|

Highlights

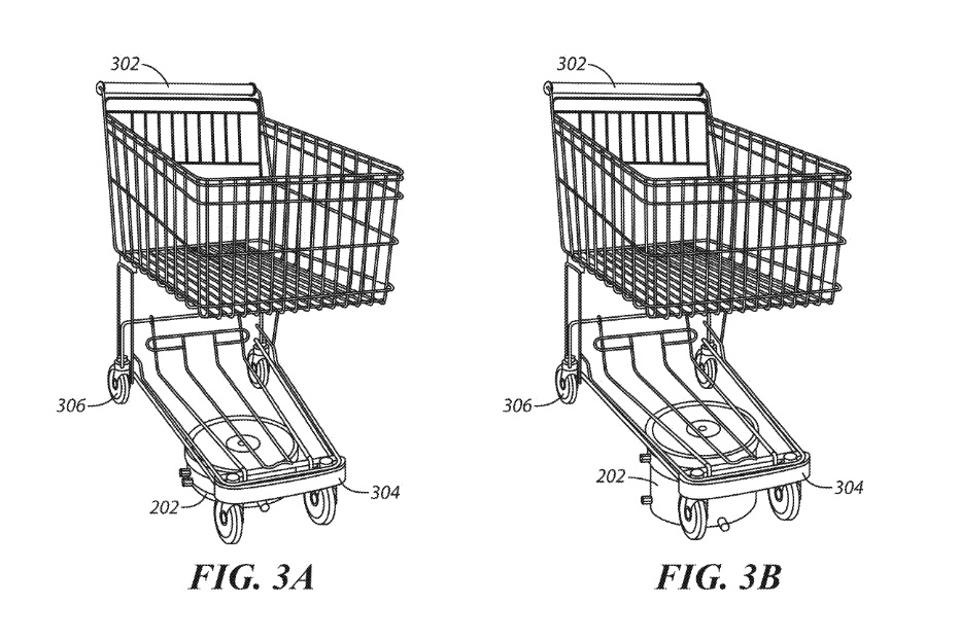

At the end of the second quarter 2016 (ended Aug. 1, 2016) the company operated 907 stores. Comparable store sales (opened at least 14 month and including e-commerce sales) rose 14.4% in the quarter. Total net sales rose 21.9% to $1.1 billion. It is interesting to note that the comparable sales growth was driven by a 9.7% increase in transactions and by a 4.7% increase in average ticket Ulta Beauty's CEO Mary Dillon Is A Dynamo Driving Growth and ProfitsRecently Fortune selected Mary Dillon as one of the most powerful women for 2016. She is CEO of Ulta Beauty, the largest beauty retailer in the United States. The stores are a destination location for cosmetics, fragrances, skin care and salon services. Ulta Beauty offers more than 20,000 products from 500 branded and emerging beauty suppliers. The Ulta stores also feature Ulta Beauty private label merchandise. Every store also operates a salon featuring hair, skin and brow services. At the end of the second quarter 2016 (ended Aug. 1, 2016) the company operated 907 stores. Comparable store sales (opened at least 14 month and including e-commerce sales) rose 14.4% in the quarter. Total net sales rose 21.9% to $1.1 billion. It is interesting to note that the comparable sales growth was driven by a 9.7% increase in transactions and by a 4.7% increase in average ticket. Average ticket growth was driven by superb customer service and innovation in merchandising. That is the company’s strength. Customers are greeted followed by vigilant attention to their needs. Ulta has an innovative vision and the customer responds. The real estate and analytics firm CoStar rates Ulta as the 10th fastest growing company in the United States. Leading the pack is Walmart, followed by Dollar General, Forever 21, Family Dollar, Dollar Tree, Marshalls, T.J.Maxx, Dick’s Sporting Goods, Tractor Supply Co. and Ultra. The company is cited for its hyper selection of cosmetic and beauty. The current aim of the company is to have 1200 units, but frankly, I expect that number to be raised as more sites will become available. For fiscal 2015 the company reported an increase of 21.0% over the previous year. Total sales were $3.9 billion. Comparable sales grew at whopping 11.8%. While management has been cautioning investors that comparable sales will slow as the company becomes larger and some stores mature, at the same time it is suggesting growth between 11 – 13% with total sales growing in the high teens for 2016. Given the opening of about 100 new locations, or about 11% new square footage growth, I think the sales estimate for this year is conservative. I estimate earnings will rise from $3.9 billion to $4.8 billion, or 23%. Much of the excitement is created by CEO Mary Dillon, 55. A native Chicagoan she joined the company in 2013. A hands-on manager who frequently visits stores and often sells over the counter; she has changed the culture of the company. After marketing Gatorade for PepsiCo she moved up in that company, working on Quaker Oats and becoming division president. In 2005 she moved to McDonald’s to become global marketing chief, and in 2010 she became CEO of U.S. Cellular. She joined Ulta Beauty in 2013. Soon after joining she recognized the need to strengthen the e-commerce business, which, at the time accounted for only 5% of Ulta sales. Sales are now jumping by 40% a quarter making the Internet an important growth channel. Ulta competes with beauty departments in major department stores, as well as in drug stores and specialty stores such as Bluemercury and Sephora. Sephora is expanding in free standing locations and in J.C.Penney stores. Drug stores like Walgreen’s Duane Reade division have made a major effort to feature cosmetics and fragrances. However, none of these competitors are growing at the pace of Ulta. Ulta’s merchandising approach which features a vast selection of brands in a wide range of prices is a major attraction that is changing the beauty business. Ulta’s combination of innovative merchandising, great customer service, and inspirational leadership is a winning formula. The company now projects 1200 stores as their target. I am sure they will surpass that number. I see many more years of strong growth for this company. Dunkin' To Sell Ready-To-Drink Coffee Starbucks may dominate the ready-to-drink coffee scene, but there's another chain hoping to caffeinate consumers on the go. Dunkin' Brands revealed on Thursday that it's partnering with Coca-Cola to launch a line of cold coffee beverages in the U.S. in 2017. Financial terms of the agreement were not disclosed. Dunkin' Brands revealed on Thursday that it's partnering with Coca-Cola to launch a line of cold coffee beverages in the U.S. in 2017. Financial terms of the agreement were not disclosed. This is the coffee chain's first foray into the $1.5 billion ready-to-drink coffee category, a space predominately ruled by the North American Coffee Partnership — a venture between Starbucks and PepsiCo. The Starbucks-Pepsi partnership, which was founded in 1994, has allowed the two companies to gain 80 percent share in the market by volume and 89 percent share by dollars, according to Beverage Digest. Dunkin' has long followed in the footsteps of Starbucks in terms of product launches. The coffee chain added pumpkin spice lattes to its menus as well as cold-brewed coffee, among other Starbucks-inspired offerings in recent years. "This new product introduction will increase consumption of Dunkin' Donuts coffee and increase our brand relevance with existing and new consumers, including many younger customers, which we believe will in turn, drive incremental visits to our restaurants," Nigel Travis, CEO and chairman of Dunkin' Brands said in a statement. Dunkin's bottled iced coffees will be distributed by Coke in grocery stores, convenience stores and in Dunkin' Donuts restaurants. Sears Is Soaring After Reports It May Sell Part Of Its BusinessSears Holdings has received a number of bids for its Craftsman tool business and the stock is soaring, according to Bloomberg. The report said that Stanley Black & Decker and Hong Kong-based Techtronic Industries have made bids for the business based on sources close to the matter. The brand may be worth $2 billion according to the Bloomberg report, and other businesses that have not bid yet — including Apex Tool Group and Sweden-based Husqvarna — are looking into bids. Sears has been in trouble for some time now, bleeding profit and shutting down stores. The sale of its assets has been rumored for a few months with the company also exploring sales of Kenmore home appliances and DieHard car batteries. Following the news, Sears stock shot up almost 17% and was halted for a time. Following the resumption of trading, the stock leveled off a bit to $13.00 a share, a $1.63 per share or 14.3% gain. The Patent For Robotic Shopping Carts Goes To WalmartThese days, it’s fairly common to see the likes of NASA and Google racking up robotics patents, but a recent first went to a company known more for bottomed-out prices than high tech (and which, incidentally, holds the Guinness World Record for selling Guinness World Records). Earlier this month, Walmart received approval on its patent application for robotic shopping carts that the company hopes will help streamline customer experiences in its stores. As Popular Science explains, shopping carts are useful for loading up with items but frequently difficult to manage, and “[Walmart], the physical retail giant, doesn’t want people to worry about the inadequacies of carts while shopping.” Filed in March of this year, the patent application describes a system of autonomously steered and self-returning carts that can, in effect, provide significant cart-related customer service when employees aren’t around or are occupied (presumably) with higher-level tasks. It also asserts the robotic carts’ potential usefulness for “[when] shopping carts are left abandoned, aisles become messy, inventory is not displayed in the proper locations or is not even placed on the sales floor, shelf prices may not be properly set, and theft is hard to discourage.” Popular Science points out that Walmart’s patented scheme also involves the placement of sensors throughout store environments, which would allow robotic shopping carts to tour stores safely but also help to instill them with pro-selling behaviors. In addition to carrying goods, the robotic carts could potentially use customer and sensor information to track down products in the store, access its inventory, and even engage in a little cross-selling by suggesting complimentary items. Unlike helpful online algorithms, of course, the robotic carts would only be able to furnish customers with complimentary items that are physically present in each store. Despite that, however, it seems likely that a fleet of robotic personal shoppers could still help Walmart stand out from the big-box crowd–on paper, anyway. Why Chick-fil-A Is Beating Every Other Fast-Food Chain In The USA

The sub chain Jason's Deli ranked a distant second with $2.7 million in per-restaurant sales, followed by Whataburger and McDonald's, each with $2.5 million in per-restaurant sales. So what is the secret to Chick-fil-A's success? According to a new study from QSR and research firm SeeLevelHX, Chick-fil-A has the best drive-thru service of any of its competitors. The chain scored the highest marks on employee politeness at the drive thru, according to the study, which compiled data from 2,000 visits to 15 fast-food chains. Employees said "thank you," smiled, and had a pleasant demeanor during nine out of 10 visits. The chain also had the second-highest rate of accuracy at the drive thru. Chick-fil-A got orders right 95% of the time, which made it second only to Carl's Jr.'s accuracy rate of 97%. The only place where Chick-fil-A didn't rank highly was in speed of service. The average wait time at Chick-fil-A's drive thru is 4 minutes and 16 seconds, which is about 31 seconds longer than the average drive-thru wait time. The drive thru is an essential element to the fast-food business. It's estimated that 60% to 70% of fast-food chains' business comes through the outside car lanes. One reason for Chick-fil-A's high scores on service is its face-to-face ordering process, in which employees stand outside and take drive-thru customers' orders using tablet computers. That leaves less room for error and provides a more personable experience at the drive thru. It's also meant to speed up the ordering process. The strategy was started by local Chick-fil-A operators in Houston and it's now being rolled out nationwide, according to QSR. Bass Pro Shops Is Buying Cabela's In a $5.5 Billion Deal

Cabela said its stockholders would be paid $65.50 in cash per share. Cabela's (CAB) stock jumped 15% at the start of trading. Johnny Morris, founder of Bass Pro Shops, assured customers in an open letter that "there will be no immediate impact to our stores." The companies did not immediately respond to CNNMoney messages about whether any of Cabela's 19,000 employees would eventually be laid off or any of its 85 U.S. and Canadian stores closed. Bass Pro Shops, which is privately held, said it would honor Cabela's rewards cards and credit cards. Cabela's stores have a distinctive rustic decor featuring displays of stuffed bears, deer, elk and moose. Some of the larger stores resemble theme parks or natural history museums, with extravagant displays of Arctic landscapes with stuffed Musk oxen, or African landscapes with stuffed elephants. Much of Cabela's merchandise is camouflage and camping gear, including tents and bear-proof food kegs. The company is also known for its so-called gun libraries, green-walled rooms with antique guns for sale, including firearms from both World Wars. The deal is being financed by Goldman Sachs (GS) and Pamplona. Sources: Forbes, CNBC, Business Insider and CNN [Discover more of net lease investment...]Should you have further questions, please sign-in with our 30-minutes confidential consultation.

1 Comment

|

AuthorDAJK GROUP is the place where investors, business owners and entrepreneurs can research and find useful information, insight, resources, advice, guidance and inspiration for acquiring funds for their project, acquisition for their net lease commercial real estate, increasing their assets and running their profitable business. Archives

July 2023

Categories |

Services |

Company |

|