|

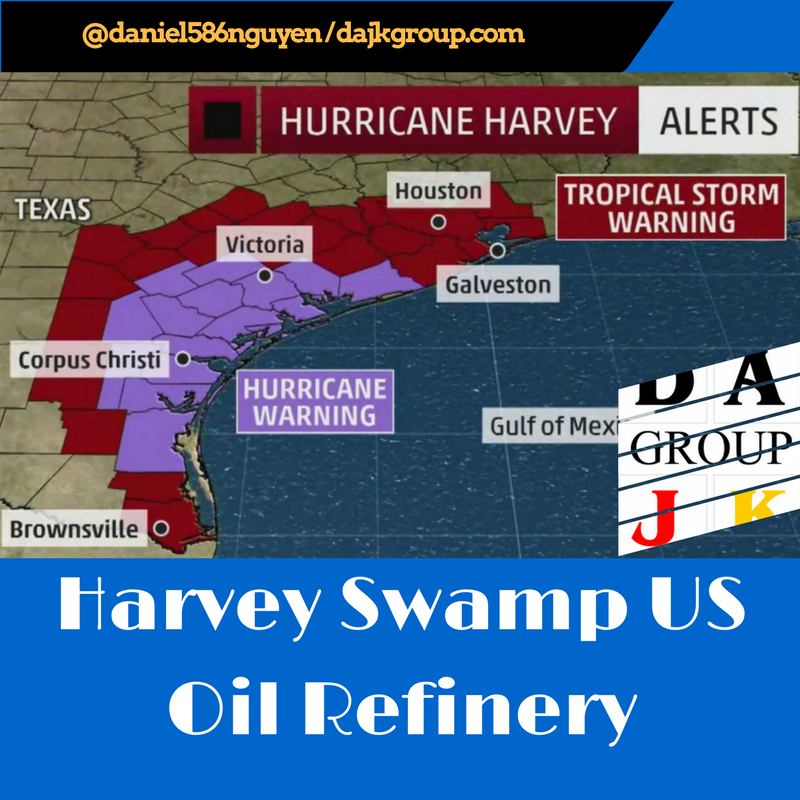

Latin America Looks To Venezuelan Fuel Cargoes As Harvey Swamps U.S. After Hurricane Harvey roared into Texas, flooding oil refineries and crippling ports along U.S. Gulf Coast, Latin American countries scouring the globe for other sources of fuel are zeroing in on a flotilla waiting to unload off the coast of Venezuela. Almost no fuel tankers have sailed from Texas for Latin America in six days, according to Thomson Reuters vessel tracking data. Terminals and refineries shut by the storm are unlikely to fully recover for weeks. The United States is the world’s largest net exporter of refined petroleum products, shipping around 5.05 million barrels of fuel per day. Latin America received almost half of that, or 2.5 million barrels per day (bpd). Most of it loads from the U.S. Gulf Coast. The United States is the world’s largest net exporter of refined petroleum products, shipping around 5.05 million barrels of fuel per day. Latin America received almost half of that, or 2.5 million barrels per day (bpd). Most of it loads from the U.S. Gulf Coast. Latin America’s top recipients of U.S. fuel shipments are Mexico, Brazil and Venezuela, which is an OPEC member sitting on the world’s largest crude oil reserves. However, Venezuela refineries are in such poor repair that the country cannot meet its domestic fuel needs. On Tuesday, a trading firm with two cargoes of diesel waiting to discharge in the port of Curacao notified Venezuela’s state-run oil company PDVSA it plans to suspend its delivery contract and divert the shipments to Ecuador, according to a PDVSA source familiar with the firm’s international trade. PDVSA did not immediately respond to a request for comment. Mexico, Brazil, Colombia and other countries also want to tap some of the about 7 million barrels of fuel sitting in the Caribbean sea, according to three traders and shippers. Some of the two dozen tankers sitting offshore have been waiting for weeks to discharge, either because cash-strapped PDVSA has been slow to pay for fuels or because of bottlenecks at ports. “Refiners are waiting for (U.S.) ports to reopen to start shipping what they have in storage, but some companies are desperate,” said a trader from an oil firm supplying some regional state-run oil companies. Mexico, which normally imports two gasoline cargoes per day, is among the countries looking to buy the fuels, the trading sources said. If trading firms that control the tankers “offer to divert a cargo from Venezuela, they (Mexico) are going to take it,” said a source at an oil company with large operations in Latin America. Peruvian oil company Petroperu on Monday launched a tender to buy up to five cargoes of diesel for delivery in September and October, according to a document seen by Reuters. Colombia’s state-run Ecopetrol ECO.CN has called trading firms to find gasoil cargoes for prompt delivery, a source said. DESPERATE FOR FUEL Harvey has caused refinery outages that resulted in about 21 million barrels of gasoline and distillates in lost production as of Wednesday, according to Reuters’ estimates based on Energy Information Administration numbers. U.S. refineries with capacity to produce 4.4 million bpd have shut. That is nearly 4.5 percent of total global fuel supply. Diverting the cargoes from Venezuela could bring big profits to traders as diesel and gasoline prices are rising fast due to the U.S. supply disruptions. But providers would have to reach agreements with PDVSA before moving the tankers. PDVSA has failed to prepay for most of the tankers anchored near Venezuelan ports, according to the sources. Even so, traders would seek to agree with Venezuela to swap them for cargoes they could deliver later, rather than violate their end of a contract and damage their relationship with PDVSA. “For diverting a cargo you need to declare a contract breach and that could lead to a long battle,” one trader said. “It might be easier for traders to negotiate another delivery window for September or October, which could allow charterers to divert these cargoes in the meantime.” Some nations have more fuel in storage than others to cushion the impact on domestic markets of the reduction in U.S. supplies. Brazil, Latin America’s largest buyer of U.S. diesel and a big gasoline importer, has fuel storage constraints, said Adriano Pires, a consultant at Brazil’s Center for Infrastructure. But he added that the storm’s hit to U.S. shipment capacity has not yet became a problem. “I don’t think those cargoes have a strong commitment to be delivered to PDVSA in the current situation, so South America, especially Brazil, could get something from there,” said Robert Campbell from consultancy Energy Aspects. NOT SO EASY U.S. sanctions on new Venezuelan debt operations and on officials, including President Nicolas Maduro and PDVSA’s Finance Vice President Simon Zerpa, have compounded trading difficulties. Some banks that routinely provided trade financing for companies importing and exporting Venezuelan oil have stopped issuing letters of credit. Maduro’s government has sought to blame the shortage of essential goods on the United States for imposing financial sanctions that have delayed imports. The sanctions meant that Venezuela “cannot pay for imported essential goods for the people”, said Delcy Rodriguez, president of Venezuela’s recently-installed pro-Maduro Constituent Assembly. How Refiners Are Faring From The Ravages Of Hurricane Harvey Hurricane Harvey, which slammed the Texas coast over the weekend and flooded large portions of Houston, is having dramatic effects on the energy complex along the Gulf Coast. By Raymond James' estimates, the storm took out more than 2 million barrels of oil per day at area refineries -- and potentially much more if run-rates are reduced at other facilities. The known shut-downs/closures have affected such companies as:

Delek US Holdings Inc. and HollyFrontier were spared, however, given that their assets are more mid-continent-focused. Raymond James analyst Justin Jenkins thinks the two companies may be best positioned given widening crude oil differentials. And if product flow from the Gulf to the East Coast is disrupted, he believes PBF Energy also may benefit given its relative overweight position in the northeast. Jenkins said it's too early to assess the lasting impact that Hurricane Harvey will have on crude oil and refined product markets. Valero reported that its refineries made it through the hurricane relatively unscathed, although a full return to its production schedule isn't known. However, each refining company will tend to benefit at least from a margins, earnings and stock price perspective from periods of disruption, Jenkins said, even if they have assets affected (shares of Raymond James' coverage list jumped 4.5% on average last week). Indeed, as of Sunday night, gasoline and diesel benchmarks surged, widening crack spreads further, and Jenkins thinks crack spreads may remain strong in the days and weeks ahead due to the disrupted operations. Shares of the major refiners were up on Monday, with Delek, Holly Frontier and PBF all up by around 7%. More refining capacity could be taken offline if Harvey loops and begins moving up the Texas coast toward Louisiana as forecasted, analysts at Tudor, Pickering, Holt said in a report. That could result in additional shutdowns in the Port Arthur/Beaumont/Lake Charles refining center that holds another 2.2 million barrels per day of capacity, or about 12% of the U.S. total, they estimated. "Thus [the] worst case suggests that upwards of 25% to 30% of domestic refining capacity could be shuttered near-term," TPH said. "We guess that the supply disruption will be in the one- to two-week range at this point." Source: Reuters and Forbes

0 Comments

Leave a Reply. |

AuthorDAJK GROUP is the place where investors, business owners and entrepreneurs can research and find useful information, insight, resources, advice, guidance and inspiration for acquiring funds for their project, acquisition for their net lease commercial real estate, increasing their assets and running their profitable business. Archives

July 2023

Categories |

Services |

Company |

|