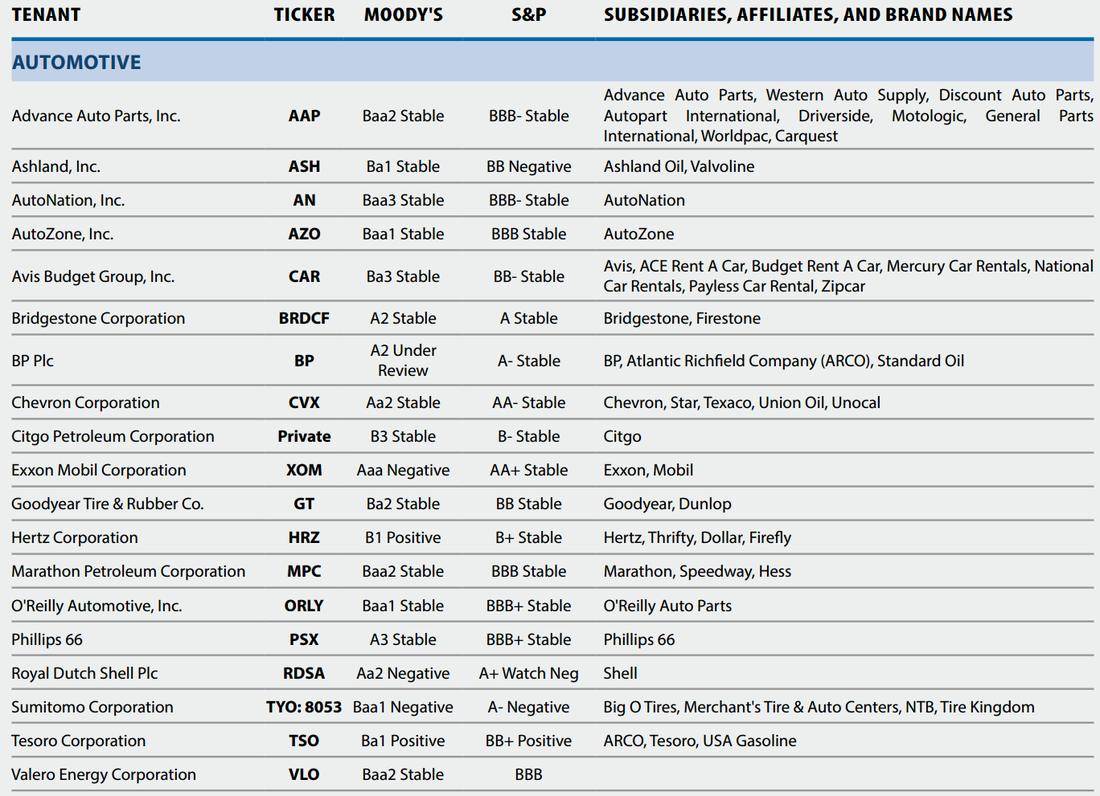

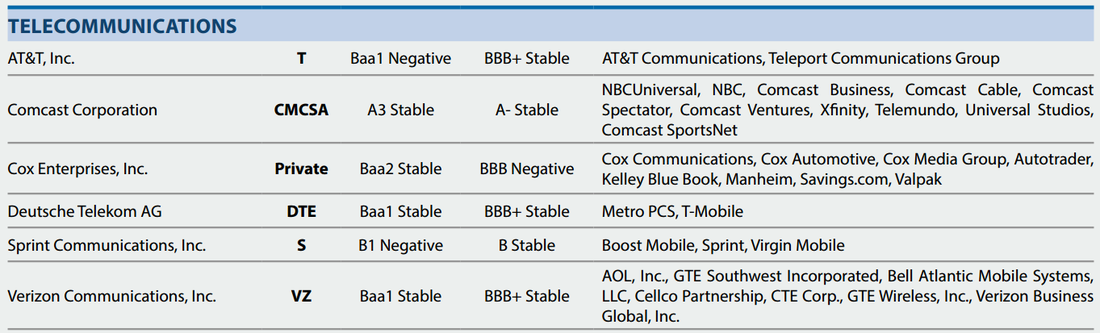

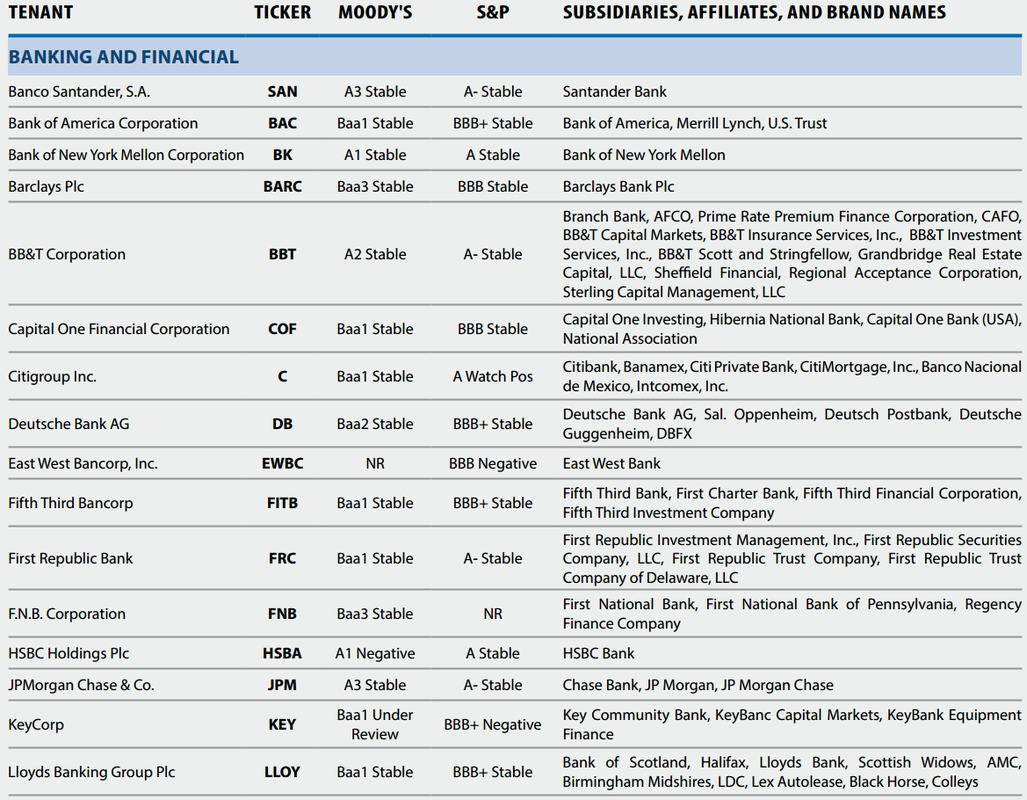

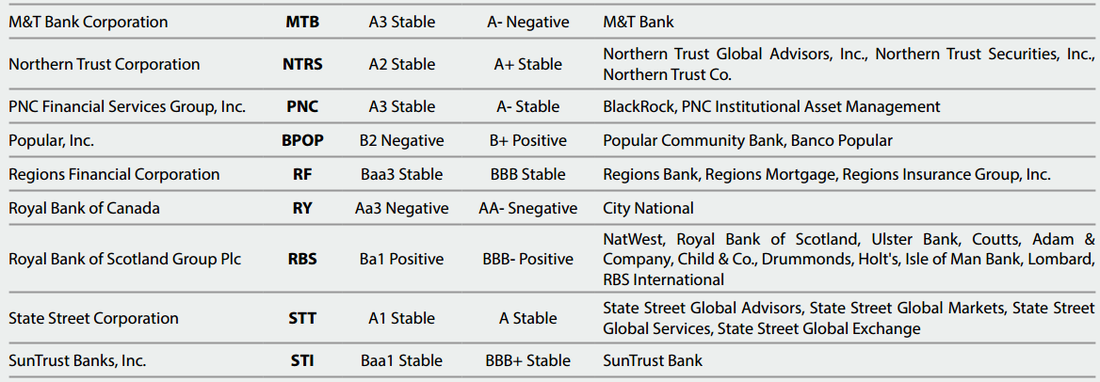

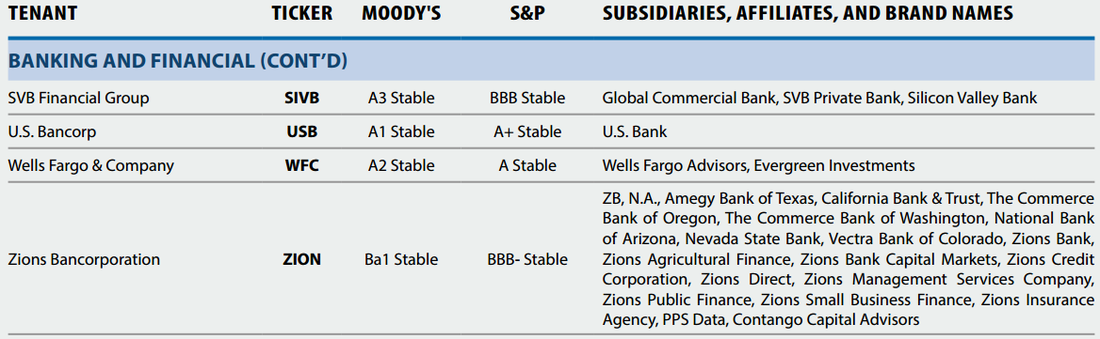

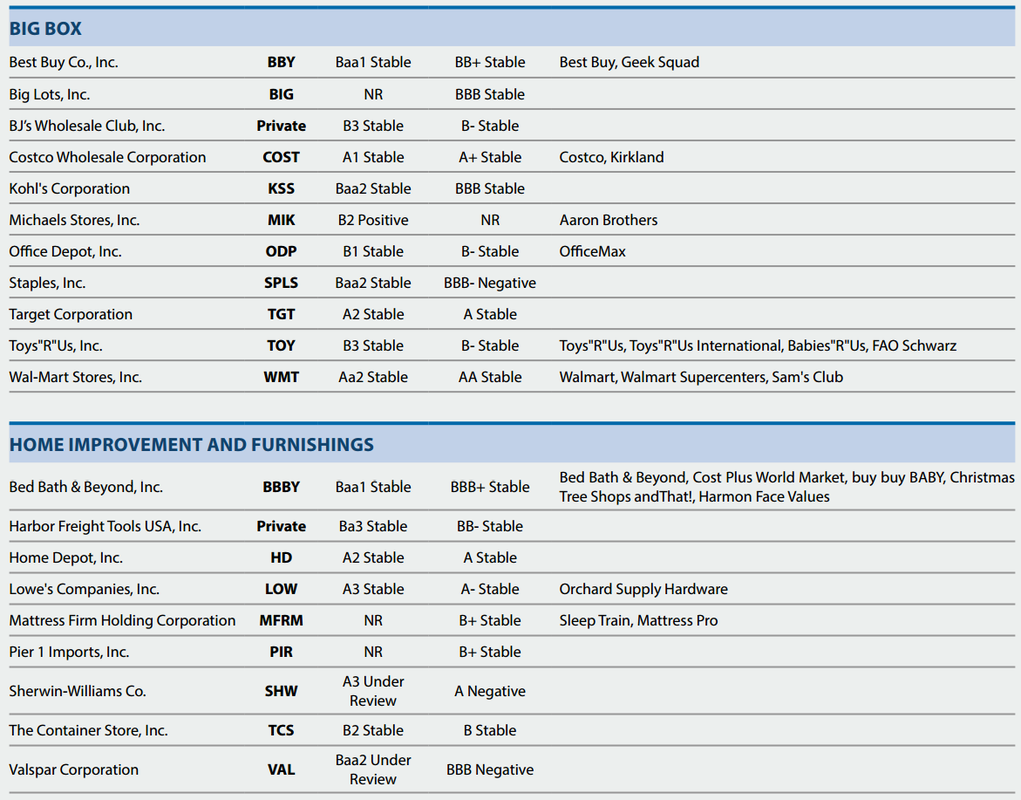

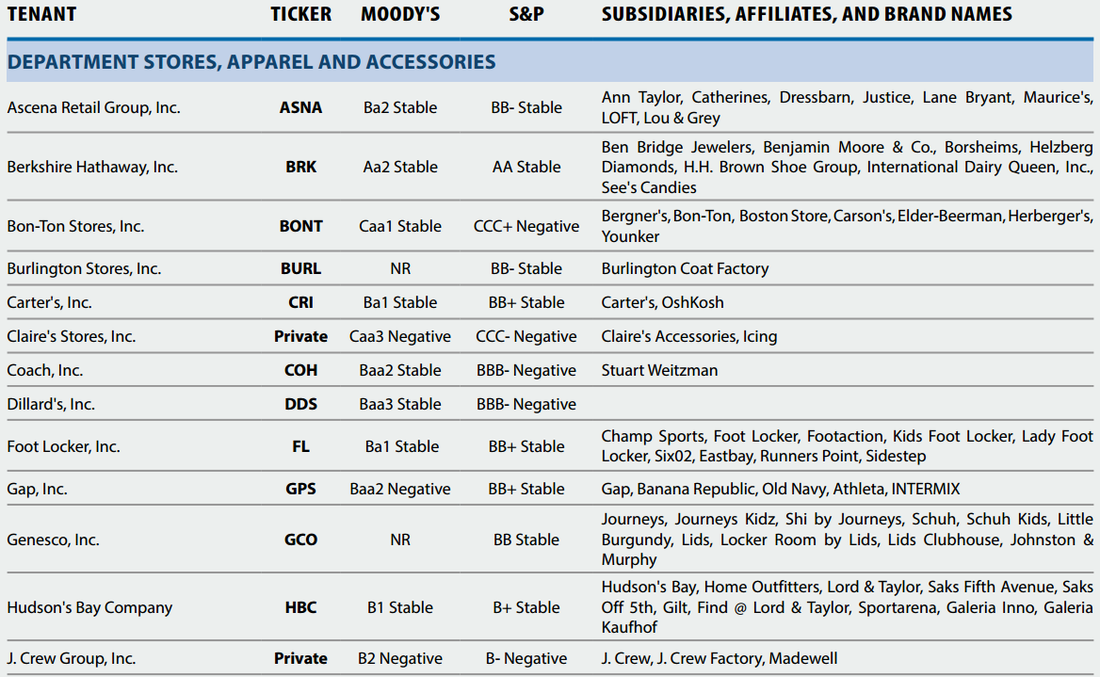

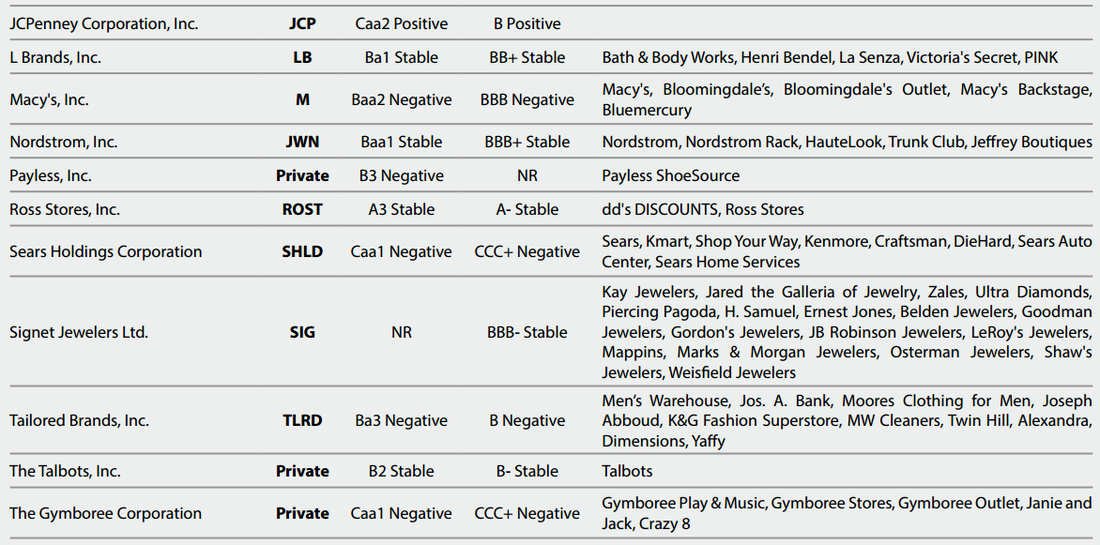

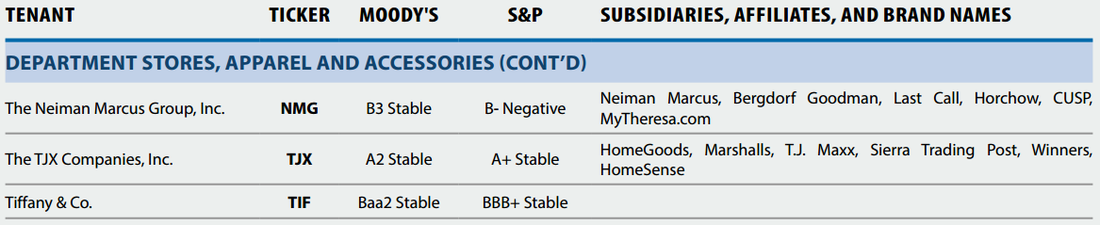

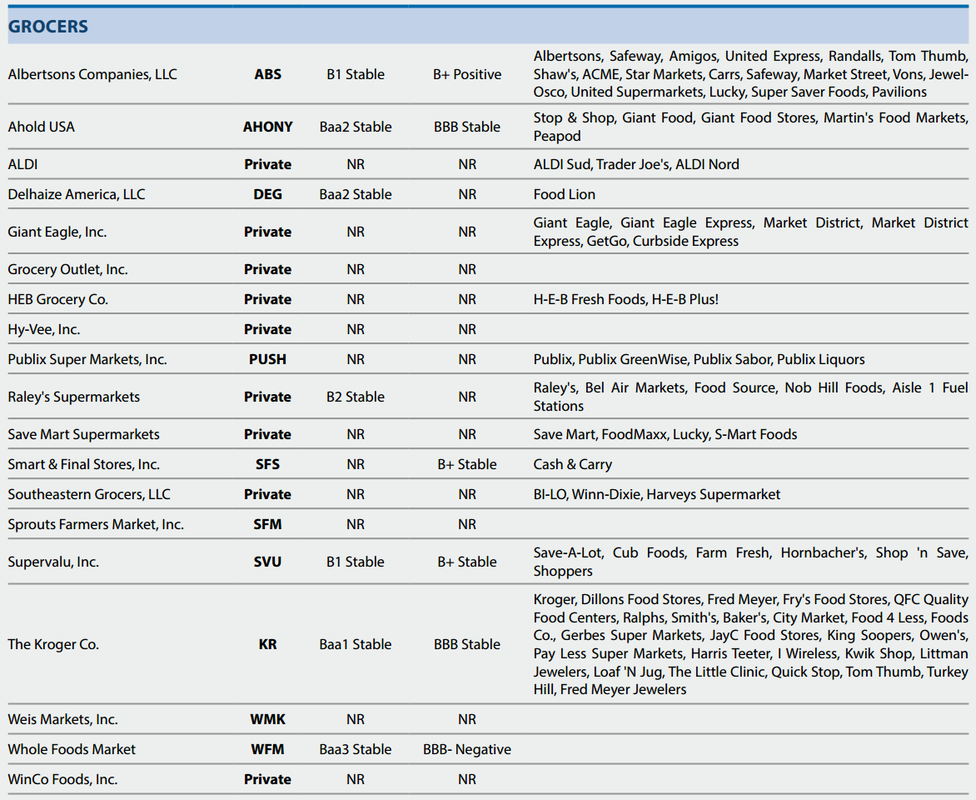

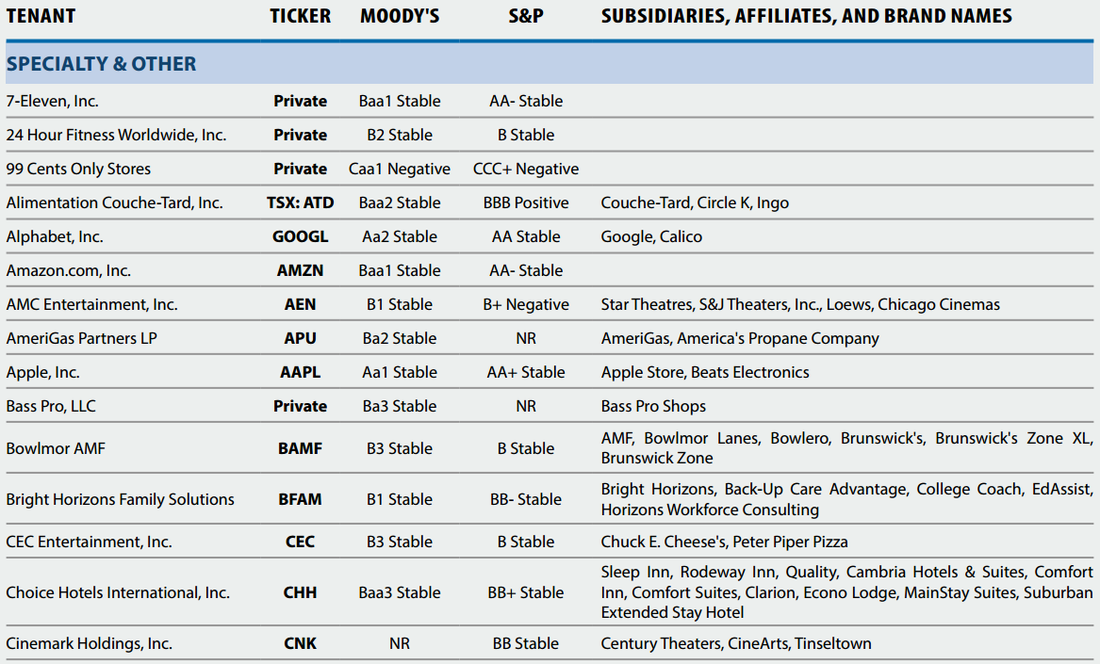

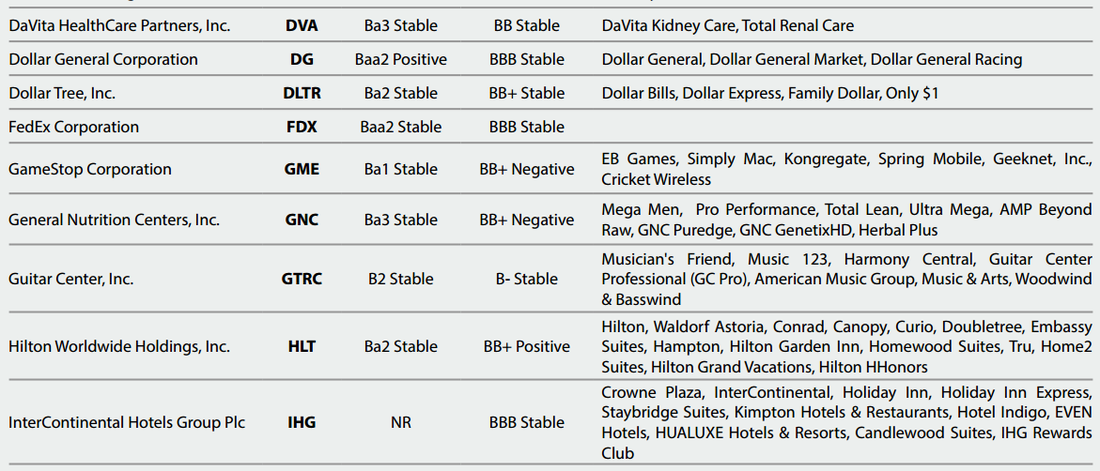

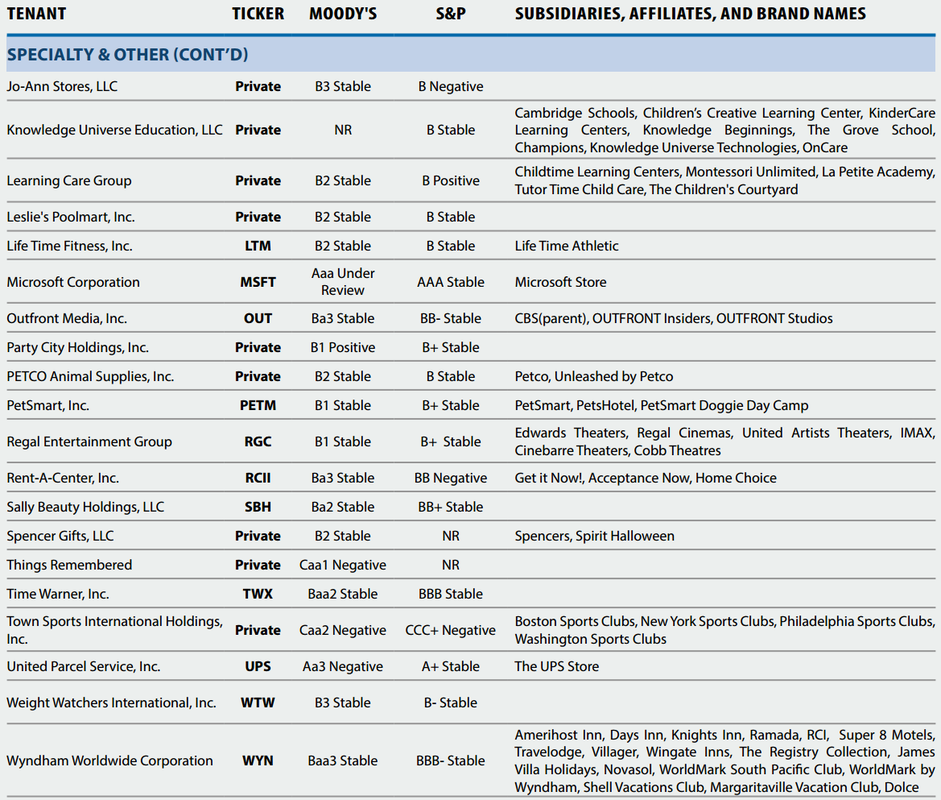

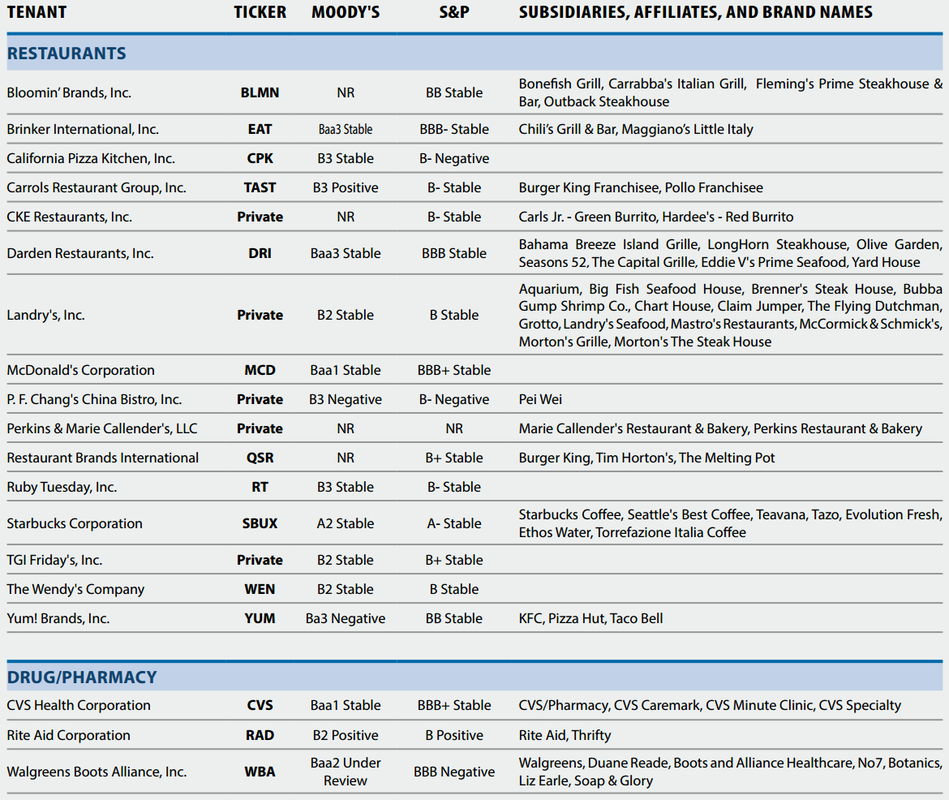

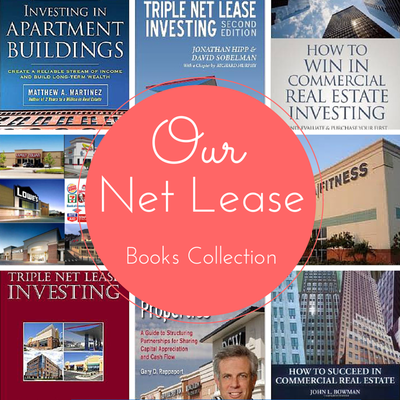

Know your tenant’s company profile and its ratings before you decide to invest (Tenant is who pays and guarantees the lease for you) One of our criteria selection for net lease commercial real estate investment (NNN CRE) is very carefully select the right tenant. In fact, it is also one of the best way to mitigate your risk as well. Our typical selected tenant is Dollar General, you can find out this company profile as follow: Dollar General Corporation is a United States chain of variety stores headquartered in Goodlettsville, Tennessee. As of January 2015, Dollar General operated over 11,500 stores in 40 U.S. states. The company acquired the 280 stores of the P.N. Hirsh Division of Interco, Inc. (now Heritage Home Group) in 1983, and in 1985 added 206 stores and a warehouse from Eagle Family Discount Stores, also from Interco, Inc. In recent years, the chain has started constructing more stand-alone stores, typically in areas not served by another general-merchandise retailer. In some cases, stores are within a few city blocks of each other. Dollar General offers both name brand and generic merchandise — including off-brand goods and closeouts of name-brand items — in the same store, often on the same shelf. Although it has the word “dollar” in the name, Dollar General is not a dollar store. Most of its products are priced at more than $1.00. However, goods are usually sold at set price points the range of 50 to 60 dollars, not counting phone cards and loadable store gift cards. Dollar General often serves communities that are too small for Walmarts (although many locations are in relatively close driving distance to a Walmart store or in the same communities that Walmart is located). It competes in the dollar store format with national chains Family Dollar and Dollar Tree, regional chains such as Fred’s in the southeast, and numerous independently owned stores. Since 2000, Dollar General has experimented with stores that carry a greater selection of grocery items. These stores, (similar to the Walmart Supercenter, but much smaller), operate under the name “Dollar General Market”. Formerly called: J.L. Turner and Son Wholesale Type: Public Traded as: NYSE: DG S&P 500 Component Industry: Discount retailer Founded: 1939 in Scottsville, KY Founders: J.L. Turner Cal Turner Sr. Headquarters: Goodlettsville, Tennessee Number of locations: 11,500+ (2014) Areas served: Contiguous United States except for the Northwest, North Dakota and Maine Key people: Richard W. Dreiling (Chairman & CEO) and David M. Tehle (Executive Vice President & CFO) Products: General Merchandise, Grocery, Photofinishing Revenue: $16.022 billion (2013) Operating income: $1.655 billion (2013) Net income: $952.7 million (2013) Total assets: $10.367 billion (2013) Divisions: Dollar General Market Website: Dollar General The dollar store chain is gearing up for heated competition after losing its bid to buy Family Dollar in January, which will instead merge with Dollar Tree and usurp Dollar General of its title as the biggest dollar store company in the country. As part of its efforts to compete, Dollar General said it will open approximately 730 new stores in 2015, bolstering its current footprint of 11,789 stores across 40 states. To compare, Dollar Tree will have approximately 13,000 stores after it combines with Family Dollar. In the quarter, Dollar General said same-store sales climbed 4.9%, driven by strong growth across food and tobacco, as well as increased customer traffic and average transaction size. Total revenue rose 9.9% to $4.94 billion, just missing analyst estimates of $4.95 billion. The company revealed plans to return capital to shareholders through a $1 billion share repurchase program, plus the initiation of a quarterly dividend of 22 cents per share. Net income rose to $355 million, or $1.17 per share, compared to $322 million, or $1.01 per share, a year ago. This was in line with the consensus call for $1.17 per share. For 2015, the company is projecting per-share earnings of $3.85 to $3.95 and revenue growth of 8 to 9%. Analysts had forecast $3.99 per share in earnings and 9% revenue growth. Shares are up 20% over the last 12 months and rose 2% to $73.15 in premarket trading. Tenant Credit Ratings: Moody’s and Standard & Poors 2Q16 |

AuthorDAJK GROUP is the place where investors, business owners and entrepreneurs can research and find useful information, insight, resources, advice, guidance and inspiration for acquiring funds for their project, acquisition for their net lease commercial real estate, increasing their assets and running their profitable business. Archives

July 2023

Categories |

Services |

Company |

|